July 2024

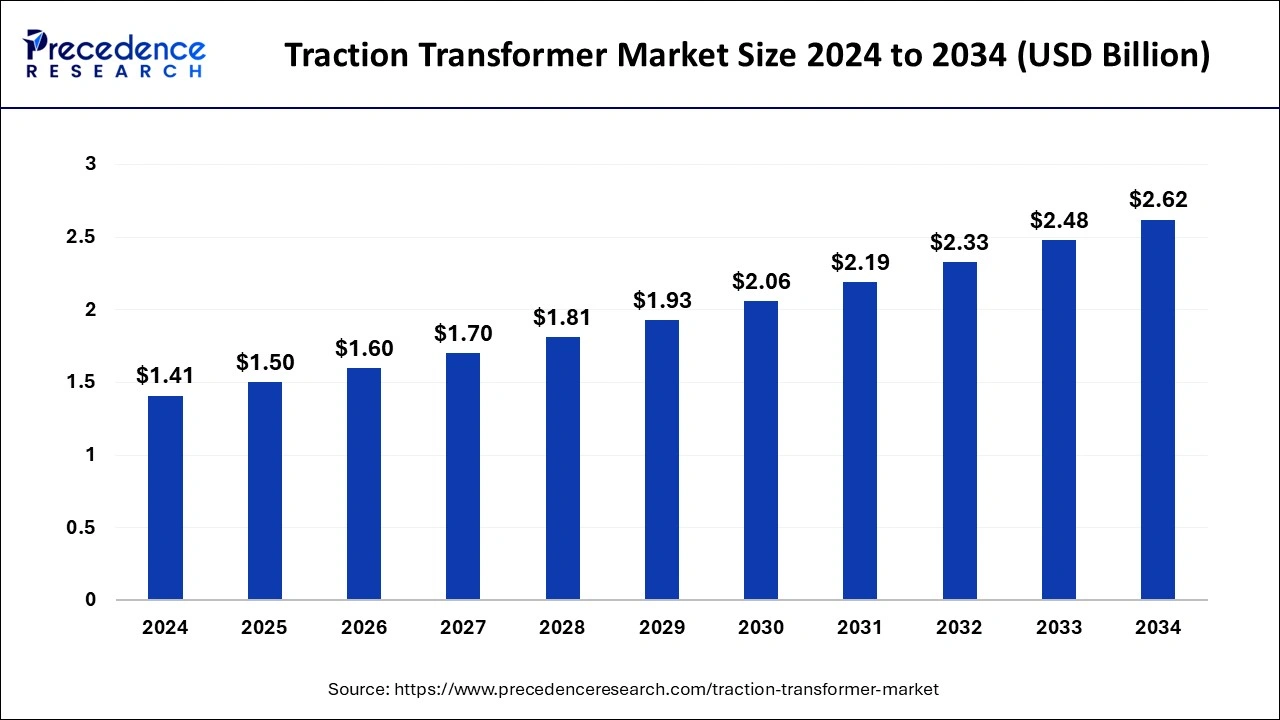

The global traction transformer market size is calculated at USD 1.50 billion in 2025 and is forecasted to reach around USD 2.62 billion by 2034, accelerating at a CAGR of 6.39% from 2025 to 2034. The Asia Pacific traction transformer market size surpassed USD 500 million in 2025 and is expanding at a CAGR of 6.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global traction transformer market size was estimated at USD 1.41 billion in 2024 and is predicted to increase from USD 1.50 billion in 2025 to approximately USD 2.62 billion by 2034, expanding at a CAGR of 6.39% from 2025 to 2034.

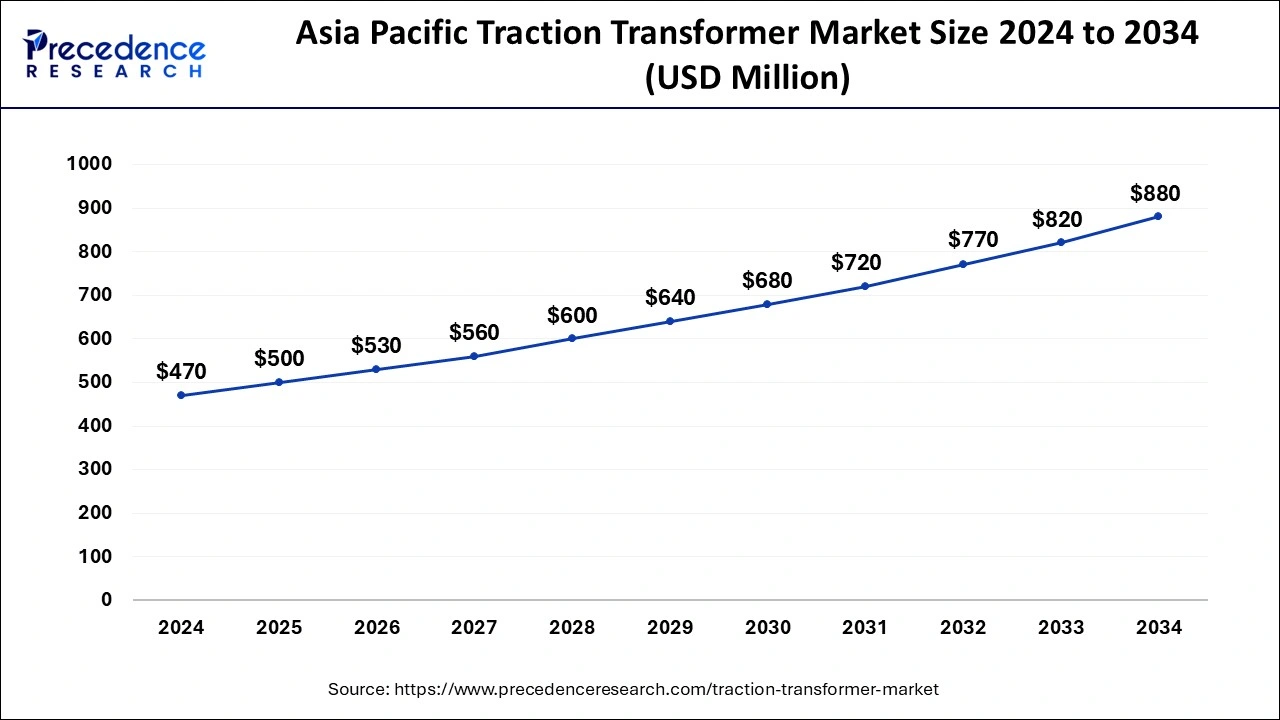

The Asia Pacific traction transformer market size was valued at USD 470 million in 2024 and is anticipated to reach around USD 880 million by 2034, poised to grow at a CAGR of 6.47% from 2025 to 2034.

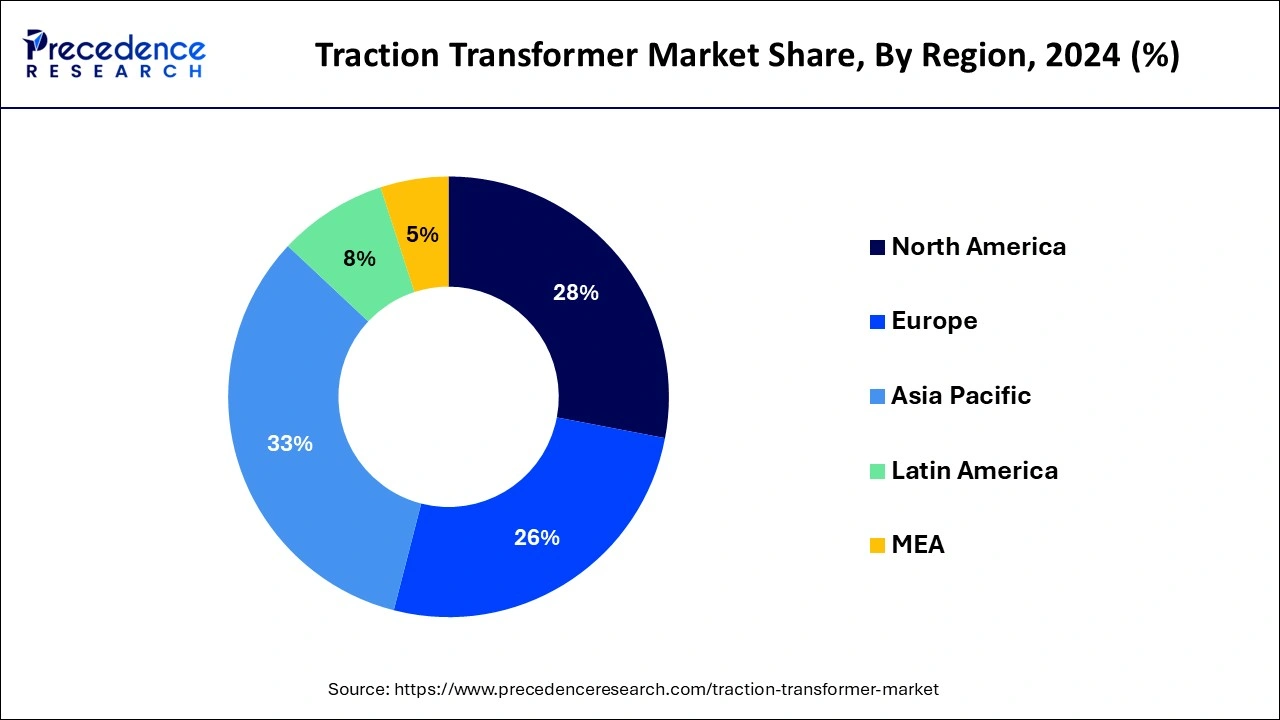

Asia-Pacific led the market with the biggest market share of 33% in 2024. due to rapid urbanization, extensive infrastructure development, and robust investments in electrified rail systems. Countries like China, Japan, and India are spearheading high-speed rail projects, driving substantial demand for traction transformers. The region's focus on sustainable transportation and government initiatives to modernize rail networks contribute to its major market share. Additionally, the burgeoning population and the need for efficient public transportation systems further amplify the significance of Asia-Pacific in the traction transformer market.

The traction transformer market in Europe is poised for robust growth due to the region's significant investments in expanding and modernizing its rail infrastructure. Governments are increasingly focusing on electrification projects to enhance sustainability and reduce carbon emissions. The push for high-speed rail networks and the adoption of advanced technologies in rail transportation contribute to the increasing demand for traction transformers. These factors, combined with supportive policies and a commitment to sustainable mobility, create a favorable environment for the traction transformer market to thrive in the European region.

Meanwhile, North America is experiencing notable growth in the traction transformer market due to increased investments in rail infrastructure and a shift towards sustainable transportation. The region's focus on modernizing and expanding electrified rail networks, driven by environmental concerns and the need for energy-efficient solutions, contributes to the rising demand for traction transformers. Government initiatives and a growing awareness of the benefits of electrification are propelling the market forward, creating opportunities for manufacturers and suppliers in the traction transformer industry.

The traction transformer market offers a technology that integrates telecommunication and informatics to enhance the functionality and connectivity of vehicles. It involves the installation of electronic devices in cars, commonly known as telematics control units, to gather and transmit real-time data. This data includes information about the vehicle's location, performance, and driver behavior. Embedded telematics systems play a crucial role in providing features such as GPS navigation, vehicle tracking, remote diagnostics, and connectivity with other smart devices. These systems not only improve driver safety and convenience but also enable advanced services like usage-based insurance and efficient fleet management. Overall, traction transformer enhances the overall driving experience by enabling smart communication between vehicles and external networks.

The increasing rate of urbanization globally is a key driver for the traction transformer market. Growing urban populations lead to higher demand for efficient and sustainable public transportation systems, fueling the expansion of electrified rail networks.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.39% |

| Global Market Size in 2025 | USD 1.50 Billion |

| Global Market Size by 2034 | USD 2.62 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Voltage Network, By Mounting Position, and By Rolling Stock |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of rail networks

For instance, India plans to invest $140 billion in expanding its rail network by 2028.

The expansion of rail networks around the world is a major catalyst for the increased demand in the traction transformer market. As more regions invest in the development and enhancement of their railway infrastructure, the need for efficient and reliable electrification solutions rises significantly. Electrification of rail systems, powered by traction transformers, offers a sustainable and eco-friendly alternative, aligning with global efforts to reduce carbon emissions. With governments prioritizing the expansion and modernization of rail networks, the traction transformer market experiences a surge in demand.

These transformers play a crucial role in powering electric trains, enabling smoother and more energy-efficient operations. As new rail lines are laid and existing ones undergo electrification, the traction transformer market responds to the growing requirements, providing essential components for the reliable functioning of electrified rail systems worldwide.

Restraint: Limited electrification in remote areas

The limited electrification in remote areas poses a significant restraint on the traction transformer market. In many sparsely populated or geographically challenging regions, electrifying rail networks may not be economically viable or feasible. The high costs associated with extending electrification infrastructure to remote areas, including the installation of traction transformers, act as a deterrent for widespread adoption. Limited demand for electrified rail systems in these regions inhibits the traction transformer market's growth, as the focus tends to be on more accessible and economically viable transportation solutions.

Additionally, the absence of electrification in remote areas impacts the overall market demand for traction transformers, as these regions may rely on traditional diesel-powered locomotives. This disparity in electrification efforts across different geographical areas creates a market challenge, emphasizing the need for innovative solutions and policies to address the constraints and extend the benefits of electrified rail systems, including traction transformers, to remote locations.

Integration of advanced technologies

The integration of advanced technologies is opening up exciting opportunities for the traction transformer market. Incorporating technologies like the Internet of Things (IoT) and predictive maintenance into traction transformers enhances their functionality and efficiency. IoT connectivity allows for real-time monitoring of transformer performance, enabling proactive maintenance measures and reducing downtime. This not only improves the overall reliability of rail systems but also contributes to cost savings for operators.

Moreover, the adoption of advanced technologies facilitates the development of smart and connected traction transformers. These innovations not only optimize energy consumption but also provide valuable insights into system health. The ability to remotely monitor and manage traction transformers contributes to streamlined operations and the potential for predictive analytics, marking a significant step forward in the industry's evolution. As the market embraces these technological advancements, traction transformer manufacturers have the opportunity to offer cutting-edge solutions that meet the growing demand for efficient and intelligent electrification systems in the rail sector.

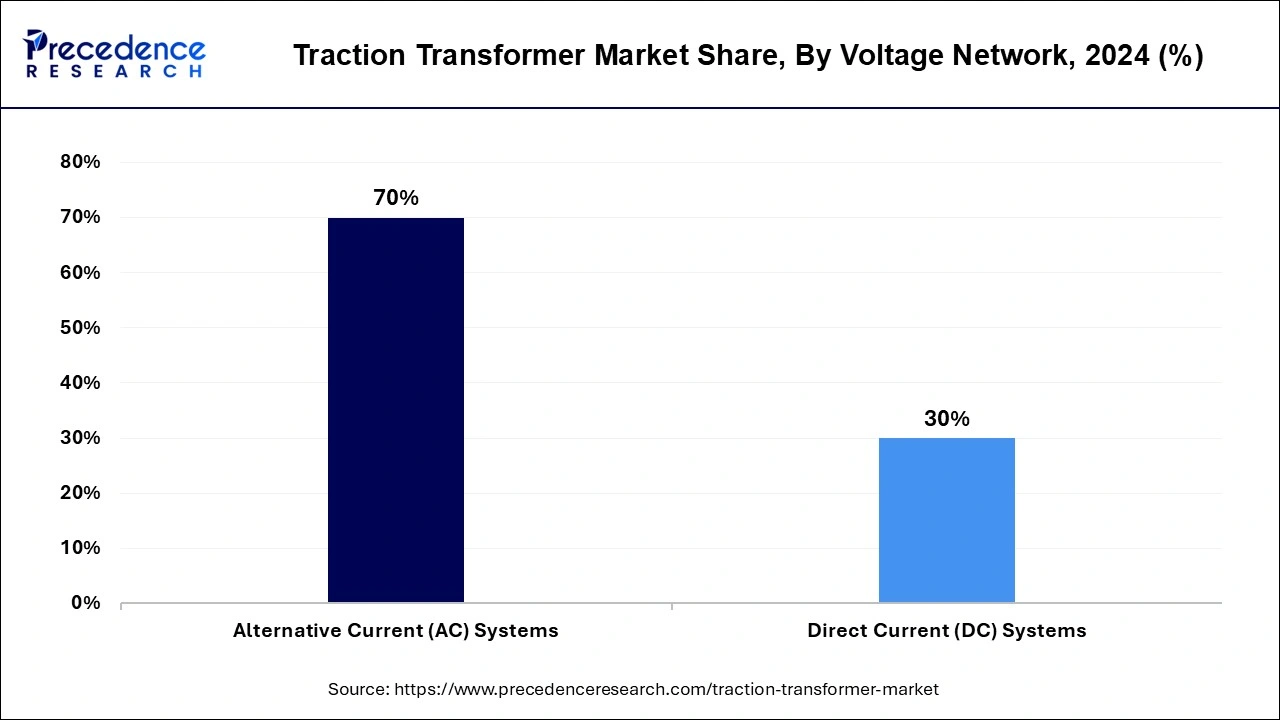

The AC (alternative current) systems segment held the highest market share of 70% in 2024 based on the voltage network. The AC (Alternative Current) systems segment in the traction transformer market refers to transformers designed for electrified rail systems that utilize alternating current. These systems are crucial for powering trains efficiently. A notable trend in this segment involves a shift towards higher voltage AC systems, aiming for increased energy efficiency and reduced transmission losses. The demand for AC traction transformers is growing as railway networks worldwide upgrade to higher voltage systems, enhancing the overall performance and sustainability of electrified rail transportation.

The DC (direct current) systems segment is anticipated to witness rapid growth at a significant CAGR during the projected period. The DC (direct current) systems segment in the traction transformer market refers to transformers designed for electrified rail networks that operate on direct current. These systems are commonly used in metro and light rail applications. A trend in this segment involves the increasing preference for DC systems in urban transit projects due to their efficiency in short-distance transportation. As cities worldwide invest in expanding metro networks, the demand for DC traction transformers is on the rise, reflecting a key trend in the market.

The under-the-floor segment held the largest share in 2024. In the traction transformer market, the mounting position segment refers to the location where the traction transformer is physically installed within a train. Common mounting positions include roof-mounted and underfloor-mounted configurations. Roof-mounted transformers are often preferred for their accessibility and ease of maintenance. However, there is a growing trend towards underfloor-mounted transformers, as they contribute to better aerodynamics and aesthetic design, addressing space constraints on the train roof. This trend reflects a shift towards more innovative and space-efficient solutions in the design and integration of traction transformers.

The machine room segment is anticipated to witness rapid growth over the projected period. In the traction transformer market, the machine room segment refers to the placement of traction transformers within the machine room of a train. This configuration is commonly employed in various rail systems, allowing for a centralized and compact design. A prevailing trend in this segment involves the continuous miniaturization and optimization of traction transformers to fit seamlessly within the limited space of the machine room. This trend aims to enhance overall efficiency and performance while accommodating the spatial constraints typically associated with the machine room configuration in modern train designs.

The electric locomotives segment held the largest share in 2024. The electric locomotives segment in the traction transformer market refers to transformers designed specifically for powering electric locomotives. These transformers play a crucial role in converting electrical power for efficient train operations. A notable trend in this segment is the increasing preference for energy-efficient and technologically advanced traction transformers. As rail networks globally electrify, there is a growing demand for transformers that enhance the performance of electric locomotives, promoting sustainability and operational excellence in the rolling stock industry.

The high-speed trains segment is anticipated to witness rapid growth over the projected period. The high-speed trains segment in the traction transformer market refers to the electrified rail systems designed for rapid transportation, typically operating at speeds significantly higher than traditional trains. As a trend, the demand for traction transformers in the high-speed train segment is on the rise globally. Increasing investments in high-speed rail projects, especially in countries like Japan, China, and parts of Europe, drive the need for advanced traction solutions to ensure efficient and reliable performance in these fast-moving rail systems.

By Voltage Network

By Mounting Position

By Rolling Stock

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024