February 2025

The global trauma fixation devices market size is accounted at USD 9.11 billion in 2025 and is forecasted to hit around USD 13.03 billion by 2034, representing a CAGR of 4.05% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global trauma fixation devices market size was estimated at USD 8.76 billion in 2024 and is predicted to increase from USD 9.11 billion in 2025 to approximately USD 13.03 billion by 2034, expanding at a CAGR of 4.05% from 2025 to 2034. The trauma fixation devices market is driven by the growing number of severe injuries. Various factors influence this development, including falls, sports injuries, industrial accidents, and traffic accidents. Fixation devices are necessary for the appropriate healing and rehabilitation of these injuries since they frequently cause fractures, dislocations, and other traumas connected to the bones.

The U.S. trauma fixation devices market size was exhibited at USD 3.09 billion in 2024 and is projected to be worth around USD 4.67 billion by 2034, poised to grow at a CAGR of 4.20% from 2024 to 2034.

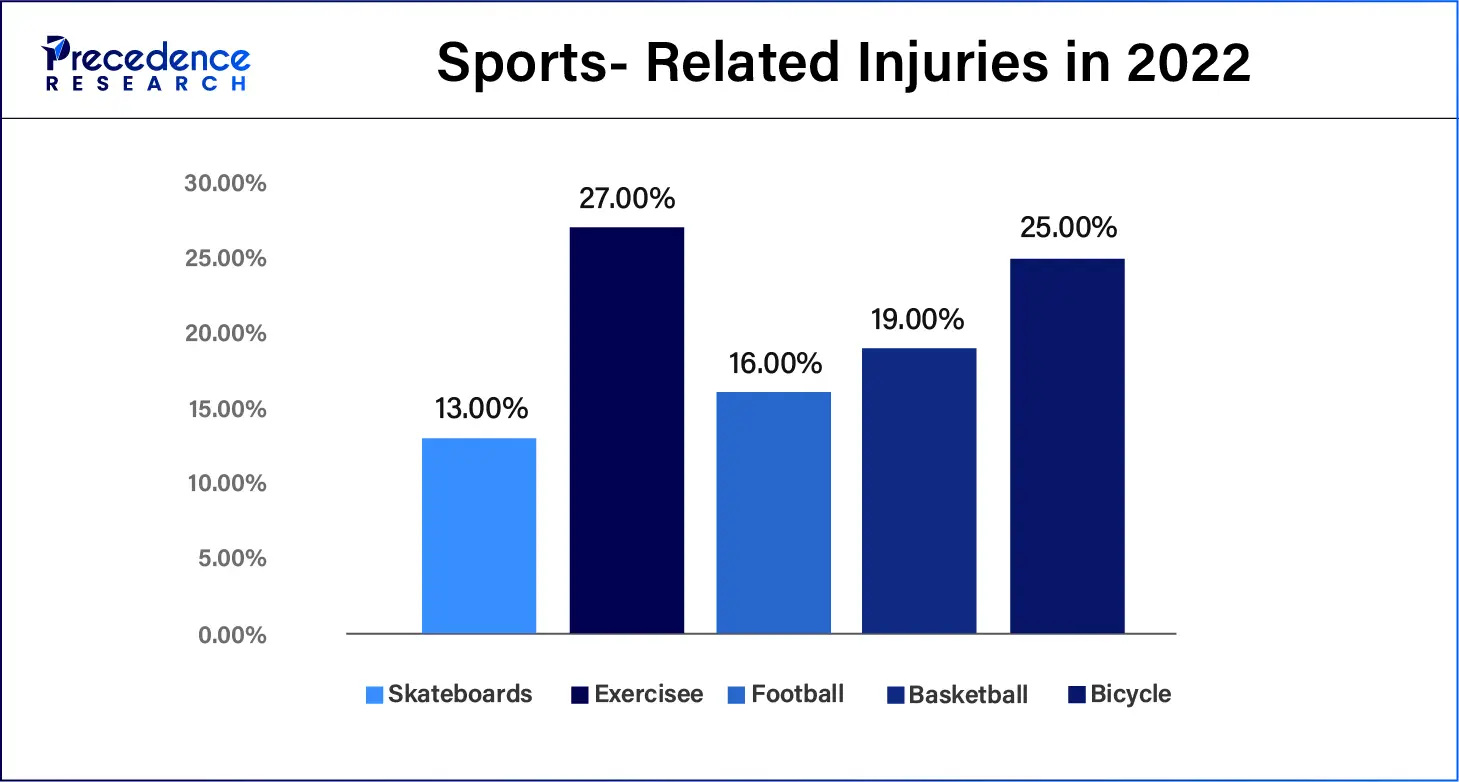

North America dominated the trauma fixation devices market in 2024. Modern, well-established hospitals, trauma centers, and specialty clinics are widely dispersed throughout North America, especially in the United States. Trauma fixation devices are in great demand, and this infrastructure helps meet that demand. The prevalence of sports-related injuries is on the rise in North America due in part to the popularity of high-impact sports. Trauma fixation devices are frequently needed for sports-related injuries, especially when fractures and dislocations are involved.

Asia- Pacific is observed to be the fastest growing in the trauma fixation devices market during the forecast period. The Asia-Pacific is home to some of the world's highest rates of traffic accidents, especially in China and India. This is brought on by growing automobile ownership, quick urbanization, and poor road infrastructure. The rising frequency of trauma cases directly fuels the need for trauma fixation devices. Improving healthcare affordability and accessibility is a growing priority for the region's governments. For instance, in India, programs such as Ayushman Bharat seek to cover a sizable section of the populace for medical care, including surgery such as trauma fixation.

The market for trauma fixation devices is the area of the medical device industry dedicated to making devices that stabilize and immobilize fractures or injuries, especially those brought on by traumatic experiences. To support and treat bone fractures and dislocations, these devices include exterior fixators, internal fixators (such as plates and screws), and other orthopedic fixation instruments.

Advances in trauma fixation technology, like minimally invasive techniques and sophisticated materials, make treatment alternatives more efficient and less intrusive, improving patient comfort and expediting recovery. One sizable worldwide medical device market category is that of trauma fixation devices. The creation and marketing of these gadgets have a significant financial impact on hospital budgets, healthcare prices, and the earnings of medical device manufacturers.

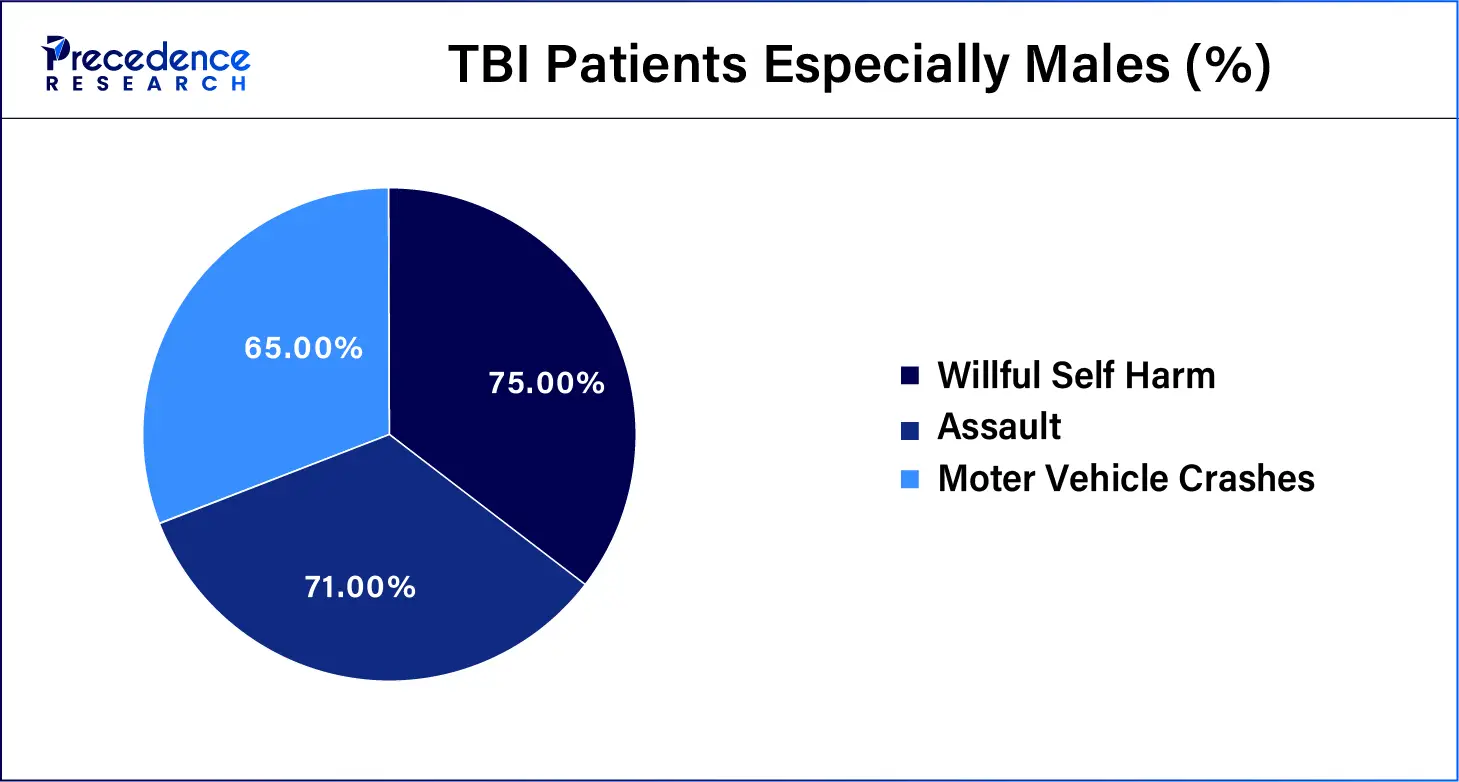

Graph: As per the Traumatic Brain Injury (TBI) Annual Report, 2024

| Report Coverage | Details |

| Market Size by 2034 | USD 13.03 Billion |

| Market Size by 2025 | USD 9.11 Billion |

| Market Size in 2024 | USD 8.76 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.05% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing incidence of injuries from road accidents

Globally, road traffic accidents have increased due to several causes, such as growing car usage, urbanization, and distracted driving. The frequency of traumatic injuries, such as fractures and complicated bone injuries that call for medical attention, has increased due to the rise in accidents. The significance of good fixation devices and sophisticated trauma care is becoming more recognized in many areas. Governments and healthcare institutions are spending money on enhancing the trauma care infrastructure, including buying high-quality fixation equipment. The goal to improve patient outcomes and lessen the long-term effects of traffic accidents is what motivates this commitment.

Growing participation in sports and physical activities

The number of people participating in sports and physical activities naturally rises, as does the frequency of associated injuries such as ligament tears, fractures, and dislocations. There is a broader market for trauma fixation devices due to the participation spanning age categories, from adult leisure leagues to professional athletes and youth sports. Governments and sports organizations frequently fund research and development to enhance the treatment and prevention of injuries. New technology and techniques for trauma fixation may result from this funding.

Limited or uncertain reimbursement policies for trauma fixation devices

The amount to which healthcare practitioners are reimbursed for the expenses related to medical devices and treatments is determined by reimbursement rules, which are critical to the healthcare industry. The acceptance and use of trauma fixation devices, which are used to stabilize and support fractured bones or wounded body parts, are significantly influenced by reimbursement regulations. The amount covered by various insurance policies for trauma fixation devices may vary. These distinctions must be navigated by patients and providers, which can make decisions more difficult and alter the market dynamics.

Improvements in healthcare infrastructure

Advanced trauma fixation devices are in higher demand because modern hospitals and clinics with state-of-the-art resources can better support complex trauma situations. More operating rooms, trauma centers, and advanced diagnostic equipment are frequently associated with improved infrastructure. Upgraded research and development facilities also enable the creation of new and enhanced trauma fixation devices, which may result in cutting-edge goods that adapt to changing clinical needs.

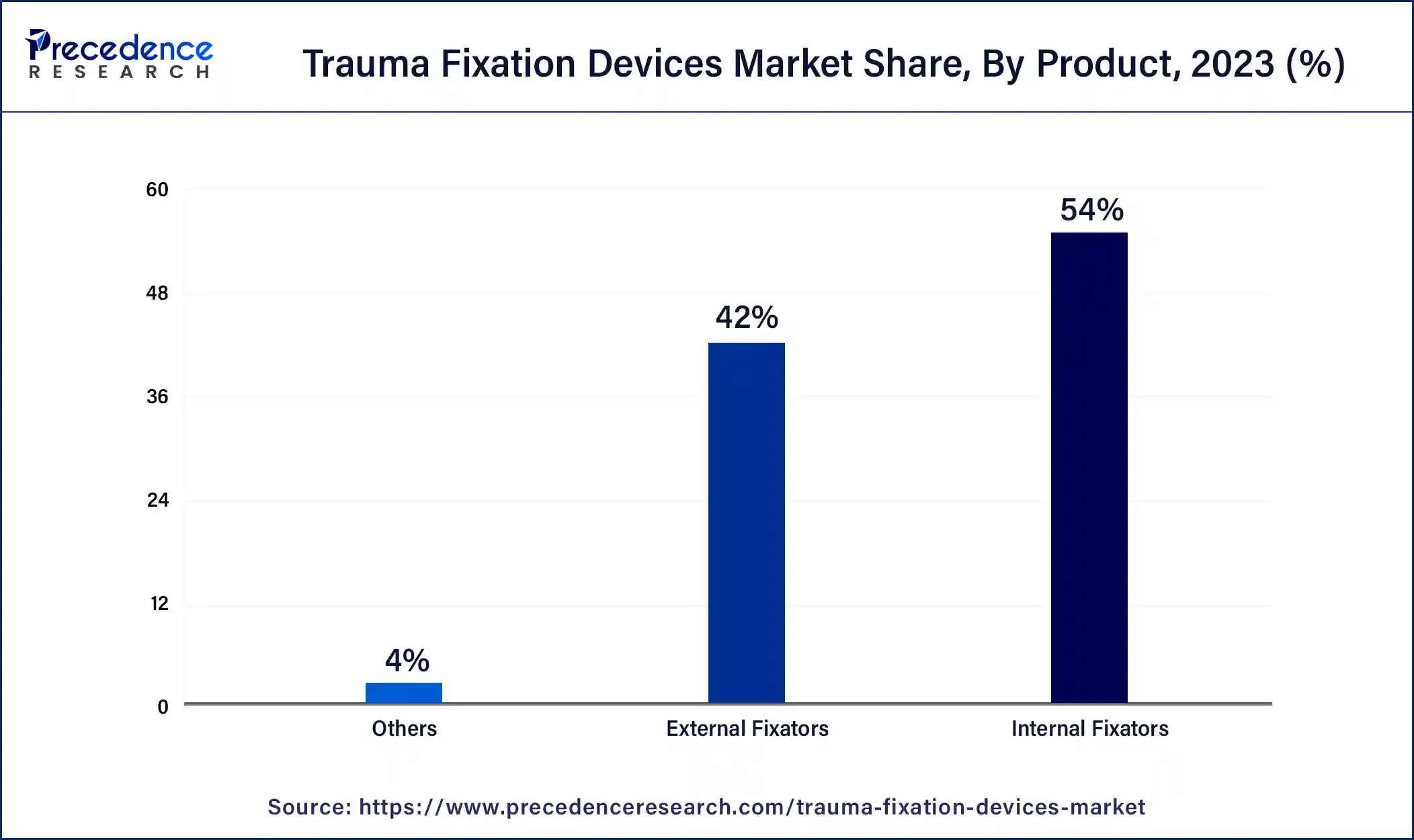

The internal fixators segment dominated the trauma fixation devices market in 2024. When it comes to aligning shattered bones, internal fixators like plates, screws, rods, and nails offer better stability and accuracy. Better healing results result from this, which lowers the possibility of nonunions or malunions. The increasing use of internal fixators can be attributed to the advancements in minimally invasive surgical procedures such as arthroscopic and percutaneous surgery. Internal fixation is becoming more appealing to patients and surgeons due to these procedures, decreasing scarring and preventing tissue damage while speeding up the healing process.

Many orthopedic surgeons specialize in internal fixation devices, which gives them greater comfort and confidence when prescribing them over alternative treatments. The reason for their extensive use is that they are familiar with the devices and the surgical techniques needed for implantation.

The external fixators segment shows a significant growth in the trauma fixation devices market during the forecast period. One of the main factors propelling the expansion of the external fixators market is the increasing number of trauma cases, which include injuries from sports, falls, and auto accidents. Since trauma is a primary global source of disability and death, there is an increasing need for efficient treatment alternatives. External fixators are critical in managing complicated fractures when quick internal fixation is impossible. The external fixators industry has grown in several locations due to government initiatives to improve trauma care and favorable reimbursement policies. These regulations promote the use of cutting-edge fixation devices by lessening the financial burden on consumers and healthcare providers.

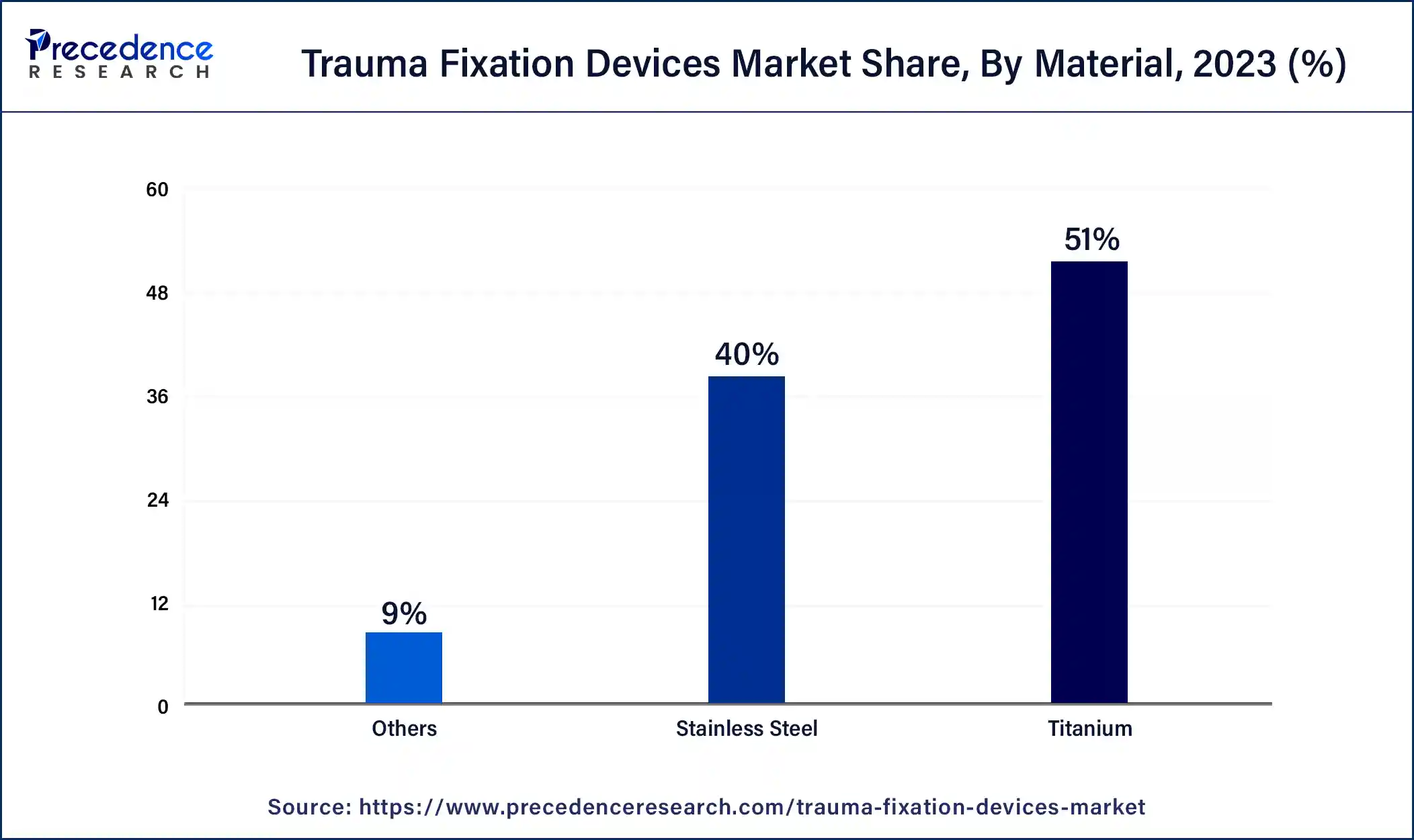

The titanium segment dominated the trauma fixation devices market in 2024. Since titanium is very biocompatible, the human body can accept it. This characteristic makes it the perfect material for implants by lowering the possibility of allergic reactions or rejection. Faster healing times and fewer problems have been linked to improved clinical outcomes when titanium is used in trauma fixation devices. Its qualities support bone stability and alignment, which are essential for a full recovery.

Titanium-based trauma fixation devices have been regularly approved by regulatory agencies, including the U.S. Food and Drug Administration (FDA), because of their safety and effectiveness. The widespread acceptance of these approvals in clinical practice has been encouraged, and trust has been strengthened.

The stainless-steel segment shows a significant growth in the trauma fixation devices market during the forecast period. Due to its exceptional endurance and tensile strength, stainless steel is popular for trauma fixation devices. Its capacity to endure high pressures and strains without breaking down is essential for preserving the stability of fractures or other bone damage. Trauma fixation tools made of stainless steel are widely used and subject to strict regulations. The regulatory endorsements and approvals of these technologies accelerate their uptake and expansion.

The lower extremities segment dominated the trauma fixation devices market in 2024. One of the most frequent forms of trauma is a lower extremity injury, such as a femur, tibia, fibula, or patella fracture or dislocation. Effective fixation devices are in considerable demand due to this high incidence. Lower extremity fixation devices have become more widely available and enticing due to frequent cost reductions brought about by advancements in device technology. Healthcare professionals will always have effective alternatives for different kinds of fractures and trauma due to the large selection of fixation devices made exclusively for lower extremity injuries.

The upper extremities segment shows a significant growth in the trauma fixation devices market during the forecast period. A rising number of sports injuries, auto accidents, and falls are resulting in upper extremity injuries, namely fractures of the hand, wrist, forearm, and shoulder. There is a direct correlation between the rise in upper extremity trauma cases and the increased popularity of high-impact sports and outdoor activities. The need for trauma fixation devices, which are crucial for fixing fractures and guaranteeing appropriate healing, is directly fueled by this increase in injuries.

The orthopedic centers segment shows a notable growth rate in the trauma fixation devices market during the forecast period. Orthopedic facilities frequently use specialized equipment and individualized treatment regimens to customize trauma fixation methods to meet the unique demands of their patients. This patient-centric approach further strengthens orthopedic facilities' market position. Due to their specialization in trauma care, which produces better results than regular hospitals, orthopedic facilities are frequently preferred by patients and their families. Those who need complicated trauma fixation operations have an extreme preference for this.

By Product

By Material

By Site

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

April 2025

January 2025