January 2025

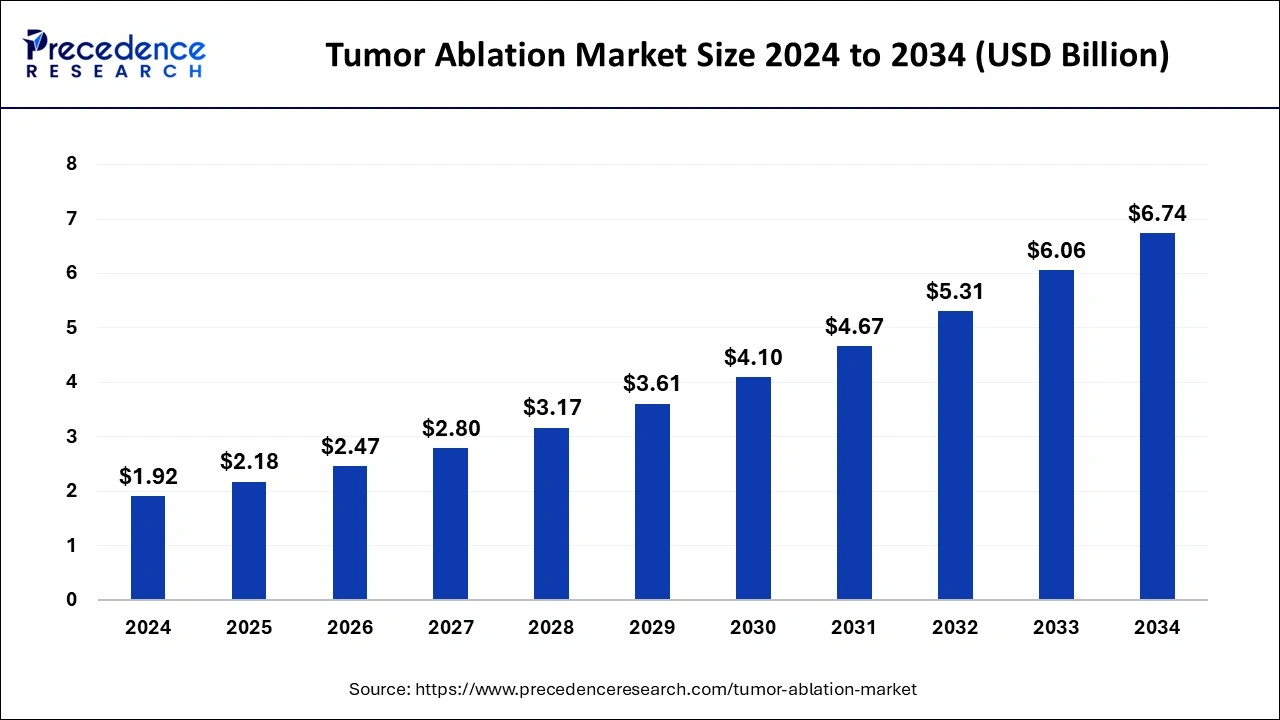

The global tumor ablation market size is calculated at USD 2.18 billion in 2025 and is forecasted to reach around USD 6.74 billion by 2034, accelerating at a CAGR of 13.38% from 2025 to 2034. The North America tumor ablation market size surpassed USD 690 million in 2024 and is expanding at a CAGR of 13.42% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global tumor ablation market size was estimated at USD 1.92 billion in 2024 and is predicted to increase from USD 2.18 billion in 2025 to approximately USD 6.74 billion by 2034, expanding at a CAGR of 13.38% from 2025 to 2034.

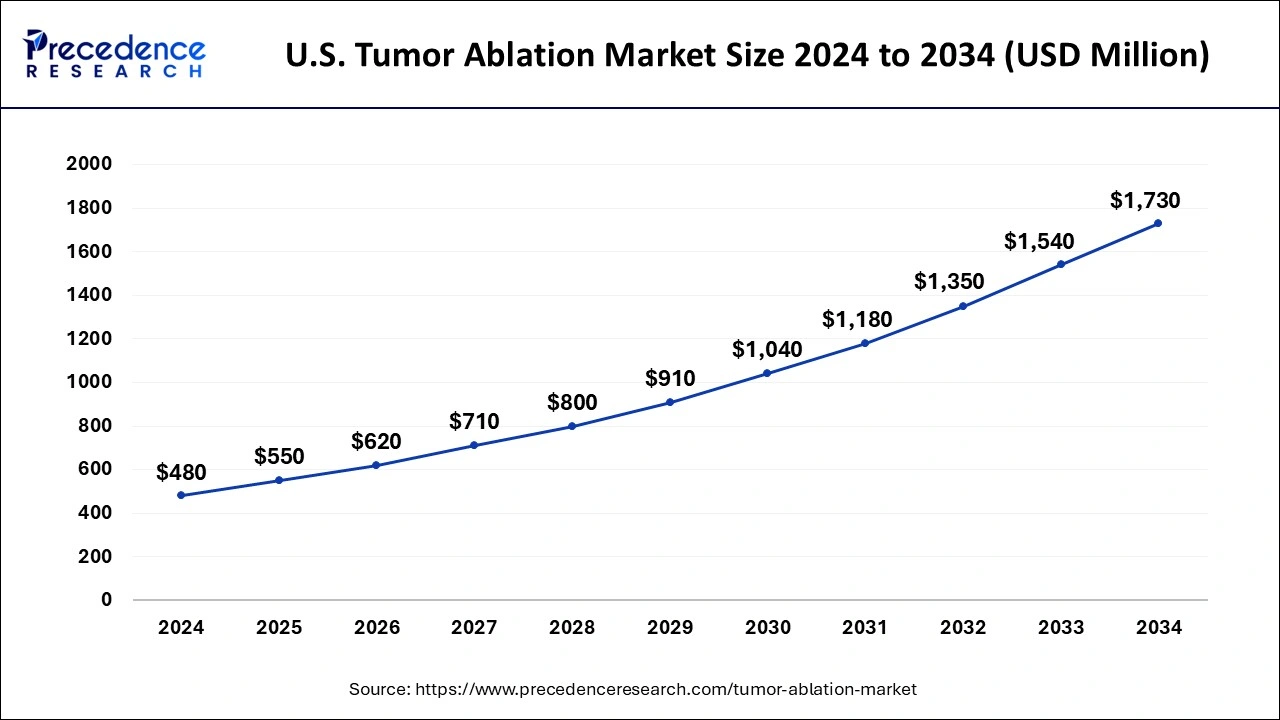

The U.S. tumor ablation market size was estimated at USD 480 million in 2024 and is anticipated to reach around USD 1730 million by 2034, growing at a CAGR of 13.68% from 2025 to 2034.

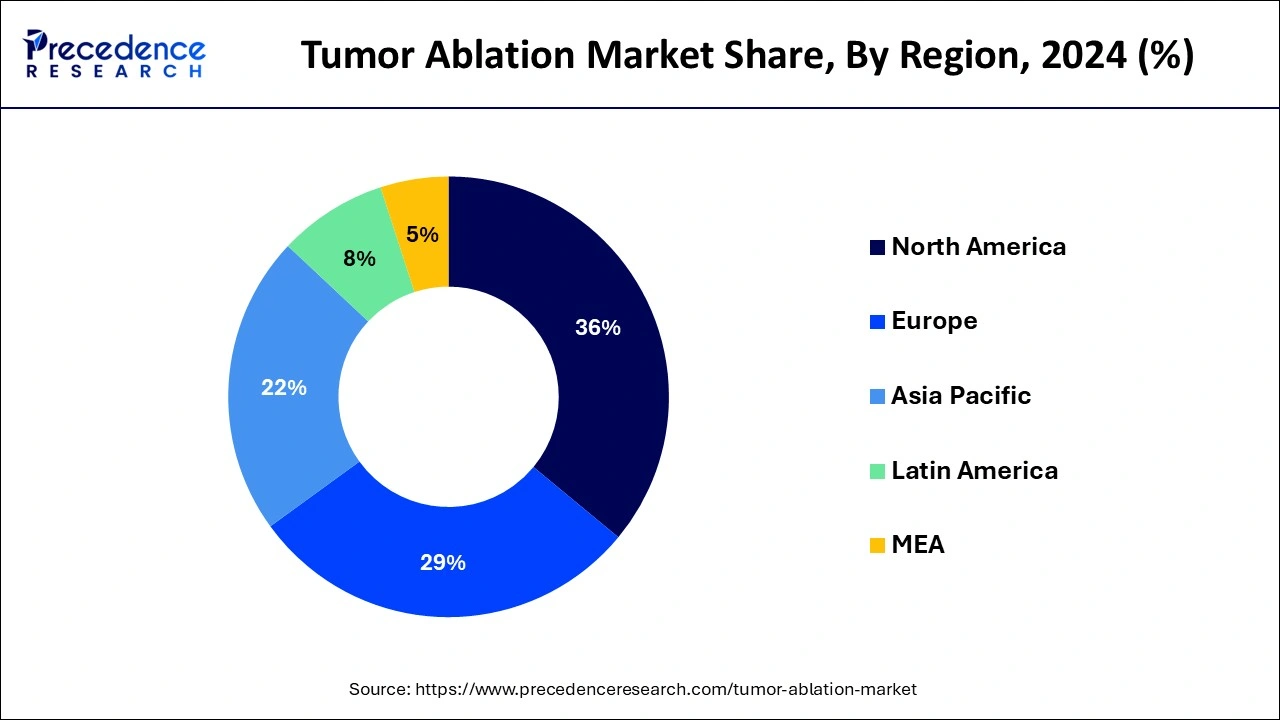

North America held the largest share of 36% in the tumor ablation market. The region's growth is propelled by several factors, including government backing for quality healthcare, a high purchasing power parity, the availability of reimbursements, and a rising incidence of cancer. Initiatives such as the patient protection and affordable cre act (PPACA) in the U.S. aim to enhance healthcare quality and affordability through health coverage policies, reducing healthcare costs for individuals and the government. Additionally, precision medicine initiatives contribute to tailored strategies based on unique disease characteristics, further improving the healthcare system and fostering market growth.

Europe holds a substantial market share, attributed to a higher degree of public funding in the region's healthcare system. The combination of a growing geriatric population and governmental support in cancer control initiatives is anticipated to bolster this growth.

Asia Pacific is expected to witness the fastest rate of growth in the tumor ablation market during the forecast period. Increasing patient numbers and the presence of prominent healthcare providers in developing economies such as India and China provide avenues for market expansion. Moreover, ongoing improvements in healthcare utilization, coupled with government support, contribute to this growth.

The tumor ablation market comprises a diverse range of ablation techniques, such as radiofrequency ablation (RFA), microwave ablation (MWA), cryoablation, high-intensity focused ultrasound (HIFU), and laser ablation, among others. These techniques employ different energy sources to administer controlled heat, cold, or sound waves, resulting in the destruction of tumor cells. This process leads to the death of the targeted cells, which are subsequently eliminated by the body's immune system. Within the global tumor ablation market, various medical equipment is utilized for these procedures, including ablation probes, electrodes, needles, catheters, ultrasound systems, MRI systems, and monitoring systems.

These devices are intricately designed to precisely deliver ablation energy to the specific target tissue while minimizing damage to surrounding healthy tissues. Factors driving market growth include the increasing cancer burden, ongoing technological advancements in ablation devices, and a growing demand for minimally invasive surgeries. Additionally, the implementation of key strategies by major players, such as partnerships and collaborations aimed at enhancing the product portfolio, is expected to have a positive impact on the market.

The tumor ablation market is expected to witness lucrative growth due to the availability of advanced therapeutic options and a high demand for minimally and non-invasive therapies. Surgeons and patients alike are increasingly favoring minimally invasive surgical procedures, driven by the benefits of faster recovery, enhanced patient comfort, and reduced procedure time. This shift in preference is a significant factor contributing to the rising demand for advanced tumor ablation techniques.

Continuous technological advancements aimed at improving accuracy, portability, and cost-effectiveness are driving tumor ablation market players to enhance and introduce innovative tumor ablation devices. The integration of internally cooled radiofrequency probes in the cooled radiofrequency denervation technique is an emerging method with substantial growth potential. This technique facilitates the expansion of the lesion's size, enabling comprehensive denervation of the sacroiliac joint and contributing significantly to pain management.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.38% |

| Market Size in 2023 | USD 2.18 Billion |

| Market Size by 2033 | USD 6.74 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology, By Treatment, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing preference among surgeons and patients for minimally invasive procedures

Minimally invasive procedures are characterized by smaller incisions or needle insertions, offering several advantages over traditional open surgeries. These procedures result in minimal tissue damage, reduced blood loss, and a lower risk of complications. Patients undergoing minimally invasive surgeries typically experience shorter hospital stays and faster recovery times, allowing them to resume normal activities sooner and enhancing their overall quality of life.

The success of minimally invasive techniques is often attributed to advanced imaging technologies that enable surgeons to visualize and precisely target tumors. Thereby, the rising preferences for minimally invasive procedures acts as a driver for the tumor ablation market. This heightened accuracy ensures the preservation of healthy surrounding tissues. Additionally, the instruments used in minimally invasive procedures are designed for greater maneuverability and agility, providing surgeons with improved control and precision during complex surgeries. The use of smaller incisions further reduces the risk of post-operative infections when compared to open surgeries.

Strict regulatory approval

The regulatory approval processes governing medical devices and procedures are typically protracted and meticulous. Evaluations focusing on safety, efficacy, and quality standards can significantly impede the introduction of new tumor ablation technologies to the tumor ablation market. These prolonged approval timelines pose a challenge to the timely availability and adoption of innovative tumor ablation solutions, consequently decelerating market growth.

Securing regulatory approvals and certifications entails substantial financial investments and specialized expertise. Companies are compelled to allocate resources to clinical studies, preclinical testing, and regulatory submissions, incurring considerable expenses. For small and medium-sized enterprises, meeting these requirements may pose financial challenges, limiting their capacity to introduce novel tumor ablation technologies to the market. The substantial cost and resource demands serve as entry barriers, constraining competition and innovation within the tumor ablation market.

Reimbursement policies

The existence of favorable reimbursement policies and comprehensive coverage for tumor ablation procedures plays a crucial role in ensuring broader accessibility to these treatments within the population. Reimbursement for tumor ablation procedures alleviates the financial burden on patients, facilitating increased accessibility across a wider patient demographic. This enhanced access, in turn, contributes to elevated procedure volumes, fostering the tumor ablation market’s growth.

When healthcare providers benefit from favorable reimbursement rates and policies, they are incentivized to incorporate tumor ablation procedures into their service offerings. Adequate reimbursement serves as fair compensation for the resources, time, and expertise invested by healthcare providers in performing tumor ablation procedures. This favorable environment encourages more healthcare facilities and providers to embrace and provide these treatments, thereby propelling tumor ablation market’s growth.

The radio frequency tumor ablation segment dominated the tumor ablation market while carrying 34% of the market share in 2024. This dominance is attributed to the specific and efficient nature of radiofrequency ablation in procedures targeting solid tumors in organs like the kidney and liver. The method allows for the treatment of multiple tumors simultaneously, enhancing procedural efficiency by utilizing multiple electrodes placed at different sites. This capability is anticipated to contribute to the increased adoption of advanced tumor ablation techniques. Radiofrequency/microwave ablation technology has demonstrated a high success rate, exceeding 85% in eliminating small liver tumors, according to the NCBI report. The advantages of radiofrequency techniques, particularly in successfully treating early-stage tumors, are expected to propel the growth of this segment.

Microwave ablation technology is projected to experience the fastest CAGR during the forecast period in the tumor ablation market. Unlike radiofrequency ablation devices that use electric current, microwave ablation devices propagate electromagnetic fields. This characteristic enhances the application of microwave ablation in tissues with low electrical conductance, such as bones and lungs. The technology offers benefits like a larger tumor ablation volume, consistent high-temperature performance, low ablation pain, and optimal heating of cystic masses. These advantages are anticipated to contribute to the growth of this segment. Moreover, the technology's minimal procedure time (5-10 minutes), improved efficacy with minimal complications, and reduced hospital stay are expected to further drive its growth.

The percutaneous ablation segment dominated the tumor ablation market with 56% of the market share in 2024. These procedures are favored for their attributes of faster recovery, minimal scarring, and heightened safety. Factors such as swift surgery time, patient comfort, and cost-efficiency are expected to further drive demand for this segment. However, challenges related to higher complications are anticipated to hinder its growth, particularly in hospitals where skilled professionals may be lacking. The recurrence rate of tumors is higher in percutaneous ablation due to inadequate ablation of tumors situated deep within the tissue.

Moreover, percutaneous ablation is contraindicated for treating lesions located very close to the gastrointestinal tract, gall bladder, bile duct, and heart due to the high risk of tumor recurrence. However, in such cases, laparoscopic ablation proves effective in delivering long-term outcomes while maintaining minimal invasiveness. This is expected to propel the growth of the laparoscopic ablation segment in the tumor ablation market during the forecast period.

By Technology

By Treatment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

March 2025