January 2025

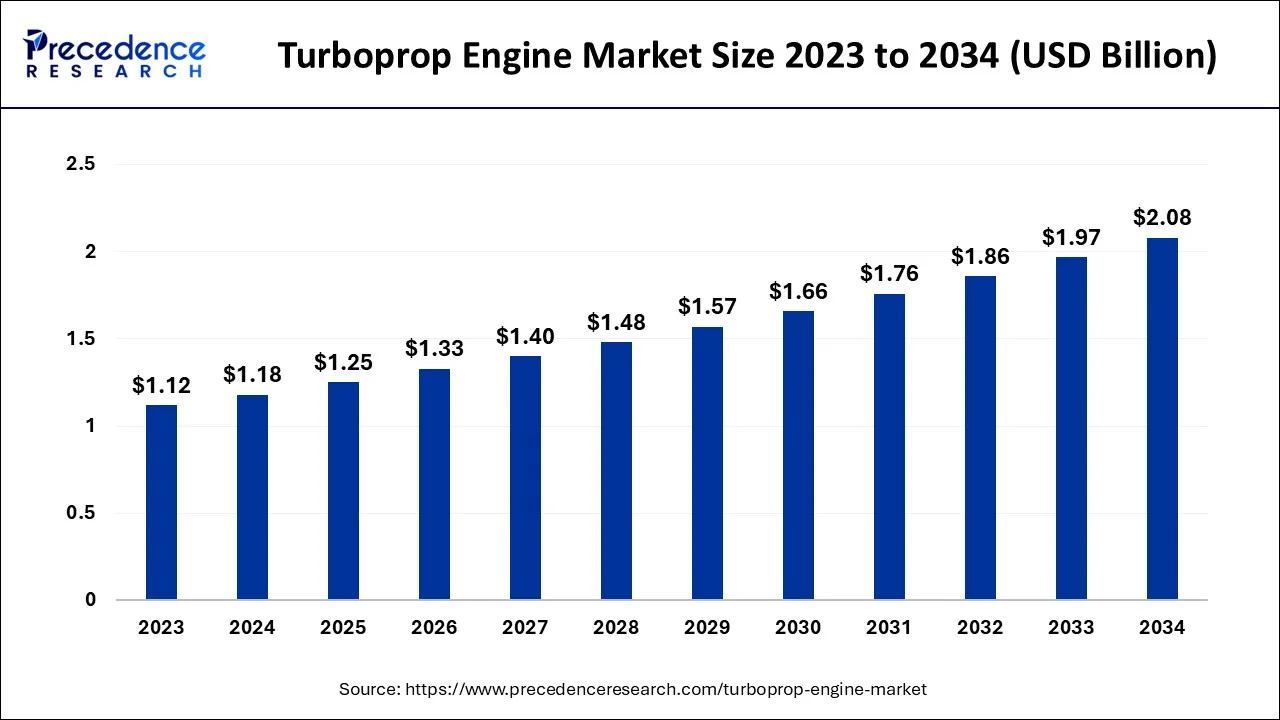

The global turboprop engine market size is predicted to increase from USD 1.18 billion in 2024, grew to USD 1.25 billion in 2025 and is anticipated to reach around USD 2.08 billion by 2034, poised to grow at a CAGR of 5.79% between 2024 and 2034. The North America turboprop engine market size is calculated at USD 50 million in 2024 and is estimated to grow at a fastest CAGR of 5.92% during the forecast year.

The global turboprop engine market size accounted for USD 1.18 billion in 2024 and is predicted to surpass around USD 2.08 billion by 2034, expanding at a CAGR of 5.79% between 2024 and 2034.

Impact of AI on the Turboprop Engine Market

Artificial intelligence is revolutionizing the turboprop engine market. Integrating AI features in turboprop engines enhances performance and efficiency. AI algorithms can predict engine behaviors, which helps to make better decisions. AI optimizes engine health and provides real-time data about performance and fuel consumption. It also optimizes fuel efficiency by monitoring engine settings. AI-driven turboprop engines are adjusted with propeller pitch and yaw for more efficiency.

Integrating AI features in the propulsion system helps maintain the engine's efficiency. Moreover, it enhances the engine's reliability by detecting defects and anomalies. AI-powered inspection systems not only monitor engine health but also provide requirement scheduling for maintenance before issues occur.

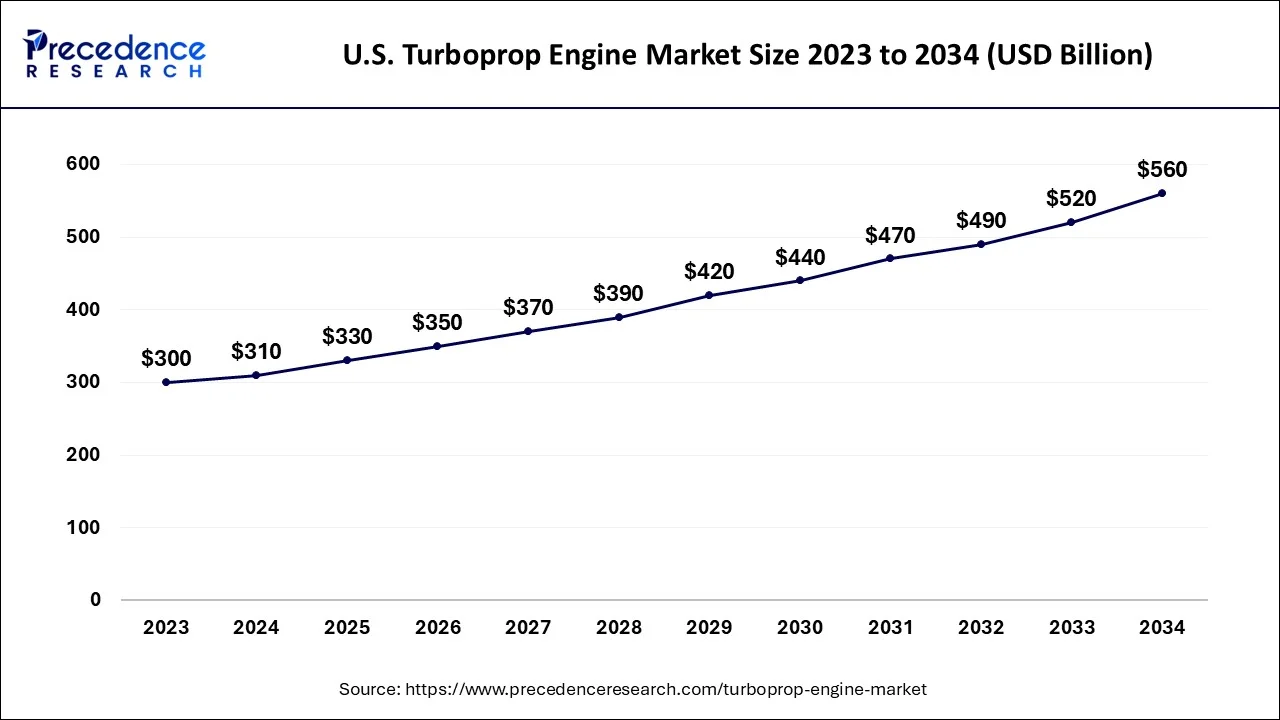

The U.S. turboprop engine market size is estimated at USD 310 million in 2024 and is expected to be worth around USD 560 million by 2034, growing at a CAGR of 6.09% between 2024 and 2034.

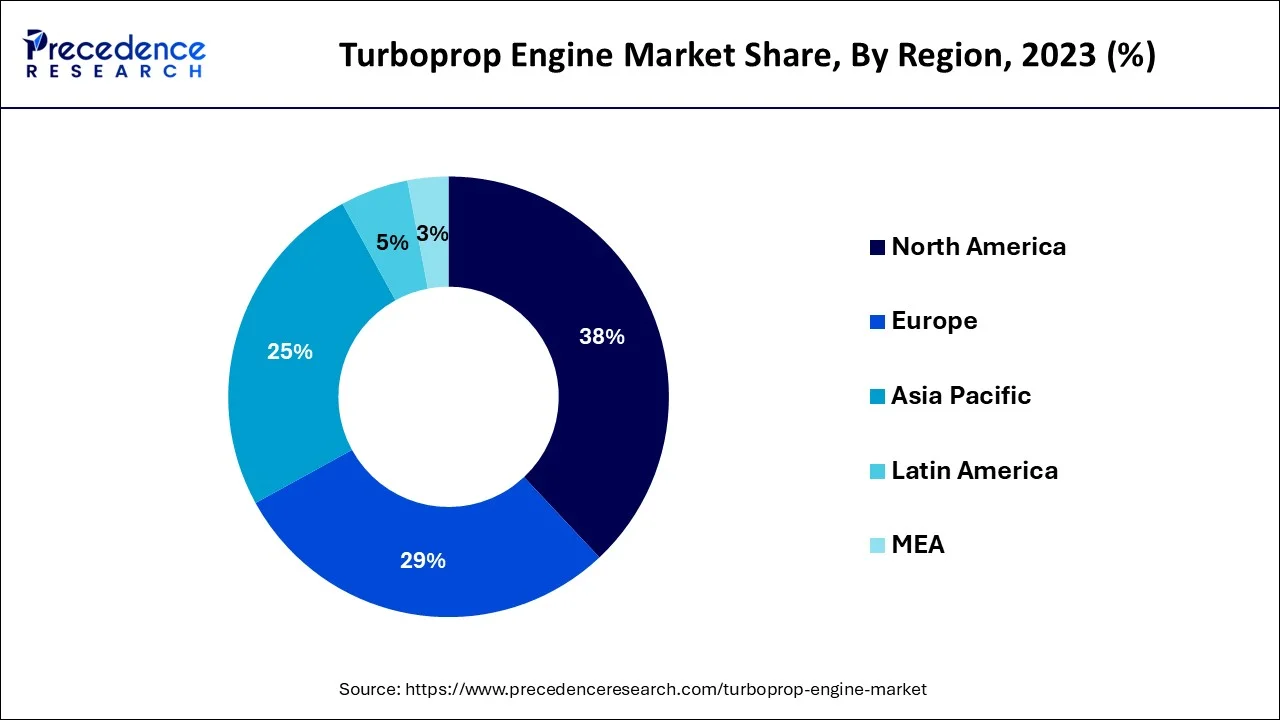

North America is expected to capture the largest revenue share of the turboprop engine market over the forecast period. The region is home to several major aircraft manufacturers, including Boeing, Bombardier, and Textron Aviation, which produce turboprop-powered aircraft. The market has witnessed steady growth over the years, driven by factors such as regional air travel demand, cargo operations, and specialized missions. The demand for regional air travel continues to grow in North America, driven by factors such as economic development, tourism, and connectivity. Turboprop-powered aircraft are well-suited for regional routes, short-haul flights, and serving smaller airports, making them a preferred choice for regional airlines.

For instance, according to the Bureau of Transportation Statistics, in 2022, American Airlines transported 194 million more passengers than in 2021, an increase of 30% from year to year. U.S. airlines handled 853 million passengers (unadjusted) over the whole 2022 calendar year, up from 658 million in 2021 and 388 million in 2020. Additionally, advancements in technology, such as hybrid-electric propulsion and improvements in engine efficiency, could shape the future of the turboprop engine market in North America. Continued investments in research and development by engine manufacturers, along with evolving regulations and market dynamics, will influence the growth and direction of the market in the region.

Europe is expected to hold a significant market share over the forecast period. The regional growth is owing to the rise in the air traffic. For instance, according to the data given by Eurostat, in the EU, 373 million passengers were flying in total in 2021, a significant rise of 34.9% from the previous year. Except for Finland (-16.1%), all Member States had increases in 2021 compared to 2020. Croatia (+129.4%) saw the largest growth, followed by Cyprus (+104.8%) and Greece (+85.9%). 19 of the remaining EU members had increases of more than 20% during the same period. The four remaining Member States all had increases of at least 10%, with Ireland (+10.0%) having the lowest gain. Moreover, turboprop engines generally offer better fuel efficiency and lower emissions compared to jet engines. With an increasing emphasis on sustainability and environmental responsibility, turboprop-powered aircraft are preferred for certain operations, contributing to the growth of the turboprop engine market in Europe.

A jet engine version that has been modified to power a propeller is known as a turboprop engine. In comparison to turbojet or turbofan-powered aircraft of the same size, turboprop-equipped aircraft are particularly efficient at lower flying speeds (less than Mach 0.6), burning less fuel per seat mile. They also require a lot less runway for takeoff and landing. Because of their reduced speed and cost-effectiveness while flying over relatively short distances, turboprops are the preferred engines for the majority of commuter aircraft.

The Pilatus PC-12, Alenia ATR 42, and Bombardier Dash 8 are a few examples of aircraft powered by turboprops. The gas generators of a turboprop engine, which uses the same principles as a turbojet to create energy, integrate a compressor, combustor, and turbine. The global turboprop engines market is being driven by several factors such as the growing aviation industry, increasing technological advancements, high fuel efficiency as compared to their counterparts, increasing demand from the military and defense, and growing collaboration between the key market players.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.18 Billion |

| Market Size by 2034 | USD 2.08 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.79% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Application, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High fuel efficiency and growing adoption in military applications

Turboprop engines are known for their fuel efficiency, particularly at lower speeds and altitudes. With rising fuel costs and increasing environmental concerns, operators are looking for engines that offer better fuel economy. Turboprops provide an advantage in terms of lower fuel consumption compared to jet engines, making them attractive for airlines and operators seeking cost-effective solutions. In addition to this, these engines are extensively used in military aircraft for various missions such as transport, surveillance, and maritime patrol. The defense sector plays a significant role in driving the demand for turboprop engines. Military organizations worldwide invest in upgrading their aircraft fleets to enhance capabilities, fuel efficiency, and operational performance. Therefore, high fuel efficiency and the growing adoption of turboprop engines in military applications will propel the market growth in the coming years.

Limited Speed

Limited speed and performance are major factors that hamper the turboprop engine market. Turboprop engines have limited speed compared to jet engines. Turboprop engine speed and performance are also not suitable for military applications. Due to the rising desire for high speed and performance, several aircraft manufacturers prefer jet engines over turboprop engines, leading to reduced adoption of turboprop engines.

Increasing emphasis on sustainable aviation across the globe

The aviation industry is increasingly focused on sustainability and reducing its environmental impact. Turboprop engines, compared to jet engines, generally produce lower carbon emissions and noise levels. This aligns with the industry’s goals for decarbonization and environmentally friendly operations. For instance, IATA member airlines adopted a resolution pledging them to achieve net-zero carbon emissions from their operations by 2050 during the 77th IATA Annual General Meeting in Boston, USA, on October 2021. With this commitment, air travel will comply with the Paris Agreement goals to keep global warming well below 2C. The shift towards sustainable aviation creates an opportunity for turboprop engines to position themselves as a greener alternative, attracting environmentally conscious operators and customers.

Based on the type, the global turboprop engine market is segmented into single shaft and free turbine. The single shaft segment is expected to dominate the market over the forecast period owing to its properties such as efficiency, rapid response, reliability, and cost-effectiveness. Single-shaft turboprop engines can achieve high overall efficiency. With a direct mechanical connection between the gas generator and the propeller, no energy losses are associated with transferring power between separate turbine stages. The efficient power transmission allows for the effective conversion of fuel energy into propulsive power, resulting in improved fuel efficiency and lower operating costs.

Moreover, these engines offer a quick response to throttle inputs. The direct mechanical link between the engines and the propeller allows for rapid adjustments in propeller speed and, consequently, thrust. This responsiveness is particularly beneficial during the take-off and landing phases, where precise control and quick power changes are necessary. Therefore, the various advantages offered by single-shaft turboprop engines will further drive market growth.

The commercial aviation segment is expected to grow at a rapid pace in the coming years. This is mainly due to the rising demand for regional air travel. Commercial aviation focuses on reducing operational costs and environmental impact. However, turboprop engines are more fuel-efficient compared to turbojet engines, making them suitable for commercial aircraft. With the rising production of commercial aircraft, the demand for turboprop engines is rising, as these engines are suitable for short-haul flights.

The conventional engine segment is projected to experience steady growth over the studied period. Conventional engines are cost-effective and do not require regular maintenance compared to electric engines, significantly reducing operational costs. Emerging technologies are helping to boost the performance of conventional engines. Conventional turboprop engines require lower initial investments, making them ideal for regional airlines.

Segments Covered in the Report:

By Type

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

August 2024

March 2025