January 2025

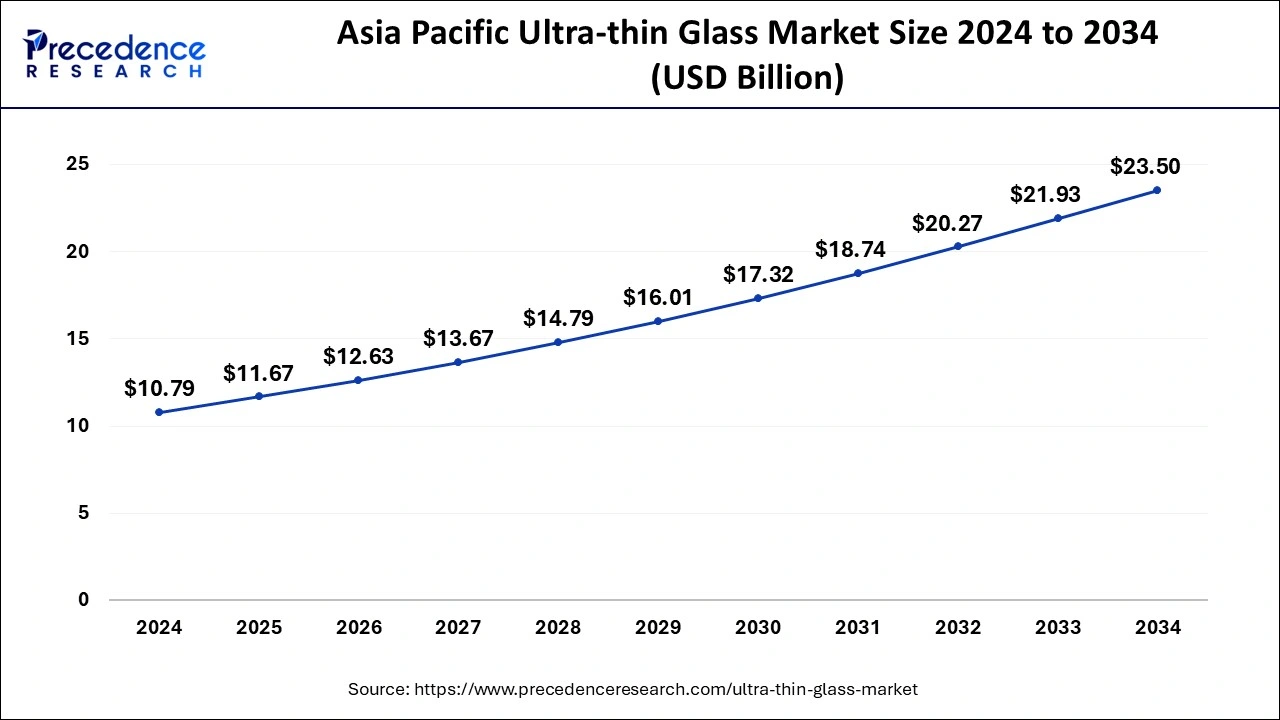

The global ultra-thin glass market size is calculated at USD 16.12 billion in 2025 and is forecasted to reach around USD 31.94 billion by 2034, accelerating at a CAGR of 8% from 2025 to 2034. The Asia Pacific ultra-thin glass market size surpassed USD 11.67 billion in 2024 and is expanding at a CAGR of 8.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ultra-thin glass market size was estimated at USD 14.93 billion in 2024 and is anticipated to reach around USD 31.94 billion by 2034, expanding at a CAGR of 8% from 2025 to 2034.

The Asia Pacific ultra-thin glass market size was evaluated at USD 10.79 billion in 2024 and is predicted to be worth around USD 23.50 billion by 2034, rising at a CAGR of 8.20% from 2025 to 2034.

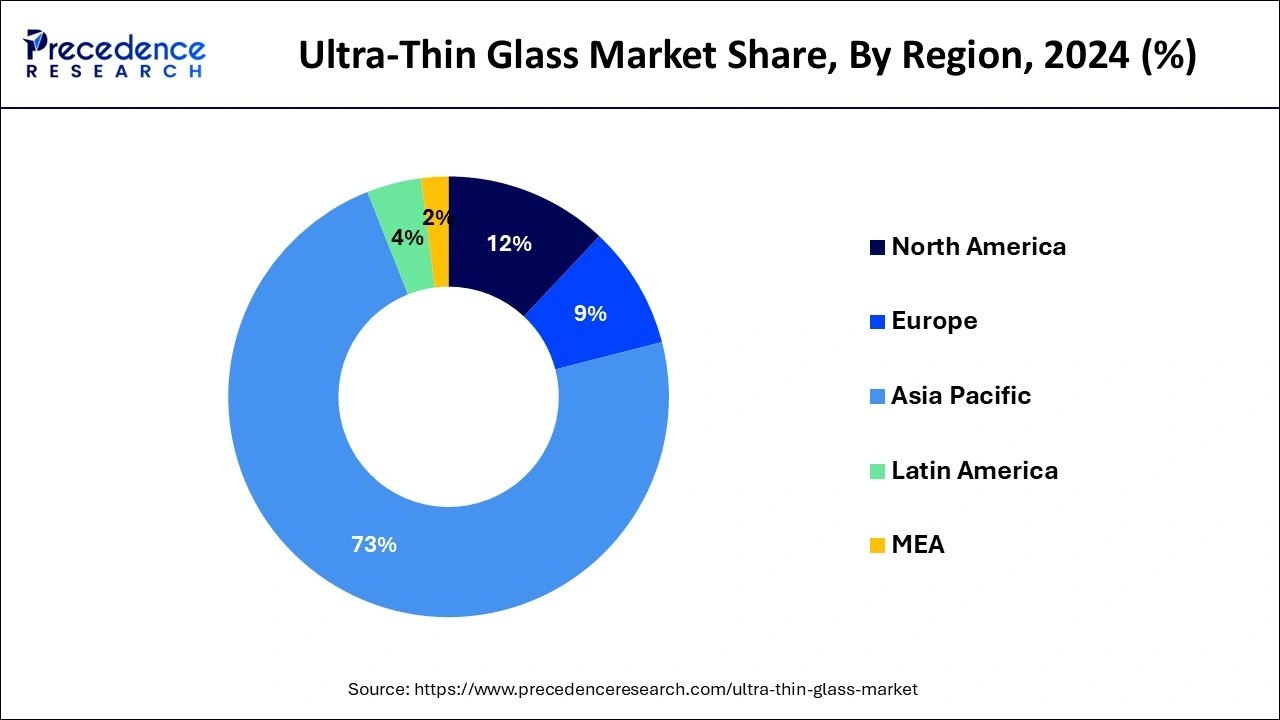

The Asia Pacific was accounted as the largest region in the global ultra-thin glass market with a volume share of approximately 73% in 2024. The prominent growth of the region is mainly attributable to the increasing demand for flat panel displays particularly in India, China, and South Korea. China holds around half of the global fabrication plants for flat panel display screens followed by South Korea.

Major manufacturing companies of LED and LCD are expanding their regional presence in these countries in order to cater the rising demand of customers. For instance, in May 2018, Corning Inc. introduced its new manufacturing facility for LCD glass substrate in Anhui province, China. The plant is mainly dedicated towards the production of TFT- grade Gen 10.5 substrates that uses Corning’s EAGLE XG® Slim glass during the manufacturing process. This further anticipated to fuels the growth of the market in the region.

Europe projected to witness prominent growth rate of around 6.5% in terms of value over the upcoming years. Major factors contributing towards the growth of the region are propelling demand for solar energy, LEDs, LCDs, and automotive sectors. The above factor expected to trigger the demand for the product over the upcoming years.

As per the Solar Power Europe, the renewable target set by the region is for the greenhouse gas emission reduction by nearly 40%. In the wake of same, some of the countries in the region for example Germany predicted to increase its capacity of solar energy generation by around 8GW to meet the renewable target. This is further likely to upscale the demand for the product over the analysis timeframe.

Ultra-thin glass offers attractive properties that include flexibility, abrasion & corrosion resistance, surface smoothness, gas barrier capability, and transparency because of which it is largely suitable for electronic & optical sensors, touch & display panels, semiconductors, energy storage devices, and organic electronics. Increasing demand for electronic devices such as Light Emitting Diodes (LEDs), Liquid Crystal Displays (LCDs), Organic LEDs (OLEDs), monitors, smartphones, and laptops expected to flourish the demand for flat panel displays that in turn boosts the market growth for ultra-thin glasses in the coming years.

Furthermore, increasing production of smartphone coupled with increasing demand for large display sizes of the electronic devices is likely to propel the market for the flat panel displays in the forthcoming years. For instance, in July 2018, Xiaomi introduced Hongmi Note 5, a new smartphone in Seoul, South Korea that uses tempered ultra-thin glass of around 0.3 mm thickness. This initiative by the company assists it in expanding its market hold in South Korea.

Besides smartphones, smartwatches are the other most prominent wearable technology that has gained prominent share over the recent past in healthcare, security, entertainment, and other sectors. In the wake of same, several manufacturers have increased their production as well as shipment volume attractively in the past year. For instance, in 2018, the shipment value of smartwatches for Garmin International, Samsung Group, Fitbit Inc., and Apple Inc. were 3.2 Million units, 5.3 Million units, 5.5 Million units, and 22.5 Million units respectively. Hence, increased production of smartwatches anticipated to flourish the growth of market for ultra-thin glasses.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.93 Billion |

| Market Size in 2025 | USD 16.12 Billion |

| Market Size by 2034 | USD 31.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application Type |

Flat panel displays held the largest market share in 2024. Prime factors that are driving the growth of the segment are growing demand from consumer electronic devices such as LCDs and LEDs. TV panel manufacturers are expected to be the largest investors in large-size screens because to cater the demand for high resolutions and picture quality. For instance, in December 2017, BOE Technology Group Co., Ltd., an electronic components manufacturer based in China enhances its production line for Gen 10.5 TFT-LCD with 75 inch and 65 inch display screens in Anhui province, China. This expected to uplift the product demand over the upcoming years.

In semiconductors segment, ultra-thin glass is majorly used in interposer and chip packaging applications because it is highly transparent as well as operates at high frequencies, thus offers better performance. Hence, with the high market growth of chip packaging due to introduction of advanced electronic devices the market for ultra-thin glasses in semiconductor segment also expected to proliferate during the forthcoming years. In addition to this, the increasing demand for integrated chips across various industrial applications that include LED lightings & sensors in transportation, networking devices, smart meters, photovoltaic (PV) inverters, and human-machine interface systems also propels the market growth for semiconductor segment prominently over the coming years.

The global ultra-thin glass industry is highly competitive in nature with the presence of major market players that are present on both regional as well as international level. The main strategy adopted by these players is capacity expansion in order to capture major end-use industry scope and thus gaining a competitive advantage over others.

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

January 2025

October 2024