January 2025

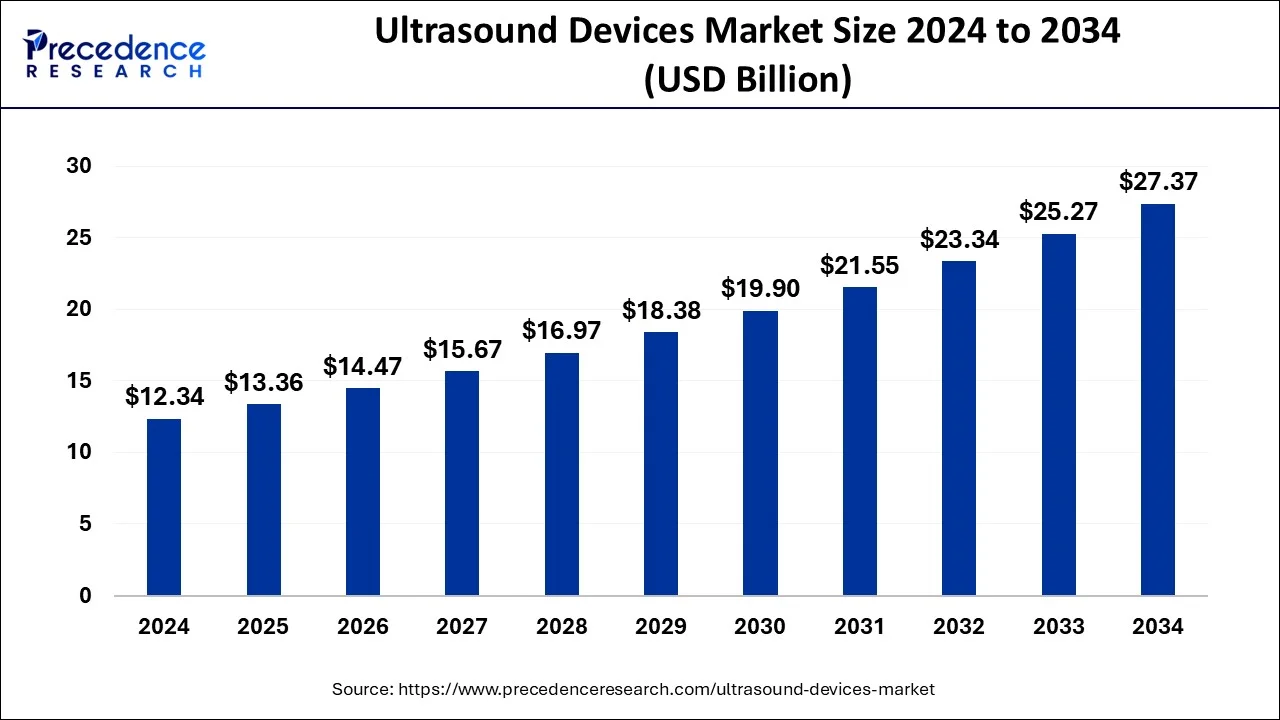

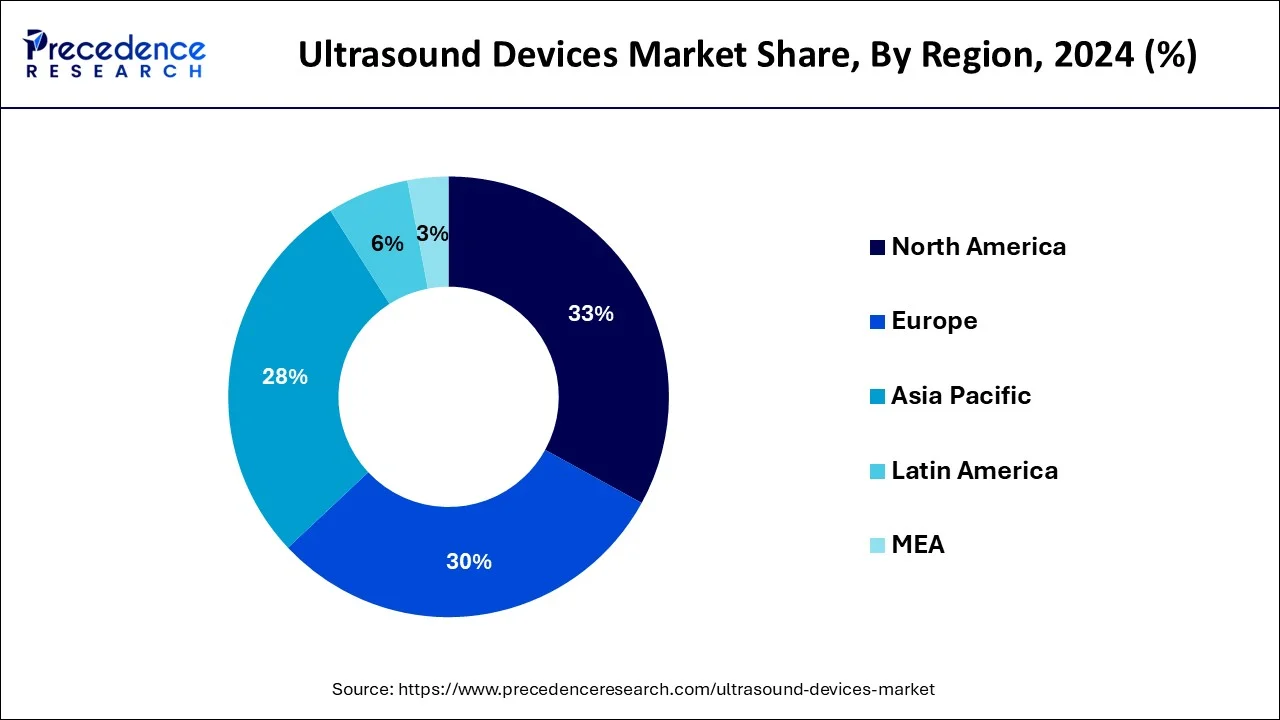

The global ultrasound devices market size is calculated at USD 13.36 billion in 2025 and is forecasted to reach around USD 13.36 billion by 2034, accelerating at a CAGR of 8.29% from 2025 to 2034. The North America ultrasound devices market size surpassed USD 4.07 billion in 2024 and is expanding at a CAGR of 8.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ultrasound devices market size accounted for USD 12.34 billion in 2024 and is expected to reach around USD 27.37 billion by 2034, expanding at a CAGR of 8.29% from 2025 to 2034. The increased integration of AI is the key factor driving the growth of the ultrasound devices market. Rising demand for non-invasive diagnostic procedures is fueling the adoption of ultrasound devices. Additionally, ongoing technology developments are expected to further boost the market growth.

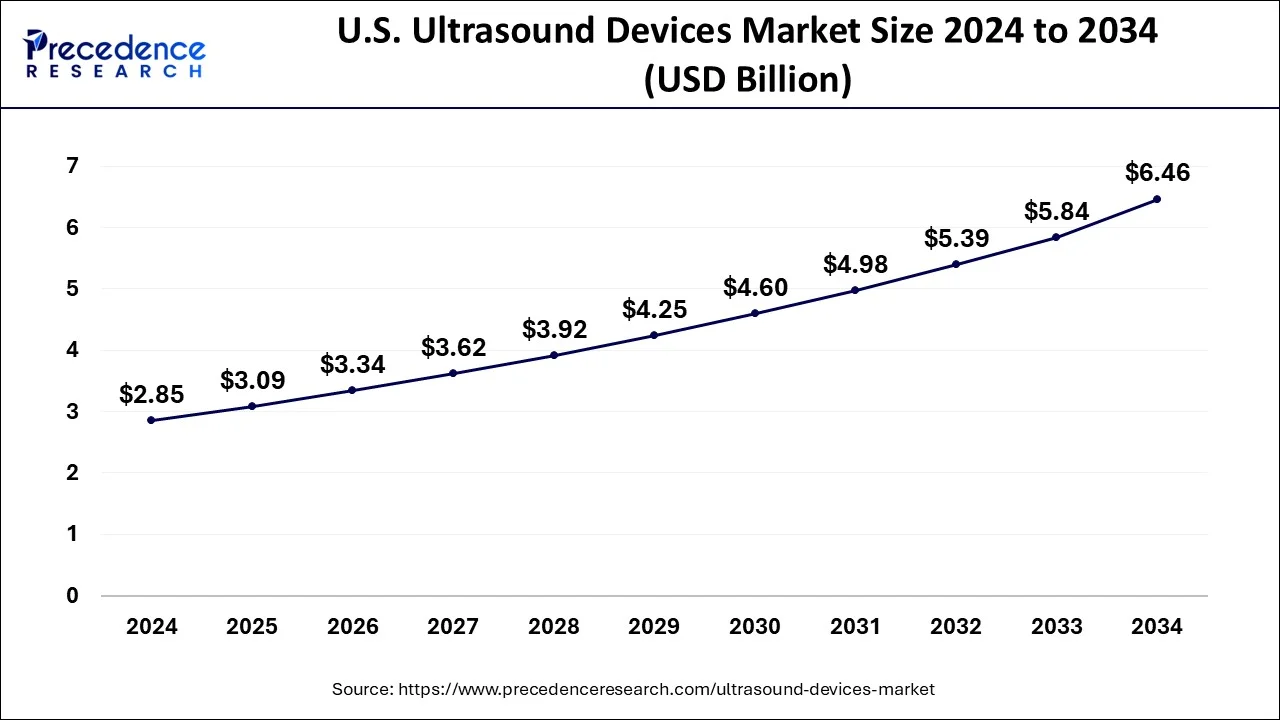

The U.S. ultrasound devices market size was valued at USD 2.63 billion in 2024 and is predicted to be worth around USD 6.92 billion by 2034, at a CAGR of 9.17% from 2025 to 2034.

The United States led the regional market due to the country's history of early adoption of advanced technology, expanded advanced healthcare infrastructure, and investments in research and developments. The well-established healthcare infrastructure of the United States allows the adoption of cutting-edge medical technologies, including ultrasound devices. The ongoing government and regulatory initiatives and investment in R&D firms are empowering countries key competitors for developments and launching of the advanced technologies that are improving the market situation in the country.

Asia Pacific is anticipated to witness significant growth during the forecast period due to rising population and expanding advanced healthcare infrastructure in the region. Additionally, the rising aging population and chronic disease among elderly patients are fueling the market growth. China is leading the regional market due to countries rapidly advancing healthcare infrastructure and adoption of the advanced medical technologies. The rising developments of advanced imaging technologies for applications, including point-of-care applications, are trending in the Chinese market. However, India is anticipated to witness spectacular market growth in the forecast period due to rising incidence of chronic disease, an aging population, and government initiatives and funding in the pharmaceutical and healthcare infrastructure.

With the growth of the IT industry and its applications in various other fields. For a long time, healthcare has led the way in technological developments, and it is now used in almost every clinical department and pharmaceutical and medical industries. AI-based solutions are being implemented to improve patient outcomes by increasing diagnostic accuracy and assisting in decision-making. For example, deep learning in medical imaging provides patients with a seamless, integrated, personalized treatment journey. With various applications of artificial intelligence integration, it may be a future opportunity for market growth. With ongoing innovations and technology developments, the AI integration is likely to empower the healthcare expenditure.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.34 Billion |

| Market Size by 2034 | USD 27.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.29% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Ultrasound devices are less expensive.

With a rise in persistent diseases comes an increase in healthcare advancement. The ultrasound method is the oldest and most effective for patient pre-diagnosis. There are other methods for pre-diagnosis detection, such as computed tomography (CT) scans and magnetic resonance imaging (MRIs), although they are relatively expensive, and the new technological advancements and techniques make them costly. Furthermore, as technology progresses, ultrasound technology develops, with new AI integration features and high image quality, but ultrasound devices remain relatively inexpensive compared to other methods. As a result, the market's expansion is driven by the low-cost and reliable old method.

Development of advanced healthcare systems

Increases in technological advancements, the digital world, the IT industry, and artificial intelligence are key market growth factors. Furthermore, population growth and the need to expand treatment methods with technological advancement can treat a greater number of patients with positive outcomes. In addition, the quality of the treatment provided to the patient is critical, and the pre-diagnosis detection should be accurate and clear to proceed with the diagnosis.

Ultrasound technology advancements such as the incorporation of artificial intelligence, improved quality of 4D imaging, elastography methods, quantification, and selecting the ideal images are a few advancements that can enhance the quality of the results, resulting in market expansion.

Furthermore, advances in technology can provide more treatment options, thereby improving healthcare quality. According to Columbia University research news, a new ultrasound device offers a new treatment option for hypertension by calming the overactive kidney nerves with ultrasound, which consistently lowers blood pressure.

Safer than other technologies

Other imaging technologies depend on radiation, which really is harmful to human health. The ultrasound device does not use radiation, is non-invasive, and has a long track record of safety. Because of this safety feature, ultrasound is the most widely used medical imaging method for fetus during pregnancy. Ultrasound imaging is one of the best options for medical diagnosis because of its lack of harmful effects and high image quality. According to the FDA, medical professionals must consider ultrasound examinations, which use relatively little ionization radiation exposure, as part of the FDA's strategy to reduce unnecessary radiation exposure from medical imaging.

Lack of training

Healthcare is a large industry, and medical practices and training are critical to the effectiveness and quality of treatments. There are few guidelines for ultrasound imaging treatment and training. Point-of-care ultrasound is the use of ultrasound at the point of care to answer a diagnostic question or to help the effectiveness of an invasive procedure. It has the potential to improve clinical decision-making and accuracy. Although the prevalence of point of care in hospitals varies, it has seen less use in recent years due to a lack of training.

According to a survey conducted by VA medical centers, the most frequently reported barrier to POCUS used among hospitalists include lack of training due to funding and opportunities for training. As a result, a lack of training can impact the quality of treatment, stifling market growth.

Rising demand of Point-of-care testing

The demand for point-of-care testing has increased in various sectors, like primary care clinics and emergency rooms, that are driving the adoption rate of the ultrasound devices. The Poc testing helps healthcare professionals to deliver effective and fast treatments. The ability to provide remote treatment and diagnostics is making them more popular among the healthcare professionals and patients. Also, the ability of POC to reduce the need for hospitalizations and expensive laboratory testing is emerging in the market. With rising adoption of the advanced technologies, the POC testing are expected to advance in the upcoming period, leading to providing room for improvements and developments of novel treatment solutions. The rising prevalence of chronic disease, aging population, and complexities in pregnancy are driving demands for effective and faster treatment options. including point-of-care testing, which is projected to enhance the adoption of ultrasound devices, making market potential.

The diagnostic ultrasound technology segment dominated the market as the demand for ultrasound inspection grows, owing to its ease of use, lower implementation costs, and versatility.

On the other hand, the therapeutic segment is expected to lead the market in the forecast period due to increased demand for the non-invasive ultrasound procedure. The therapeutic ultrasound devices are non-intrusive and able to work for pain management. The demand for advanced devices to reduce the risk of complications is the key factor driving the growth of the segment. The ability of therapeutic ultrasound devices to heal chronic wounds and enhance patient outcomes is making them more popular in the healthcare sector. The expanding application of therapeutic ultrasound devices in physical therapy and rehabilitation is expected to further fuel the growth of the segment in the forecast period.

The ultrasound devices market is divided into diagnostic and therapeutic segments. Diagnostic ultrasound technology is expected to dominate the market as the demand for ultrasound inspection grows, owing to its ease of use, lower implementation costs, and versatility. Considering these advantages, advances in diagnostic ultrasound imaging technology for improved diagnosis and immediate clinical information have been made.

Due to its efficacy, speed, low cost, and non-invasive nature, this technology is recommended over other imaging techniques. The diagnostic ultrasound industry will continue to evolve as the clinical application scope expands, including orthopedics, cardiology, obstetrics, gynecology, breast and prostate cancer detection, and emergency medicine.

The radiology segment of the market is expected to dominate in the forecast period. Population growth, as well as the rising prevalence of cancer and chronic diseases, are factors influencing its expansion. Furthermore, because ultrasound devices are primarily used in the radiology segment, in vitro testing will increase demand for imaging workups due to its increased sensitivity and potential diagnoses.

Furthermore, as various advancements in imaging and capturing technology are made, the use of ultrasound devices will become more prevalent. In addition, many new features, such as harmonic tissue imaging, model-based segmentation and imaging, catheter-based ultrasound, and elastography, are increasing demand in the radiology ultrasound application.

On the other hand, the obstetrics/gynecology segment is anticipated to witness significant growth in the forecast period due to increased applications in prenatal care. Additionally, the segment growth is attributed to rising awareness of maternal and fetal health. Ultrasound devices are majorly utilized to monitor the fetal health and provide early detection of fetal abnormalities and pretends the diagnosis. The increased cancer cases are demanding the ultrasound devices for gynecological cancer screening. The need for monitoring of reproductive health, the segment is likely to lead the market in upcoming years.

The market for ultrasound devices market is segregated into hospitals, surgical centers, diagnostic centers, and others. The hospital segment is anticipated to dominate the market in the forecast period. A few of the driving factors of the hospital ultrasound devices market are the rise in the number of patients, an increase in chronic diseases, a large population, more treatment options, and quality diagnosis. Furthermore, an increase in the number of clinical departments in hospitals that use ultrasound devices best boosts market growth in the hospital sector.

The rise in road accidents and the increase in orthopedic surgery and surgical procedures are driving the demand for ultrasound technology for pre-diagnosis and immediate and quality treatment. According to an orthopedic study, fractures were the most common type of injury, accounting for 71% of all total injuries. As a result, the number of accidents has increased, as have the number of surgeries and the use of ultrasound devices for pre-diagnosis.

“With cutting-edge AI features and the potential of ACUSON Origin to improve diagnostic accuracy and patient care, the system is determined to change healthcare’s approach to cardiovascular imaging.”

“By launching o of iQ3, the company is likely to witness a paradigm shift in ultrasound. This novel launching of the company has created a new standard of digital image quality to match with traditional handheld devices and even certain carts. The device is projected to attract POCUS experts to choose a company and support interference to generate confidence and competency through artificial intelligence and advanced imaging tools.”

By Technology

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

November 2024