April 2025

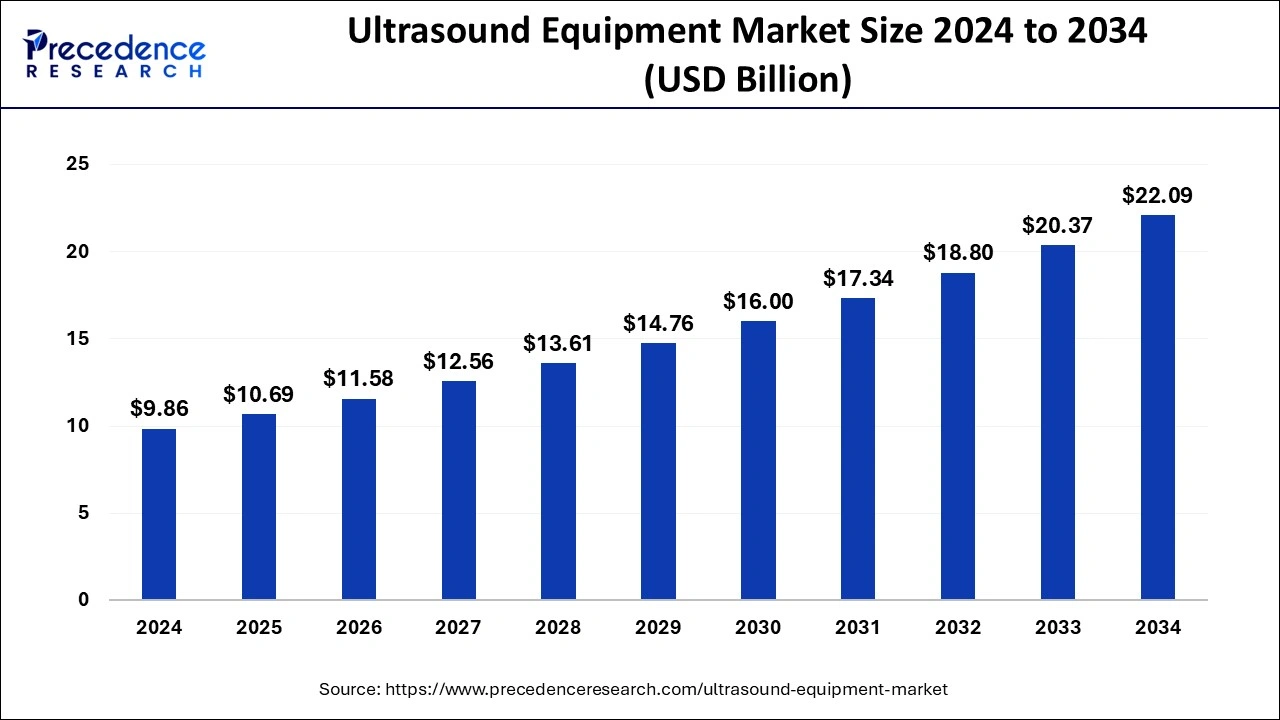

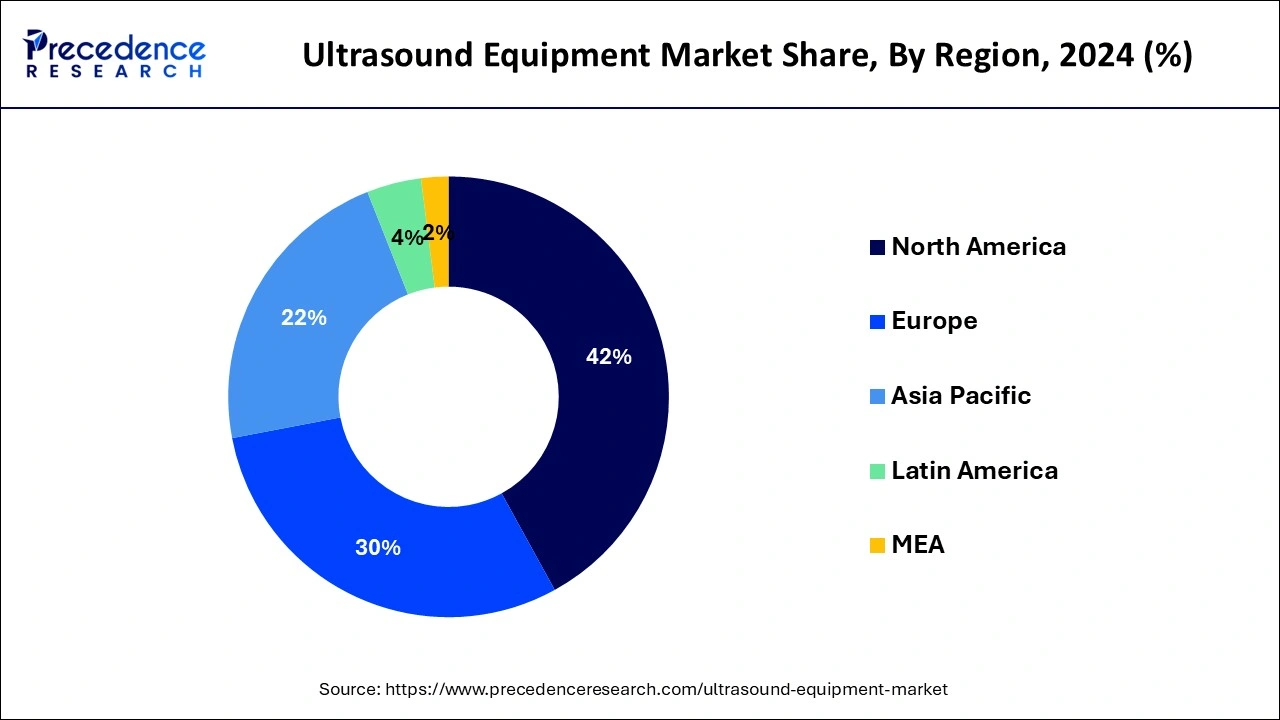

The global ultrasound equipment market size recorded at USD 10.69 billion in 2025 and is expected to reach around USD 22.09 billion by 2034, expanding at a CAGR of 8.40% from 2025 to 2034. The North America ultrasound equipment market size reached USD 4.14 billion in 2024 and is expanding at a CAGR of 8.43% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ultrasound equipment market size accounted for USD 9.86 billion in 2024 and is expected to reach around USD 22.09 billion by 2034, expanding at a CAGR of 8.40% from 2025 to 2034. The rapidly expanding diagnostics sector, rising incidences of chronic disorders, and increasing investments boost the market.

Artificial intelligence (AI) finds immense potential in the diagnostics sector. Several researchers are investigating the role of AI in ultrasound equipment. AI can aid in easy analysis and interpretation of the imaging data. This can reduce manual errors, increase sensitivity, specificity, and accuracy, and save time for physicians. It can enhance the quality of ultrasonographic images, providing diagnostic support and improving workflow efficiency. AI can also be used to standardize image acquisition and integrate clinical information. It can also provide performance feedback for operators with integrated clinical information and demographics. AI-enabled ultrasound equipment can increase access to large amounts of patients globally, where access to trained sonographers is limited.

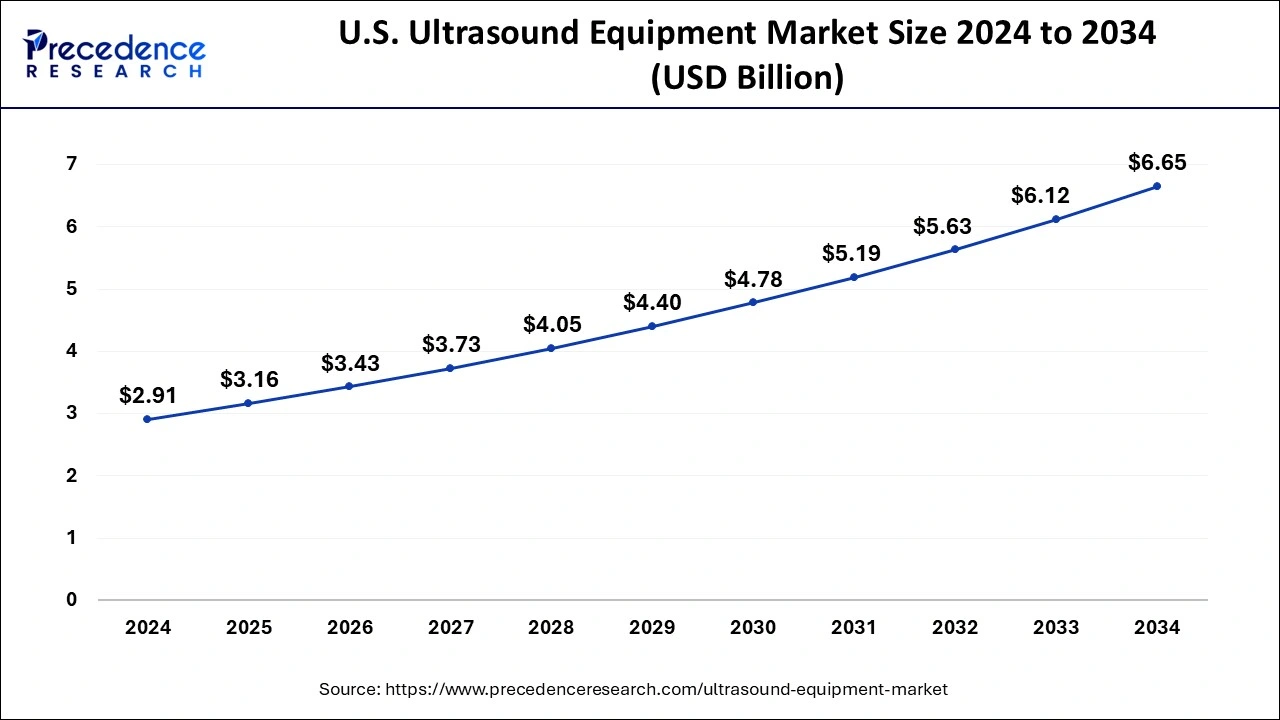

The U.S. ultrasound equipment market size was valued at USD 2.91 billion in 2024 and is predicted to be worth around USD 6.65 billion by 2034, at a CAGR of 8.60% from 2025 to 2034.

North America dominated the market in terms of revenue and is projected to surpass remarkable CAGR during the forecast period. This can be attributed to the increased adoption of advanced systems and technologies in the healthcare sector of North America. The growing geriatric population in the US and the rising number of private clinics and hospitals are boosting the demand for ultrasound equipment in the region.

On the other hand, Asia-Pacific is estimated to be the most opportunistic market during the forecast period. The huge population, rising disposable income, increasing expenditure in health and wellness, and growing government investments in the development of sophisticated healthcare infrastructure is boosting the economy of Asia Pacific and the ultrasound equipment market players have huge growth potential in the untapped region of Asia Pacific.

Favorable government policies and increasing investments fuel market growth in the US. The US Food and Drug Administration regulates the approval of ultrasound equipment in the country. The National Institute of Biomedical Imaging and Bioengineering (NIBIB) provides funding for research projects related to ultrasound.

The Chinese government takes suitable steps to promote the use of ultrasound equipment in the country. The growing healthcare expenditure and suitable regulatory framework boost the market. The rapidly expanding healthcare and medical device sector in China also augments market growth.

An ultrasound is an equipment that captures images of the organs inside the body to examine them. It is based on sound waves to capture the image of the body’s internal organs, fluids, and soft tissues for testing, diagnosis, or therapeutic purposes. It enables healthcare professionals to diagnose problems associated with internal organs and to examine the sources of inflammation or pain in the body. Unlike X-rays and CT scans, they do not emit ionizing radiation. The ultrasound equipment comprises a transducer, central processing unit, display, control knobs, keyboard, and printer. The ultrasound image is produced based on the reflection of the waves of the body structures. This equipment finds immense applications in obstetrics and gynecology, urology, cardiology, biopsy, and probing.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.4% |

| Market Size in 2024 | USD 9.86 Billion |

| Market Size in 2025 | USD 10.69 Billion |

| Market Size by 2034 | USD 22.09 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Application, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Increasing Pregnancy Cases

Ultrasound equipment is predominantly used in pregnancy to evaluate the condition of the fetus. According to the WHO, 41.3 women per 1000 women gave birth in 2023 globally. The increasing cases of pregnancy can also be due to early marriages of adolescent girls. The ultrasound images help to check the baby’s development, the presence of multiple pregnancies, and to pick up any abnormalities during the pregnancy. The ultrasound equipment is non-invasive, painless, and safe for both the mother and the fetus, hence widely used during pregnancy. The number of ultrasound scans during pregnancy varies depending on the health of the patient. However, it is regulated to offer ultrasound scans at least 2 times during pregnancy.

Lack of Trained Professionals and High Installation Cost

The major challenge of the ultrasound equipment market is the lack of trained professionals. This limits access to ultrasound imaging by numerous people, especially in low- and middle-income countries (LMICs). Around 50% of pregnant women in LMICs do not receive ultrasound scans through the full course of their pregnancy. Another major challenge is the high installation cost of the equipment. The high cost is not limited to installation but also extends to timely maintenance of the equipment. Both these factors restrict the use of ultrasound equipment, hindering market growth.

Growing Demand for Point-of-Care Diagnostics

The growing demand for point-of-care diagnostics creates ample opportunities for the ultrasound equipment market players. Point-of-care diagnostics are devices that can diagnose a disease at a patient’s bedside, eliminating the need for healthcare professionals. The growing demand for home healthcare services potentiates the demand for point-of-care diagnostics. Ongoing research and development activities are carried out to develop point-of-care ultrasound (POCUS). The need for POCUS increases due to its portability and cost-effectiveness. POCUS can deliver the same accuracy and precision as that of conventional equipment. The post-pandemic era has also created a buzz for point-of-care diagnostics. Several government organizations also release guidelines to support the development of point-of-care diagnostics.

The table-top segment accounted largest revenue share in 2024 and is estimated to sustain its dominance during the forecast period. This is attributable to the increased adoption of table-top ultrasound equipment in the healthcare sector owing to its low cost as compared to that of compact ultrasound equipment. The segment is expected to grow further owing to the rising government expenditure in developing economies to build hospitals to improve the healthcare sector.

On the other hand, the compact segment is anticipated to register the highest CAGR during the forecast period. This can be attributed to the enhanced features of the compact ultrasound equipment such as instant and accurate ultrasound results, safety, improved radiation-free imaging, and non-invasiveness. These features are considered to be boon in emergency settings and thus the adoption of compact ultrasound equipment is expected to register a significant growth in the forthcoming years.

The hospital's segment dominated the largest revenue share in 2024 and is projected to witness notable CAGR during the forecast period. This can be attributed to the extensive use of ultrasound equipment in hospitals across the globe. Ultrasound equipment is a boon in the diagnosis of various chronic diseases and hence is widely used across hospitals. Moreover, the rising number of patients and hospital admissions is perfectly complementing the growth of this segment.

On the other hand, the clinics segment is estimated to be the fastest-growing segment. The rising demand for the diagnosis of various diseases is fostering the growth of clinics. According to the CDC, in 2019, there were over 900 million physician visits in the U.S. Further, the rising penetration of private clinics in the developed and developing economies is a major factor fueling the growth of this segment.

The radiology segment accounted largest revenue share in 2024 and is anticipated to hit a notable CAGR during the forecast period. There are various factors that fuel the demand for radiology such as the growing geriatric population and rising prevalence of diseases such as cancer and cancer survivors. Furthermore, developing economies are expected to drive the demand as developing economies hold vast potential for expansion in the healthcare sector.

On the other hand, the gynecology segment is estimated to register the highest CAGR during the forecast period, owing to the increasing usage of ultrasound diagnosis during pregnancy. According to NCBI, the average number of ultrasound diagnoses performed during pregnancy has increased from 1.5 in 1995 to 2.7 in 2006, in the U.S. There are several complications related to pregnancy, reproductive system, and fertility that needs to be diagnosed by the ultrasound systems.

By Product

By End User

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2025

November 2024

December 2024