September 2024

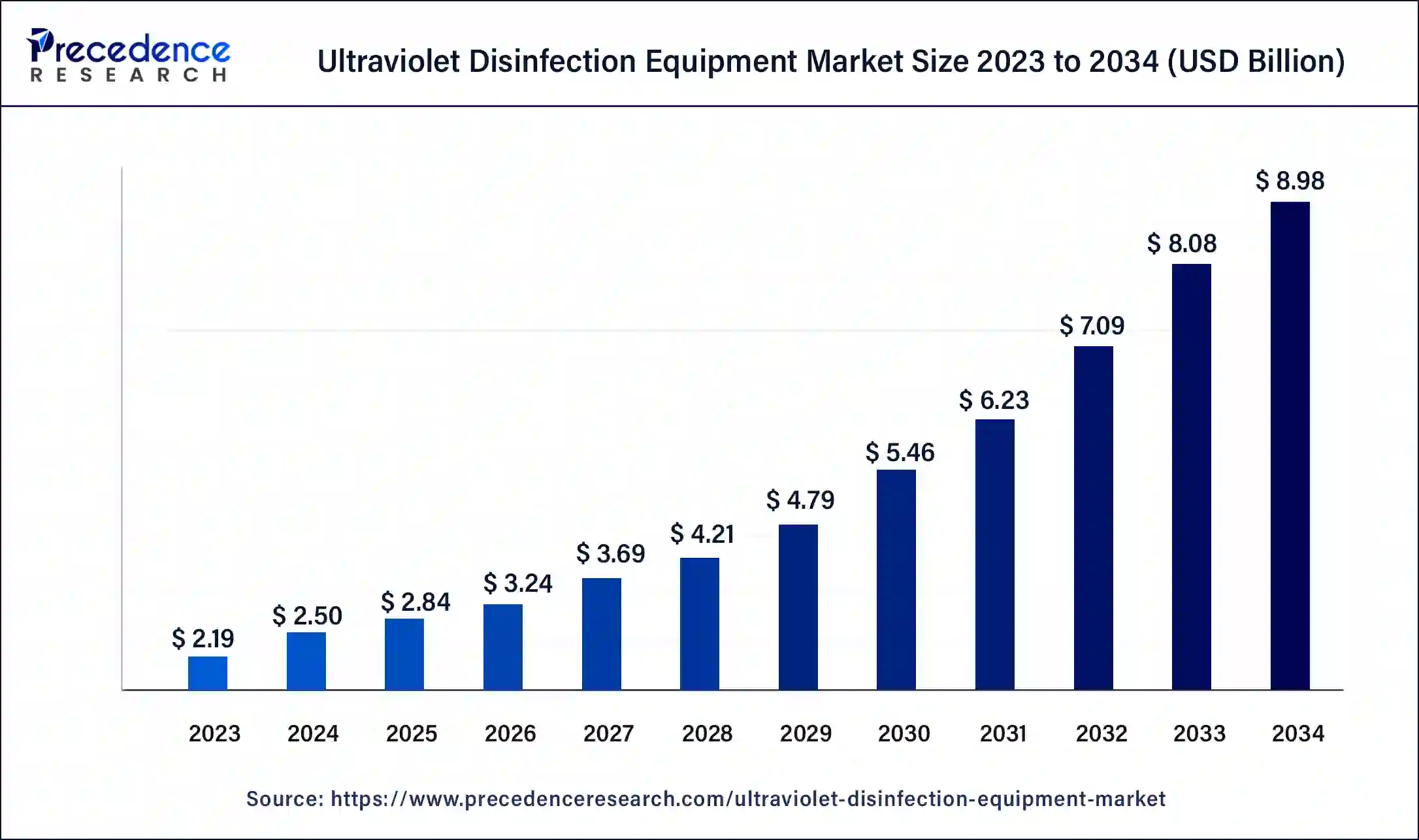

The global ultraviolet disinfection equipment market size was USD 2.19 billion in 2023, estimated at USD 2.50 billion in 2024 and is anticipated to reach around USD 8.98 billion by 2034, expanding at a CAGR of 13.64% from 2024 to 2034.

The global ultraviolet disinfection equipment market size accounted for USD 2.50 billion in 2024 and is predicted to reach around USD 8.98 billion by 2034, expanding at a CAGR of 13.64% from 2024 to 2034.

Growing investments in wastewater plant expansion, coupled with the prevalence of Hospital-Acquired Infections (HAIs), are expected to fuel market growth over the forecast period. Moreover, an increase in the use of reclaimed water in landscape irrigation, car washing, and urinals has contributed to the need for disinfection technologies, which are expected to fuel market growth over the forecast period.

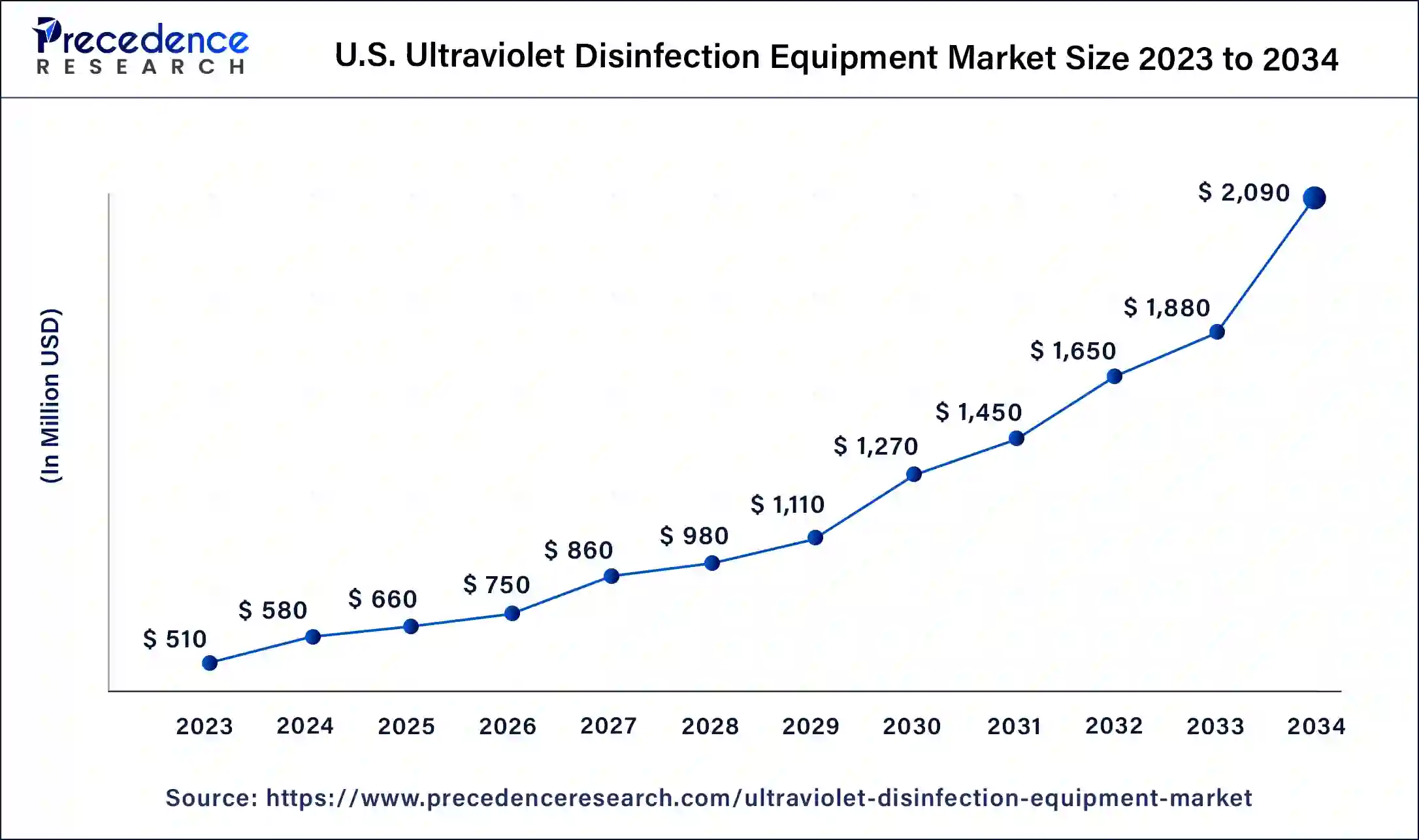

The U.S. ultraviolet disinfection equipment market size was valued at USD 510 million in 2023 and is expected to be worth around USD 2,090 million by 2034, at a CAGR of 14% from 2024 to 2034.

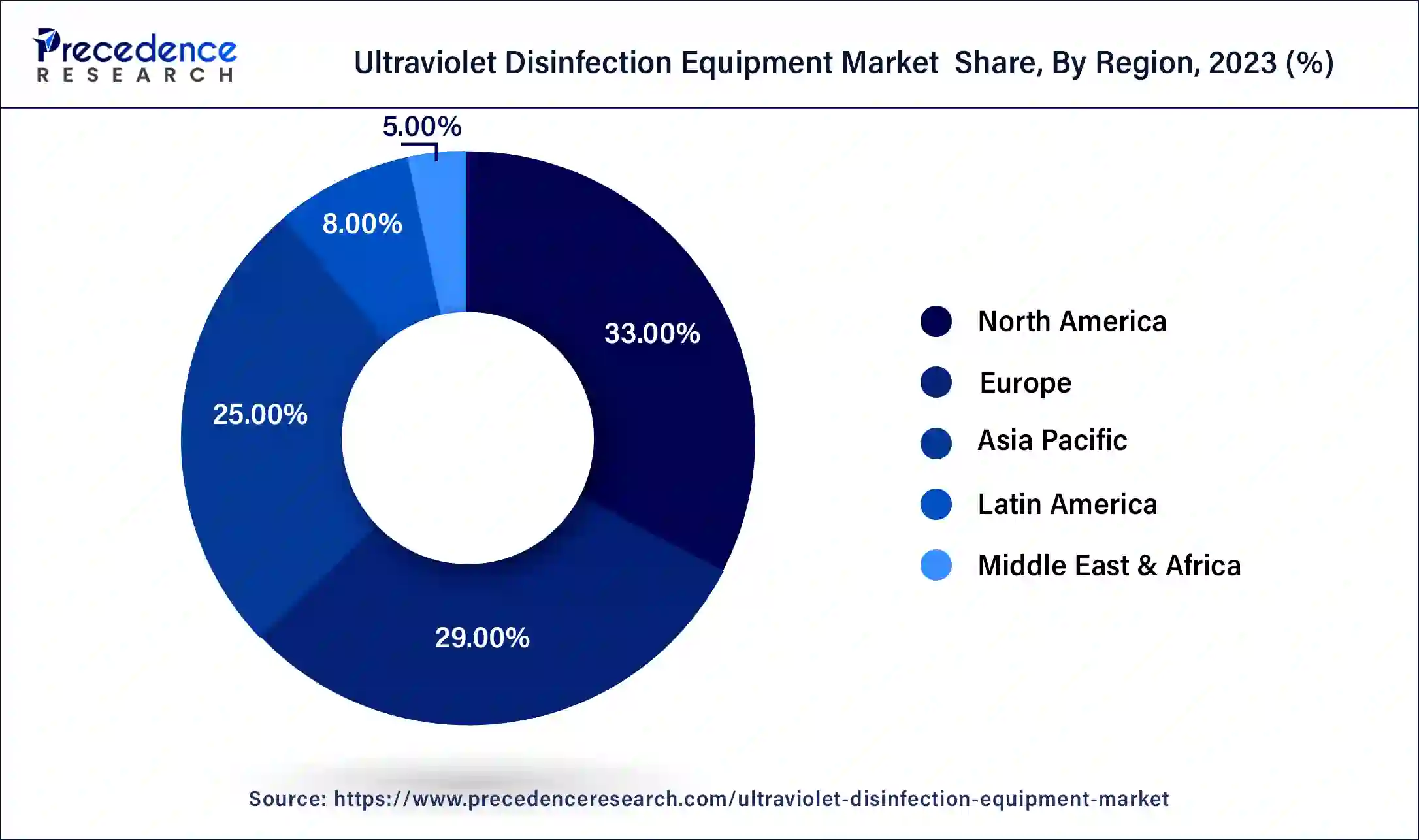

In 2023, North America accounted for the major share of the global market for UV disinfection equipment, due to increasing concerns about the environmental and health impacts of disinfection, chemical, and biological pollutants as by-products in wastewater and water supply, which are the main opportunities to drive the future of this market. Moreover, the market is mainly driven by the production of modern, low-cost, more reliable, environmentally friendly, easy-to-operate, and residue-free UV disinfection products.

In addition, the growth of the UV disinfection market in North America is driven by increased incidences of pandemic diseases such as H1N1, chronic diseases, and aging populations. Due to its acceptance as a disinfection process for drinking water and wastewater treatment, UV technology has almost replaced chemical treatment, as it is environmentally friendly and safe to use. Therefore the demand for UV disinfection equipment in this area offers good competition for the chemical-based industries. In addition, in 2020, due to the COVID-19 pandemic outbreak, demand for UV disinfection equipment for surface disinfection applications has increased. Instead of manual cleaning, hospitals across North America, especially in the U.S., now use automated UV-C light-based surface disinfection systems to prevent the transmission of COVID-19. During the forecast period, this factor is expected to drive the growth of the UV disinfection equipment market.

Report Scope of the Ultraviolet Disinfection Equipment Market

| Report Highlights | Details |

| Market Size in 2023 | USD 2.19 Billion |

| Market Size in 2023 | USD 2.50 Billion |

| Market Size by 2034 | USD 8.98 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.64% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Due to the rising demand for water and wastewater treatment plants, UV lamps led the industry and accounted for 33% of the worldwide revenue share in 2023. Demand is likely to be driven by the growing traction for proper disinfectant technologies along with increasing hygiene and safety concerns, especially in the healthcare and food & beverage industries. Maintenance and maintenance costs for sleeves, lamps, ballasts, and other staffing provisions are highly dependent on the annual operating costs for this equipment. Over the past few years, the prices of UV disinfection equipment have decreased due to the improved lamp and device designs, which have increased competition among manufacturers.

UV lamps normally last up to 14,000 working hours and after every 12,000 hours, are usually altered. It is expected that quartz sleeves can last up to 8 years and are usually replaced after five years. Furthermore, according to the U.S., the ballast life cycle is roughly 15 years and is typically replaced every ten years. Fact Sheet on EPA Wastewater Technology

In 2023, the use of UV disinfection equipment in applications for water & wastewater treatment led the industry and accounted for 71% of global sales. Infections from five common foodborne pathogens including Cyclospora, Vibrio, STEC, Yersinia, and Campylobacter are on the rise, according to the food net report published by the Center for Disease Control in 2019. As a result, demand for UV technology is projected to boost the demand for disinfection equipment. An area of concern is diseases associated with the poultry industry and leafy green produce. As a result, the study by the Center for Disease Control also emphasizes the need for improved widespread disinfection technologies, such as UV, to minimize contamination during food processing, preparation, and manufacturing. The product discovers a wide variety of applications in point-of-entry, point-of-use, filling points, post-carbon philter, pre-membrane filtration, pre-reverse osmosis system, post-water and pre-syrup storage tanks, post-reverse osmosis storage tank, prior to processing and distribution loops, and where there is a problem of bio-contamination, as UV disinfection prevents bacterial growth that may occur from seeing.

Based on end user the ultraviolet disinfection equipment market is segmented into municipal, residential, commercial, and industrial. The municipal segment led the demand for UV disinfection equipment and accounted for over 46% of worldwide sales in 2023 due to the growing penetration of technology in developing countries' water & wastewater treatment plants. As it is cost-effective, safe, and eco-friendly, several municipal wastewater treatment plants have begun to implement UV disinfection treatment solutions over traditional technologies. The UV disinfection process only adds ultraviolet light and thus has no effect on the oxygen levels of the water and requires the necessary low contact time. The demand for goods is also expected to see a rise in wastewater disinfection for reuse across different applications in the municipal, commercial, and industrial sectors.

The global Ultraviolet Disinfection Equipment market seeks intense competition due to rapidly changing consumer preferences. The major producers are concentrating on technical developments and product innovations because of the rising demand for UV equipment amid the COVID-19 outbreak. Germfalcon, for example, uses a UV-C light system specifically built for airplanes that can clean a 30-row aircraft in less than 3 minutes. In addition, Puro supplies the New York City transit services with UV-C light to disinfect subway cars and buses.

Segments Covered in the Report

This research study comprises a complete assessment of the market using far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers a classification of the marketplace into impending and niche sectors. Further, this research study calculates the market size and its development drift at global, regional, and country from 2024 to 2034. This report contains a market breakdown and its revenue estimation by classifying it based on material, application, and region:

By Component Type

By Application

By End Use

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

February 2025