January 2024

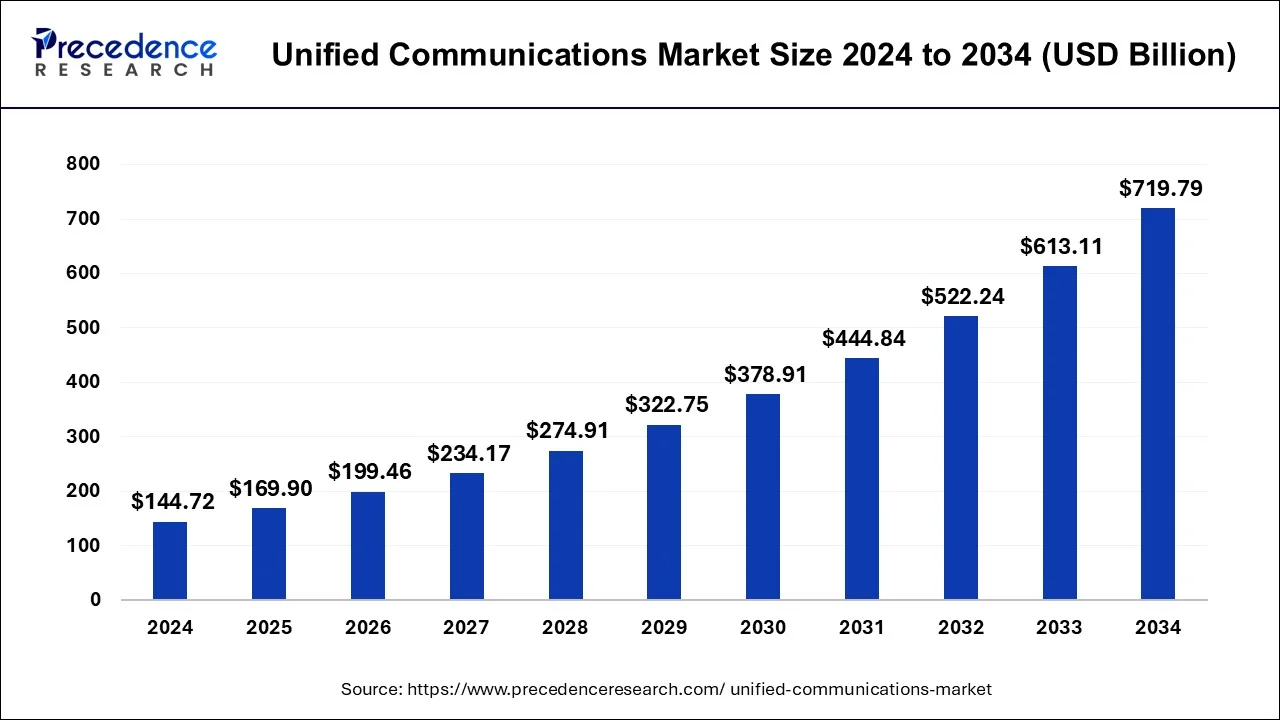

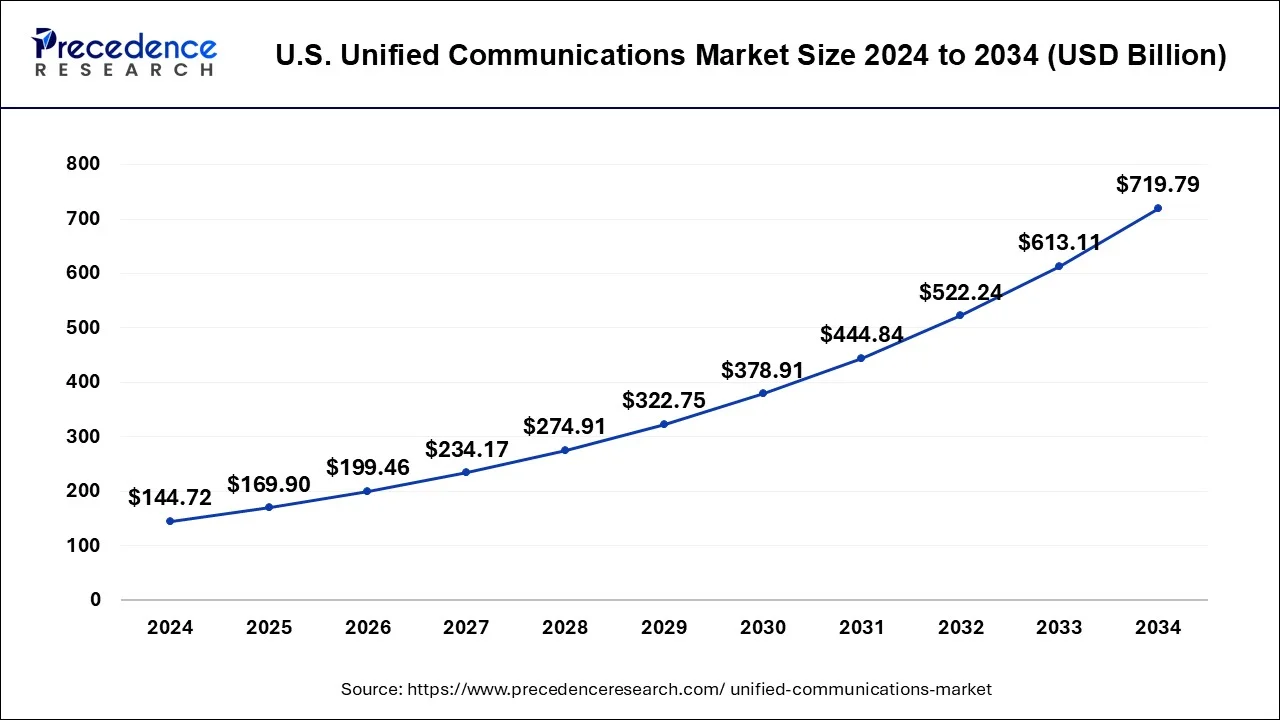

The global unified communications market size is calculated at USD 169.9 billion in 2025 and is forecasted to reach around USD 719.79 billion by 2034, accelerating at a CAGR of 17.40% from 2025 to 2034. The North America unified communications market size surpassed USD 52.10 billion in 2024 and is expanding at a CAGR of 17.42% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global unified communications market size was estimated at USD 144.72 billion in 2024 and is anticipate to reach around USD 719.79 billion by 2034, expanding at a CAGR of 17.4% from 2025 to 2034. . The growing adoption of hybrid and remote work, with the advancement of technology and growing collaboration of tools leads to the proliferation of a unified communications market

Artificial Intelligence (AI) plays a crucial role in evolving the unified communications market by enhancing its productivity and providing superior user experience. The incorporation of features such as virtual assistants to online communication applications such as Zoom, Microsoft Teams, Slacks, and many others enhances the customer experience. It helps to modify the technology by extracting information from gathered data and understanding market demand. It can bring advancement to the business by improving the productivity of the employees and providing an upgraded experience to the customers. It improves the voice quality as well as video quality by reducing background noise and adjusting the lighting of the video.

The U.S. unified communications market size surpassed USD 144.72 billion in 2024 and is predicted to be worth around USD 719.79 billion by 2034, growing at a CAGR of 17.6% from 2025 to 2034.

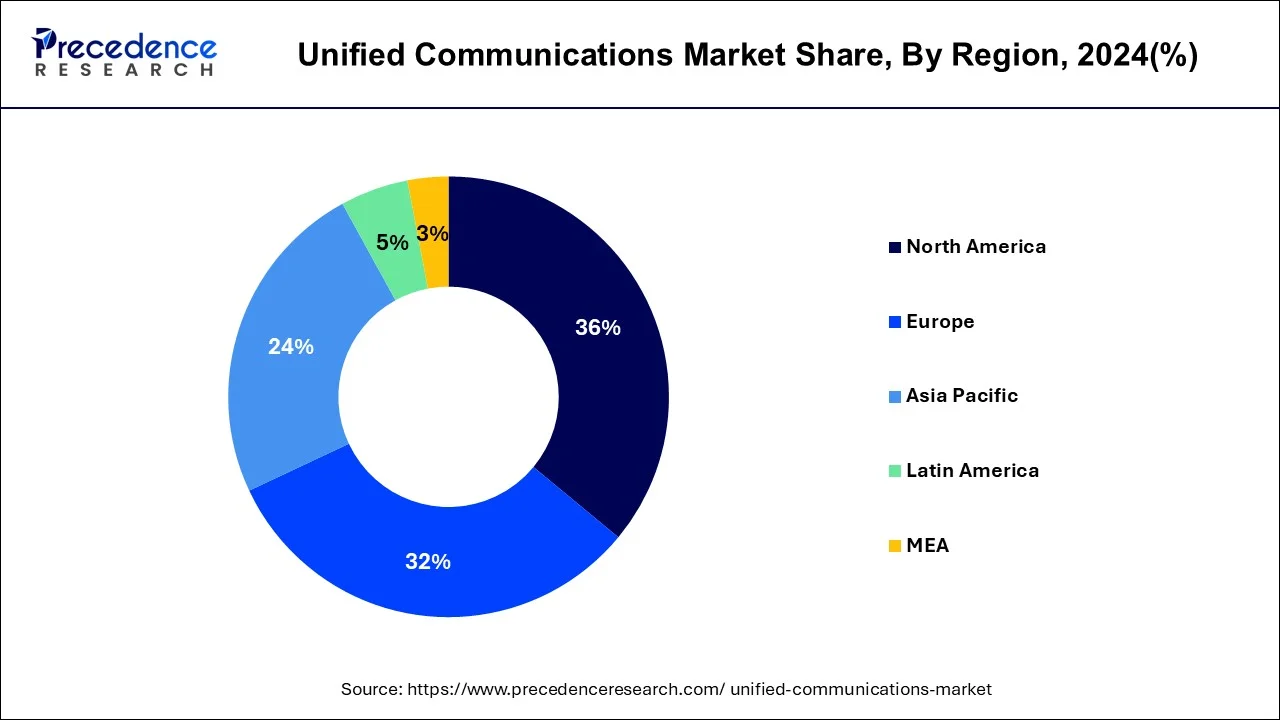

North America dominated the unified communications market in 2024 with a 36% revenue share. As well as Europe held a revenue share of 32% in 2024. The UK dominated the unified communications market in Europe region. The growth of unified communications market in Europe region is being driven by the existence of major market players operating in unified communications market. In addition, small and large enterprises are also installing digital platforms for communication. This factor is driving demand for unified communications in European market.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. The technological advancements and adoption of cloud-based solutions are driving the growth of unified communications market in Asia-Pacific region. In addition, government of India, China, Japan, Australia, and New Zealand are taking constant efforts for the promotion of digital platforms. Moreover, the concept of e-learning and distance learning are also boosting the demand for unified communications in the region. All of these factors are propelling the growth of unified communications market in Asia-Pacific region.

One of the prominent factors driving the growth of global unified communications market is the growing penetration of mobile devices and gadgets on a large scale. The unified communications solutions can be easily used through mobile devices. In several organizations, bring your own device (BYOD) concept is gaining traction. This factor is driving the growth of global unified communications market over the forecast period.

The communication is regarded as a complex process, but the utilization of unified communications platforms is simplifying the communication process in various organizations. Thus, this factor is creating demand for unified communications in the global market. The installation, operating, and maintenance costs are low for unified communications. As a result, all of these factors are providing growth prospects for the unified communications in the global market.

On the other hand, the growing concerns regarding data security and privacy are hindering the growth of global unified communications market. The data through unified communications platforms can be hacked easily. The data of enterprises and organizations are very confidential in nature. Thus, this information needs to be secured properly. As a result, this factor is restricting the growth of global unified communications market over the projected period.

The growth of global unified communications market is attributed to the growing government initiatives and activities for the deployment of unified communications platforms across diverse sectors. The government is also collaborating with players and organizations operating in global unified communications market. This collaboration is trying to create awareness regarding unified communications in the market.

In addition, technological developments and adoption of digital platforms across every vertical of industries are creating new opportunities for the growth of global unified communications market. Moreover, rapid urbanization and industrialization are also propelling the expansion and development of global unified communications market.

| Report Coverage | Details |

| Market Size in 2025 | USD 169.9 Billion |

| Market Size by 2034 | USD 719.79 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.4% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Solution, End Use, Organization Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

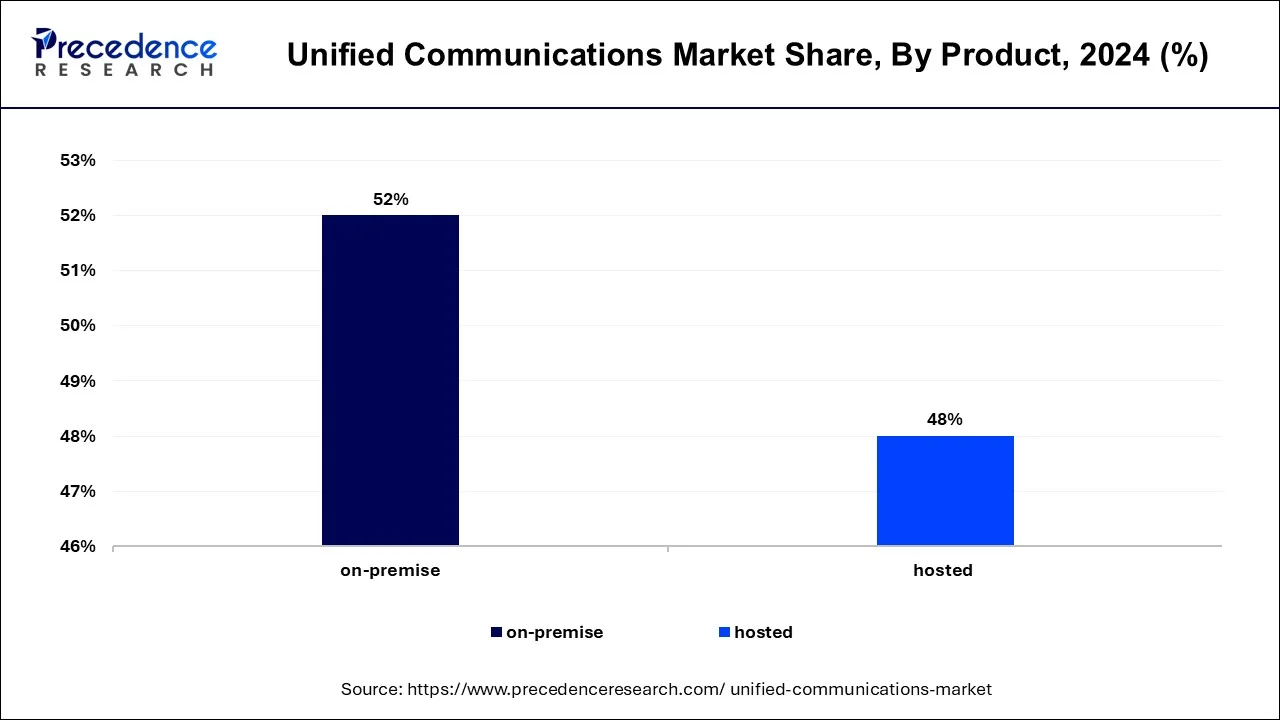

The on-premise segment dominated the market in 2024 with a revenue share of around 52%. The on-premise unified communications are considered as traditional unified communications solution for different types of enterprises. The on-premise unified communications do not require good amount of internet connection. However, this type of unified communications platform is quite expensive as compared to other types.

The hosted unified communications segment is expected to grow at a fastest rate during forecast period. The hosted unified communications are installed and operated at low costs. This factor is driving the demand for hosted unified communications in the market. The hosted unified communications can be operated with single digital platform.

The instant and unified messaging segment accounted for 35% market share in 2024. The instant and unified messaging allows enterprises to communicate and engage with clients and employees at a rapid pace. The increase in smartphone penetration is driving the growth of instant and unified messaging segment.

The audio and video conferencing segment is expected to witness strong growth during the forecast period. The audio and video conferencing had gained traction over a period of time. The adoption of 5G technology is paving way for the growth of the segment. Moreover, international client calls have become easy due to audio and video conferencing unified communications.

The large enterprises segment dominated the unified communications market in 2024 and garnered market share of around 80%. The large information technology (IT) firms require communication platform with advanced features. This helps them to work with more efficiency and effectiveness. The large enterprises contain number of departments. Here, communication is the biggest problem. Thus, the adoption of unified communications platforms is helping large enterprises to communicate effectively.

The small and medium sized enterprises (SMEs) segment is fastest growing segment of the unified communications market in 2024. The adoption of unified communications solutions and platforms by small and medium sized enterprises (SMEs) has increased over a period of time. The advanced features of unified communications platforms such as tracking caller’s history and details are creating growth prospects for unified communications for small and medium sized enterprises (SMEs).

The enterprise segment hit 50% revenue share in 2024. The number of remote workers has increased on a large scale. The enterprises require advanced level of communications platform for it. This is possible due to the adoption of unified communications platform for large and medium sized enterprises. In addition, audio and video conferencing is driving the growth of unified communications market for enterprises all over the globe.

The government segment is fastest growing segment of the unified communications market in 2023. The government is taking constant efforts for the deployment of unified communications in remote offices and branches. The adoption of unified communications solutions in government sector has tried to remove communication gap. The government is also investing heavily for the adoption of unified communications platforms and solutions all around the world.

By Product

By Solution

By Organization Size

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2024

July 2024

July 2024