February 2025

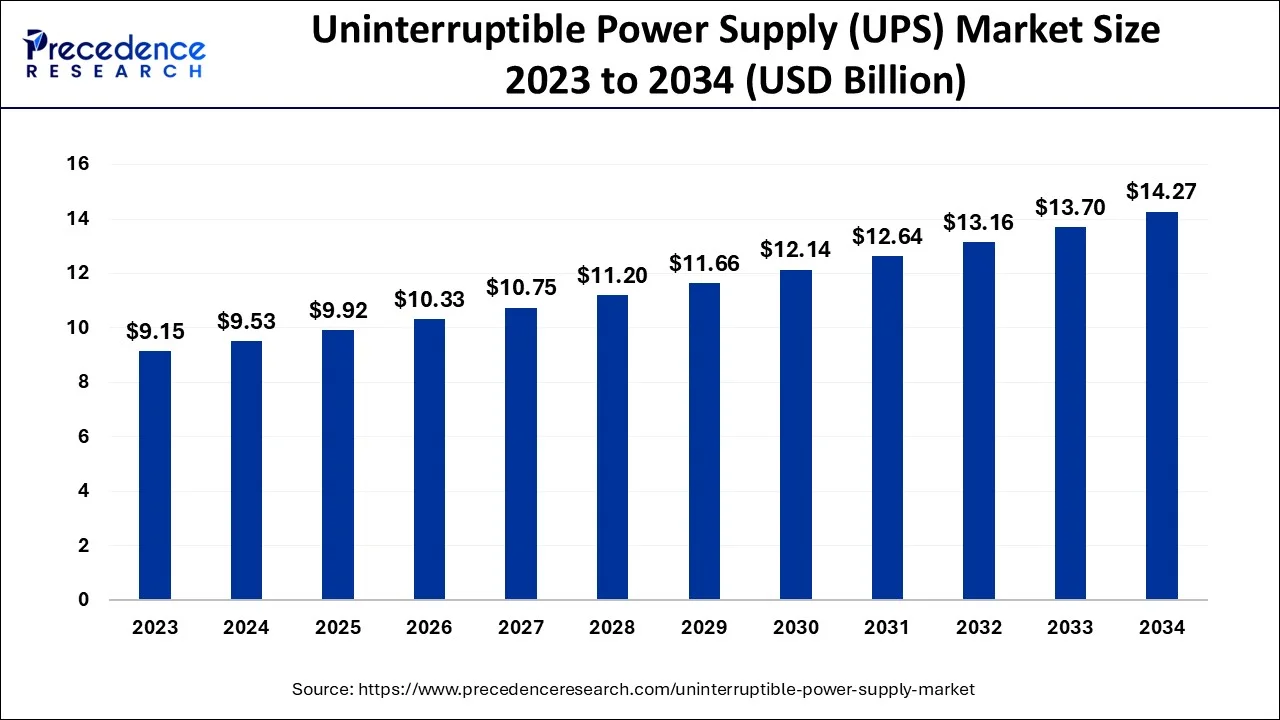

The global uninterruptible power supply (UPS) market size accounted for USD 9.53 billion in 2024, grew to USD 9.92 billion in 2025 and is predicted to surpass around USD 14.27 billion by 2034, representing a healthy CAGR of 4.12% between 2024 and 2034.

The global uninterruptible power supply (UPS) market size is estimated at USD 9.53 billion in 2024 and is anticipated to reach around USD 14.27 billion by 2034, expanding at a CAGR of 4.12% from 2024 to 2034.

The enormous increase in the need for dependable power options that can support expansive manufacturing facilities is anticipated to fuel the expansion of the uninterrupted power supply market. Businesses may operate when there is a power outage, thanks to UPS. The need for dependable power solutions is anticipated to drive the expansion of the UPS market as rising economies, including developing countries, experience a significant industrial boom.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.53 Billion |

| Market Size by 2034 | USD 14.27 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.12% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Capacity and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The UPS market is anticipated to be supported by rising electricity demand, increasing disposable income, and the requirement for a dependable power source. Industries and organizations that depend mainly on reliable electricity for efficient operation suffer severe harm from power outages and variable power supply. It is challenging for the government to maintain high-quality power in developing nations.

For instance, Invest India estimates that by 2026–2027, India's installed capacity for power generation will be close to 620 GW, with 44% of that capacity coming from renewable energy sources and 38% from coal. According to estimates, India's desire to increase the variety of its energy sources and its goal of supplying electricity around the clock through a considerable expansion of its renewable energy production capabilities will positively impact the market.

Furthermore, the fourth industrial revolution has significantly increased over the past few years. Incorporating cutting-edge technology into production facilities and operations, such as the IoT, cloud computing and analytics, AI, and machine learning, is transforming manufacturing processes. These operations are crucial, so many businesses use a UPS system to stabilize power and speed up production during outage to secure the data and prevent production line downtime. Hence, the UPS market is anticipated to increase during the projected period based on the abovementioned considerations.

However, UPS's primary concern is the associated costs. The UPS is usually more expensive because of the battery it uses. Even for corporations that require multiple UPS systems, this cost adds up. Because of this, only some users will be able to afford them. Utilizing a UPS system also has a lot of maintenance-related considerations.

For corporations with numerous UPS connections, this is considerably more challenging. Moreover, adequate ventilation is necessary to function correctly because the UPS system frequently releases fumes. Therefore, the uninterruptible power supply industry is constrained severely by the high price of UPSs and their expensive maintenance.

Nevertheless, conventional data centers are predicted to benefit significantly from technological developments in UPS battery systems, such as new Li-ion batteries with high working temperatures. Therefore, during the projection period, UPS systems, which may be placed as a backup if the electricity grid goes down, are anticipated to offer growth prospects for the UPS market.

COVID-19 Impact

The COVID-19 outbreak has significantly affected the market for uninterruptible power supplies (UPS). The closure of many governments, energy, and other private sector companies on both the supply and demand sides influenced the uninterruptible power supplies (UPS) market.

The COVID-19 pandemic resulted in business continuity problems across several industries, including information technology (IT), healthcare, and the manufacturing sector, with decreasing demand. This was due to global lockdowns. Uninterruptible power supply (UPS) has sold less frequently in several sectors concurrently due to frequent interruptions in the operation of these business units.

The market is divided into online conversion, offline/standby, and line-interactive sectors based on the product. Due to its lower cost, modular design, and higher dependability, the offline/standby category, which accounted for the majority of the market, is expected to maintain its appeal during the projection period.

To extend the standby systems' operational life and available recharge time, they are used only when there has been a disruption in the usual power supply lines. The demand for standby is also driven by the expanding use of such uninterrupted power supply systems in small- and medium-sized applications like consumer electronics.

The UPS market segments include less than 10 kVA, 10–100 kVA, and above 100 kVA based on capacity. The demand for up to 100 kVA capacity units has increased recently due to the rising demand for continuous power supply in residential and commercial areas. With the 10-100 kVA sector controlling a sizeable portion of the worldwide UPS market, this trend is anticipated to continue in the upcoming years.

The global UPS market is split into various segments based on its application, including telecommunication, data centers, industrial, medical, marine, residential & commercial, and others. The first to implement UPS systems to preserve seamless functionality were data centers. Due to the necessity for and usage of the uninterruptible power supply by several small to medium-sized data centers, which has made it a necessary component in the industries, the industrial segment now makes up a significant portion of the market.

Various geographic regions, including North America, Europe, Asia Pacific, and LAMEA, are analyzed when evaluating the worldwide uninterruptible power supply market. Among these regions, Asia Pacific accounts for the rapidly growing demand for UPS, owing to frequent blackouts and unpredictable power supplies in the expanding areas, which includes the Philippines, Malaysia, Cambodia, and several other nations. The region's booming telecom, industrial & manufacturing, and commercial & residential sectors are some of UPS systems' significant consumers.

Furthermore, the necessity for UPS systems in industrial facilities has been motivated by automation in manufacturing incorporating process control applications, computer-based control systems, and Programmable Logic Control (PLC) units. In addition to offering backup power during a power outage, UPS systems shield electronic equipment against power surges, sags, under voltages, line noise, high-voltage, frequency fluctuations, harmonic distortions, and switching transients.

As a result, UPS systems are now a crucial component of practically all industries, including finance, engineering, communications, R&D, manufacturing, education, and healthcare.

China is the leading center of the industrial sector, and it contributes significantly to the economies of many countries in the Asia-Pacific area. For instance, China approved projects to construct four mega clustered data centers in the north and west to service Beijing's and other key coastal centers' data needs in December 2021.

The clusters will be developed in the northwest Ningxia region, the southwestern Guizhou province, the northern Inner Mongolia region, and the northwestern Gansu region. The biggest contributors from the Asia-Pacific region include South Korea, Japan, Indonesia, and India. Singapore, Vietnam, and Malaysia are all anticipated to see an increase in their share throughout the projection period.

By Product

By Capacity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

August 2024

December 2024