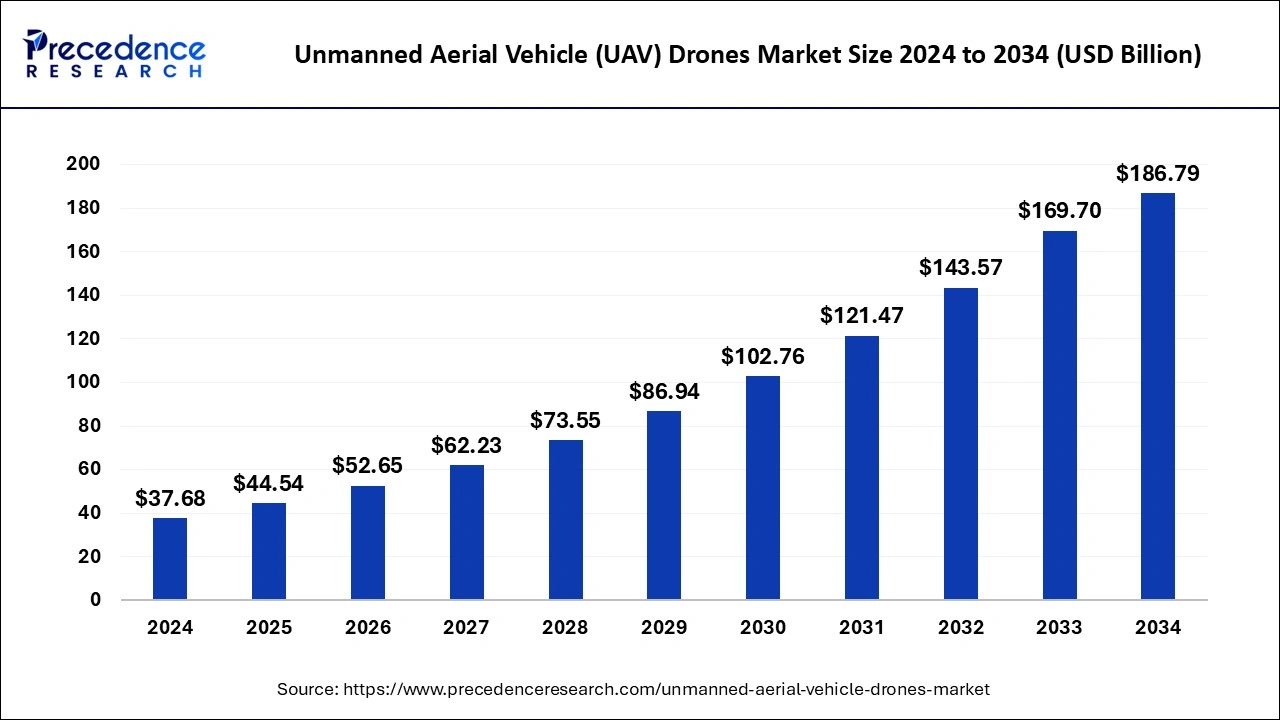

The global unmanned aerial vehicle (UAV) drones market size is calculated at USD 44.54 billion in 2025 and is forecasted to reach around USD 186.79 billion by 2034, accelerating at a CAGR of 17.36% from 2025 to 2034. The North America market size surpassed USD 13.94 billion in 2024 and is expanding at a CAGR of 17.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global unmanned aerial vehicle (UAV) drones market size accounted for USD 37.68 billion in 2024 and is expected to exceed around USD 186.79 billion by 2034, growing at a CAGR of 17.36% from 2025 to 2034.

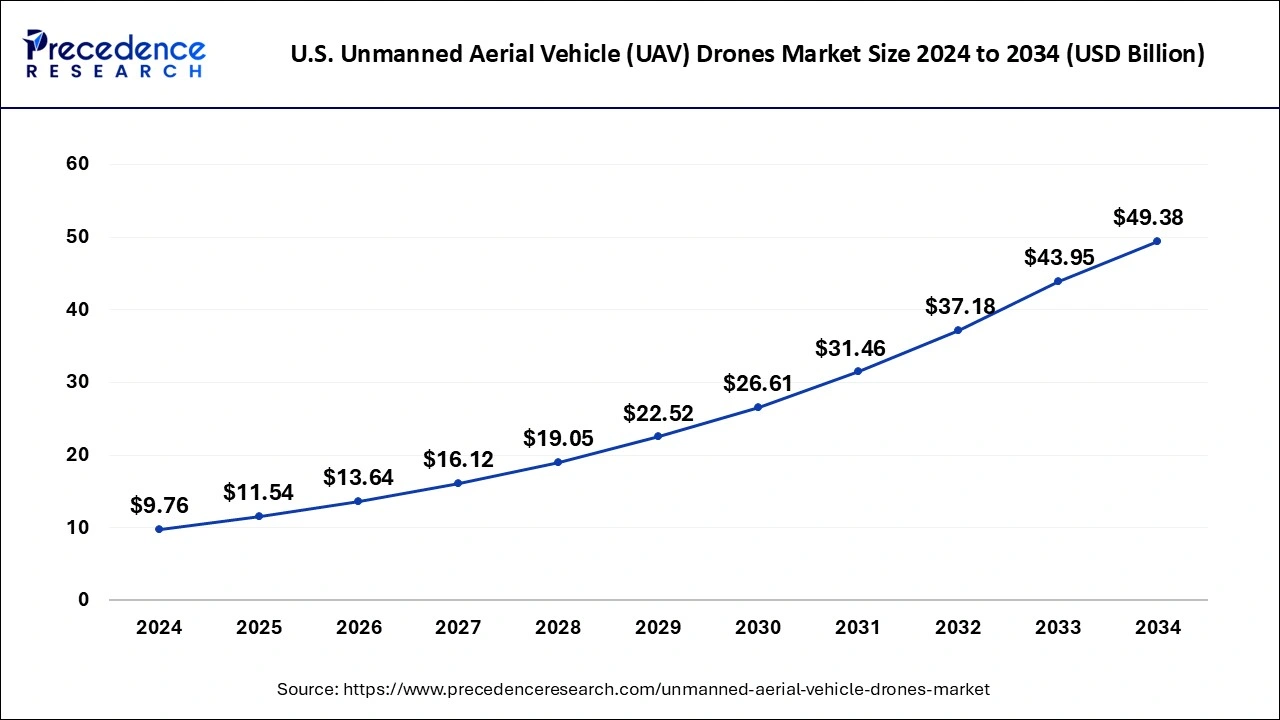

The U.S. unmanned aerial vehicle (UAV) drones market size was evaluated at USD 9.76 billion in 2024 and is projected to be worth around USD 49.38 billion by 2034, growing at a CAGR of 17.60% from 2025 to 2034.

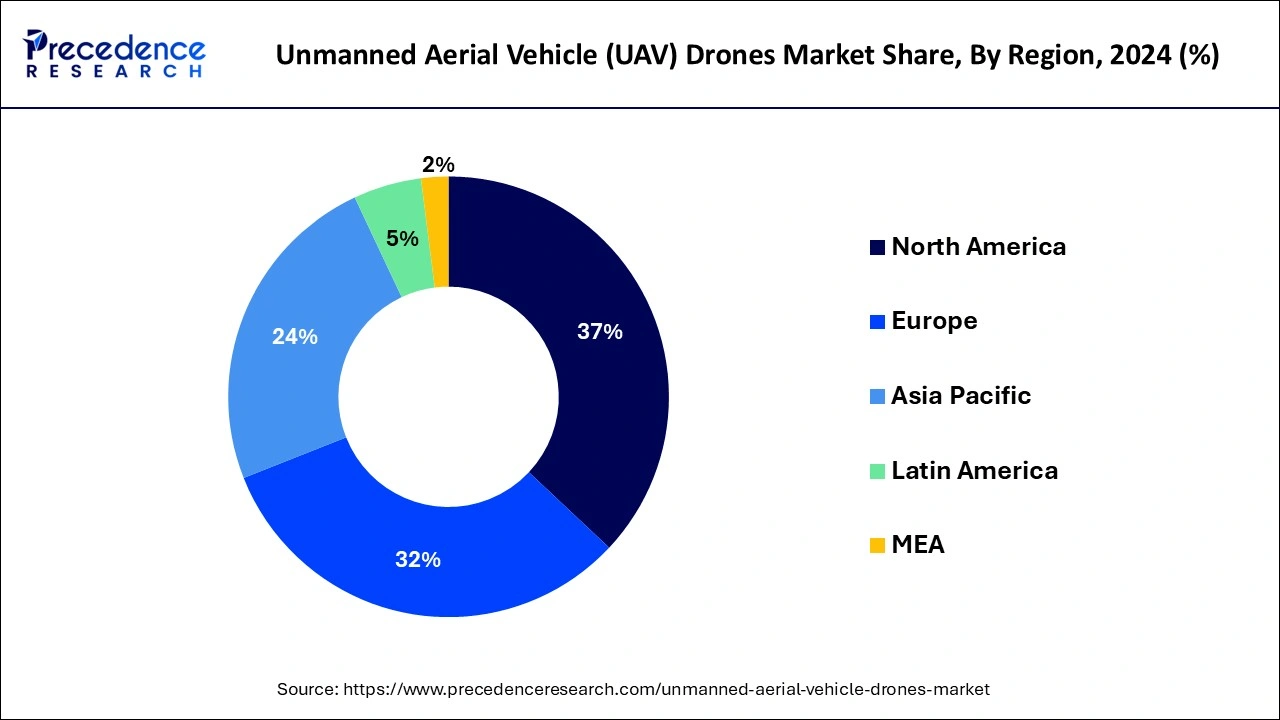

North America dominated the unmanned aerial vehicle (UAV) drones market in 2024. Due to rising demand for military and commercial applications in nations like the Canada and the U.S., the market for unmanned aerial vehicle (UAV) drones in North America is likely to rise.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The increase in original equipment manufacturer (OEM) production towards the development of unmanned aerial vehicle (UAV) drones is expected to be a major driving factor for the Asia-Pacific region market over the forecast period.

An unmanned aerial vehicle (UAV) drone is a plane that flies without a human pilot, passengers, or crew. The unmanned aerial vehicle (UAV) is a part of unmanned aircraft system (UAS), which also includes a ground-based controller and a communications system with the unmanned aerial vehicle (UAV). The unmanned aerial vehicle (UAV) drones can be controlled remotely by a human operator, as in a remotely pilot aircraft (RPA), or with varying degrees of autonomy, such as autopilot help, up to fully autonomous aircraft with no human interaction.

The unmanned aerial vehicle (UAV) drones are increasingly being used to collect data. During this process, confidential information about a private property or conduct may be gathered. As a result, safety and security concerns, as well as social issues such as privacy concerns, are limiting the market for unmanned aerial vehicle (UAV) drones.

The primary factors driving the unmanned aerial vehicle (UAV) drones market’s growth are rapid technological developments in drones and an increase in demand for drone-generated data in commercial applications. The market for unmanned aerial vehicle (UAV) drones is also growing due to an increase in venture capital funding.

The unmanned aerial vehicle (UAV) drones are type of unmanned aerial vehicle (UAV) which are also used in wars. The unmanned aerial vehicle (UAV) drones are commonly used for monitoring farmlands to enable farmers to respond rapidly to problems such as pests and drought, which is driving the growth of the unmanned aerial vehicle (UAV) drones market during the forecast period.

Due to changes in government laws and an increase in the number of exceptions allowed to companies for commercial use of unmanned aerial vehicle (UAV) drones, this market is expected to grow significantly during the projected period. The surveying, inspection, media and entertainment, military and homeland security, precision agriculture, and other commercial sectors all contribute to the market for unmanned aerial vehicle (UAV) drones.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.36% |

| Market Size in 2025 | USD 44.54 Billion |

| Market Size by 2034 | USD 186.79 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Component, and Payload |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The vertical take-off and landing (VTOL) had the highest revenue share in 2024. The vertical take-off and landing (VTOL) unmanned aerial vehicle (UAV) uses rotors to take off, hover, and land vertically, similar to a helicopter. All multi-copter drones, as well as some hybrid fixed wings drones, fall under this category.

The medium altitude long endurance (MALE) segment is fastest growing segment of the unmanned aerial vehicle (UAV) drones market in 2024. A medium altitude long endurance (MALE) is an unmanned aerial vehicle (UAV) that flies for extended periods of time. The unmanned combat aerial vehicle and unmanned reconnaissance aerial vehicle are both included in this list.

The up to 150 kg segment dominated the unmanned aerial vehicle (UAV) drones market in 2024. This type of unmanned aerial vehicle (UAV) drones are adaptable and can perform a wide range of operations, including search rescue, ground force support, irregular traffic surveillance, and intelligence missions.

The up to 600 kg segment, on the other hand, is predicted to develop at a rapid rate over the projection period. Nowadays, the unmanned aerial vehicle (UAV) drones are being manufactured mostly with the payload of 600 kg.

In 2024, the camera segment dominated the unmanned aerial vehicle (UAV) drones market. The unmanned aerial vehicle (UAV) drones employ investigation, continuous video monitoring, border security, remote surveillance, rescue and law enforcement, and vital infrastructure protection.

The sensor segment, on the other hand, is predicted to develop at the quickest rate in the future years. The inertial measurement units (IMUs) are unmanned aerial vehicle (UAV) sensors that combine data from several sensors such as accelerometers, gyroscopes, and magnetometers to generate readings that may be used to compare the unmanned aerial vehicle (UAV) drones’ velocity and orientation.

The media and entertainment segment dominated the unmanned aerial vehicle (UAV) drones market in 2024. The unmanned aerial vehicle (UAV) drones have a number of advantages over traditional means of image capture, including lower costs and better film and photo quality. This is the primary factor driving the growth of the segment over the projection period.

The precision agriculture segment, on the other hand, is predicted to develop at a rapid rate over the projection period. The unmanned aerial vehicle (UAV) drones are used in precision agriculture for a variety of tasks, including field and soil analysis, pesticide, and planting. The unmanned aerial vehicle (UAV) drones can be used with a variety of imaging technologies, such as multispectral, hyperspectral, and thermal, to offer farmers with temporal and site-specific information about fungal infections and crop health.

By Type

By Load Capacity

By Duration

By Range

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client