January 2025

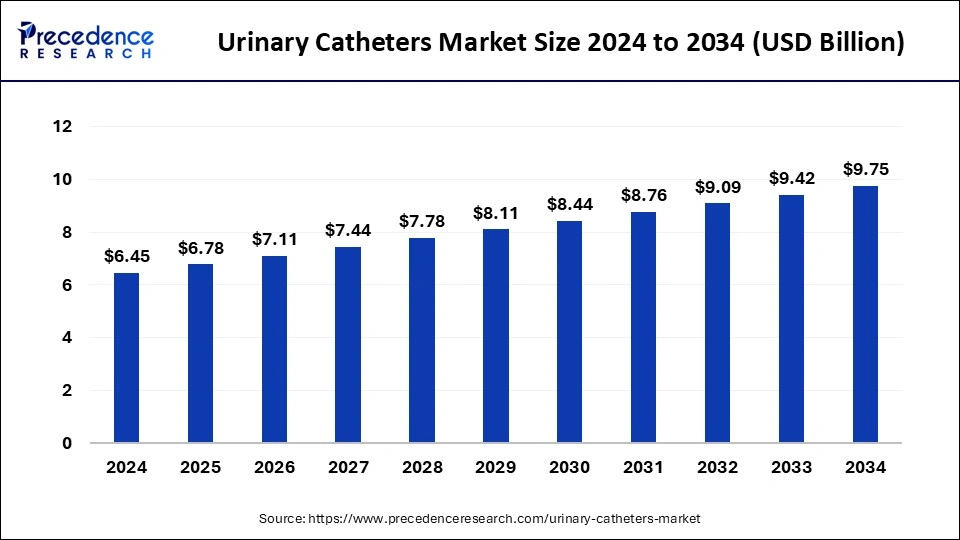

The global urinary catheters market size accounted for USD 6.78 billion in 2025 and is forecasted to hit around USD 9.75 billion by 2034, representing a CAGR of 4.10% from 2025 to 2034. The North America market size was estimated at USD 2.53 billion in 2024 and is expanding at a CAGR of 3.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global urinary catheters market size accounted for USD 6.45 billion in 2024 and is predicted to increase from USD 6.78 billion in 2025 to approximately USD 9.75 billion by 2034, expanding at a CAGR of 4.10% from 2025 to 2034.

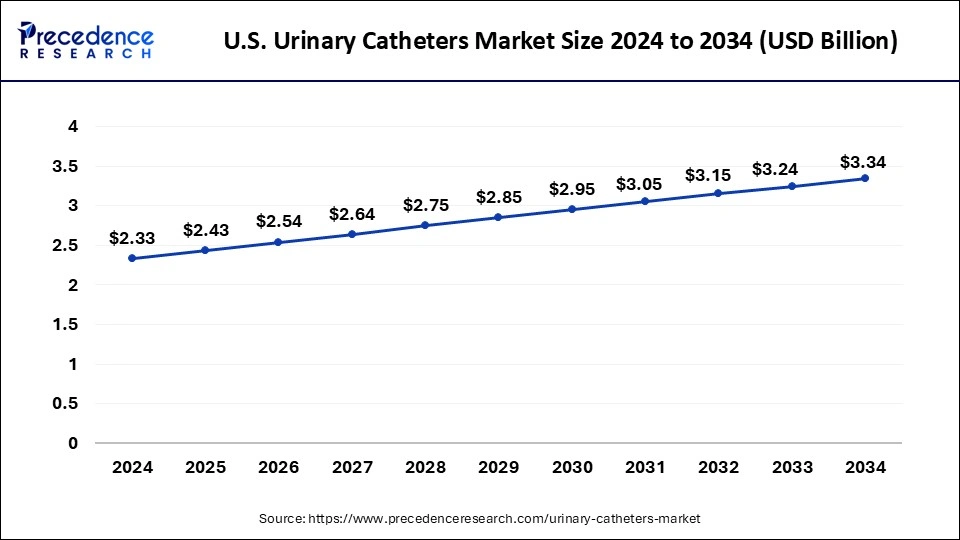

The U.S. urinary catheters market size was exhibited at USD 2.33 billion in 2024 and is projected to be worth around USD 3.34 billion by 2034, growing at a CAGR of 3.60% from 2025 to 2034.

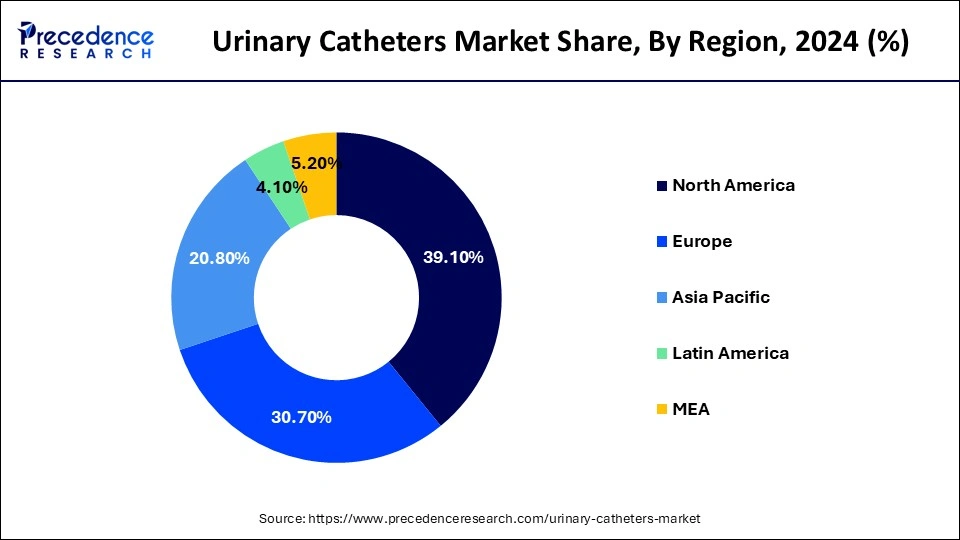

North America led the global market with the highest market share of 39.1% in 2024. While promising a sustained growth in the urinary catheters market over the forecast period. Benign Prostate Hyperplasia (BPH), urine retention, bladder blockage, UI, and bladder cancer are among the key disorders that are driving the regional market. Pee urgency and Overactive Bladder (OAB) are frequent in persons 40 years of age and older, according to the National Association for Continence. Urologic disorders rank third among complaints among Americans 65 and older, making up around 47% of all doctor visits. This information comes from the American Society of Nephrology. Similarly, the Canadian Cancer Society reports that 2,600 persons lost their lives to bladder cancer in 2020, compared to 12,200 new cases of the disease.

The Asia Pacific is expected to grow at the highest CAGR in the urinary catheters market during the forecast period. The Asia Pacific region has been experiencing an increase in the ageing population, leading to a higher prevalence of urological conditions and contributing to the demand for urinary catheters. Moreover, the rising incidence of chronic diseases such as diabetes and neurological disorders in the region has contributed to an increased need for urinary catheters.

A urinary catheter is a flexible tube inserted into the urinary bladder through the urethra to assist with draining urine from the bladder. It is a medical device commonly used when a person is unable to empty their bladder naturally or efficiently. The urinary catheters market offers various types of urinary catheters, including indwelling catheters (also known as Foley catheters) that remain in place for an extended period and intermittent catheters, which are used periodically for drainage.

Urinary catheters serve various medical purposes, such as relieving urinary retention, managing incontinence, assisting with bladder emptying during surgery or medical procedures, and monitoring urine output in critically ill patients. It is essential to follow proper hygiene and sterile techniques during catheter insertion to minimize the risk of infections and complications. Medical professionals typically manage the placement and care of urinary catheters to ensure their effectiveness and the well-being of the patient.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.10% |

| Market Size in 2025 | USD 6.78 Billion |

| Market Size by 2034 | USD 9.75 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Type, Gender, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for urinary catheters coated with antimicrobials

Thirty to forty percent of nosocomial infections are UTIs, which can cause high rates of morbidity and death as well as extended hospital stays. Patients in hospitals and home care settings frequently utilize urinary catheters, which are frequently connected to the high incidence of CAUTI. To create and release innovative products that facilitate simple insertion and have clinical efficacy, vendors in the urinary catheters market are making significant investments in R&D.

Bard, for instance, provides BARDEX I.C. anti-infective latex Foley catheters with a Bacti-Guard silver alloy coating and BARD hydrogel, which lowers the risk of biofilm formation on the catheters, bacterial infection, and CAUTIs. For the treatment of urine incontinence, Medtronic provides a wide range of silver-coated urological devices. Additionally, Bard's MAGIC3 Antibacterial Hydrophilic Catheter delivers the advantages of nitrofurazone, an antibacterial agent, which dramatically reduces the development of microorganisms that cause urinary tract infections.

Thus, the availability of sophisticated catheters encourages patients and caregivers to use them, which fuels the urinary catheters market’s expansion. Consequently, throughout the forecast period, these variables are probably going to drive the expansion of the worldwide urinary catheter market.

Stringent regulation

Strict framework criteria and labeling standards have been enforced by regulatory bodies on medical equipment used in urological procedures. Before being approved, these medical devices must pass a safety evaluation to prove their therapeutic value. Urinary catheter growth prospects are anticipated to be hampered by an increase in product recalls. Suppliers producing these goods risk damage to their brand equity in addition to litigation from patients who have used them.

Tight rules will compel suppliers to recall defective products. Therefore, before releasing their devices into the commercial market, manufacturers should concentrate on gathering sufficient clinical data on the safety and effectiveness of their products. Urinary catheter sales may be impacted by the strict rules governing medical supplies and equipment, which might also be a challenge for producers in the market over the projected period. Therefore, throughout the projected period, strict restrictions would impede the growth of the worldwide urinary catheter market.

The introduction of external catheters for women

The newest development in the worldwide urine catheter market is the use of female external catheters. Female external catheters that are secure and simple to use are offered by vendors in this industry. Urinary incontinence is becoming more common; thus, manufacturers are creating new urinary catheters with biocompatible materials and coatings that are user-friendly and enhance patient satisfaction. Many suppliers develop male external catheters.

However, because female external catheters are becoming more and more popular, several companies are currently creating and producing them. This catheter also makes it easier to expel urine quickly and does not require the connection of sticky devices like glue, straps, or tapes. As a result, end users' quick acceptance of these wearable catheters will optimize their sales and support market expansion throughout the projection period. Consequently, throughout the projected time, these elements will propel the expansion of the worldwide urinary catheter market.

The intermittent catheters segment held the dominating share in 2024. The segment growth is attributed to the growing product launch in the industry. For instance, in February 2023, Coloplast introduced the male catheter design to lower the incidence of UTIs. Urinary tract infections pose a serious concern to individuals utilizing intermittent catheters and to the healthcare system overall. The novel intermittent catheter LujaTM tackles these risks.

The external catheters segment is expected to grow at a rapid rate during the forecast period. For male patients, these catheters are a great substitute for other catheters, such as inhabiting catheters, which must be inserted via the urethra. Additionally, male external catheters are the first choice in situations of UI/urine retention for a large number of patients who prefer self-catheterization. In addition, these catheters come in an assortment of sizes and shapes, providing consumers with several options to select from according to their specific requirements. Prominent corporations provide cutting-edge external catheter solutions. For instance, BD (C.R. Bard) offers a unique selection of male catheters, including the ULTRAFLEX male external catheter, which offers a more secure fit than non-silicon sheaths.

Global Urinary Catheters Market Revenue, By Product, 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Indwelling Catheters | 1,842.3 | 1,937.4 | 2,030.9 |

| Intermittent Catheters | 3,079.2 | 3,246.3 | 3,411.5 |

| External Catheters | 891.1 | 949.8 | 1,009.2 |

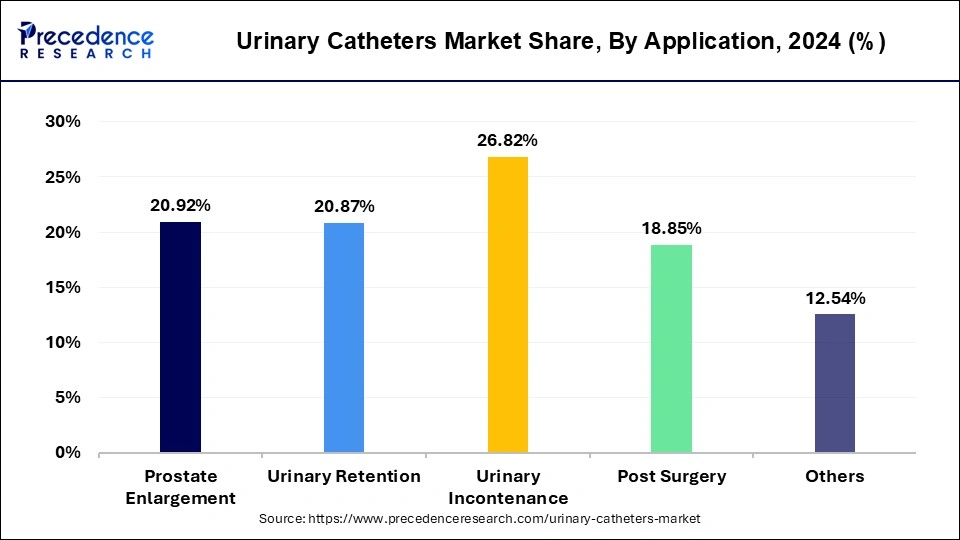

The Urinary Incontinence (UI) segment captured the largest share of the urinary catheters market in 2024. A third of people have UI, and it affects more women than males, according to the American Urological Association. It is a major factor in the admission of older individuals to long-term care facilities and is one of the primary causes of this kind of care. Numerous reasons, including ageing-related changes to the urinary system, urinary tract infections (UTIs), and other indirect illnesses including diabetes, stroke, cancer, and impaired mobility, can lead to bladder incontinence. Stress and urge incontinence are the two most prevalent forms of urinary incontinence in women.

Besides, the Benign Prostate Hyperplasia (BPH) & prostate surgeries segment is expected to grow at a significant rate in the urinary catheters market during the forecast period because people are becoming more knowledgeable about BPH and how it affects life quality. Prostate gland enlargement, or BPH, is a prevalent medical disorder that affects male patients 50 years of age and beyond. Urine flow obstructions and other painful urinary symptoms may result from this. Minimally invasive operations can help treat it by relieving the obstruction and urine retention brought on by the prostate and BPH.

Global Urinary Catheters Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Prostate Enlargement | 1,201.4 | 1,275.5 | 1,350.0 |

| Urinary Retention | 1,209.4 | 1,278.1 | 1,346.4 |

| Urinary Incontenance | 1,572.1 | 1,651.8 | 1,730.0 |

| Post Surgery | 1,093.7 | 1,155.0 | 1,215.9 |

| Others | 736.2 | 773.1 | 809.3 |

The coated catheters segment dominated the urinary catheters market in 2024. Coated catheters often feature specialized surfaces aimed at reducing infections and improving patient’s comfort. Antibacterial and hydrophilic coatings are common, providing a barrier against microbial colonization and facilitating smoother insertion and removal. These coatings contribute to a lower risk of catheter-associated urinary tract infections and may enhance overall patient satisfaction. On the other hand, the uncoated segment is expected to grow at a rapid rate over the projected period because it is simple in design and cost-effective in nature.

The women segment dominated the urinary catheters market in 2024. The segment is observed to sustain the position owing to the rising urinary tract infections in women. According to the data published by OASH, women caught UTI up to 30 times more often than men do. In addition, 4 out of 10 women will get UTI at least one more within six months.

The hospitals segment held the largest share of the urinary catheters market in 2024. Catheters are employed in hospitals for various medical conditions, including surgeries, critical care and long-term patient management. Intermittent and indwelling catheters are commonly used in hospitals settings based on the specific needs of patients. Besides, the clinics segment is expected to experience a substantial growth due to growing pool of patients with chronic conditions.

By Product

By Application

By Type

By Gender

By End-user

`By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

February 2025