February 2025

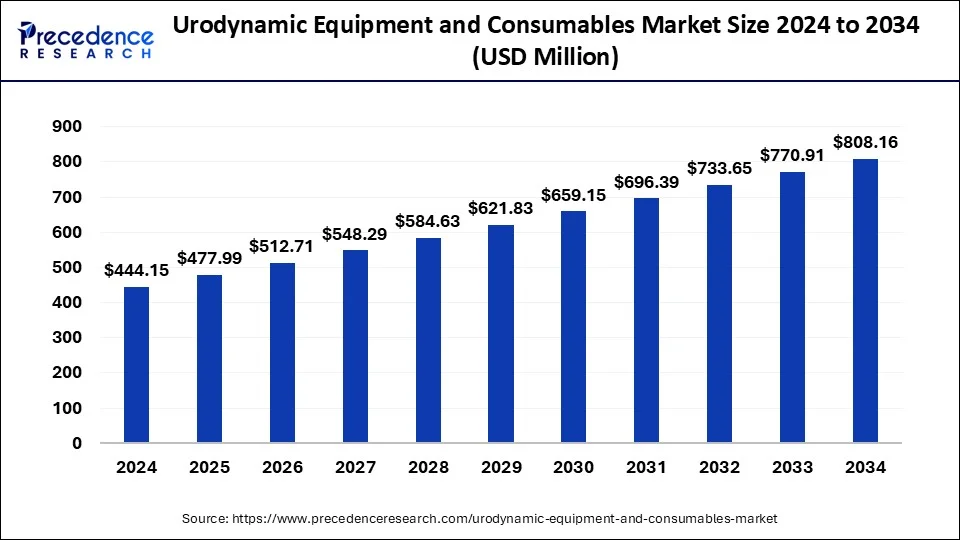

The global urodynamic equipment and consumables market size is calculated at USD 477.99 million in 2025 and is forecasted to reach around USD 808.16 million by 2034, accelerating at a CAGR of 6% from 2025 to 2034. The North America urodynamic equipment and consumables market size surpassed USD 205.06 million in 2024 and is expanding at a CAGR of 5.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global urodynamic equipment and consumables market size was USD 444.15 million in 2024, estimated at USD 477.99 million in 2025, and is anticipated to reach around USD 808.16 million by 2034, expanding at a CAGR of 6% from 2025 to 2034. The urodynamic equipment and consumables market is driven by the increasing prevalence of bladder and renal problems, especially in underdeveloped countries.

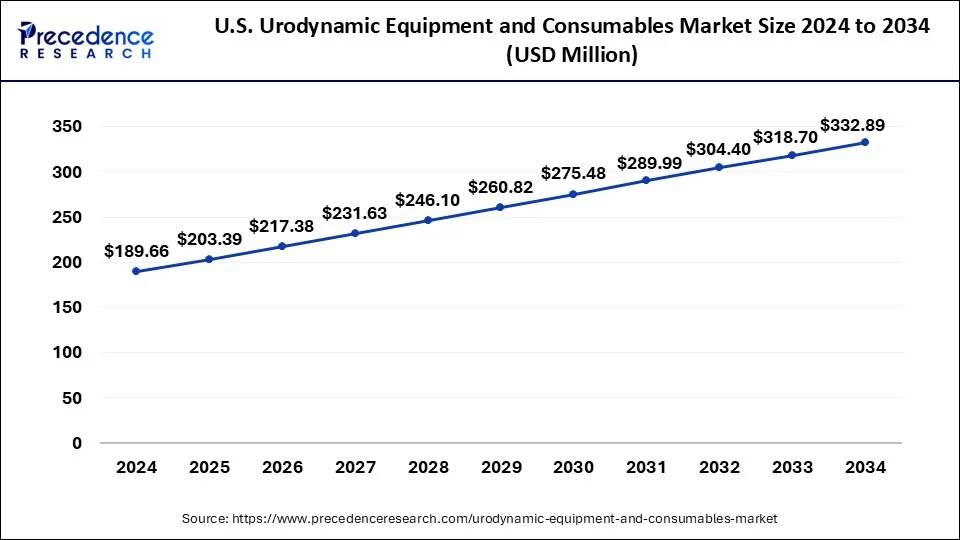

The U.S. urodynamic equipment and consumables market size was estimated at USD 189.66 million in 2024 and is projected to surpass around USD 332.89 million by 2034 at a CAGR of 5.60% from 2025 to 2034.

North America held the largest share in 2024 in the urodynamic equipment and consumables market and expected to sustain the position throughout the predicted timeframe. Most healthcare spending in North America goes toward treating and diagnosing urological disorders. Healthcare facilities are encouraged to invest in modern equipment and consumables by the region's high healthcare spending and favorable reimbursement regulations for urodynamic testing. The increased focus on early illness detection and preventative healthcare further fuels the need for urodynamic testing.

A well-established network of clinics, hospitals, and diagnostic facilities with cutting-edge medical technology, including urodynamic equipment, is present in the area. This makes it easier to acquire cutting-edge urological problem diagnosis and treatment methods, which increases demand for urodynamic tools and supplies.

Asia-Pacific is the fastest growing urodynamic equipment and consumables market during the forecast period. Healthcare spending usually rises in the Asia-Pacific area as economies continue to thrive. This makes investing more heavily in cutting-edge medical technology like urodynamic apparatus possible. Urological problems are becoming more recognized among the public and medical experts. The need for urodynamic supplies and equipment increases due to the growing frequency of diagnosis and treatment. As minimally invasive procedures become more popular, the demand for urodynamic equipment will probably rise, enabling precise diagnosis.

The healthcare business segment focuses on supplies and equipment used in urodynamic testing and is known as the urodynamic equipment and consumables market. Urodynamic testing is a diagnostic technique that assesses the efficiency of urine storage and release in the bladder, urethra, and sphincters. It aids in the diagnosis of diseases like neurogenic bladder dysfunction, overactive bladder, and urine incontinence.

Urodynamic supplies and equipment allow medical professionals to carry out urodynamic tests precisely and effectively. This comprises a variety of tools, including catheters, electromyographs, uroflowmetry systems, cytometers, pressure transducers, and consumables, including tubing, sensors, and catheterization kits.

Urodynamic Equipment and Consumables Market Data and Statistics

| Report Coverage | Details |

| Global Market Size in 2024 | USD 444.15 Million |

| Global Market Size in 2025 | USD 477.99 Million |

| Global Market Size by 2034 | USD 808.16 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Consumables, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in prevalence of lower urinary tract symptoms

Urinary symptoms that impact the bladder, urethra, and related tissues are lower urinary tract symptoms (LUTS). These symptoms might include urgency, frequency, nocturia, incontinence, and difficulty voiding. These symptoms can have a severe negative effect on a person's quality of life and are frequently a marker of underlying urological diseases such as overactive bladder (OAB), benign prostatic hyperplasia (BPH), urinary tract infections (UTIs), and neurological abnormalities that impair bladder function. Urodynamic testing processes are made more accessible by urodynamic equipment and consumables. This comprises disposable consumables like catheters, tubing, electrodes, and specialist equipment, including pressure transducers, uroflowmetry devices, cystometrography systems, catheters, and infusion pumps.

The development of more advanced urodynamic equipment with improved data collecting, analysis, and interpretation capabilities has been made possible by technological advancements, which have improved the precision and dependability of urodynamic testing techniques.

High cost of equipment

Alternative diagnostic modalities like magnetic resonance imaging (MRI), ultrasound imaging, and non-invasive urodynamic procedures compete with urodynamic testing. Despite the possibility of cost reductions or other benefits, these substitutes might not give the same degree of thorough examination or diagnostic accuracy as conventional urodynamic testing. The expenditures of purchasing, maintaining, and training staff on urodynamic procedures may not be sufficiently covered by reimbursement rates in many healthcare systems. Consequently, the market growth may be limited if healthcare providers exhibit reluctance to invest in urodynamic equipment or restrict the provision of urodynamic services.

Government initiatives for incontinence treatment

Governments set aside large sums to enhance healthcare services, including facilities for diagnosing and treating ailments like incontinence. These expenditures pay for cutting-edge medical supplies, such as urodynamic testing apparatus and associated items. Governments frequently enact healthcare reforms and laws to enhance patient outcomes and lessen the total cost of healthcare. The need for urodynamic supplies and equipment will likely increase due to these reforms, which may include recommendations for using urodynamic testing for precise diagnosis and treatment planning in cases of urine incontinence.

The uroflowmetry equipment segment dominated the urodynamic equipment and consumables market in 2024. Since uroflowmetry is non-invasive, the urine system is not penetrated or instrumented throughout the process. Patients find this method less painful and daunting than other urodynamic examinations, such as cystometry or pressure flow studies. Because of this, medical professionals frequently choose to use uroflowmetry as their primary diagnostic method. Generally, it is cheaper than other urodynamic testing equipment. This makes it a desirable choice for medical establishments on a tight budget or looking for affordable diagnostic options. Uroflowmetry is also more cost-effective because it is non-invasive, which lowers related expenses like sedation, disposables, and recovery time.

The ambulatory urodynamic systems segment is the fastest growing in the urodynamic equipment and consumables market during the forecast period. Due to ambulatory urodynamic equipment, patients can conveniently undertake urodynamic testing outside of a clinical setting. Wearing these portable devices allows patients to continue their everyday activities, improving comfort and lowering anxiety related to traditional diagnostic methods used in clinics or hospitals. Wireless communication, downsizing, and sensor technologies have greatly enhanced the dependability and efficiency of ambulatory urodynamic systems. More thorough evaluations of urinary function are now possible thanks to these devices' ability to precisely measure various physiological characteristics, such as bladder pressure, urine flow rate, and detrusor muscle activity.

The electromyographs segment shows a significant growth in the urodynamic equipment and consumables market. Since electromyographs (EMG) can illuminate the neuromuscular mechanisms behind urine failure, researchers and clinicians increasingly use EMG-based urodynamic testing. Electromyography facilitates the evaluation of the patterns of muscle activity, reflexes, and the coordination of the many muscle groups involved in bladder control. Making treatment selections and diagnosing forms of urinary dysfunction depend heavily on this knowledge.

Urodynamic Equipment and Consumables Market Revenue, By Type 2022-2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| Uroflowmetry Equipment | 97.4 | 104.8 | 112.6 |

| Cystometer | 75.8 | 81.4 | 87.2 |

| Ambulatory Urodynamic Systems | 58.6 | 63.4 | 68.4 |

| Electromyographs | 46.1 | 50.1 | 54.2 |

| Video Urodynamic Systems | 37.9 | 40.9 | 44.0 |

| Urodynamic Consumables | 67.6 | 72.6 | 77.7 |

The urodynamics catheters segment dominated the urodynamic equipment and consumables market in 2024. Urodynamics catheters are essential components of urodynamic testing, a diagnostic procedure used to assess bladder and urinary tract function. These catheters are used to measure various parameters such as bladder pressure, urine flow rate, and sphincter muscle activity, providing valuable insights into urinary system disorders and dysfunctions. As urodynamic testing is a standard procedure for diagnosing conditions such as urinary incontinence, urinary retention, and overactive bladder, the demand for urodynamics catheters remains high among healthcare providers and urology clinics.

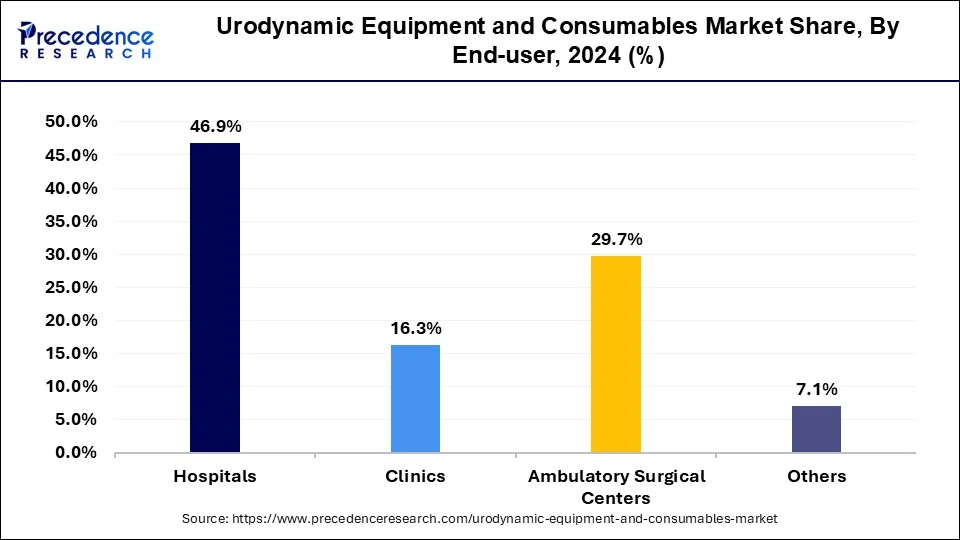

The hospitals segment led the urodynamic equipment and consumables market in 2024. The segment is observed to witness a notable rate of growth during the forecast period. Hospitals are the primary healthcare providers for patients with urological conditions, such as urinary incontinence, overactive bladder, and urinary retention. As such, they have a high demand for urodynamic equipment and consumables to diagnose and manage these conditions effectively. Urodynamic tests, which assess bladder and urinary tract function, are routinely performed in hospital settings to aid in diagnosis and treatment planning.

Hospitals often invest in state-of-the-art medical equipment and facilities to deliver high-quality patient care. Urodynamic laboratories within hospitals are equipped with sophisticated urodynamic machines, pressure transducers, catheters, and other consumables necessary for performing a wide range of urodynamic tests, such as cystometry, pressure-flow studies, and electromyography. The availability of advanced facilities enhances the accuracy and reliability of urodynamic testing, making hospitals preferred providers for urology patients.

Urodynamic Equipment and Consumables Market Revenue, By End-user 2022-2024 (USD Billion)

| End-user | 2022 | 2023 | 2024 |

| Hospitals | 180.5 | 194.1 | 208.1 |

| Clinics | 62.2 | 67.1 | 72.3 |

| Ambulatory Surgical Centers | 112.9 | 122.3 | 132.1 |

| Others | 27.9 | 29.7 | 31.6 |

By Type

By Consumables

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

September 2024

January 2025