August 2024

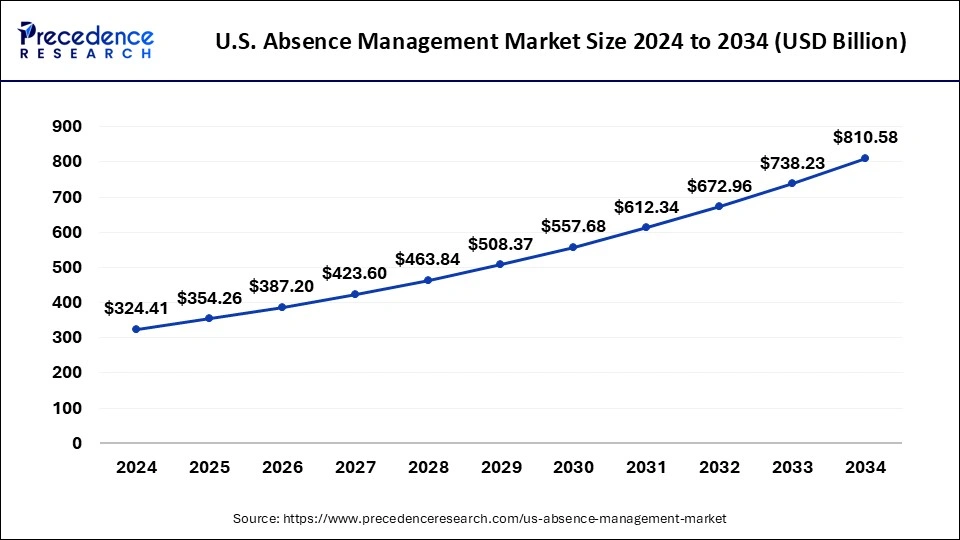

The U.S. absence management market size accounted for USD 354.26 million in 2025 and is forecasted to hit around USD 810.58 million by 2034, representing a CAGR of 9.6% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. absence management market size was estimated at USD 324.41 million in 2024 and is predicted to increase from USD 354.26 million in 2025 to approximately USD 810.58 million by 2034, expanding at a CAGR of 9.6% from 2025 to 2034.

A strategy utilized by employers to decrease employee absenteeism, enhance the productivity of employees, and avoid disturbance of the workforce is absence management. It includes the development of the balance between workers and those who were absent from jobs due to accidents, illness, or other events. When an employee is unable to work, each company has its absence policy. Employees have a right to be aware of the rules, obligations, and privileges in the workplace, so the organization must make the absence policy clear to new employees. The absence of employees is tracked by using absence management software which is a computer program. As per the survey, this program is a great tool for managing leave.

| Report Coverage | Details |

| Market Size in 2025 | USD 354.26 Million |

| Market Size by 2034 | USD 810.58 Million |

| Growth Rate from 2025 to 2034 | CAGR of 9.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Mode, Application, and End User |

Rising awareness of the importance of employee well-being

The value of employee well-being at work has become more widely recognized in recent years. As a result, many businesses are increasingly funding absence management tools to make sure that their staff members are healthy, content, and effective. For instance, Centre Parcs U.K. & Ireland chose Dayforce in March 2022, according to an announcement by Ceridian HCM Inc., in order to optimize its workforce, increase employee engagement, and boost regulatory compliance.

Growing awareness of the impact of mental health

The rising awareness of mental health issues is one of the major factors driving the absence management industry. Novel goods, services, and technology are being developed as a result of the necessity for businesses to find ways to manage the mental health of their staff. The absence management market is increasingly focusing on mental health for a number of reasons. As per the National Institute of Mental Health, one in five Americans suffers from a mental disorder at some point each year. This states that a sizable portion of the workforce may experience mental health problems.

High cost

The absence management industry has been expanding recently due to factors like rising labor costs, stricter laws, and the necessity for businesses to maintain efficiency and profitability. The high cost of installing and maintaining absence management systems is one of the most significant issues in the absence management market. These expenses may cover those for hardware, software, support, training, and continuous maintenance and updates. The expenses also change based on the organization's size and the degree of customization needed to satisfy particular requirements. Additionally, suppose an organization does not consider absenteeism to be a significant problem or is not influenced that the system's advantages outweigh its drawbacks. In that case, it may be reluctant to invest in absence management systems.

The growing trend of remote work

The market for absence management, or the systems and procedures set up to manage employee absences such as sick leave, vacation time, and other types of leave, is uniquely positioned to benefit from the expanding trend of remote work. The flexibility that remote work gives allowing employees to work from anywhere and at any time, is one of its key benefits. Absence management systems help organizations track and manage employee absences more successfully by giving them the tools and procedures necessary.

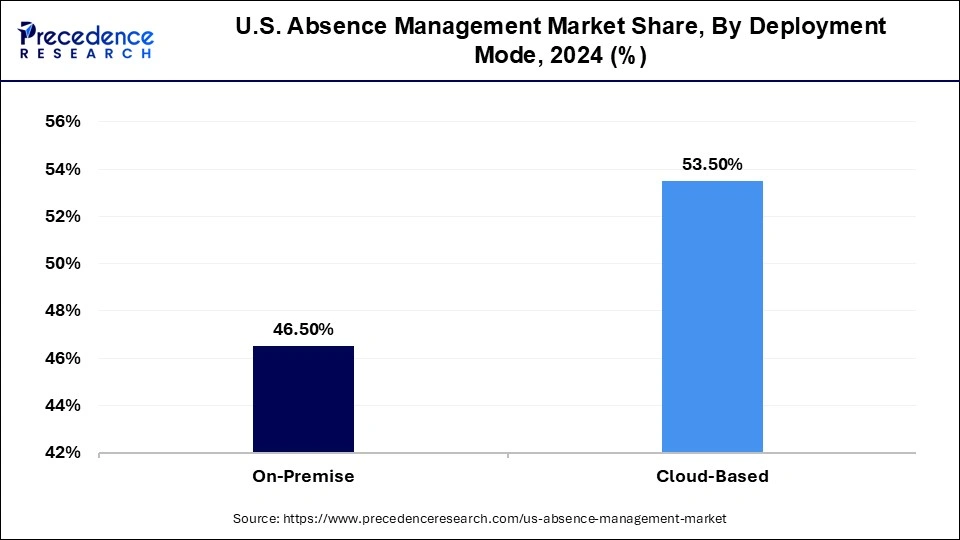

The On-Premises sector is expected to expand at a faster rate during the forecast period as a result of the growing adoption of enterprise application software. Additionally, the industry is growing as more businesses embrace enterprise application software. On-premises corporate application software is anticipated to give opportunities for the market's expansion due to the data privacy and security it offers. More companies are utilizing absence and leave management software since it assists them in learning about their employees' leave habits, which will help them perform better overall. This kind of software simplifies the task of H.R. management at an organization by enabling them to track and record employee attendance in real-time rather than manually updating a spreadsheet.

The Cloud-Based sector is expected to expand at a remarkable rate. The main factor driving cloud services is cost-effectiveness. By utilizing cloud services, businesses reduce their operating expenses by more than 30% to 35%. The second factor includes all the operational characteristics that enhance an organization's capacity to conduct business.

U.S. Absence Management Market, By Deployment Mode, 2022-2024 (USD Million)

| By Deployment Mode | 2022 | 2023 | 2024 |

| On-Premise | 128.22 | 139.01 | 150.85 |

| Cloud-Based | 144.58 | 158.34 | 173.56 |

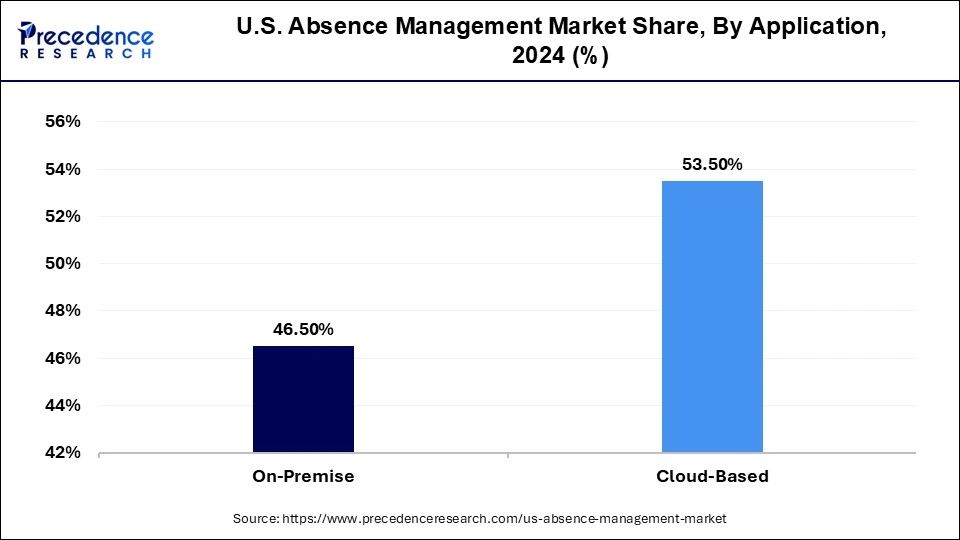

Large Enterprises are anticipated to grow at a higher rate from 2025 to 2034. Due to their massive workforces, major businesses typically embrace workforce management software at a higher rate than small businesses. Due to their extensive investments in advanced technology and robust I.T. infrastructure, large businesses account for a significant portion of the market. However, due to the improved absence management software offerings of key companies and cost-effective alternatives, large businesses are predicted to transition from on-premises options to cloud-based ones.

The SME sector is anticipated to grow at the fastest CAGR from 2025 to 2034. The growth is due to the increasing adoption of absence and leave management programs by small and medium-sized businesses (SMEs) and the growing demand among businesses for information.

U.S. Absence Management Market, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Large Enterprises | 166.41 | 180.64 | 213.44 |

| SMEs | 106.39 | 116.71 | 140.82 |

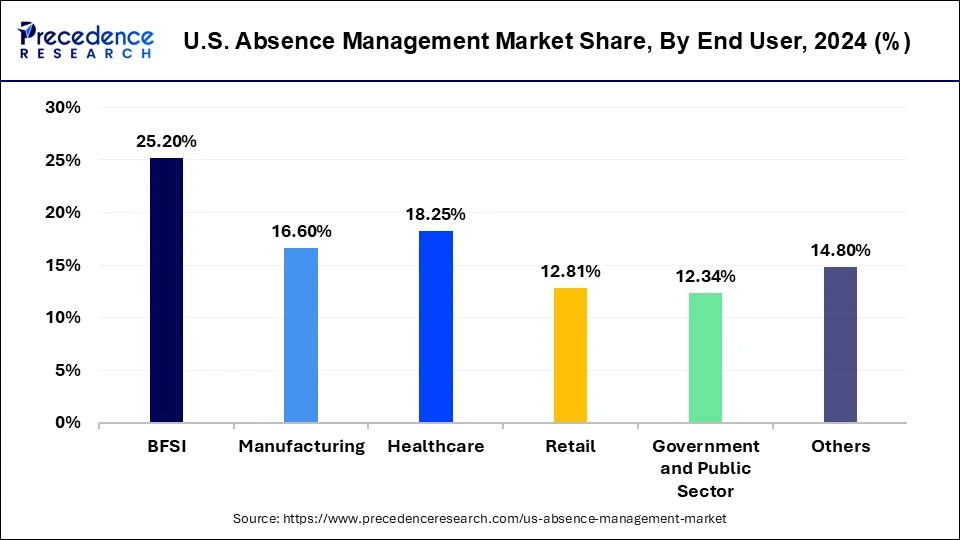

The BFSI sector is growing at the highest CAGR from 2025 to 2034. Financial organizations make sure that BFSI staff receive complete instructions on how modern financial instruments operate. In order to efficiently manage its staff and set priorities for its actions, this industry benefits from innovative technologies and a variety of management solutions and services. Furthermore, the BFSI industry has been significantly disrupted by the arrival of FinTech companies into the market. As a result, it is anticipated that many businesses will embrace absence management solutions.

The manufacturing segment is anticipated to expand at the fastest CAGR from 2025 to 2034. The expanding partnership between Original Equipment Manufacturers (OEM) and Engineering Service Providers (ESP) (ESO) is probably one of the key factors affecting the acceptability of absence management outsourcing. R&D initiatives have pushed key ESO industry players to include global delivery systems in their business plans. Additionally, it affects how employees are managed, how they are evaluated, and how well they are treated. The Centre for Disease Control and Prevention (CDC) estimates that productivity losses due to absenteeism cost U.S. companies $225.7 billion annually, amounting to about $1.684 per worker.

U.S. Absence Management Market, By End Users, 2022-2024 (USD Million)

| By End Users | 2022 | 2023 | 2024 |

| BFSI | 68.2 | 74.64 | 81.75 |

| Manufacturing | 45.83 | 49.66 | 53.85 |

| Healthcare | 48.97 | 53.82 | 59.21 |

| Retail | 34.51 | 37.85 | 41.56 |

| Government and Public Sector | 34.37 | 37.08 | 40.03 |

| Others | 40.92 | 44.31 | 48.01 |

By Deployment Mode

By Application

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

September 2024

November 2024