October 2024

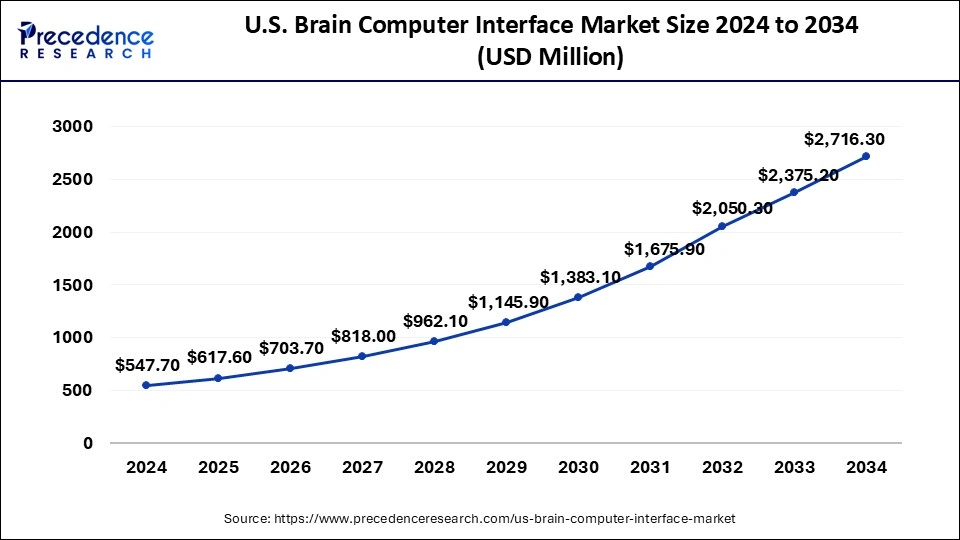

The U.S. brain computer interface market size accounted for USD 617.60 million in 2025 and is forecasted to hit around USD 2,716.30 million by 2034, representing a CAGR of 17.90% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. brain computer interface market size was calculated at USD 547.70 million in 2024 and is predicted to increase from USD 617.60 million in 2025 to approximately USD 2,716.30 million by 2034, expanding at a CAGR of 17.90% from 2025 to 2034.

A brain computer interface (BCI), also known as a brain machine interface (BMI) or direct neural interface (DNI), is a technology that establishes a direct communication pathway between the brain and an external device, such as a computer or a robotic system. The primary goal of BCIs is to enable the direct A brain computer interface (BCI), also known as a brain machine interface (BMI) or direct neural interface (DNI), is a technology that establishes a direct communication pathway between the brain and an external device, such as a computer or a robotic system. BCIs operate by recording, interpreting, and translating neural signals into actionable commands or data. These neural signals can be acquired through various methods, including electroencephalography (EEG), intracortical electrodes, electrocorticography (ECoG), and functional magnetic resonance imaging (fMRI), among others.

The primary goal of BCIs is to enable the direct transmission of information between the brain and an external device without relying on the traditional neuromuscular pathways, such as peripheral nerves and muscles. These technologies have diverse applications ranging from assisting individuals with disabilities and enhancing human-computer interaction to enabling control of external devices through direct neural commands. BCIs have shown promise in helping people with paralysis regain communication and control over their environment by translating their thoughts into commands that can operate assistive devices or communication systems.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.90% |

| Market Size in 2025 | USD 617.60 Million |

| Market Size by 2034 | USD 2,716.30 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Component, and End User |

Rising prevalence of neurodegenerative disorders

The rising cases of related neurodegenerative conditions among the growing American senior population globally form a major consumer base for the U.S. brain computer interface market. The region has been experiencing a growth in the percentage of diagnoses every year. Parkinson’s is the second-most common neurodegenerative condition after Alzheimer’s. According to the Parkinson’s Foundation, 1 million people are suffering from Parkinson’s Disease (P.D.) in the U.S., and it is expected to reach 1.2 million by 2030.

An increase in the requirements for neuroprosthetics

Through the use of a hardware-software interface known as brain computer interface, computers or external devices may be controlled only by mental activity. The main goal of BCI research is to apply communication skills to severely disabled individuals who are immobilized by neurological neuromuscular dysfunctions, such as stroke, spinal cord injury, or brain stem damage. This also fuels the expansion of the U.S. brain computer interface market. An application called 'cognitive monitoring' uses real-time brain signal decoding (RBSD) to gather data on the cognitive condition of users. By employing automated RBSD, a BCI is created that offers a unique information modality for technological techniques based only on brain activity. The user can communicate with these devices or operate the connected computer system by giving voluntary, controlled commands using BCI.

High cost

The cost of therapy increased as a result of newly developed, highly advanced technologies that were introduced to the market and improved the effectiveness and efficiency of treatments for degenerative conditions by improving connections between the brain and external devices. Due to the high cost of the therapy, this could negatively impact the U.S. brain computer interface market, which would lower demand and slow market development. The general public is unable to profit from the enhanced methods of treating the illness.

Rising gaming sector

The U.S. brain computer interface market has found applications in a growing variety of gaming industries to improve the attraction and interaction of video games. With the elimination of conventional controls, neurogaming offers a revolutionary gaming paradigm that greatly improves both the overall gaming experience and the financial possibilities for game firms. In addition, there is a growing trend in the mobile and virtual gaming sectors for the incorporation of BCI technology into V.R. headsets. Additionally, this technology creates a plethora of opportunities for mind-controlled gadgets, which are expected to fuel the U.S. brain computer interface market's expansion throughout the analysis period.

One prominent example is Emotiv, Inc., which has created video games using Neurogaming, a non-intrusive BCI technique that reads users' emotions and modifies music and graphic components appropriately.

The non-invasive brain computer interface segment held the largest share of the U.S. brain computer interface market in 2024. Owing to the technology's broad application and the rise in neurological illnesses, the non-invasive brain-computer interface industry is seen to have a dominant market share. It is anticipated that the prevalence of BCI technology will rise with the creation of non-invasive brain-computer interface devices based on EEG. Further anticipated to support the market's growth is an increase in the number of approvals.

The healthcare segment held the largest share of the U.S. brain computer interface market in 2024 because of this technology's great potential for treating neurological conditions and paralysis, treating sleep problems, and researching neuroscience. Furthermore, the area is growing as a result of increased initiatives by major industry players and technical improvement.

The U.S. brain computer interface market is bifurcated into hardware and software. The software segment held the largest share of the market in 2024. BCI systems generate large amounts of neural data that require sophisticated signal processing and analysis. Software plays a crucial role in extracting meaningful information from neural signals, reducing noise, and enhancing the overall performance of BCIs. In addition, BCI software often includes communication protocols and middleware that enable seamless integration with external devices, such as robotic systems, computers, or prosthetic limbs. This ensures effective communication between the BCI and the target application. Thereby driving the market growth.

The medical segment held the largest share of the U.S. brain computer interface market in 2023 and is observed to sustain the position during the forecast period due to its use in helping people with disabilities. Patients with conditions including Parkinson's, epilepsy, paralysis, and Alzheimer's can walk about and do tasks more independently because of BCI technology. These activities include using a wheelchair, prosthetic limbs, and other devices.

By Product

By Application

By Component

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

November 2024

November 2024

March 2025