January 2025

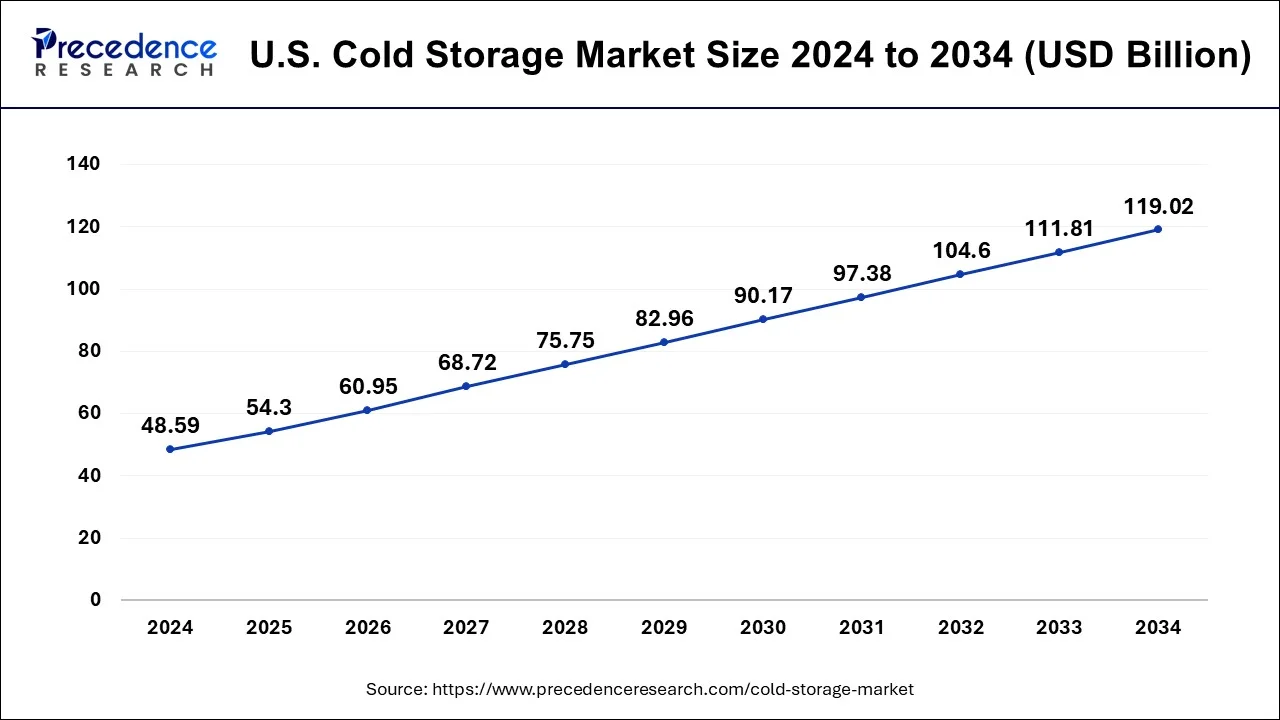

The global U.S. cold storage market size is calculated at USD 54.3 billion in 2025 and is forecasted to reach around USD 119.02 billion by 2034, accelerating at a CAGR of 10.47% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. cold storage market size reached USD 48.59 billion in 2024 and is anticipated to reach around USD 119.02 billion by 2034, poised to grow at a CAGR of 10.47% during the forecast period from 2025 to 2034.

Cold storage is used for the preservation of food items for the long term, cold storage helps in preserving food long term means its shelf life increases and its looks fresh and having exactly the same test. There are many types of cold storage equipment it helps in long-term storage in warehouses and it includes frozen storage, dry storage, and chilled refrigerated storage. Cold storage is a widely used method for bulk handling of food production till the marketing processing. some dairy products, meat, seafood, vegetables, and fruits have very limited life spans after harvesting or producing moreover cold storage or cooling instantly removes the heat and allows for a longer storage period. Cold storage are also used for the storage of medicines and vaccine for its efficacy.

| Report Coverage | Details |

| Market Size in 2024 | USD 167.31 Billion |

| Market Size by 2034 | USD 435.18 Billion |

| Segments Covered | By Warehouse Type, By Temperature Type, By Application |

An increase in the demand of dairy product drive the market growth

Increase the demand of process food, meat, and dairy product in the U.S. population because of the increasing young population as they like to consume more processed food in addition to this person from the united states are focused on vegan food as mostly aware of the benefits of vegan food. According to Ipsos (the global market research company), there are 9.7 million are vegan. The vegan frozen meals contain plant-primarily based totally meals merchandise and plant-primarily based totally dairy options. The call for vegan frozen meals in international locations which include the United Kingdom and the United States has increased.

The health concern nowadays increases among consumers as increases many types of diseases, coupled with the implementation of stringent quality standards in the U.S. region so people believed on fresh goods and quickly available medicines, so it required large amounts of cold storage.

The requirement of high energy and less availability of fossil fuel restrain the market growth

Powerful long-time period secure meals garage alongside the delivery chain has come to be important for the continuing operation of gift meals systems. Refrigeration, packaging, meal transportation, meal product improvements, and several socio-monetary trends have all contributed to the introduction of pretty energy-established, it required more amount of energy and due to less availability of fossil fuel hindered the market growth.

Availability of renewable refrigerator technology

As the increasing demand of process food, meat, fresh veggies, and fruits increases the demand of cold storage. The cold storage required more amount of energy for cooling and temperature maintenance. The United States is working on renewable refrigeration technology it increasing the opportunity in the cold storage market.

Covid 19 Impact:

The COVID-19 pandemic that originated in China has become an excessive difficulty internationally in a short time. The coronavirus spread from China to Europe after which estimated very badly on the world economy, COVID-19 caused a lockdown and tour regulations in lots of components of the world, impacting numerous business delivery chains. The survey conducted by CBRE on the impact of covid 19 on the storage sector, in many countries the essential sectors are open as more consumers buy food products in bulk and it increases the demand of online food retail and it affects the food supply chain.

The private storage segment is expected to be the fastest-growing segment during the forecast period, this is because retail giants are investing more in building their own warehouses to provide fast shipping at a minimal cost. The rapid growth of online groceries and groceries is expected to further drive the growth of the segment. The growing involvement of retail giants in online and home delivery businesses has necessitated the construction of their own warehouses to provide fast and convenient deliveries to their customers. On the other hand, public warehouses provide certain services such as handling, transportation, and storage of goods at reasonable costs. According to the Global Cold Chain Alliance, public storage capacity is approximately 75% of the cold storage capacity in the United States. Public warehouses help merchants and manufacturers store perishable products cheaply and facilitate their distribution network.

U.S. Cold Storage Market, By Warehouse Type, 2021-2023 (USD Million)

| By Warehouse Type | 2021 | 2022 | 2023 |

| Private | 22,966.1 | 25,200.0 | 30,752.1 |

| Public | 12,798.7 | 14,232.2 | 17,834.9 |

The chilled segment's warehouses keep their storage temperatures in the ranges of more than –5°C. They are used to keep fresh produce, eggs, dried fruits, milk, and dehydrated items in storage. it required less voltage as compared to frozen refrigerators. Moreover, the increasing consumption of frozen foods in developed markets and rising demand for frozen foods in emerging markets have contributed significantly to the growth of the frozen segment. The main items stored in the frozen department include fruits, vegetables, fish, meat, dried fruits, eggs, and dairy products. This segment is expected to remain dominant throughout the forecast period, owing to increasing demand for fresh food and growing awareness of the immutable nutrients of frozen food. Additionally, the busy and hectic lifestyles of consumers have increased the demand for ready-to-eat and ready-to-eat foods, driving the growth of this segment.

U.S. Cold Storage Market, By Temperature Type, 2021-2023 (USD Million)

| By Temperature Type | 2021 | 2022 | 2023 |

| Frozen | 27,257.9 | 29,872.7 | 32,885.4 |

| Chilled | 8,506.9 | 9,559.5 | 10,787.1 |

The fish, meat, and seafood segment held the largest share of the U.S. cold storage market with 32% in 2022. The fish and seafood industry in the United States is often subject to stringent regulations regarding food safety and hygiene. Cold storage facilities aid in complying with these regulations by ensuring proper storage conditions. Cold storage facilitates proper quality control measures and traceability of seafood products. Maintaining the cold chain helps in tracking the origin and handling of the products, ensuring consumer safety.

U.S. Cold Storage Market, By Application, 2021-2023 (USD Million)

| By Application | 2021 | 2022 | 2023 |

| Fruits & Vegetables | 3,543.3 | 3,930.8 | 4,380.4 |

| Dairy | 2,998.6 | 3,348.2 | 3,755.0 |

| Fish, Meat & Seafood | 11,455.0 | 12,588.4 | 13,896.6 |

| Processed Foods | 10,170.0 | 11,144.7 | 12,267.6 |

| Others (Pharmaceuticals, Chemicals, Etc.) | 7,598.0 | 8,420.0 | 9,373.0 |

Segments Covered in the Report

By Warehouse Type

BY Temperature Type

By Application

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

March 2025

October 2024