May 2024

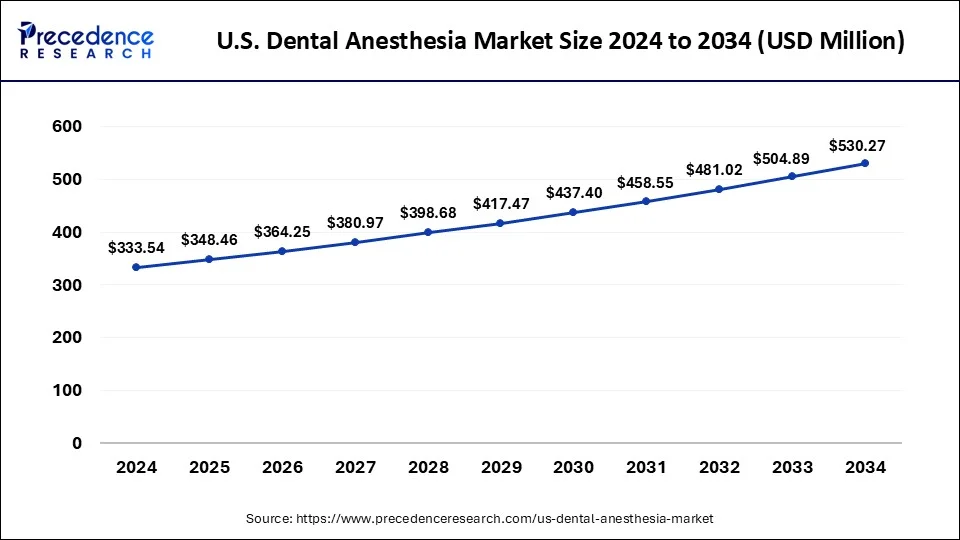

The U.S. dental anesthesia market size is calculated at USD 348.46 million in 2025 and is forecasted to reach around USD 530.27 million by 2034, accelerating at a CAGR of 4.80% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. dental anesthesia market size was USD 333.54 million in 2024, estimated at USD 348.46 million in 2025, and is anticipated to reach around USD 530.27 million by 2034, expanding at a CAGR of 4.80% from 2025 to 2034. The increasing prevalence of oral and dental care treatment that driving the growth of the market.

The U.S. dental anesthesia market revolves around the offering of drugs given to the patients in the form of injections, gels, or spray to numb the dental area in which the dental procedure will take place. It restricts the sensation in the specific area of the mouth where it injected without losing complete consciousness. Dental anesthesia is considered as the safe and secure procedure in dental treatment. Local anesthesia, general anesthesia, and sedation anesthesia are the three main types of anesthesia. The rising cases of the dental problems and oral hygiene issues in the population due to the aging factors and the shift in lifestyle that driving the expansion of the U.S. dental anesthesia market.

| Report Coverage | Details |

| U.S. Dental Anesthesia Market Size in 2024 | USD 333.54 Billion |

| U.S. Dental Anesthesia Market Size in 2025 | USD 348.46 Billion |

| U.S. Dental Anesthesia Market Size by 2034 | USD 530.27 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Anesthesia Type, End User, and Packaging Type |

Growing aging population

The growing geriatric population of the United States is one of the major driving factors in the growth of the market. The geriatric population is more likely to get affected by some kind of oral and dental healthcare problems due to the aging effects and lifestyle that need a time-to-time treatment procedure which are driving the demand for dental anesthesia. Dental anesthesia is used in dental surgeries that is used to numb the specific areas inside the mouth in which the surgery will take place, it is administered by the dentists. Dental anesthesia is given in the form of gels, sprays, and mostly by injections. The increasing prevalence of the dental surgeries in the United States are propelling the growth of the U.S. dental anesthesia market.

High cost

The increased cost of the dental treatment and procedures like medicine, anesthesia, and others are observed to create a restraint for the U.S. dental anesthesia market. Moreover, the overall costly treatments for dental and oral issues in the United States creates another hindering factor for the market to grow. However, government initiatives and production of cost-effective solutions for the dental industry is observed to overcome the restraining factor.

Advancements in procedures

The technological advancements in the dental anesthesia like in enhancing the comfort by innovations in the anesthesia formulation and delivery methods that minimizes the discomfort of administration of the traditional dental anesthesia procedures are driving the opportunity in the market’s growth. The rising investment in the research and development program in enhancing the safety and efficiency of the dental anesthesia and the customization of the dental anesthesia as per the requirement of the patients are boosting the growth market. Additionally, the rising major pharmaceuticals and healthcare facilities are further propelling the growth of the U.S. dental anesthesia market.

The Articaine segment dominated the U.S. dental anesthesia market with the largest share in 2024. Articaine is marketed as Septocaine in the United States. It is the local anesthesia was approved by the U.S. food and drug administration in 2000. It is the second most used and effective anesthesia which is used in dentistry in the U.S. Articaine contains the thiophene group and commonly used as the dental anesthesia in the United States. Articaine is used in the dental anesthesia for local filtration injections, also in the mandible, with the higher successful rate that other anesthesia in the dentistry. It is the safer and most secure type of anesthesia in dentistry that can be used in both adult and pediatric patients.

The Lidocaine segment is expected to be the fastest growing segment in the market during the forecast period. Lidocaine is the type of anesthesia which is used in the numbing of the body part temporarily before the surgical procedures. The increasing popularity of lidocaine in the dentistry due to its efficiency that drives the expansion of the segment.

U.S. Dental Anesthesia Market by Product Type, 2022-2024 ($Billion)

| Product Type | 2022 | 2023 | 2024 |

| Articaine | 105.93 | 110.77 | 115.89 |

| Lidocaine | 78.07 | 81.8 | 85.75 |

| Mepivacaine | 39.06 | 40.73 | 42.48 |

| Mepivacaine | 25.93 | 26.93 | 27.97 |

| Prilocaine | 17.29 | 17.99 | 18.73 |

| Others | 39.82 | 41.23 | 42.72 |

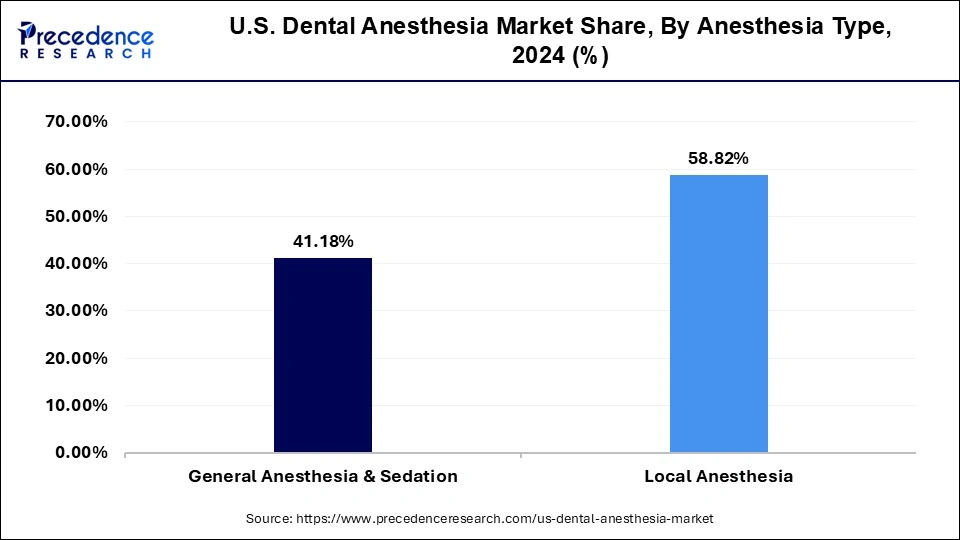

The local anesthesia segment dominated the U.S. dental anesthesia market and expected to sustain its position in the market during the forecast period. The growth of the segment is attributed to the rising prevalence of the small less invasive dental surgeries that are driving the expansion of the local anesthesia in the dentistry. Local anesthesia is used in the smaller surgical procedures like cavity filling, and others.

The local anesthesia takes effects on 10 min and lasts up to 30 to 60 minutes. Local anesthesia is easily available in the form of ointments, gel, cream, patch, spray, liquid, and injectable forms. Articaine, bupivacaine, lidocaine, mepivacaine, and prilocaine are some of the examples of the local anesthetic.

U.S. Dental Anesthesia Market by Anesthesia Type, 2022-2024 ($Billion)

| Anesthesia Type | 2021 | 2022 | 2023 |

| General Anesthesia & Sedation | 121.94 | 126.81 | 131.93 |

| Local Anesthesia | 171.54 | 179.30 | 187.51 |

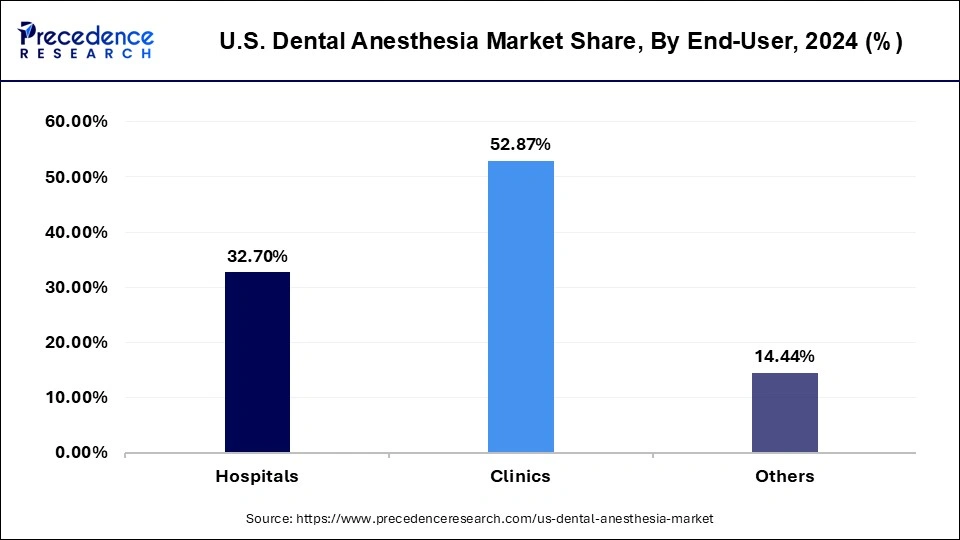

The clinic segment dominated the market and expected to sustain its position in the market during the forecast period. The higher prevalence of the dental treatment in the clinic due to the increase availability of the skilled professionals and modern dental equipment that makes the procedure less invasive and higher efficient which drives the growth of the clinical segment.

The increasing preference by the patients to visit the clinics for the dental treatment of surgical procedure due to the availability of the technological advance equipment and timely availability of the medication which boosts the growth of the segment.

U.S. Dental Anesthesia Market by Anesthesia Type, 2022-2024 ($Billion)

| End User | 2022 | 2023 | 2024 |

| Hospitals | 100.29 | 104.55 | 109.06 |

| Clinics | 161.18 | 168.54 | 176.33 |

| Others | 44.64 | 46.36 | 48.16 |

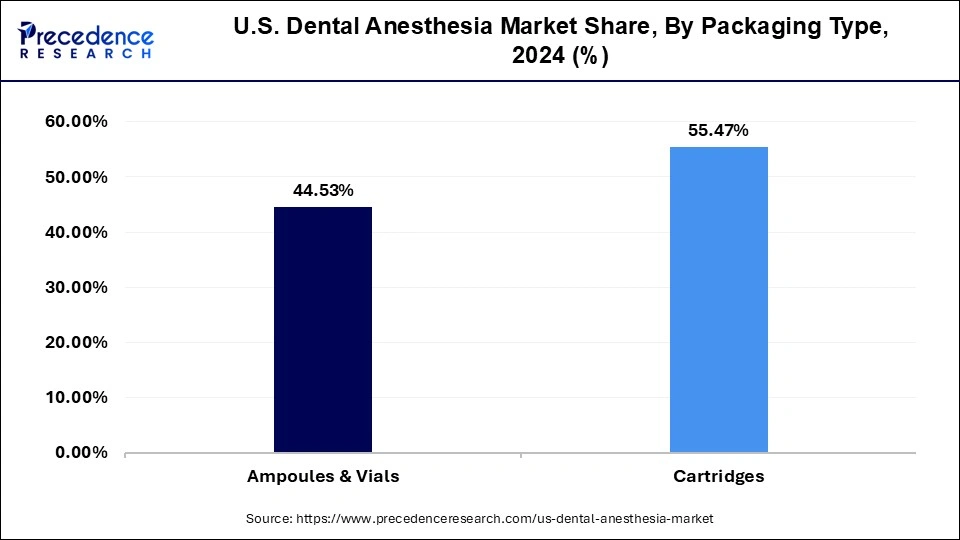

The cartridges segment dominated the market with the largest share in 2024. The growth of the segment is attributed to the rising adoption of cartridges for allowing safer and pain free experience during the dental procedures. Dental anesthesia cartridge come into the three variants that are cylinder, plunger or stopper, and cap.

The cylinder cartridge is one of the main types of the dental cartridge, it the cylindrical shape glass tube that contains the anesthetic liquid or drug which is closed by the plunger of cap. Cartridge is considered as the safest and secure medium to store or transport the drugs which results in the higher adoption of the segment.

U.S. Dental Anesthesia Market by Packaging Type, 2022-2024 ($Billion)

| Packaging Type | 2022 | 2023 | 2024 |

| Ampoules & Vials | 137.12 | 142.66 | 148.51 |

| Cartridges | 168.99 | 176.78 | 185.03 |

By Product Type

By Anesthesia Type

By End User

By Packaging Type

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

April 2025

February 2025

January 2025