January 2025

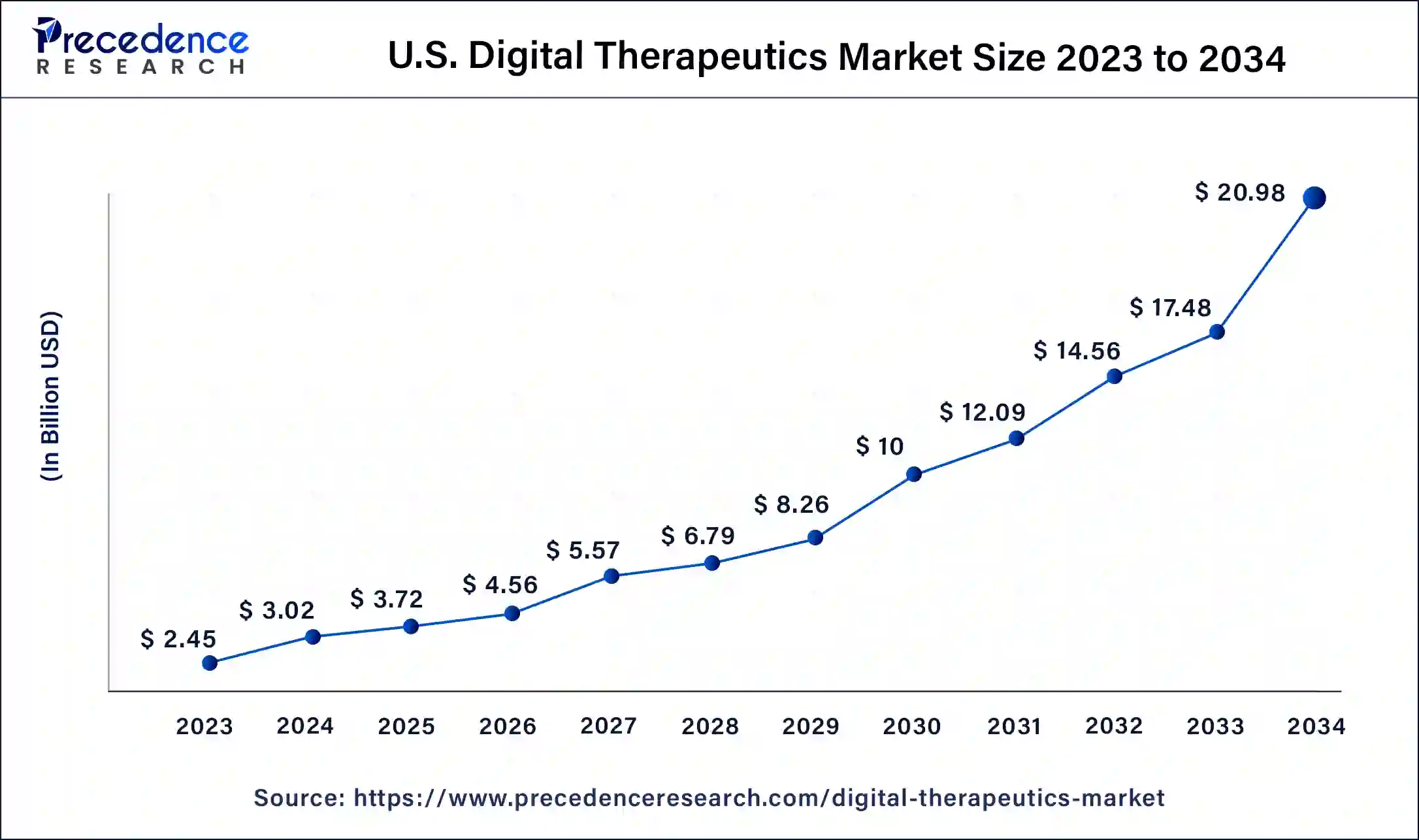

The U.S. digital therapeutics market size was USD 2.45 billion in 2023, calculated at USD 3.02 billion in 2024 and is expected to reach around USD 20.98 billion by 2034, expanding at a CAGR of 21.38% from 2024 to 2034.

The U.S. digital therapeutics market size accounted for USD 3.02 billion in 2024 and is projected to surpass around USD 20.98 billion by 2034, representing a CAGR of 21.38% from 2024 to 2034.

Digital Therapeutics are proven therapeutic procedures driven by software to prevent, manage or treat a medical condition or disease. In other words, Digital Therapeutics are patient-facing application software that helps in treating, preventing, or managing diseases and have been proved the clinical benefit. For instance, DTx assists the patient in self-managing symptoms and improving their quality of life and other clinical objectives. DTx uses digital tools such as mobile devices, apps, sensors, virtual reality, the Internet of Things, and others in order to induce behavioral changes in patients. DTx development has a positive impact on offering well-adapted health services as their design is targeted to the demands of the patient.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 21.38% |

| Market Size in 2023 | USD 2.45 Billion |

| Market Size in 2024 | USD 3.02 Billion |

| Market Size by 2034 | USD 20.98 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application, By Product, and By Sales Channel |

Rising demand for digital therapeutics

The demand for U.S. digital therapeutics is on the rise owing to increased penetration of digital healthcare applications and platforms due to the rapid adoption of smartphones, tablets, and smart wearables is likely to drive market growth in the coming years. The Rising prevalence of chronic diseases with the growing need to control the rising cost of healthcare facilities is another factor that is expected to drive the market growth. Furthermore, constantly changing digital platforms in many industries have encouraged consumers to use these digital platforms. Also, increased awareness about health and fitness are the major drivers that boost the market in the upcoming years.

Data privacy concerns

The various health applications lack the necessary authorization raising issues about the product and data quality, patient privacy, security, and data use responsibly. Digital therapeutics providers have access to the patient’s information but are not permitted to share information about who is involved in the patient’s treatment. However, with the digital technologies to consolidate data, the patient’s information is at risk which can be accessed by any healthcare professional who is not involved in patients’ treatment procedure. As a result, data privacy issues are impeding the growth of the market during the forecast period.

Rising investments and strategic acquisition

Increased pharma investment and healthcare-focused start-ups are more likely to act as market drivers for digital therapeutics, influencing and shaping the future of digital therapeutics. There is also a positive trend for digital medication reimbursement, with 25% of organizations currently covering them and another 45% promising to do so in the future. Consolidation in the digital therapeutics sector is ongoing, with vendors expanding their market presence through strategic acquisitions and collaborations with pharmaceutical companies. Mergers and acquisitions are being used by global and prominent regional suppliers to enhance their market positions and extend their product ranges.

Furthermore, the growing emphasis on strategic acquisitions and the formation of collaborative partnerships among key stakeholders such as providers, payers, and the US federal government to meet prevalent unmet patient needs and provide supportive healthcare services in remote locations is contributing to the growth of the digital therapeutics market in the US. These strategic alliances will boost healthcare infrastructure utilization, enhance patient and physician interaction, and deliver improved disease management and patient access services.

Based on application, the U.S. digital therapeutics market is segmented into Diabetes, Obesity, Central Nervous System (CNS), cardiovascular disease (CVD), Gastrointestinal Disorder (GID), Respiratory diseases, Smoking Cessation, and Others. The diabetes segment holds the largest market share during the forecast period owing to the high prevalence of diabetes. Additionally, the demand for cost-efficient healthcare options and high prevalence rates for diabetes are observed in the U.S. thus it further boosts the demand for digital therapeutics among diabetes patients in the country.

Moreover, the obesity segment is estimated to account for the highest growth during the forecast period. This is due to the increasing number of overweight populations which leads to an increase in the number of chronic diseases from obesity. Furthermore, improved accessibility of digital therapeutics software applications that assist patients in maintaining a healthy diet, tracking health data, and daily physical activity boosts growth in the US digital therapeutics market. Moreover, the DTx software application offers frequent online guidance from certified doctors, which is projected to contribute to the future reduction of obesity prevalence.

U.S Digital Therapeutics Market Revenue, By Application, 2022-2023(USD Million)

| Application | 2022 | 2023 |

| Obesity | 345.06 | 433.48 |

| Diabetes | 530.00 | 652.38 |

| CNS Disorders | 240.47 | 298.21 |

| Gastrointestinal Disorders | 223.22 | 277.34 |

| CVD Disease | 267.10 | 328.58 |

| Smoking Cessation | 89.86 | 110.09 |

| Respiratory Diseases | 162.22 | 201.90 |

| Others | 122.98 | 148.68 |

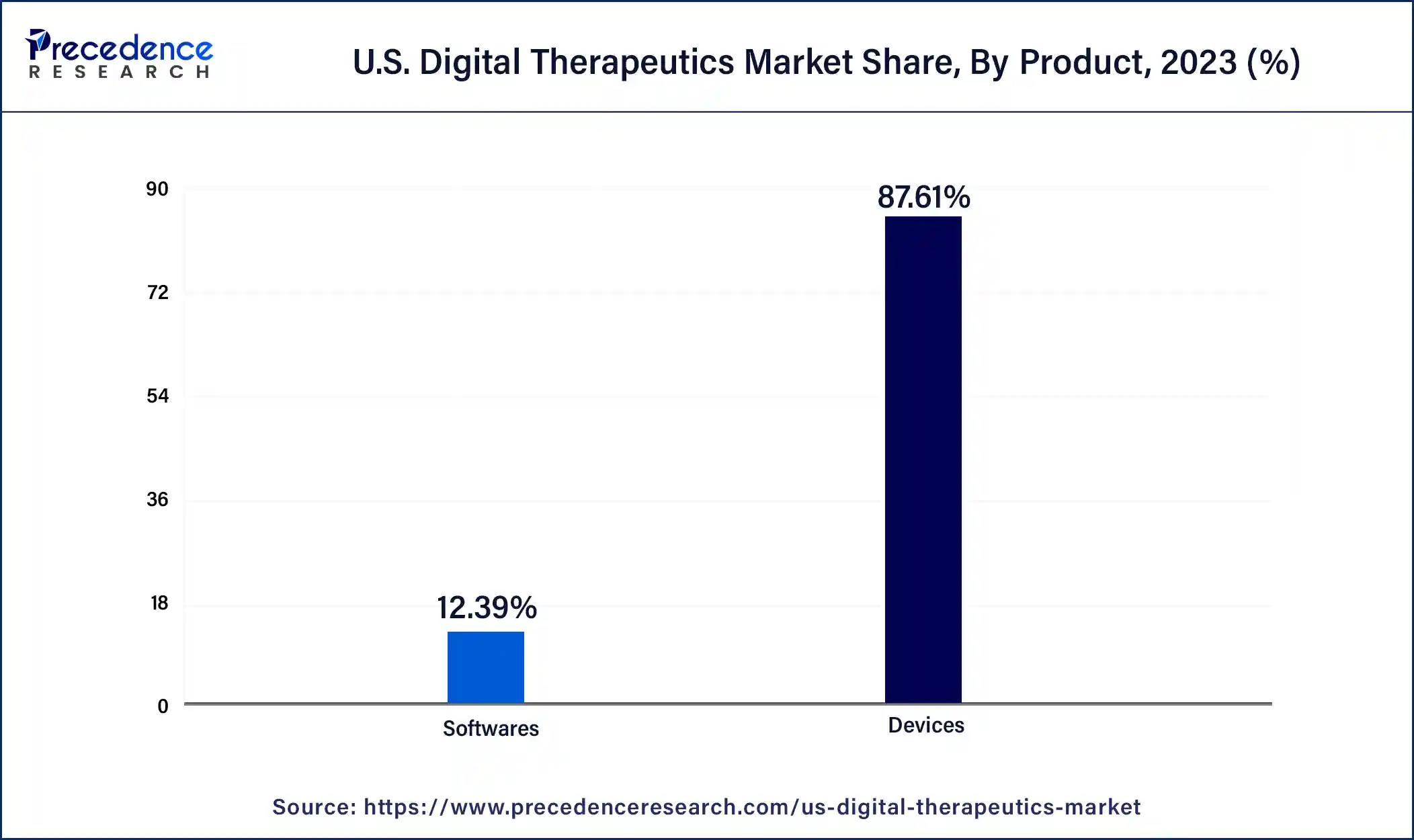

The devices segment held 87.61% share of the market in 2023, owing to the increasing adoption of advanced healthcare technologies. Increasing focus on remote healthcare to enhance patient outcomes bolstered the market. Physicians in the US have recognized the importance of digital health devices in managing various conditions. Moreover, the increasing adoption of wearable devices significantly contributed to the segmental growth. For instance,

The business-to-business segment led the market in 2023, accounting for 64.65% market share. B2B sales channels offer customized digital health solutions to businesses, catering to the specific needs of organizations and promoting employee health. Moreover, the rising collaborations between companies providing digital health solutions and healthcare providers and pharmaceutical companies to facilitate easy integration of digital health solutions in existing healthcare facilities contributed to the segment expansion.

Segments Covered in the Report

By Application

By Product

By End Use

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

September 2024

January 2025