December 2024

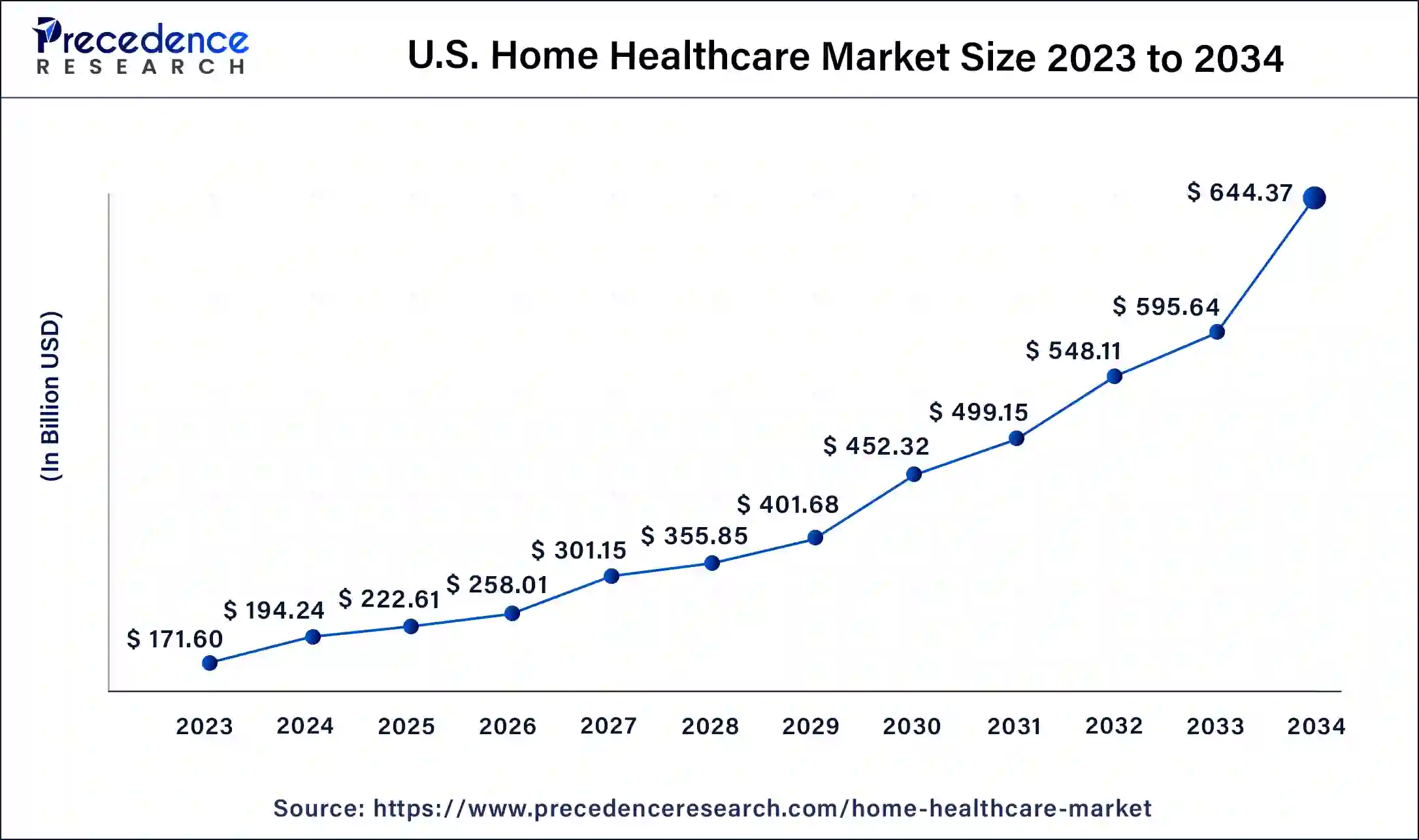

The US home healthcare market size was USD 171.60 billion in 2023, calculated at USD 194.24 billion in 2024 and is projected to surpass around USD 644.37 billion by 2034, expanding at a CAGR of 12.74% from 2024 to 2034.

The US home healthcare market size accounted for USD 194.24 billion in 2024 and is expected to be worth around USD 644.37 billion by 2034, at a CAGR of 12.74% from 2024 to 2034.

A various range of medical services is provided at home for injury and illness by home healthcare. Home healthcare's main advantage is that it is less expensive, more convenient, and as effective as hospital-based or nursing care. There is significant growth in the geriatric population in the U.S. As the geriatric population increases there is an increase in age-related disorders, such as diabetes, osteoarthritis, and dementia. Sedentary lifestyles and excessive alcohol intake are factors contributing to the rise in the incidence of lifestyle illnesses. During the projected period, the market is likely to be driven by the rising prevalence of target illnesses. For instance, according to the American Heart Association, around 83.6 million individuals in the United States suffer from one or more forms of cardiovascular illnesses, with approximately 42.2 million persons over 60.

| Report Coverage | Details |

| Market Size in 2023 | USD 171.60 Billion |

| Market Size in 2024 | USD 194.24 Billion |

| Market Size by 2034 | USD 644.37 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.74% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Device, Services |

Rapid growth in the elderly population

As the aging population is more prone to chronic diseases, this increases the demand for healthcare as well as the burden on the government and health systems. For instance, according to the United Nations Department of Economic and Social Affairs, there were 703 million individuals aged 65 and over in the world in 2019; by 2050, this amount is predicted to rise to 1.5 billion. Furthermore, the number of individuals aged 80 and up is expected to increase by 2050, from 143 million in 2019 to 426 million. T the unnecessary hospital admission and readmissions and the time and cost involved in traveling to meet healthcare professionals are reduced due to home healthcare.

Rising incidence of chronic diseases

Chronic illness is a long-term illness that can be managed but not cured. Chronic illness treatment and management have become a serious problem. Approximately half of all home healthcare patients have at least one chronic condition, and this figure is anticipated to rise in the coming years. Chronic illnesses, which disproportionately impact older persons, lead to disability, lower quality of life, and raise long-term care expenditures, creating an array of potential for various home healthcare organizations.

As healthcare expenses rise, there is a greater demand for cost-effective healthcare delivery

The key factor driving the adoption of services for homecare settings during the forecast period is the increasing healthcare expenditure in the U.S. For instance, according to an article published in 2021, by the American Journal of Managed Care (AJMC), the cost reduction in home healthcare management in a recent randomized trial was 19%. Further, the market will be boosted by the growing demand for respiratory therapy services and infusion services at home.

Concerns regarding patient safety

The nurse-physician relationship in-home care entails less face-to-face interaction, and the nurse is responsible for performing evaluations and conveying results. This aspect influences patient safety and outcomes. Another distinguishing feature of home healthcare is that professionals provide medical treatment to each patient in his or her own location. However, there may be external aspects that pose dangers to patients that are difficult to exclude. To handle such incidents, hospitals have well-equipped environmental safety departments.

Telehealth's rising popularity and unexplored developing regions

The fast increase in the global elderly population, the growing incidence of chronic illnesses (including COPD and asthma), and the cost benefits of home care equipment and services (in comparison to hospital visits) are the primary factors driving the growth of the home healthcare industry. COVID-19 has resulted in a significant increase in the usage of telehealth. Consumer usage has skyrocketed, with 11 percent of US consumers adopting telehealth in 2019 and 46 percent currently using telehealth to replace canceled healthcare appointments.

Shortage of home care workers

Home healthcare is a booming industry, with a high need for home care providers/workers. According to the US Bureau of Labor Statistics' employment predictions for 2014-2024, home healthcare occupations such as personal care aides and home health aides are among the top ten. As the demand for home healthcare increases the demand for workers also increases.

By type, the services segment dominated the US home healthcare market with a revenue share of 52.4% in 2023. Healthcare services offered to patients at home depend on their diagnosis and according to care plans outlined by their physician. Services can range from doctor and nursing-based care to physical, occupational, and speech therapy or specialized medical services. The demand for home healthcare services has grown rapidly in the United States due to the country’s growing elderly population. According to projections by the US Census Bureau, the number of people aged 65 and above is likely to reach 83.9 million by 2050, nearly double that in 2012. Nursing is the most commonly utilized home healthcare service, especially for elderly adults. Nursing care includes the provision of services such as medicine administration, wound dressing, ostomy care, and monitoring patient vitals.

By type, the devices segment is projected to expand rapidly in the market in the coming years. A home medical device is intended for use in a non-clinical environment and is usually managed, at least partially, by the user. Rising hospitalization costs in the United States and a shortage of care facilities are putting pressure on the medical infrastructure and compelling individuals to opt for home-based healthcare options. Even complex devices such as dialysis machines and ventilators are being retrofitted to operate at home.

By device, the diagnostic and monitoring devices segment dominated with a revenue share of 30.04% in 2023. Diagnostic and monitoring devices cover a wide range of equipment, including testing kits for measuring different chemicals and parameters in blood or urine and various types of meters and monitors for keeping track of specific vitals such as pulse, oxygen levels, etc. Standard diagnostic and monitoring devices include thermometers, blood pressure cuffs, glucometers, and pulse oximeters. Home healthcare usually involves monitoring one or more critical patient parameters to deliver timely and accurate medicine administration.

By device, the home mobility assist devices segment is predicted to witness significant growth in the US home healthcare market over the forecast period. An impending rise in the geriatric population in the country over the next few years is expected to drive demand in this segment. Mobility assist devices ease the burden of caregiving by creating a safer, more accessible environment for the sick, disabled, and aged. They make daily tasks more manageable for those with mobility, hearing, and vision impairments.

US Home Healthcare Market, By Devices, 2020-2023 (USD Billion)

| Devices | 2020 | 2021 | 2022 | 2023 |

| Diagnostic & Monitoring Devices | 6,703.8 | 7,614.5 | 8,515.3 | 9,607.0 |

| Therapeutic Devices | 6,670.2 | 7,585.6 | 8,493.3 | 9,593.6 |

| Home Mobility Assist Devices | 9,304.6 | 10,420.7 | 11,489.7 | 12,780.1 |

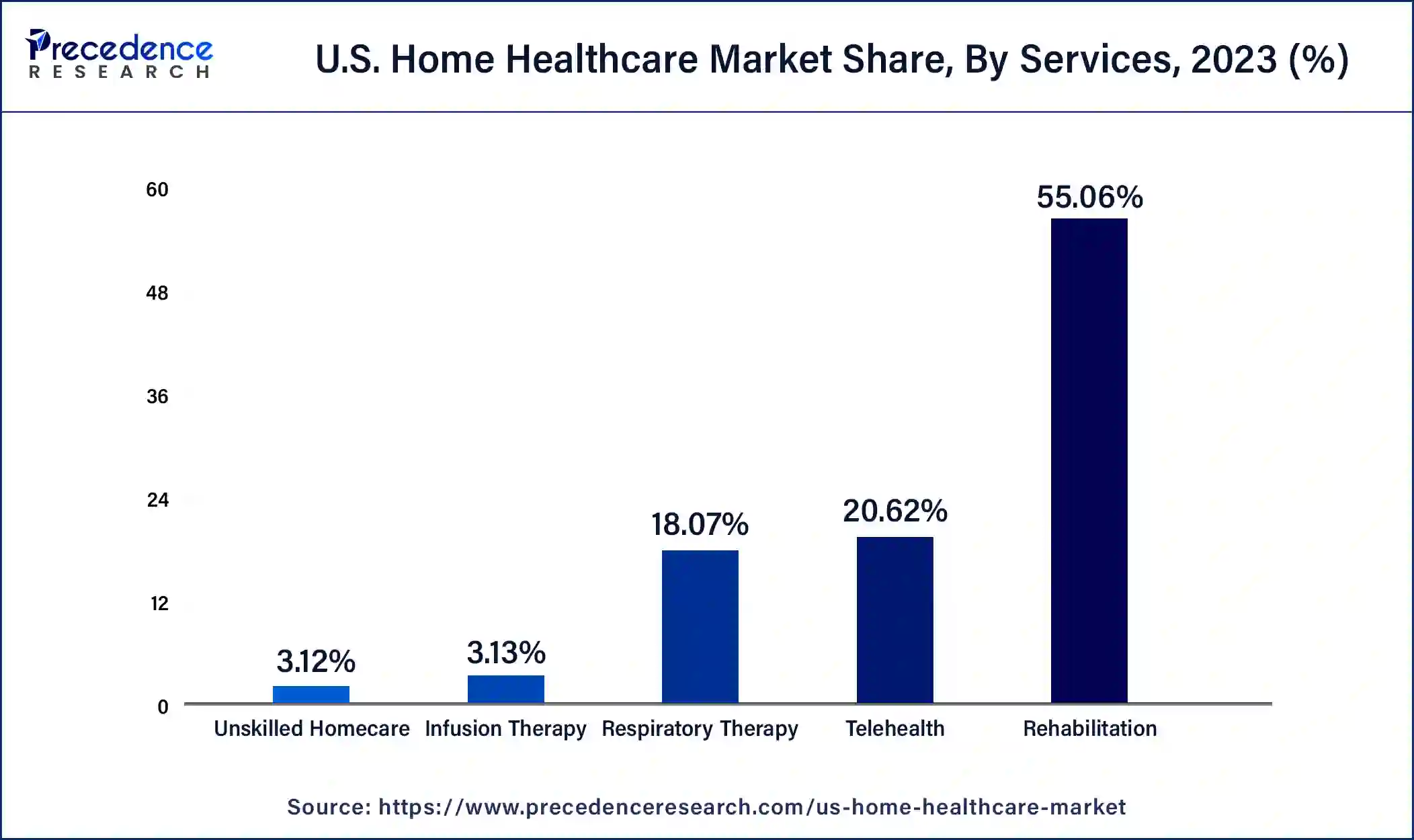

By services, the rehabilitation segment accounted for a considerable revenue share of 55.06% in 2023. Rehabilitation services are a crucial part of healthcare and aim to enable children, elders, and adults with disabilities to operate as independently as possible and participate in society through work, education, recreation, etc. According to the World Health Organization, an estimated 2.4 billion people globally currently live with a condition that can benefit from rehabilitation. Demand for rehabilitation is fueled by demographic changes in the world population with increasing number of people living longer and a higher instance of chronic illness and disability.

By services, the telehealth segment is expected to gain a significant market share from 2023 to 2034. Demand for telehealth services surged during the pandemic, offering several benefits to medical staff and patients, such as improving care delivery, patient outcomes, and preventive care. Telehealth services include palliative care, chronic disease management, transitional care, mental health, and more.

US Home Healthcare Market, By Services, 2020-2023 (USD Billion)

| Services | 2020 | 2021 | 2022 | 2023 |

| Rehabilitation | 37,118.8 | 41,169.9 | 44,951.2 | 49,508.6 |

| Telehealth | 11,604.2 | 13,698.3 | 15,882.2 | 18,537.4 |

| Respiratory Therapy | 12,101.7 | 13,451.6 | 14,719.6 | 16,248.7 |

| Infusion Therapy | 2,048.0 | 2,293.7 | 2,529.1 | 2,813.6 |

| Unskilled Homecare | 2,123.6 | 2,348.7 | 2,557.0 | 2,807.8 |

Segments Covered in the Report

By Type

By Device

By Services

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2024

June 2024

December 2024