September 2024

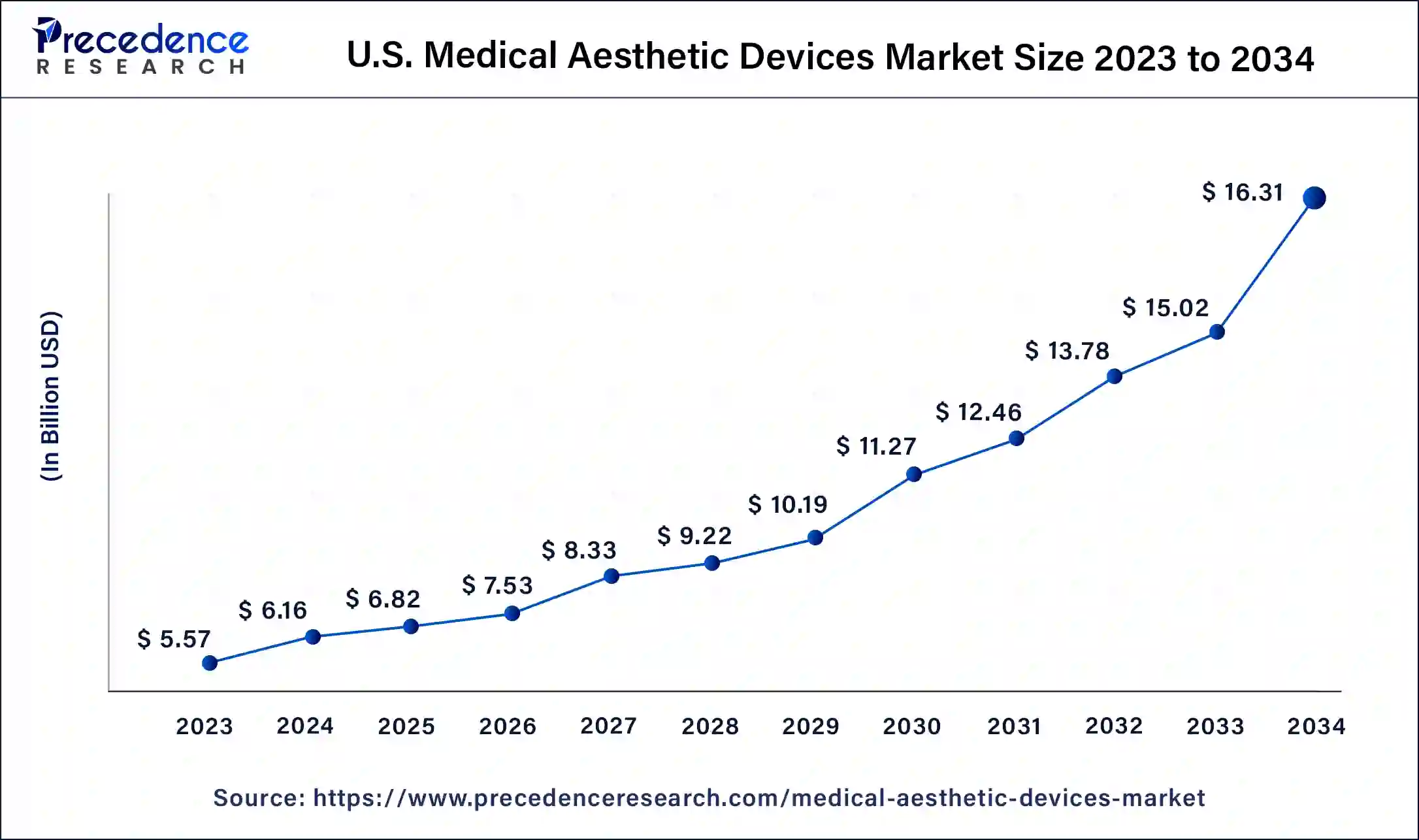

The U.S. medical aesthetic devices market size was USD 5.57 billion in 2023, estimated at USD 6.16 billion in 2024 and is anticipated to reach around USD 16.31 billion by 2034, expanding at a CAGR of 10% from 2024 to 2034.

The U.S. medical aesthetic devices market size is estimated at USD 6.16 billion in 2024 and is predited to surpass around USD 16.31 billion by 2034, growing at a CAGR of 10% from 2024 to 2034.

Medical Aesthetic Devices are used to overcome flaws in a person's physical appearance. The American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) estimates that in the United States in 2021, 1.4 million surgical and non-surgical operations were carried out. The top 5 cosmetic surgical procedure in the United States includes Facelift surgeries, Liposuction, Breast Augmentation, Nose reshaping, and eyelid surgery. The demand for aesthetic treatment in developing countries is growing due to the urge to look young and fit.

The aesthetic method such as liposuction, nose reshaping, and Botox injection are gaining consumer attention. Skin-tightening and non-invasive fat technologies have recently established out a new niche in the medical aesthetics market. The key factors enhancing the growth of the U.S. Aesthetic Medical Device market are a surge in the prevalence of facial deformities and congenital teeth, enhancement in demand for non-invasive surgeries, an increase in the number of cosmetic surgeries, and advancement in aesthetic devices.

COVID -19 Impact:

Manufacturers of cosmetic and aesthetic devices were ordered to cease manufacturing and supply because of the global lockdown that was implemented at the start of the COVID-19 pandemic. The pandemic had a significant impact on both invasive and non-invasive aesthetic operations, including the market for body contouring. For instance, according to Bloomberg, non-invasive fat removal, injectable lipolysis, invasive liposuction soft tissue fillers, facelifts, eye lifts, eyelid operations, laser skin resurfacing, rhinoplasty, and tummy tucks, saw a 20% decline in first half of 2020. However, according to The International Society of Aesthetic Plastic Surgery, by the end of 2020, the desire and demand for aesthetic procedures like body contouring had dramatically grown and had surpassed pre-pandemic levels.

| Report Coverage | Details |

| Market Size in 2023 | USD 5.57 Billion |

| Market Size in 2024 | USD 6.16 Billion |

| Market Size by 2034 | USD 16.31 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.75% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type of Device, By Application, By End User |

The rising prevalence of obesity, increased awareness of cosmetic treatments, expanding use of minimally invasive devices, and technical developments in devices are some factors that are fueling the market's growth.

The rise in the choice of minimally invasive and non-invasive cosmetic surgeries

High Awareness of cosmetic operations and rising obesity rates

High cost and side effects of the aesthetic surgery device

Accessibility to technologically advanced and user-friendly products

The breast implants sub-segment is Expected to show rapid grow in the implants segment of the market

The devices segment dominated the market in 2023, accounting for the largest market share. The increasing demand for non-invasive aesthetic surgeries significantly boosted the demand for medical aesthetic devices. Laser and radiofrequency devices are increasingly used in aesthetic procedures to remove hair, tighten skin, reduce wrinkles, and stimulate collagen production, which further promotes skin rejuvenation. The increasing investments in R&D to develop sophisticated aesthetic devices further contributed to the segment’s growth. Moreover, the increased number of laser-based aesthetic procedures performed in the last few years bolstered the segment.

The aesthetic implants segment is anticipated to expand at the fastest growth rate during the forecast period due to the rising demand for body contouring procedures. Aesthetic implants, including buttocks and breast implants, are widely used in body contouring procedures to enhance the specific part of the body. Moreover, the increasing popularity of breast augmentation surgery fuels the segment. For instance,

The non-surgical segment led the market in 2023 and is expected to continue its dominance throughout the projection period due to the increasing number of non-surgical aesthetic procedures performed in the US. The segment growth is attributed to the easy availability and accessibility of non-surgical procedures in medical spas and beauty centers. Non-surgical aesthetic procedures often require less time than surgical procedures, appealing individuals seeking aesthetic enhancement. Moreover, the growing awareness about the benefits of non-surgical procedures is expected to boost the segment.

The hospitals and clinics segment held a large share of the market in 2023 due to the availability of advanced aesthetic devices in hospital settings. The easy accessibility to these devices and the availability of skilled professionals encourage individuals to perform aesthetic surgeries in hospital settings under physician consultation. Moreover, the rapid expansion of derma clinics contributed to the segmental growth.

Segments Covered in the Report

By Type

By Application

By End-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2024

March 2025

April 2025