September 2024

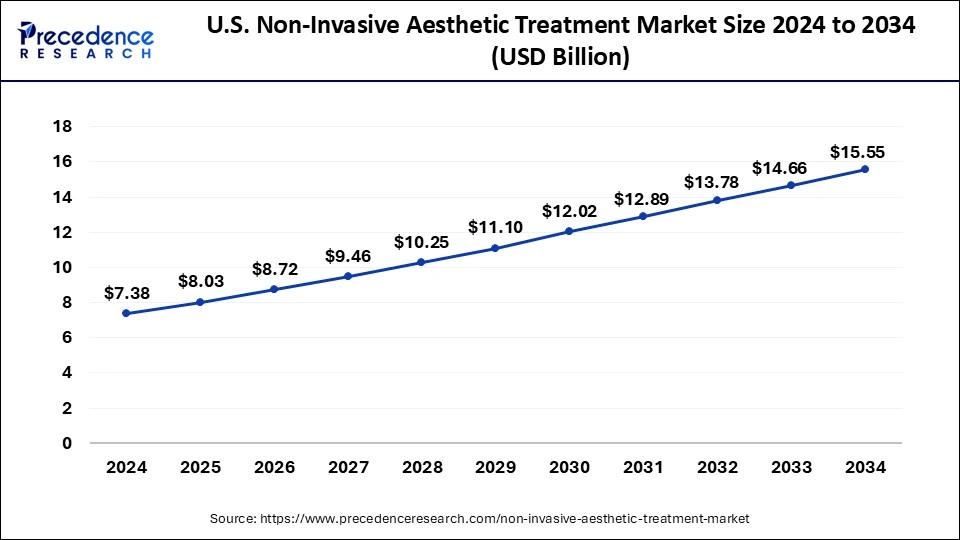

The U.S. non-invasive aesthetic treatment market size accounted for USD 8.03 billion in 2025 and is forecasted to hit around USD 15.55 billion by 2034, representing a CAGR of 7.60% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. non-invasive aesthetic treatment market size was calculated at USD 7.38 billion in 2024 and is predicted to increase from USD 8.03 billion in 2025 to approximately USD 15.55 billion by 2034, expanding at a CAGR of 7.60% from 2025 to 2034.

The US non-invasive aesthetic treatment market refers to the industry sector encompassing cosmetic procedures and treatments that do not involve surgical incisions or invasive techniques. Skin rejuvenation, body reshaping, and anti-ageing are the main goals of these procedures. When doing non-invasive treatments, one may usually target particular parts of the body with equipment like radiofrequency, ultrasound, or lasers, or minimize the appearance of wrinkles and fine lines using injectables like Botox and dermal fillers. Because they are less intrusive, uncomfortable, and time-consuming than invasive procedures, non-invasive aesthetic treatments are more widely used.

| Report Coverage | Details |

| Market Size by 2034 | USD 15.55 Billion |

| Market Size in 2025 | USD 8.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.60% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Procedure, End Use |

Drivers

Rising interest of individuals in modeling and aviation career

A few sectors, like modeling and flying, have a direct connection to human attractiveness on the outside. A person wishing to work in these fields must meet certain requirements regarding appearance. The airline has requirements for height, skin tone, and body type for applicants seeking to become flight attendants. Applications from applicants with noticeable physical scars or tattoos are frequently denied.

Individuals who choose to pursue these professional paths make every effort to meet the standards. Many people would rather have cosmetic procedures done, but the recovery period and possibility of suture scars from operations frequently prevent them from doing so. In this case, non-invasive aesthetic treatments are the ideal option since they can get around these problems. Thus, this is expected to drive the U.S. non-invasive aesthetic treatment market during the forecast period.

Rising disposable income and technological advancements

Higher disposable income levels among consumers allow for increased spending on aesthetic treatments and procedures. As people become more financially able to invest in their appearance and well-being, the demand for non-invasive aesthetic treatments grows. Constant innovations in non-invasive aesthetic technologies, such as laser therapy, radiofrequency, ultrasound, and cryolipolysis, have expanded treatment options, improved efficacy, and reduced downtime for patients. These technological advancements attract more consumers seeking safer and more effective cosmetic procedures.

Restraint

Risk of complications during treatment

Although non-invasive cosmetic procedures are straightforward and reliable, even with skilled injectors, issues can sometimes arise. Ensuring the patient's safety throughout treatment is the first and foremost aim of any given treatment. Complications including erythema, discomfort, and bruising are possible with some non-invasive cosmetic procedures such as BONT and soft tissue fillers. Erythema, burning sensations, and irritation are often reported side effects of chemical peels.

Furthermore, if the filler is injected into a blood artery rather than under the skin, it might obstruct blood flow. Depending on the location of the filler injection, the obstruction may change in certain situations. If it has impacted the skin, there may be cuts or skin loss if it has impacted the eye, blindness or vision loss may result. Thus, this is expected to hamper the US non-invasive aesthetic treatment market over the forecast period.

Opportunity

High disposable income

The demand for beauty treatments is anticipated to rise in tandem with the growing number of individuals over 50 who have high spending power. People are now fixated on looking young because of today's society. People's attention has shifted as a result to the body as a means of self-expression. High earners are paying large sums of money to slow down or perhaps stop the ageing process.

People who are older than fifty are interested in skin-wrinkle reduction procedures. Additionally, as people in this age group have substantial discretionary incomes, they are spending more on a variety of opulent activities, including non-invasive aesthetic procedures. Thus, the increasing disposable income is expected to offer a lucrative opportunity for the U.S. non-invasive aesthetic treatment market during the projected period.

The injectable segment dominated the U.S. non-invasive aesthetic treatment market in 2024. Patients choose injectables because they offer a rapid and comparatively painless method of reducing wrinkles and fine lines. To enhance lips and cheekbones and provide the look of youth, dermal fillers are frequently utilized. It is anticipated that the market for injectables will rise as the world's population ages, propelling the segment's revenue growth.

The skin rejuvenation segment is expected to grow significantly during the forecast period. Skin rejuvenation treatments aim to enhance the appearance and health of the skin, addressing issues such as wrinkles, fine lines, pigmentation, and texture irregularities. The growing consumer awareness is expected to propel the segment's growth.

With an aging population and increasing emphasis on maintaining youthful appearances, there is a rising demand for non-invasive treatments that can address signs of aging such as wrinkles, fine lines, and skin laxity. Skin rejuvenation procedures, such as laser therapy, microdermabrasion, and chemical peels, offer effective solutions for improving skin tone, texture, and elasticity without the need for surgery or downtime.

Advances in medical technology have led to the development of innovative skin rejuvenation devices and techniques that deliver superior results with minimal discomfort and downtime. Cutting-edge technologies such as laser skin resurfacing, radiofrequency micro needling, and intense pulsed light (IPL) therapy enable healthcare providers to customize treatments based on patients' unique skin concerns and desired outcomes.

The hospitals & surgery centers segment held the largest share of the U.S. non-invasive aesthetic treatment market in 2024. Hospitals and surgery centers often take a multidisciplinary approach to aesthetic care. This may involve collaboration between dermatologists, plastic surgeons, aestheticians, and other healthcare professionals to provide comprehensive treatment plans.

Moreover, hospitals and surgery centers are equipped to provide comprehensive recovery and post-procedure care for patients undergoing non-invasive aesthetic treatments. This includes access to medical facilities and personnel in case of any unforeseen complications. Thereby, driving the segment growth.

The medical spa segment is expected to grow at the fastest pace during the forecast period. Medical spas typically offer a variety of non-invasive aesthetic treatments, including injectables (e.g., Botox, dermal fillers), laser therapies, chemical peels, microdermabrasion, and other skin rejuvenation procedures. The availability of a broad range of services attracts a diverse clientele seeking different solutions for their aesthetic concerns.

In addition, medical spas often invest in state-of-the-art technologies and equipment for non-invasive treatments. This includes laser devices, radiofrequency machines, and other advanced technologies that contribute to effective and efficient procedures.

By Procedure

By End Use

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

August 2024

October 2024

March 2025