September 2024

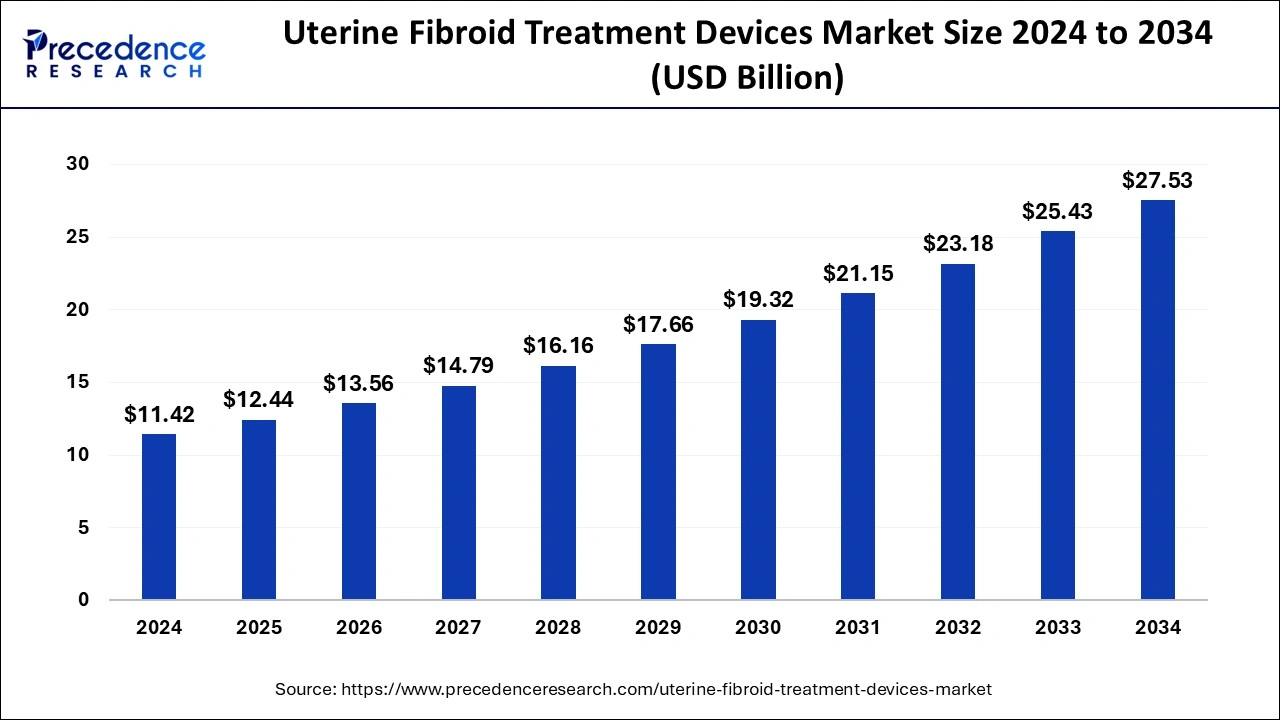

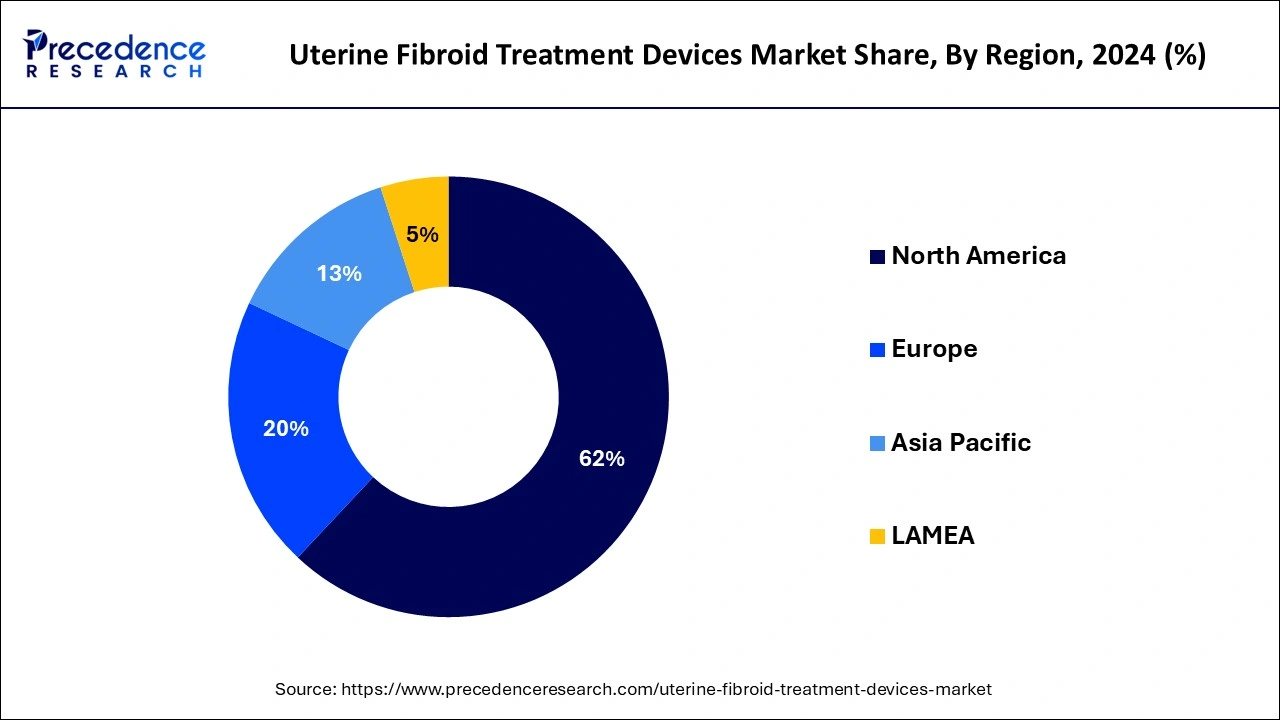

The global uterine fibroid treatment devices market size is calculated at USD 12.44 billion in 2025 and is forecasted to reach around USD 27.53 billion by 2034, accelerating at a CAGR of 9.20% from 2025 to 2034. The North America uterine fibroid treatment devices market size surpassed USD 7.08 billion in 2024 and is expanding at a CAGR of 9.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global uterine fibroid treatment devices market was estimated at USD 11.42 billion in 2024 and is predicted to increase from USD 12.44 billion in 2025 to approximately USD 27.53 billion by 2034, expanding at a CAGR of 9.20% from 2025 to 2034. The uterine fibroid treatment devices market is driven by the growing desire for less invasive medical procedures.

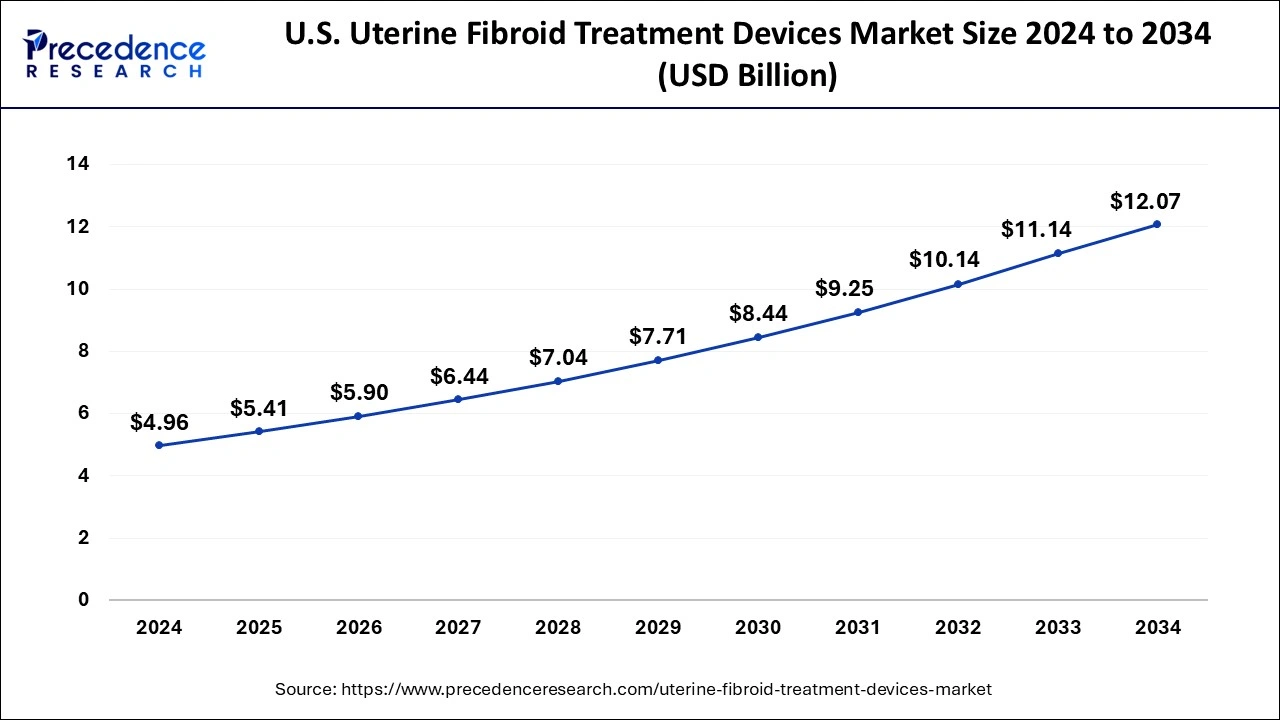

The U.S. uterine fibroid treatment devices market size was estimated at USD 4.96 billion in 2024 and is anticipated to reach around USD 12.07 billion by 2034, growing at a CAGR of 9.30% from 2025 to 2034.

North America held the largest market share of 62% in 2024 in the uterine fibroid treatment devices market. North America has a highly developed healthcare infrastructure including access to state-of-the-art technologies, well-established medical facilities, and research institutions. This may result in the widespread and early adoption of novel uterine fibroid treatment technologies. The regulatory landscape is frequently seen as transparent but strict. Investing extensively in research and development and enabling quicker approval processes for innovative uterine fibroid treatment devices can boost confidence in patients and healthcare professionals. This dedication to innovation may lead to developing cutting-edge and successful uterine fibroids treatment tools.

Asia-Pacific is observed to expand at a CAGR of 10.8% during the forecast period. The demand for treatment alternatives is rising as uterine fibroids are becoming more common in the Asia-Pacific area. The need for treatment devices may increase due to increased knowledge about uterine fibroids and improvements in diagnostic methods that lead to the identification of more cases. Initiatives and policies by governments in the Asia-Pacific area that support healthcare could favor growth.

Non-cancerous growths called uterine fibroids form in the uterus's muscular wall. The uterine fibroid treatment devices market offers devices for treating uterine fibroids are utilized in a range of non-invasive and minimally invasive methods to manage these symptoms while maintaining uterine integrity. Typical device types include embolization devices, which stop blood flow to fibroids and cause them to shrink; myomectomy devices, which remove fibroids surgically; and ablation devices, which destroy fibroids using heat, radiofrequency radiation, or ultrasound.

Organon is a pharmaceutical business that focuses on women's health and has been trying to reinvent hysterectomy. The goal of Claria Medical is to produce a medical device that will enable the removal of the uterus to be completed more quickly and safely than with existing operations by using a minimally invasive laparoscopic technique. Organon brought Claria and its hardware entirely in January 2023 for an upfront $8 million expenditure from its R&D budget. The National Science Foundation and the National Institutes of Health have already awarded grants to Claria, a pre-series A business based in the San Francisco area.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.20% |

| Market Size in 2025 | USD 12.44 Billion |

| Market Size by 2034 | USD 27.53 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology and By Mode of Treatment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing awareness of symptoms and potential complications

There is a growing need for efficient and minimally invasive treatment alternatives as more women become aware of the symptoms and dangers of uterine fibroids. Because of increased early detection rates brought about by this understanding, there is a growing need for sophisticated medical devices that can offer focused and effective management strategies for uterine fibroids. As a result, the uterine fibroid treatment devices market for devices used to treat uterine fibroids is growing as patients and healthcare professionals look for cutting-edge solutions to this prevalent gynecological ailment.

Shift towards minimally invasive and non-invasive procedures

Incisions made during minimally invasive operations are usually smaller or nonexistent, which lowers the risk of bleeding, infection, and other problems that come with more standard surgical methods. Because they believe that less intrusive treatments will result in a quicker recovery, less scarring, and a lower risk of problems, patients frequently favor them. Minimally invasive methods cause less damage to the surrounding tissues, which lessens postoperative pain and suffering. Because focused ultrasound doesn't involve physical penetration, it further reduces discomfort compared to invasive procedures.

Obtaining regulatory approval is a complex and lengthy process

Medical devices must receive regulatory approval before being marketed and utilized for patient care to guarantee their efficacy and safety. The regulatory process frequently entails stringent testing, clinical studies, and documentation regarding products used to treat uterine fibroids, like minimally invasive surgical instruments or novel therapeutic technologies.

Regulatory bodies like the European Medicines Agency (EMA) in Europe or the food and drug administration (FDA) in the United States often receive extensive data on device performance, safety profiles, and clinical results. These regulatory agencies review the provided data to determine whether the device satisfies safety requirements and helps treat uterine fibroids.

Increasing awareness of treatment options

As awareness increases, more people learn about the range of available uterine fibroid therapies, which boosts the market’s growth. In addition to helping patients look for workable answers, this increased knowledge opens doors for medical professionals and device makers to satisfy the growing need for cutting-edge and varied treatment alternatives. Ultimately, greater awareness promotes technical developments and enhances patient results while aiding the general expansion and growth of the uterine fibroid treatment devices market.

Medtronic

A multinational leader in medical technology, Medtronic designs and produces a range of medical tools and treatments. In the meantime, Medtronic works in many medical specialties, such as neurology, diabetes, cardiology, and more. Medtronic has shown interest in creating products or programs about treating uterine fibroids and medical equipment and technologies for women's health.

The surgical techniques segment held the largest market share of 34% in 2024 in the uterine fibroid treatment devices market during the forecast period. Uterine fibroids can frequently be removed or reduced with great effectiveness by surgical treatments, including myomectomy and hysterectomy. These processes offer a thorough and long-lasting remedy by going straight after the illness's underlying cause. Most surgeons are very skilled and experienced in performing uterine fibroid procedures. Their inclination for these operations is influenced by their experience with surgical techniques, which raises the adoption rate.

The ablation techniques segment is observed to grow at a CAGR of 10.4% in the uterine fibroid treatment devices market during the forecast period. Ablation procedures include using radiofrequency, microwave, or laser energy, among other approaches, to remove or destroy uterine fibroids. Compared to typical surgical operations, this strategy has various advantages, such as less intrusive procedures, shorter recovery times, and decreased risk.

Ablation procedures are becoming increasingly popular among patients since they frequently lead to reduced length of stay in the hospital, decreased pain following surgery, and a quicker return to regular activities. Furthermore, technological developments have produced ablation devices that are more accurate and effective, improving the treatment's total effectiveness.

The invasive treatment segment held the largest market share of 46% in 2024 in the uterine fibroid treatment devices market. More efficacy is frequently seen in invasive fibroid excision or symptom reduction therapies. Myomectomy and hysterectomy are two surgical procedures that directly address the existence of fibroids and can lead to a more thorough cure of symptoms. Because they address the underlying causes of uterine fibroids, invasive treatments frequently offer complete cures. Fibroids can be reduced or removed using surgical and minimally invasive methods, giving patients long-term symptom relief.

The non-invasive treatment segment is observed to grow at a significant pace during the forecast period. In contrast to typical surgical procedures, non-invasive treatments minimize risks, shorten recovery times, and improve patient satisfaction overall. Because they may target and eliminate uterine fibroids without requiring incisions or anesthesia, technologies, including magnetic resonance-guided focused ultrasound (MRgFUS), radiofrequency ablation, and focused ultrasound, have become increasingly popular. Reduced side effects, a desire for a quicker recovery, and an increasing need for minimally invasive procedures are the main drivers of this growing need for non-invasive solutions.

By Technology

By Mode of Treatment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

May 2024

February 2025