January 2025

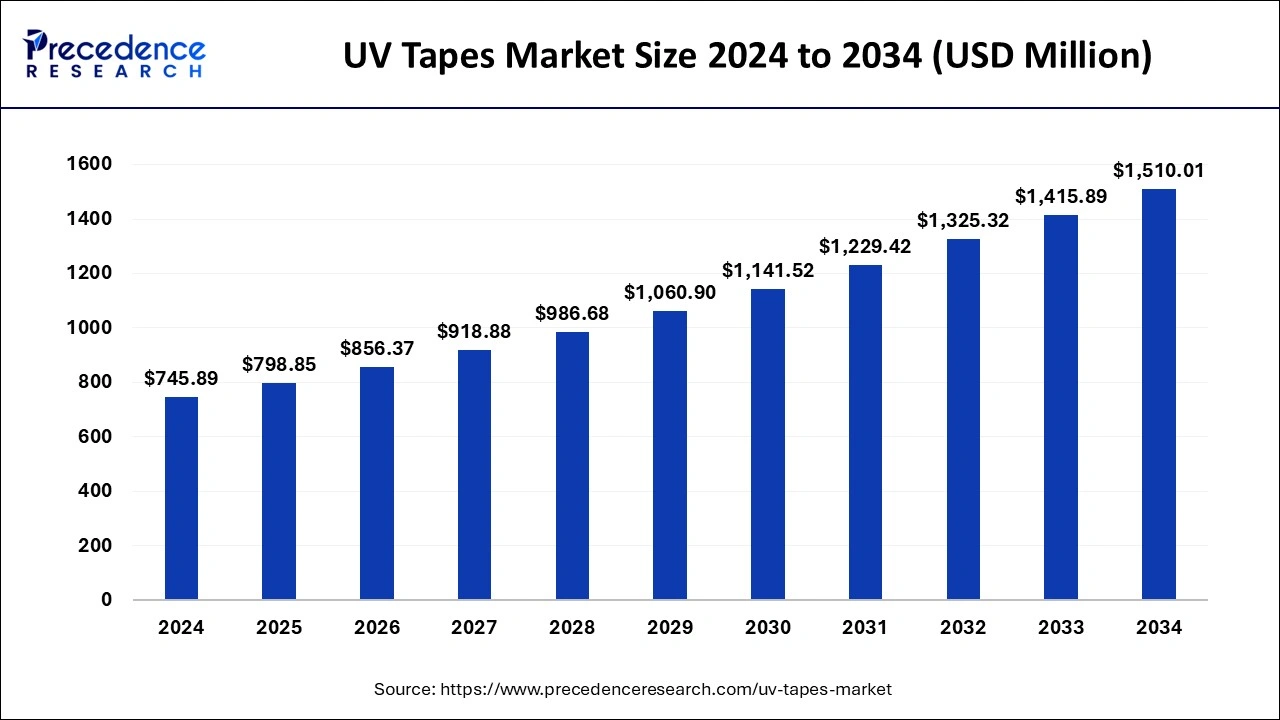

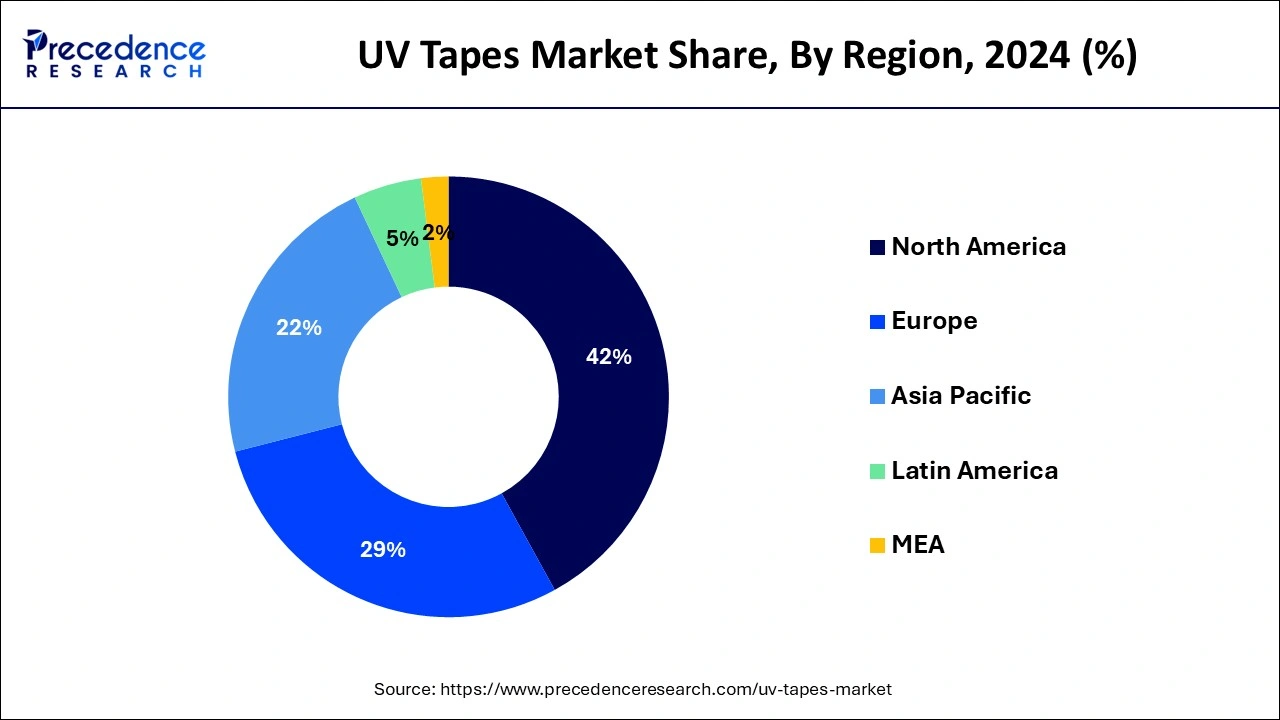

The global UV tapes market size is accounted at USD 798.85 million in 2025 and is forecasted to hit around USD 1,510.01 million by 2034, representing a CAGR of 7.31% from 2025 to 2034. The North America market size was estimated at USD 313.27 million in 2024 and is expanding at a CAGR of 7.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global UV tapes market size was calculated at USD 745.89 million in 2024 and is predicted to increase from USD 798.85 million in 2025 to approximately USD 1,510.01 million by 2034, expanding at a CAGR of 7.31% from 2025 to 2034.

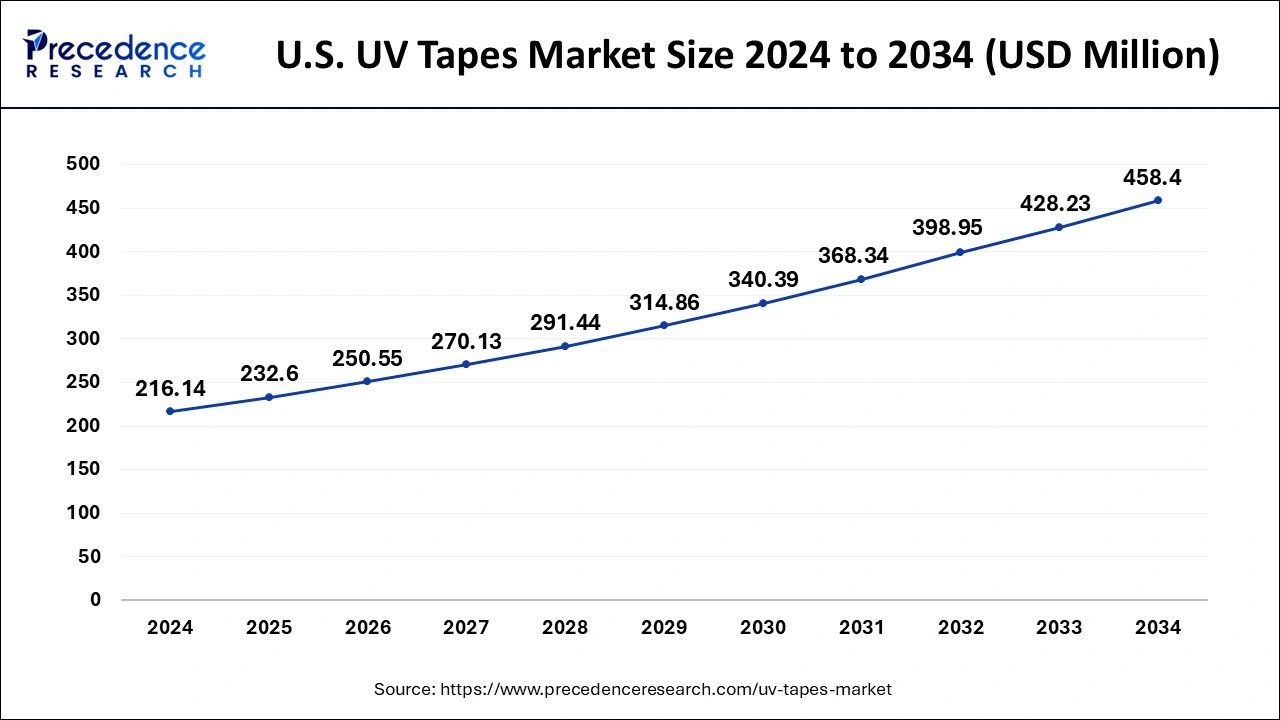

The U.S. UV tapes market size was exhibited at USD 216.14 million in 2024 and is projected to be worth around USD 458.40 million by 2034, growing at a CAGR of 7.81% from 2025 to 2034.

North America has held the largest revenue share of 41.12% in 2024. In North America, the UV tapes market witnesses a robust demand driven by technological advancements and the presence of a thriving electronics sector. The region's strong emphasis on innovation and adoption of cutting-edge technologies in industries like semiconductor manufacturing and electronics assembly contributes to the growing utilization of UV tapes. Additionally, stringent quality standards and regulatory compliance further fuel the demand for UV tapes in North America.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the UV tapes market experiences dynamic growth attributed to the flourishing electronics manufacturing industry. Countries like China, Japan, and South Korea are prominent contributors to the market, hosting major electronics manufacturing hubs. The increasing demand for consumer electronics, smartphones, and automotive electronics in this region significantly boosts the adoption of UV tapes, as they play a crucial role in ensuring precise and efficient assembly processes.

In Europe, the UV tapes market showcases steady growth driven by advancements in manufacturing technologies and a strong focus on sustainability. The region's well-established electronics and automotive industries leverage UV tapes for applications that demand precision and reliability. Additionally, the European market benefits from a growing awareness of environmental concerns, leading to an increased preference for UV-curable tapes, which are known for their eco-friendly properties and ability to enhance manufacturing efficiency while minimizing environmental impact.

The UV tapes market is witnessing growth due to the rising demand for compact electronic devices and advancements in semiconductor manufacturing. UV tapes provide essential functionality in protecting delicate electronic components during fabrication, contributing to the overall efficiency and reliability of semiconductor production processes.

Their UV curing property enhances operational speed and accuracy in manufacturing, further fueling their adoption in the industry. The market is characterized by ongoing technological developments and collaborations to meet the evolving needs of the electronics sector. The UV tapes market is driven by increased demand for miniaturized electronics, especially in sectors like smartphones and wearables. Continuous innovation and collaborative efforts among industry players contribute to market dynamism.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.31% |

| Market Size in 2025 | USD 798.85 Million |

| Market Size by 2034 | USD 1,510.01 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Precision in manufacturing and miniaturization demand

The increasing demand for precision in manufacturing processes, especially in the electronics industry, is a key factor driving the UV tapes market. UV tapes play a crucial role in precision bonding and protecting delicate electronic components during manufacturing. The miniaturization trend in electronics, with the development of smaller and more complex devices, necessitates highly precise manufacturing techniques. UV tapes offer a solution by providing a reliable method for temporary bonding and securing components in intricate assemblies.

Moreover, as industries embrace advancements like flexible and organic electronics, the demand for UV tapes intensifies. These tapes enable the manufacturing of flexible electronic components and facilitate the assembly of devices with unconventional shapes. The ability of UV tapes to accommodate miniaturization requirements while ensuring precision in manufacturing processes positions them as essential components in various industries, including electronics, semiconductors, and medical devices, driving their continued market demand.

Limited temperature resistance and availability of alternatives

Limited temperature resistance poses a significant constraint on the demand for UV tapes, restricting their applicability in high-temperature environments. UV tapes may lose adhesion or encounter degradation when exposed to elevated temperatures, limiting their use in applications that involve heat-intensive processes. Industries requiring materials with exceptional resistance to heat, such as automotive and aerospace, might seek alternative solutions that can withstand extreme temperature conditions, thereby impacting the widespread adoption of UV tapes.

Moreover, Cost constraints act as a restraint in the UV tapes market as UV-curable tapes, while highly effective, may be perceived as relatively more expensive than conventional tapes. Some end-users may prioritize cost considerations over the unique benefits of UV-curable tapes, impacting the adoption rate. Overcoming cost constraints through strategic pricing or emphasizing long-term benefits is crucial to fostering wider market acceptance.

Furthermore, the availability of alternatives in the adhesive tapes market can act as a restraint. Industries have a range of adhesive tapes to choose from, including acrylic, silicone, and rubber-based tapes, which may offer better temperature resistance or specific properties suited to their applications. This availability of substitutes can divert demand away from UV tapes, especially in cases where alternative tapes better meet the specific requirements of a particular industry or application. Investments in research and development play a pivotal role in driving the market demand for UV tapes.

Continuous R&D efforts lead to the development of innovative products with enhanced features and applications, meeting the evolving needs of industries such as electronics and manufacturing. This fosters a competitive edge, attracting businesses seeking cutting-edge UV tape solutions and contributing to the overall growth of the UV tapes market.

Expanding electronics industry and rising demand for UV-curable tapes

The UV tapes market experiences a surge in demand propelled by the expanding electronics industry. As electronic devices become more integral to daily life, manufacturers increasingly rely on UV tapes for applications like semiconductor manufacturing and printed circuit board (PCB) assembly. UV tapes offer precise adhesion during intricate electronic assembly processes, ensuring efficient manufacturing and high-performance electronic components. The growth of the electronics industry, driven by advancements in smart devices, IoT, and telecommunications, contributes significantly to the increasing demand for UV tapes.

Furthermore, the rising demand for UV-curable tapes represents a notable trend in the market. UV-curable tapes provide rapid curing through exposure to ultraviolet (UV) light, allowing for faster processing times in manufacturing. Industries seeking enhanced efficiency and productivity, such as automotive, medical devices, and packaging, are increasingly adopting UV-curable tapes. This trend is fueled by the desire for quick and reliable bonding solutions, contributing to the overall expansion of the UV tapes market.

The UV tapes market experiences heightened demand due to cross-industry adoption, with various sectors leveraging UV-curable tapes for their unique properties. Industries such as electronics, automotive, and construction recognize the benefits of UV tapes in providing secure and clean bonding solutions. This cross-industry adoption underscores the versatility and effectiveness of UV tapes across diverse applications, contributing to increased market demand.

Based on the product type, the Polyethylene Terephthalate (PET) based UV tape segment held the largest market share of 48% in 2024. Polyethylene terephthalate (PET) based UV tape is a type of UV tape composed of PET material, known for its high strength and excellent chemical resistance. The PET-based variant exhibits growing popularity in the UV tapes market due to its versatility and suitability for various applications, particularly in the electronics and automotive sectors. This UV tape type provides reliable adhesion and protection, enhancing the efficiency of assembly processes in industries requiring precise bonding.

On the other hand, the Polyvinyl Chloride (PVC) based UV tape segment is projected to grow at the fastest rate over the projected period. Polyvinyl chloride (PVC) based UV tape is another significant product type in the UV tapes market. PVC-based UV tapes are recognized for their flexibility and durability, making them well-suited for applications where conformability is crucial, such as in automotive manufacturing and cable harnessing. The PVC-based UV tape segment experiences trends emphasizing customization and improved UV resistance, addressing specific industry needs. These trends contribute to the market's diverse applications and continued growth of PVC-based UV tapes.

Based on the application, the electronics & semiconductors segment held the largest market share of 34% in 2024. In the field of electronics & semiconductors, UV tapes play a crucial role in semiconductor manufacturing and PCB assembly. These tapes offer precise adhesion and protection during intricate electronic assembly processes. As the demand for advanced electronic devices continues to rise, the UV tapes market is witnessing a trend towards higher precision and efficiency in semiconductor production, supporting the evolving needs of the electronics industry.

On the other hand, the Polyvinyl Chloride (PVC) based UV tape segment is projected to grow at the fastest rate over the projected period. In the Automotive sector, UV tapes find application in bonding, sealing, and protection of various components. As the automotive industry emphasizes lightweight materials and advanced manufacturing processes, UV-curable tapes are gaining traction due to their rapid curing capabilities. This trend reflects a broader shift towards efficient bonding solutions in automotive manufacturing, addressing the industry's demand for speed, reliability, and improved performance in assembly processes.

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025

February 2025