August 2024

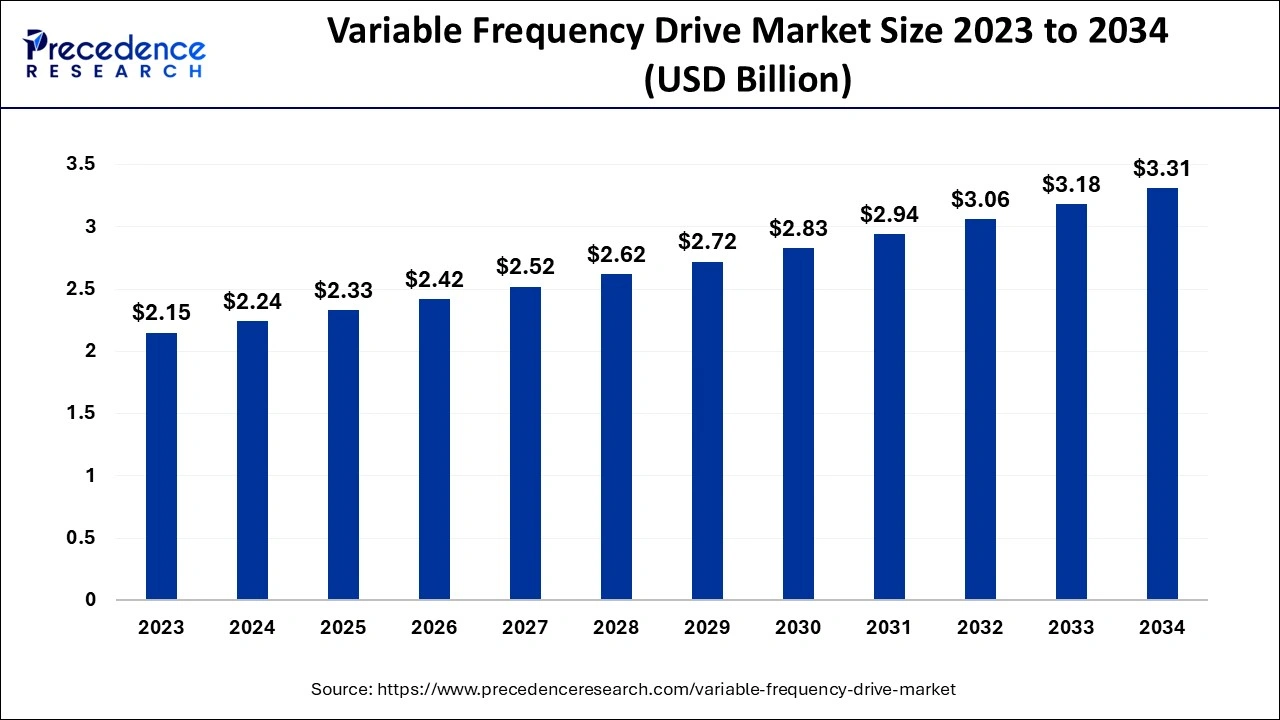

The global variable frequency drive market size accounted for USD 2.24 billion in 2024, grew to USD 2.33 billion in 2025 and is predicted to surpass around USD 3.31 billion by 2034, representing a healthy CAGR of 4% between 2024 and 2034.

The global variable frequency drive market size is accounted for USD 2.24 billion in 2024 and is anticipated to reach around USD 3.31 billion by 2034, growing at a CAGR of 4% from 2024 to 2034.

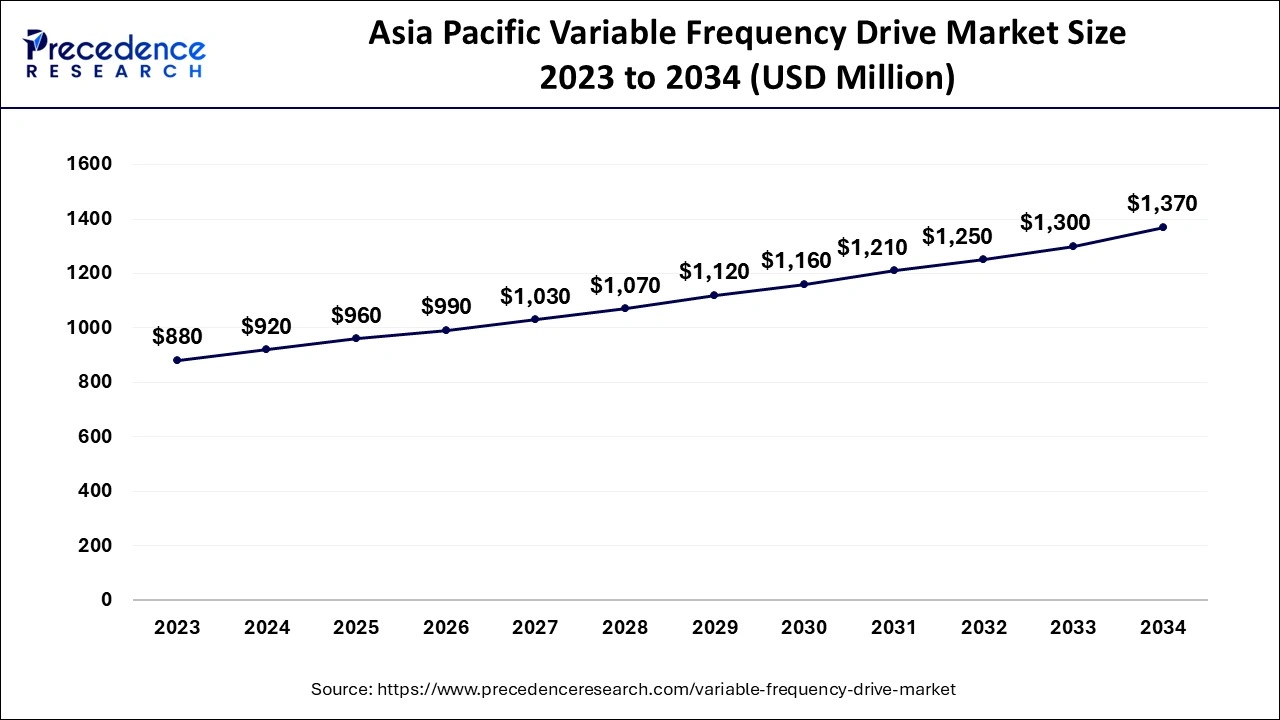

The Asia Pacific variable frequency drive market size is evaluated at USD 920 million in 2024 and is predicted to be worth around USD 1370 million by 2034, rising at a CAGR of 4.11% from 2024 to 2034.

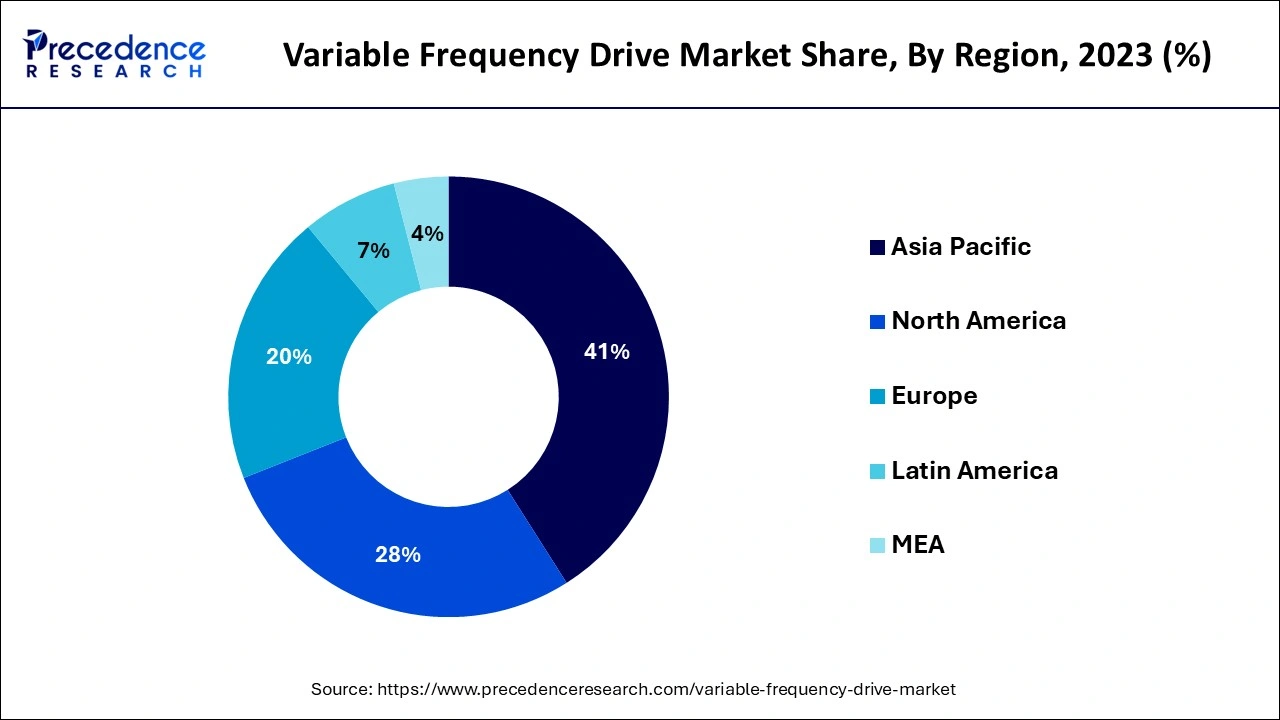

The Asia Pacific region accounted largest revenue share in 2023. Rapid industrialization in developing nations, market liberalization, and increased building activity are all projected to boost regional market expansion. Similarly, increased energy demand is likely to promote energy companies' adoption of VFD, which will help regional growth. Furthermore, the presence of water treatment, large automotive and food & beverage producers operational in the countries such as India, China, and Japan are likely to boost supply for VFD to increase working efficiency and minimize power usage.

Latin America is predicted to grow at a notable CAGR over the projection period, primarily to privatization and urbanization in countries such as Brazil & Mexico. Similarly, growth of the market from end-use industries such as cement, chemicals, and pulp is likely to fuel VFD market expansion in this area.

Due to ever increasing penetration of connected devices across the various sectors including residential sectors, commercial and industrial sectors, demand for variable frequency drive (VFD) is consistently growing. Variable frequency drive comes with numerous benefits; such as dynamic torque control, adjustable speed and energy-saving. These factors are crucial for power generation, auto motive as well as oil and gas industry. These elements are expected to impact the market in positive manner.

Furthermore, another considerable factor for market is growth in investment percentage for infrastructure development. Since investments are pouring in, demand for HVAC systems is as high as never before. HVAC systems are used to energy efficiency of buildings, due to which expected power savings are achieved. Hence, these demands for the systems are also to drive the market further. Throughout world industrialization is making its way faster than ever before. Specially, in developing countries rapid industrialization is underway which ultimately results in growth of industrial and manufacturing sectors, which further are propelling the demand for variable frequency drive.

Similarly, the power generation sector is widely adopting variable frequency drive at large scale these days as they are using it to operate large motors and continuously make the speed fluctuations as required by the process. Variable frequency drive is not limited to power generation sector only. More industries are adapting to the market trend. To name a few oil and gas, metal and mining and food processing industries are on top for now.

Climate change and Carbon emission are the biggest threat for planet’s environment and biodiversity. To preserve the planet’s depleting biodiversity and lower the carbon emission, governments across the globe are implementing stringent rules and regulations. Due to which there is significant rise in demand for products to assist energy saving to further achieve energy efficiency. Owing to favorable rules and policies are projected to boost market expansion, as it is one of the prime reasons of industrial investment in energy conservation globally. This is especially true of policies enacted by major industrial manufacturers such as India, China, Europe and the United States. For example, the Ecodesign Regulation (EU) 2019/1781 went into force in October 2019, with the first stage taking effect in July 2021 and the second one in July 2023. The first part of the legislation addressed the IE2 efficiency class, which is required for AC drives.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.24 Billion |

| Market Size by 2034 | USD 3.31 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.0% |

| Asia Pacific Market Share in 2023 | 46% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Power Range, Voltage Type, Application, End User, Geography |

In 2023, the AC drives segment accounted largest market share. This rise can be attributed to the advantages of AC drives, such as their high power, ease of application compared to others, and low maintenance. These advantages are enticing end-users in industries such as automotive, power generation and food and beverage, to improve operational efficiency. As a consequence of the significant increase in the industrial sector, there is a strong demand for AC drives, which is expected to boost segment growth.

The DC drive sector is fastest growing segment during forecast period. Because DC technology is more expensive to maintain than AC technology, its usage in industry is limited. Furthermore, DC technology is not deemed energy-efficient and cannot work in critical settings; these issues are expected to stall market expansion.

The low power range segment led the global market in 2023. Low voltage frequency drives are used in end-use industries to power equipment such as centrifugal pumps, belt conveyors, pumps, fans and centrifugal compressors. Manufacturers are making significant investments in the development of slightly elevated, compact-size, relatively low voltage drives. As a result, broad use of low voltage frequency drive technology in industrial verticals, as well as increased investment in R&D activities, are likely to assist the sector dominate market expansion.

The medium power range frequency drive segment is expected to witness fastest growth during projected timeframe. Medium (41-200 kW) power range frequency drive gives benefits such as better operating flexibility and greater control, which is one of the main reasons its popularity is rising in many sectors such as wastewater plants, petrochemical, mining, and so on. Furthermore, strong demand from the petrochemical industry is likely to fuel segment expansion.

In 2023, the pumps section contributed largest share in overall market. Pumps are frequently employed in the treatment of water, metal, and petroleum industry. These pumps are equipped with adjustable speed drives, which assist them, minimise energy usage, lower the cost of pump operation, and run at varied velocities without the use of a gearbox. Thus, the stated effect of implementing VFD to pump are leading in growing demands for variable frequency drive from the water treatment plant market, oil & gas, and other industries for overloading the flow rate and improving efficiency, which is likely to boost the expected segment's growth.

The HVAC segment is estimated to witness remarkable grow over the forecast period. The increasing expansion of residential and commercial development activity is expected to enhance consumption for HVAC systems. Connecting a VFD to an HVAC system ensures greater efficiency by managing the speed of blower fans, pumps, or compressors.

By Product

By Power Range

By Voltage Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024