January 2025

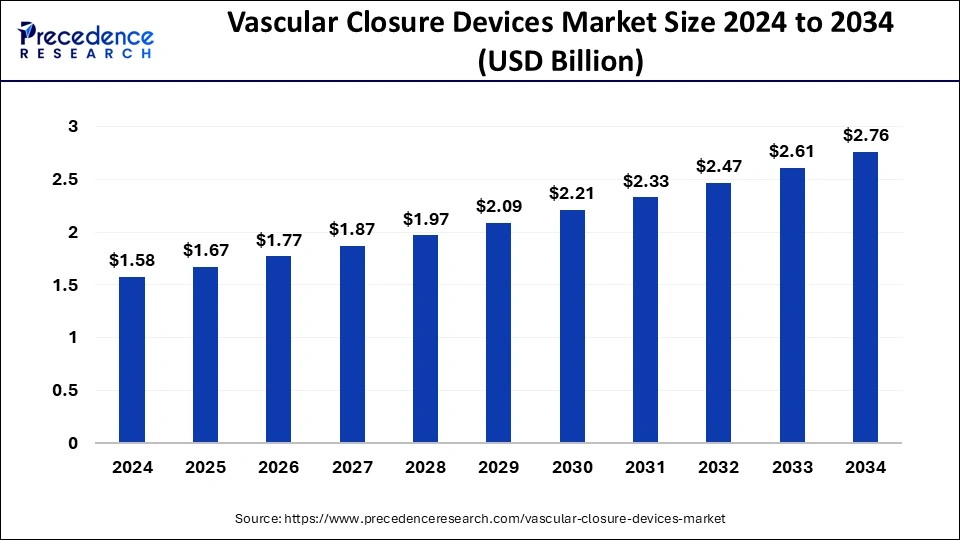

The global vascular closure devices market size accounted for USD 1.67 billion in 2025 and is forecasted to hit around USD 2.76 billion by 2034, representing a CAGR of 5.73% from 2025 to 2034. The North America market size was estimated at USD 710 million in 2024 and is expanding at a CAGR of 5.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vascular closure devices market size was calculated at USD 1.58 billion in 2024 and is predicted to increase from USD 1.67 billion in 2025 to approximately USD 2.76 billion by 2034, expanding at a CAGR of 5.73% from 2025 to 2034.

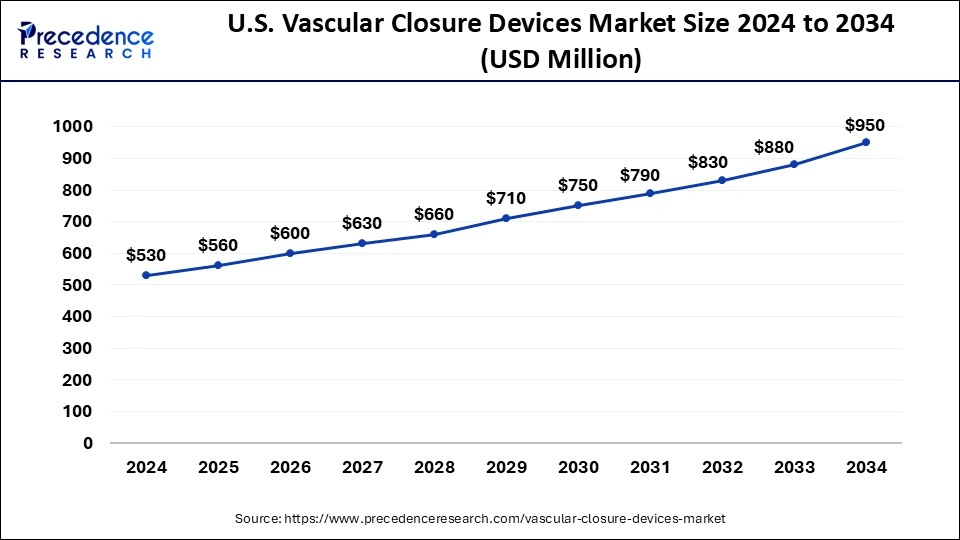

The U.S. vascular closure devices market size was exhibited at USD 530 million in 2024 and is projected to be worth around USD 950 million by 2034, growing at a CAGR of 6.01%.

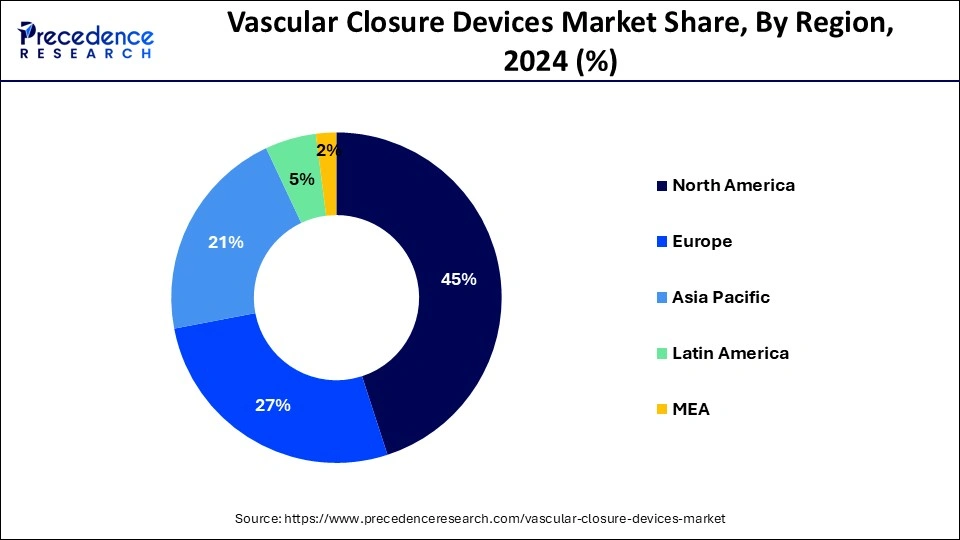

North America led the global market with the highest market share of 45% in 2024. The region's market is expanding due to the nation's well-established healthcare system, rising rates of cardiovascular disease, a surge in operations involving catheterization, and a growing need for less invasive treatments. Heart disease is the greatest cause of mortality in the United States, according to an article published in February 2022 by the Centers for Disease Control and Prevention (CDC) titled "Heart Diseases Facts." Additionally, it stated that heart disease claimed the lives of around 659,000 Americans annually. Vascular closure devices are required due to the high illness pressure, which propels the market's expansion in the area.

Moreover, regulatory agencies like Health Canada and the US Food and Drug Administration provide clearance for such devices, which accelerates the expansion for vascular closure devices market. To establish hemostasis of the brachial artery following a transbronchial endovascular treatment, EnsiteVascular, for instance, acquired its second FDA market clearance in April 2021 for their SiteSeal SV (small vessel) VCD compression device. The novel closure device SiteSeal SV is intended for the closure of brachial, radial, and pedal small arteries. It mimics external compression, but it eliminates all related variables, leaving nothing in their place. Thus, this is expected to drive the growth of vascular closure devices market in the region.

Asia Pacific is observed to witness the expansion at the fastest rate during the forecast period in the vascular closure devices market. Countries in Asia Pacific are investing in their healthcare infrastructure, expanding access to advanced medical technologies and procedures, including cardiac interventions that require vascular closure devices. Cardiovascular diseases, including coronary artery disease and peripheral vascular diseases, are on the rise in Asia Pacific due to changing lifestyles, unhealthy dietary habits, and increasing prevalence of risk factors such as obesity and diabetes. Economic growth in countries like China, India, and Southeast Asian nations has led to increased healthcare spending and improved access to healthcare services, driving the demand for vascular closure devices in these emerging markets.

The vascular closure devices market revolves around the offering of medical devices designed to achieve hemostasis, which is the cessation of bleeding, after a catheterization procedure or other vascular interventions. These devices are used to seal the puncture site in the blood vessel through which a catheter was inserted, reducing the risk of bleeding and complications. Catheterization procedures, such as angiography or angioplasty, involve the insertion of a catheter through the skin and into a blood vessel to access the cardiovascular system.

After the procedure is complete, it is crucial to close the puncture site to prevent bleeding and minimize the recovery time for the patient. Vascular closure devices come in various types, including mechanical devices, plug-based devices, and suture-based devices. They are designed to provide a quick and efficient way to achieve hemostasis, reducing the need for prolonged manual compression or other traditional closure methods.

The selection of a specific vascular closure device depends on factors such as the size of the access site, the type of procedure performed, and the patient's overall health. These devices play a significant role in improving patient comfort, reducing complications, and expediting the recovery process following vascular interventions.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.73% |

| Market Size in 2025 | USD 1.67 Billion |

| Market Size by 2034 | USD 2.76 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Access, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of cardiovascular disease

The increasing prevalence of cardiovascular disease across the globe is expected to propel the vascular closure devices market growth over the projected period. For instance, according to the World Health Organization:

The increasing cost of VCDs

It is estimated that currently, vascular closure devices (VCDs) are used in about 20–25% of catheter-based operations performed worldwide to achieve access site hemostasis. The main factors impeding the market's growth are the increase in radial access interventional procedures, the skyrocketing expense of vascular closure devices, and the risks associated with these devices. The need for highly qualified individuals is impeding the vascular closure devices market’s expansion. Vascular closure devices are not used in a great number of catheter-based procedures due to a lack of operator expertise, complexity risks, and expense. One device is permitted for arteriotomies up to 21F, but the majority of vascular closure devices are only authorized for those between 5 and 8F. The two main complications are limb ischemia and inclusive infection. Thus, these problems are impeding the market's growth for vascular closure devices.

Growing product approvals

Over the anticipated period, the vascular closure devices market is anticipated to benefit greatly from the increasing number of product approvals. For example, in September 2023, Boston Scientific Corporation declared that the US Food and Drug Administration had authorised the latest model, the WATCHMAN FLXTM Pro Left Atrial Appendage Closure (LAAC) Device. The gadget now features a polymer coating, wider size matrix, and visualisation markers to treat a greater number of patients. WATCHMAN technology, which is suggested to lower stroke risk in patients with non-valvular atrial fibrillation (NVAF) who need an alternative to oral anticoagulation medication, is expected to be further improved by this development in procedure performance and safety.

The active vascular closure devices segment in 2024, held the largest share of the vascular closure devices market due to their high efficiency. In addition, active vascular closure devices provide faster hemostasis compared to traditional manual compression methods. This can lead to quicker recovery times for patients. Moreover, VCDs are particularly well-suited for minimally invasive procedures, where achieving quick and efficient hemostasis is crucial.

The passive vascular closure devices segment is expected to grow at a substantial rate over the forecast period because it offers vascular access site hemostasis that is reliable as well as fast. Passive closure devices offer enhanced patient comfort compared to active closure devices, as they do not require the application of external pressure or manual compression. This can lead to improved patient satisfaction and compliance with post-procedural care instructions.

The femoral segment dominated the vascular closure devices market in 2024. Vascular access for coronary angiography and other interventional treatments is increasingly being provided via the femoral method. Because femoral arteries allow for larger catheters and are less likely to spasm than radial arteries, this sector is expected to increase significantly. Additionally, the ability to expand segments is improved by the creation of certain devices that offer femoral arterial access. Nevertheless, acceptability is somewhat limited by a few femoral access-site problems, including arteriovenous (AV) fistula, pseudoaneurysm, and arterial dissection. Consequently, the segment is predicted to increase well over the projection timeline given the general characteristics and high procedure volume.

Besides, the radial segment is expected to grow at a rapid rate during the forecast period owing to the rising technological advancements. Radial access procedures are often associated with shorter hospital stays and faster patient recovery times compared to femoral access. Vascular closure devices that enable efficient and reliable closure of radial artery puncture sites contribute to enhanced procedural outcomes and patient satisfaction, further driving adoption in clinical practice.

Manufacturers have made significant advancements in the design and performance of vascular closure devices tailored for radial access, including improved hemostasis, ease of use, and compatibility with different procedural techniques. These innovations address the unique anatomical and physiological characteristics of the radial artery, making radial access procedures more accessible and efficient for healthcare providers.

The ambulatory surgical centers segment held the largest Market share of 61% in 2024. The segment is observed to sustain the dominance over the forecast period. The number of interventional procedures performed in hospitals directly impacts the demand for vascular closure devices. Hospitals with high procedural volumes are likely to be key consumers of these devices. Additionally, hospitals may have specialized units or departments focused on cardiovascular interventions, such as interventional cardiology units. These units often drive the adoption of vascular closure devices. Furthermore, they prioritize patient safety and efficient recovery. VCDs play a significant role in achieving faster hemostasis, reducing complications, and facilitating early ambulation, contributing to overall patient care.

Besides, the hospital segment is expected to grow at a significant rate over the forecast period. ASCs perform a significant number of outpatient procedures, including various interventional and catheter-based treatments. The volume of these procedures contributes to the demand for vascular closure devices. ASCs emphasize efficient procedures and fast patient recovery. VCDs that facilitate quick hemostasis and allow for early ambulation aligns with the goals of ASCs in providing timely care. Thereby driving the segment expansion.

By Type

By Access

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

August 2024