January 2025

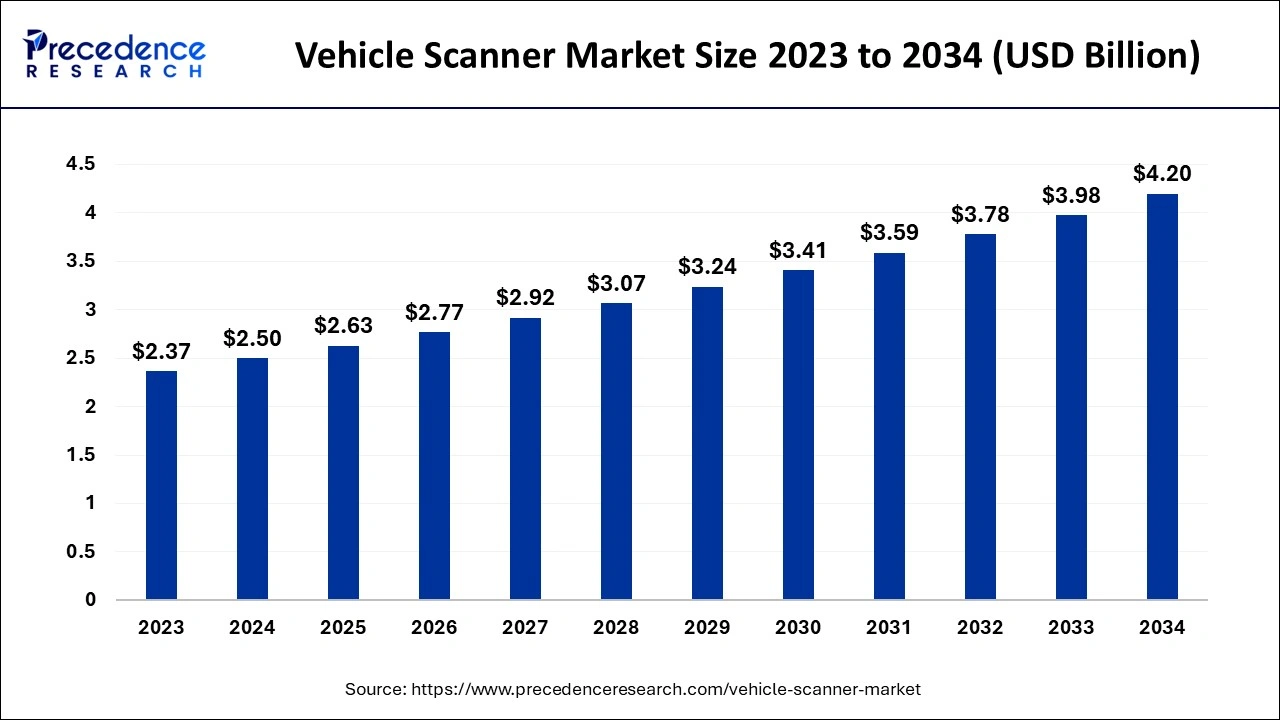

The global vehicle scanner market size accounted for USD 2.50 billion in 2024, grew to USD 2.63 billion in 2025 and is expected to be worth around USD 4.20 billion by 2034, registering a CAGR of 5.33% between 2024 and 2034. The North America vehicle scanner market size is calculated at USD 1.00 billion in 2024 and is expected to grow at a CAGR of 5.43% during the forecast year.

The global vehicle scanner market size is worth around USD 2.50 billion in 2024 and is anticipated to reach around USD 4.20 billion by 2034, growing at a CAGR of 5.33% from 2024 to 2034. The vehicle scanner market growth is attributed to the increasing need for enhanced security measures at critical infrastructure locations and over-border security.

Integration of artificial intelligence and machine learning in vehicle scanners enhances real-time threat detection and predictive capabilities, which is expected to improve system performance and reduce manual intervention. AI in the vehicle scanner market brings new steps, such as real-time data analysis, finding recurring patterns, and defining the maintenance schedule. These enhance the probability of perceiving threats and detecting concealed prohibited items or secretly smuggled articles better than before.

AI algorithms in the vehicle scanner market also help in traffic management since they enable organizations to enhance vehicles passing through checkpoints to minimize the time the inspectors take to inspect the pathway. Furthermore, the implementation of machine learning models enables tweaking of scanner systems that address the task by covering different settings, be it high-security zones or urban spaces.

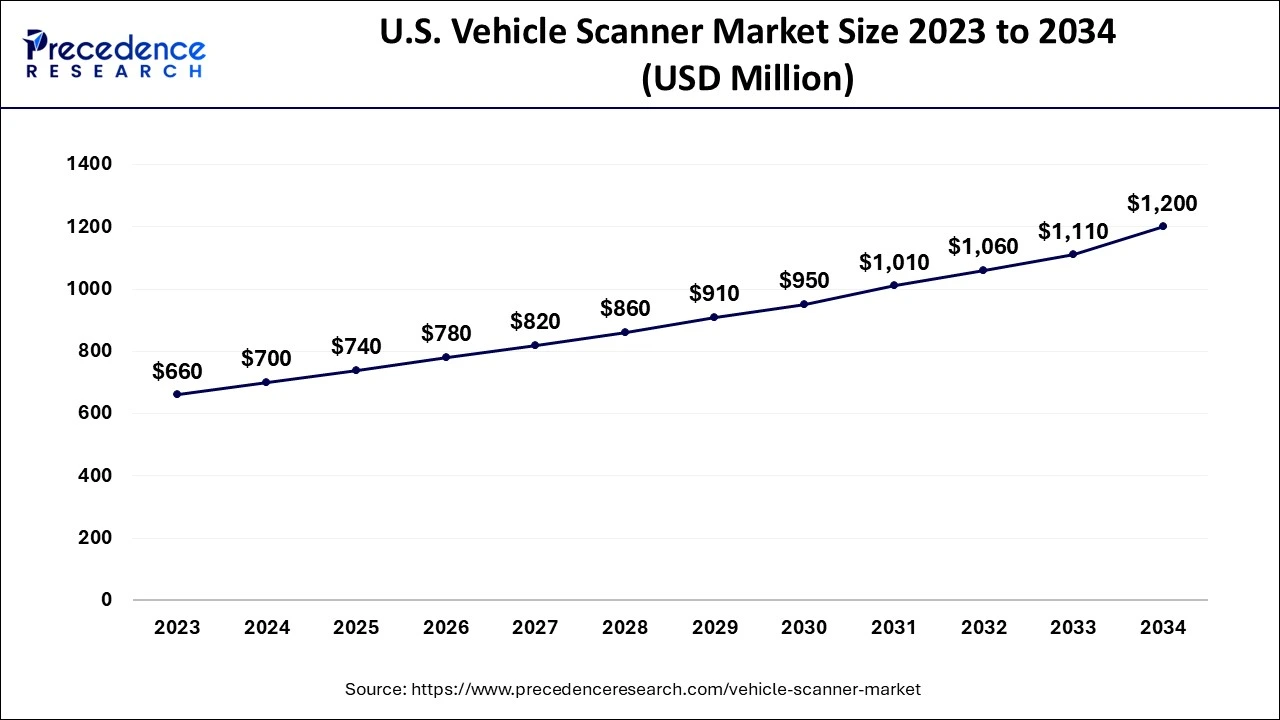

The U.S. vehicle scanner market size is exhibited at USD 700 million in 2024 and is expected to be worth around USD 1,200 million by 2034, growing at a CAGR of 5.59% from 2024 to 2034.

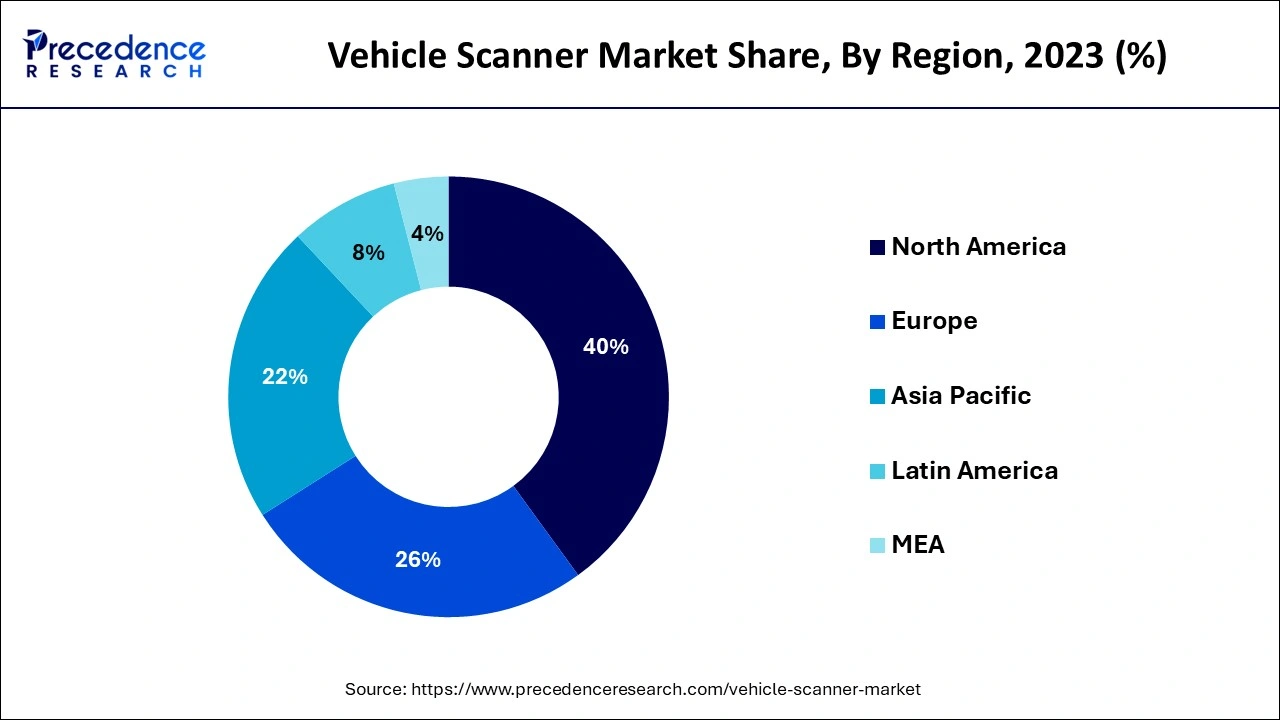

North America accounted for the largest share of the vehicle scanner market in 2023 due to the need to improve border protection, the fight against terrorism, and prevent illicit business, creating the need for vehicle inspection in the region. According to the survey done in 2023, customs and Border Protection CBP depended on vehicle scanners to check vehicles at different cross-border zones and points of entry to see whether they hide threats such as drugs, explosives, and weapons. Furthermore, countries such as the U.S. and Canada have focused more on investment in border security measures to enhance the security and efficiency of the inspection.

Asia Pacific is projected to host the fastest-growing vehicle scanner market in the coming years, owing to the growing security concerns and rapidly developing urbanization. The region is keen on countering terrorism, preventing smuggling, and protecting the infrastructure, which creates a higher demand for enhanced vehicle scan systems. India has embarked on a major investment spree to improve some of its border security reinforcements, such as the installation of vehicle scanning facilities at critical entry points. Furthermore, improving the security protocols of China’s customs and transportation infrastructure.

Vehicle scanning systems have gained acceptance worldwide due to the increasing requirement of identifying and combating risks like smuggling, terrorism, and unlawful transport. The technologies, including the non-intrusive imaging systems, offer high accuracy for threat detection while not affecting traffic patterns. Furthermore, countries such as India and the U.S. have also recently increased their spending on improving their sectors related to border security.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.20 Billion |

| Market Size in 2024 | USD 2.50 Billion |

| Market Size in 2025 | USD 2.63 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.33% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Structure Type, Component, Application, Technology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing need for enhanced security measures

Increasing concerns about public safety and national security are expected to drive the adoption of the vehicle scanner market globally. The importance of security and the instances of smuggling across borders have put pressure on governments to use better scanning technologies to detect vehicles. Governments use X-ray and gamma-ray imaging systems for checkpoints to detect concealed illegitimate items and Explosives without the congestion of vehicular traffic. Moreover, AI-integrated solutions have improved efficiency in terms of detection.

Vehicle scanning and border security (2023–2024)

| Metric | Value/Stat | Year |

| Drugs intercepted at U.S. borders | 500,000 pounds | 2023 |

| Number of vehicle scanners deployed in India for border security | 150 units | 2024 |

| Cross-border illegal activity incidents detected in the EU | Increased by 20% | 2023 |

| Contraband detected using gamma-ray scanners in the U.S. | 3,000+ incidents at seaports | 2023 |

| Investment in non-intrusive inspection systems (non-market values) | Prioritized in 2023-2024 border budgets | 2024 |

High initial investment costs

High upfront costs for installing advanced vehicle scanner systems are anticipated to restrain the vehicle scanner market adoption, especially in developing regions. These systems need a lot of funding for purchase, integration, and periodic service, which is often a shortfall for small checkpoints and poorly funded safety organizations. Combining functional X-ray and gamma-ray imaging systems is capital-intensive and invasive, and they have expensive hardware that requires highly trained staff to manage. This financial restraint prevents sizeable businesses from experimenting with the technology.

Growing emphasis on border security investments

Growing cross-border threats, including smuggling and terrorism, are projected to drive demand for vehicle scanning systems in border control applications. The focus on border security all over the world due to rising threat factors, including smuggling and terrorism, is a great marketing opportunity for vehicle scanning systems. Governments around the globe, including the United States and India, among others, are spending a lot of money in efforts to modernize their borders. India has also increased its border fencing security by implementing artificial intelligence-integrated, nonintrusive scanners. Furthermore, such growing investments in global security facilitate the market for advanced and reliable scanner technology.

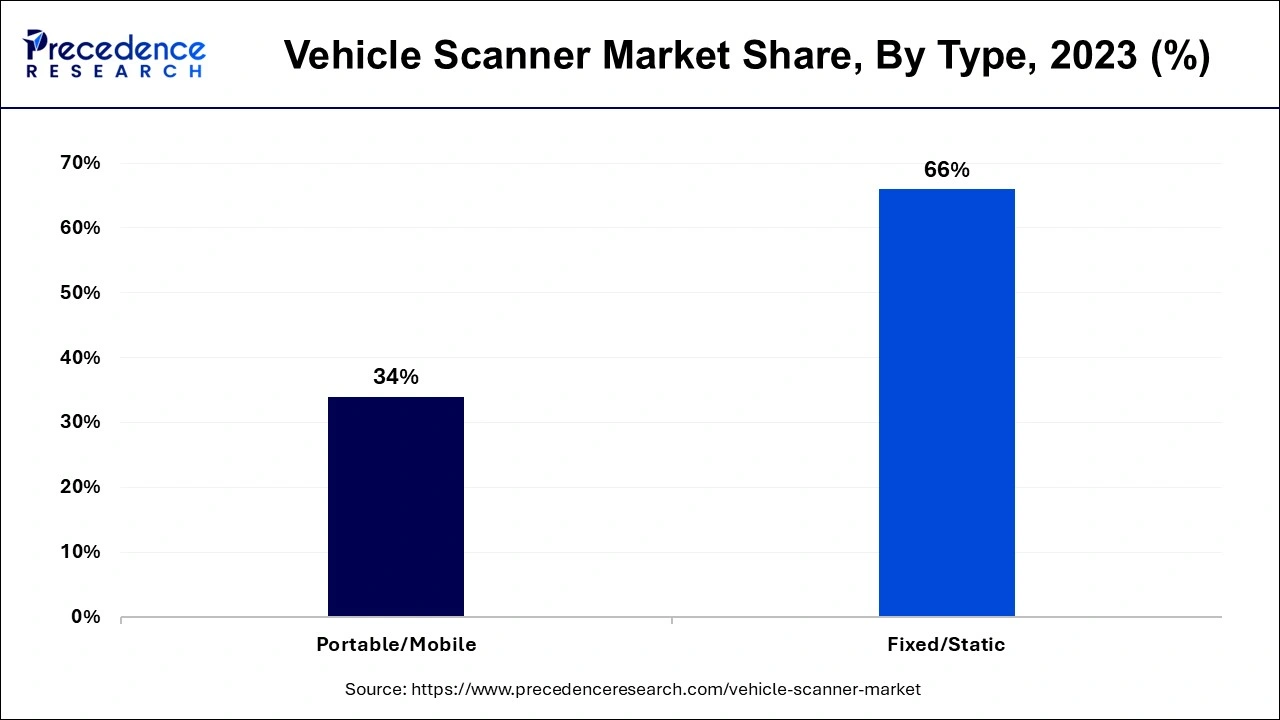

The fixed/static segment held a dominant presence in the vehicle scanner market in 2023, as they are commonly used in places that use biometrics, including immigration, government offices, seaports, and airports, amongst others. These systems provide a round-the-clock and high level of monitoring, which, when given to vehicle inspection, results in a comprehensive check-up without necessarily affecting traffic flow. The U.S. Department of Homeland Security disclosed a substantially large sum of money for improving fixed vehicle scanning technology at the entry and exit points to ease and speed up customs processes at the same time as the security systems improvement. Furthermore, fixed scanning technologies have been of interest in many countries, including the U.S., the United Kingdom, and India, as they support safe, reliable, and nonintrusive inspections.

The portable/mobile segment is expected to grow at the fastest rate in the vehicle scanner market during the forecast period of 2024 to 2034. These mobile systems are popular for temporary deployments, such as remote checkpoints, disaster regions, and event security. India started the use of transportable scanners at various injection points around the country's borders in 2023 in response to the need for germinal solutions that can be easily deployed and respond reliably to fresh security threats. These systems are easily deployed and be shifted from one region to another due to these factors, making them highly advisable in use during counter-terrorism & counter smuggling due to fluid security needs. Moreover, the paradigm of security requirements is shifting in the face of the increasing dynamism and complexity of security threats across the world.

The drive-through segment accounted for a considerable share of the vehicle scanner market in 2023 due to the increased access to such points as border control points, customs offices, airports, or seaports. This system lets the car run through the scanning tunnel, which uses high-technology imaging and X-ray devices to scan this car for threats, contrabands, or other security threats while allowing the traffic to flow. Furthermore, the drive-through scanners ensure the least interference to traffic flow, making a significant contribution to increased operations effectively.

The UVSS segment is anticipated to grow with the highest CAGR in the vehicle scanner market during the studied years, owing to the advantages they offer in terms of offering a comprehensive check of the undercarriage of various automobiles without having to interfere physically with the automobiles. UVSS is built to detect concealed objects like explosives and guns hidden under cars, making them useful in serious security situations such as in embassy or military compounds and airports. In 2023, governments at international and local levels, such as the United States and the European Union, paid attention to the application of UVSS to provide security to critical areas.

The camera segment led the global vehicle scanner market due to its primary responsibilities of digital surveillance and threat identification. Turret cameras, which are used in vehicle scanners, are expected to capture clear images of contraband items or even explosives or any security threat hidden within or outside a vehicle. The Expanding camera is attributed to the increase in imaging technologies, including the highest point of clearness camera and three-dimensional extrapolation systems that have enhanced the excellence of the scans. Furthermore, there is an increased need for minimal contact, high throughput, and effective security scanning.

The software segment is projected to expand rapidly in the vehicle scanner market in the coming years, owing to the advanced technologies and automation by artificial intelligence (AI), as well as machine learning (ML) for threats and data analysis. Software is vital in processing the information collected by cameras, sensors, and other parts to detect threats, raise alarms, and perform the scanning process. In 2024, AI software systems are expected to bring quite a significant change to the scanning of vehicles by identifying threats to a better extent of perfection and efficiency compared to human interference. Furthermore, there is a growing demand for automatic, efficient scanning equipment in areas of high security, including airports, seaports, and border checkpoints.

The scanning segment dominated the vehicle scanner market in 2023, as it plays a sensitive function in identifying concealed threats and banned objects in cars. Inspection systems use different technologies, including X-ray and gamma-ray technologies, with special resolutions to ensure that they scan the interior of vehicles and perform thorough inspections without having to dismantle vehicles. Furthermore, the rise as the global population seeks effective, quick, and contact-free scans for use in areas such as borders, airports, and key infrastructures, among others, further fuels the segment. The U.S. Customs and Border Protection (CBP), which covers all points of entry, makes use of advanced technologies, which include scanners to evaluate trucks and cargo containers before being allowed into the country for some possible threats, such as explosives and prohibited goods.

The imaging technology segment is projected to lead the vehicle scanner market in the future years, owing to the higher clarity of endoscopic maneuvers and AI applications. Imaging systems take clear, high-resolution photos of the vehicle’s interiors to detect concealed hazards such as IEDs, weapons, and prohibited items. The integration of imaging systems with AI is expected to enable an increase in the speed and accuracy of identified threats. Furthermore, besides enhancing safety controls, these technologies also capture real-time decisions to allow the operators to act in case of risks.

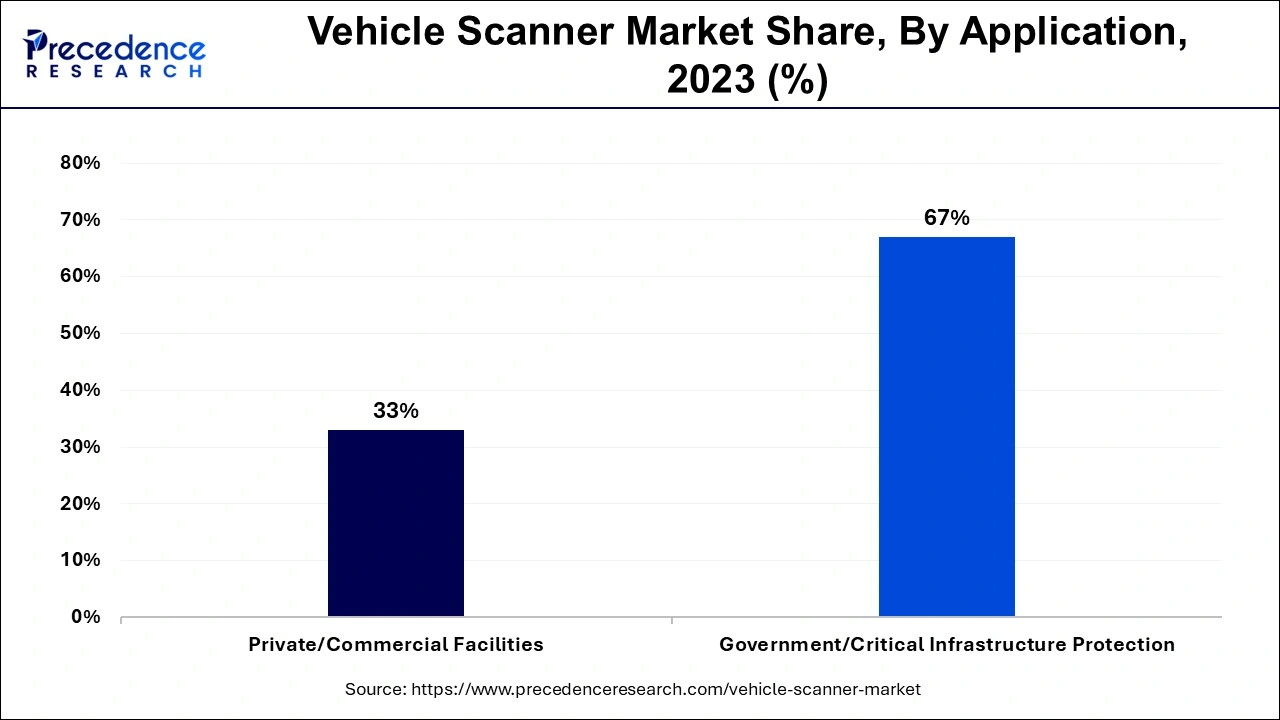

The government/critical infrastructure segment dominated the global vehicle scanner market in 2023 due to the growing threat perception regarding the security of the state, terrorist attacks, and smuggling. Governments of the world, especially of the high-risk countries, have considered the use of efficient vehicle scanning systems to protect borders, military installations, airports, and other critical assets. Moreover, the rising risk levels involving computer and physical security have put forward the indispensability of more extensive and complex security solutions, making vital use of vehicle scanners in important structures.

The private/commercial segment is projected to grow at the fastest rate in the vehicle scanner market in the future years, as industries such as logistics, retail, and entertainment are focusing on security investments to safeguard their assets and people. Perceived rising incidences of crimes, which include smuggling, theft, and even potential terror threats, are likely to push private organizational entities to procure better scanning systems at entry points. The industries that are most sensitive are manufacturing industries, warehouses, and transport facilities. Moreover, there are global threat level concerns and increasing security requirements for vehicle access in the corporate sector.

By Type

By Structure Type

By Component

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

August 2024