September 2024

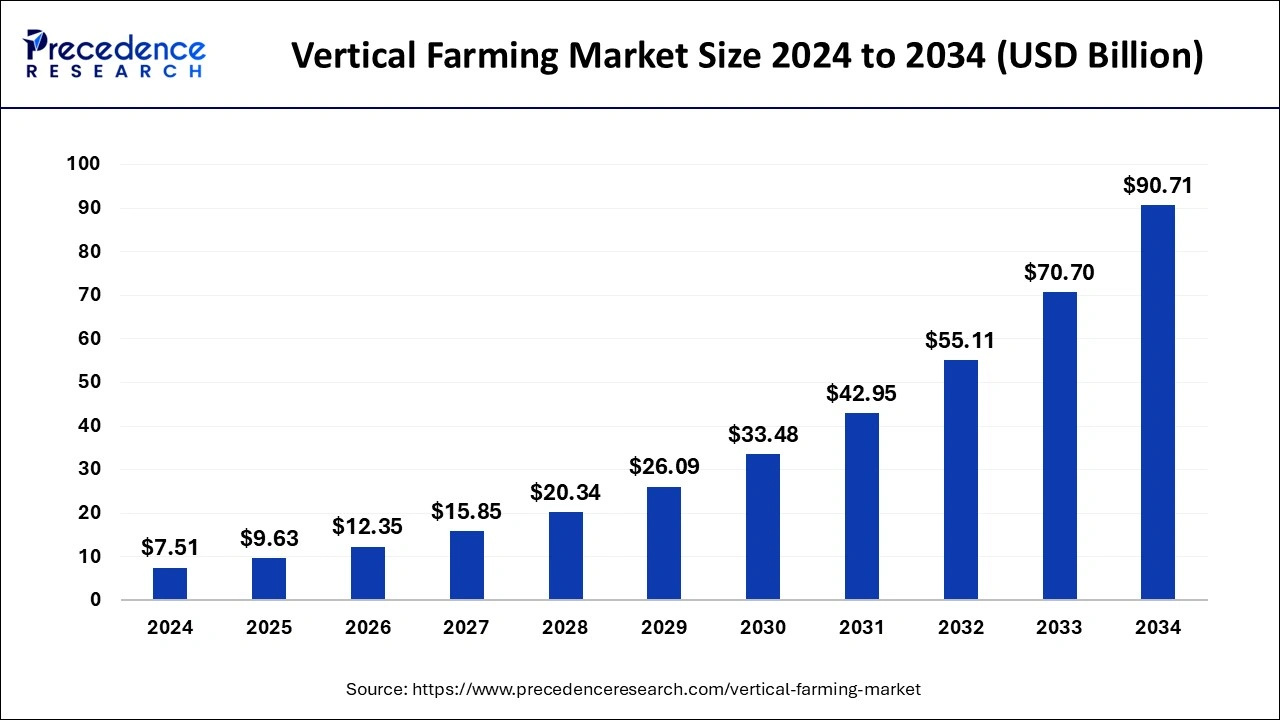

The global vertical farming market size is calculated at USD 7.51 billion in 2025 and is forecasted to reach around USD 90.71 billion by 2034, accelerating at a CAGR of 28.30% from 2025 to 2034. The North America vertical farming market size surpassed USD 3 billion in 2024 and is expanding at a CAGR of 28.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vertical farming market size accounted for USD 7.51 billion in 2024 and is anticipated to reach around USD 90.71 billion by 2034, expanding at a CAGR of 28.3% from 2025 to 2034.

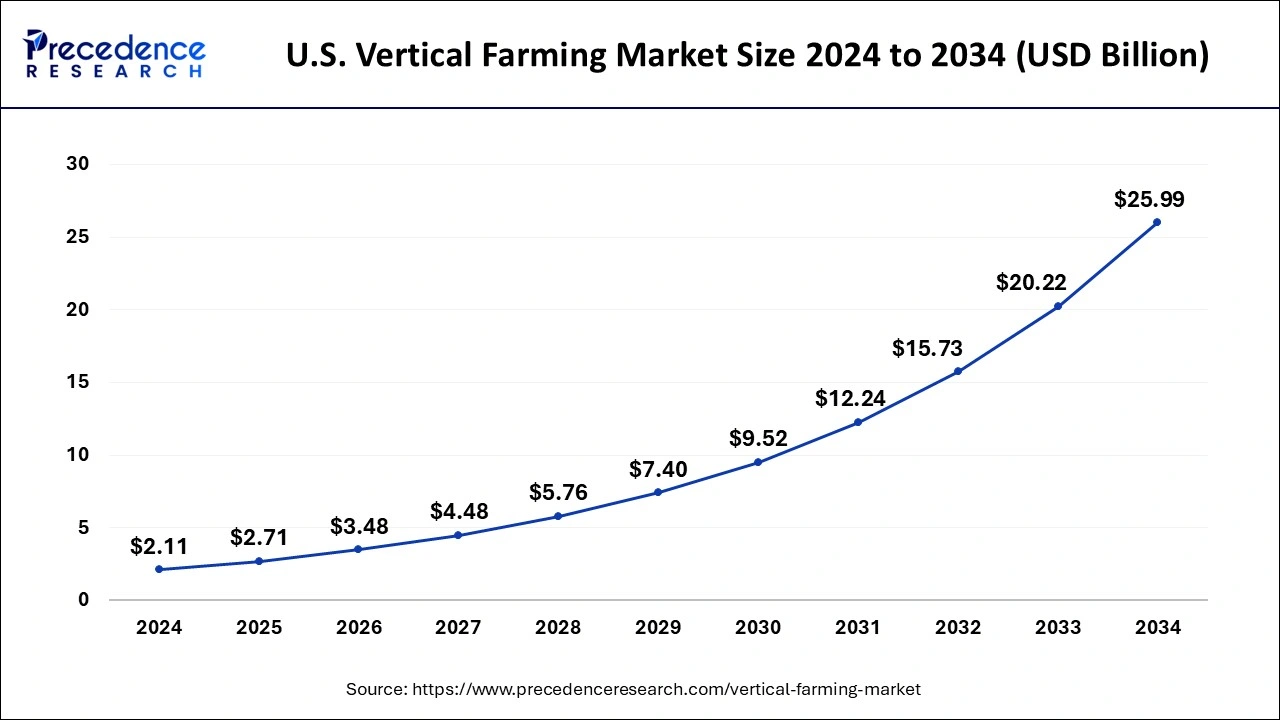

The U.S. vertical farming market size was estimated at USD 2.11 billion in 2024 and is predicted to be worth around USD 28.50 billion by 2034, at a CAGR of 28.5% from 2024 to 2034.

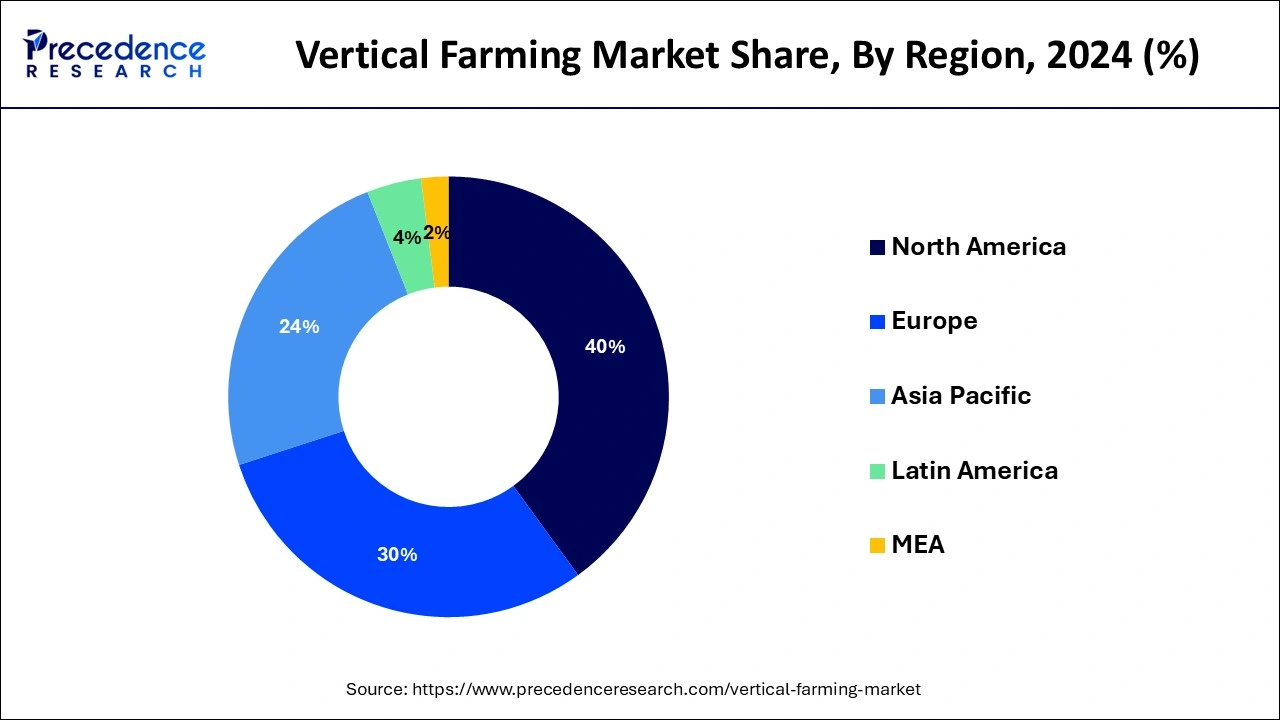

North America held the largest share of the vertical farming market while contributing almost 40% of the market share in 2024. Vertical farming is gaining traction in North American countries with the rising efforts of sustainability and food security in the area. Vertical farming ensures food security by offering the solutions for producing food on building and even closer where they are planned to be consumed. The overall material shortage and supply chain disruptions during the COVID-19 pandemic offered a significant potential for the vertical farming market to grow in North America. The United States and Canada are observed to remain as the largest contributors to the market in the upcoming years. Growing urbanization and degradation of food product quality is observed to promote the market’s expansion in the upcoming years.

Vertical farming by 2050 is considered to be a new method for feeding huge global populations. Building a farm that is close to the people it serves by supplying cheaper, organic, disease-free crops and preserving limited natural resources. The more sustainable and innovative method of agriculture than conventional agriculture and greenhouse farming is known to be vertical farming. It takes very little water and saves a large amount of soil and space. In difficult conditions, such as villages, mountain towns and deserts, this farming method is useful. The growth of the global vertical farming market is driven by rising customer health awareness, along with increasing urbanization and increasing per capita income. Indoor farming methods are also used by companies involved in the manufacture of pharmaceutical goods for cultivation and crop production in a green climate. Many pharmaceutical companies are introducing indoor farming techniques that are commonly used in producing biopharmaceutical products for the production of various crops.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 7.51 billion |

| Market Size by 2034 | USD 90.71 billion |

| Growth Rate from 2025 to 2034 | CAGR of 28.3% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Growth Mechanism, Component, Fruits, Vegetables & Herbs, Structure |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

The prime market share in the global vertical farming market was recorded in 2024 by hydroponic segment. Over the projected period, the climate control segment is predictable to register a high CAGR. To drive demand for hydroponic components, increasing adoption of hydroponic components by farmers to minimize the weight load and infrastructure needed to support the equipment is anticipated. Vertical farming automation aims to minimize time to market, reduce costs for distribution, production and the environment, and standardize high quality.

Using this method, strawberries, lettuce, leafy greens, and tomatoes are among the most cultivated vegetables. Of all products, due to its adaptability to grow in small spaces with limited need for additional care, lettuce shows significant growth. Validating the economic viability of that crop, which ensures that the company is making a large amount of money from its cultivation, is one of the important factors behind growing any crop in vertical farming. Similarly, one of the criteria is the time taken for crops to grow completely because some vegetables such as lettuce and mint grow quickly, while herbs and some fruiting crops take longer to grow, but can have higher margins than many other plants.

In terms of revenue, the shipping container conquered the sector in 2024 and is projected to remain leading during the forecast era. This growth is accredited to the structure's capability to assistance grow crops irrespective of the geographical site. Over the forecast period, factors such as budding technological advances and penetration of precision farming are expected to drive the shipping container segment. In Japan, China, and other Asian countries, the building based segment is extensively accepted and is the fastest-growing segment by revenue due to its growing acceptance in the region.

By Growth Mechanism

By Component

By Fruits, Vegetables & Herbs

By Structure

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

December 2024

February 2025