December 2024

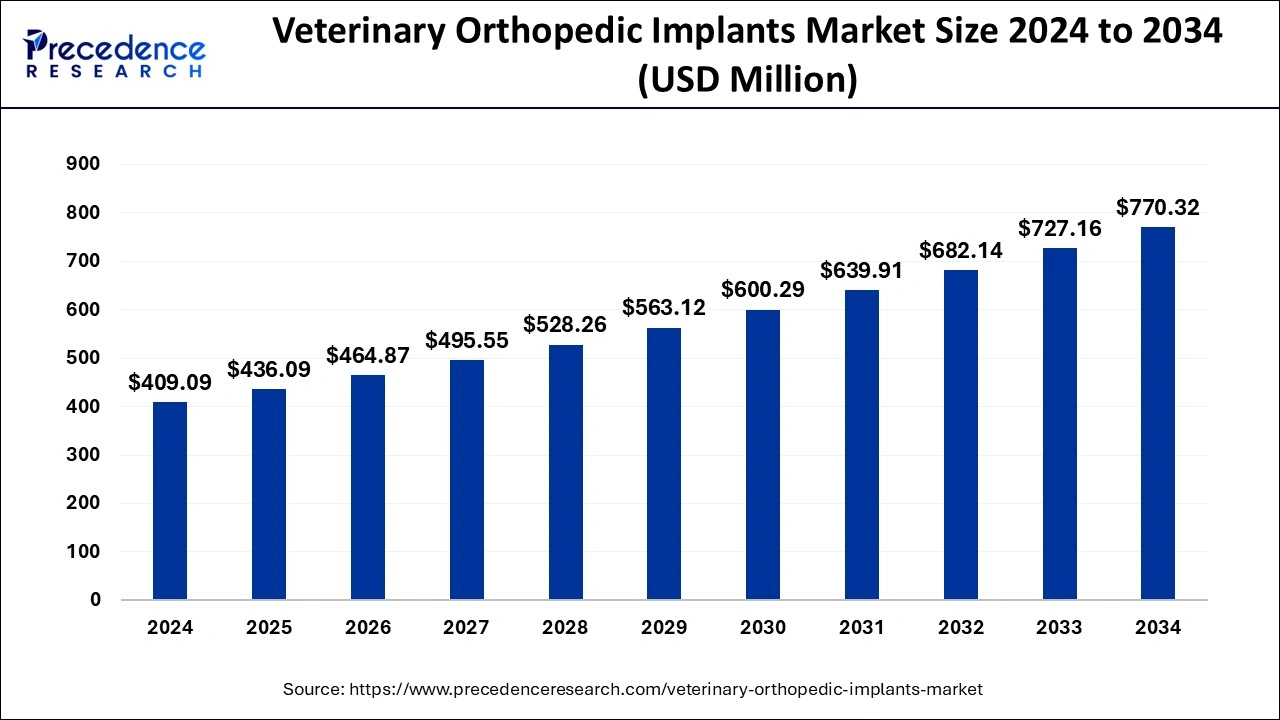

The global veterinary orthopedic implants market size was USD 409.09 million in 2024, estimated at USD 436.09 million in 2025 and is anticipated to reach around USD 770.32 million by 2034, expanding at a CAGR of 6.53% from 2025 to 2034.

The global veterinary orthopedic implants market size was accounted for USD 409.09 million in 2024 and is predicted to reach around USD 770.32 million by 2034, growing at a CAGR of 6.53% from 2025 to 2034. The rising adoption of animals, growing awareness for veterinary care, and rising incidences of orthopedic injuries in animals drive the market.

Advanced technologies such as artificial intelligence (AI) and machine learning (ML) algorithms can be used to diagnose orthopedic injuries in animals. AI can enhance the sensitivity and specificity of imaging data. AI can also be used to design novel orthopedic implants based on animal needs. The novel implants developed using AI can facilitate enhanced integration with the host bone, promoting improved treatment outcomes. Additionally, AI can be used in large-scale manufacturing of veterinary orthopedic implants, enhancing efficiency and reproducibility. It also reduces human intervention, eliminating manual errors. Furthermore, AI can be used to evaluate veterinary orthopedic implants. AI can analyze hardware complications in implants before surgery

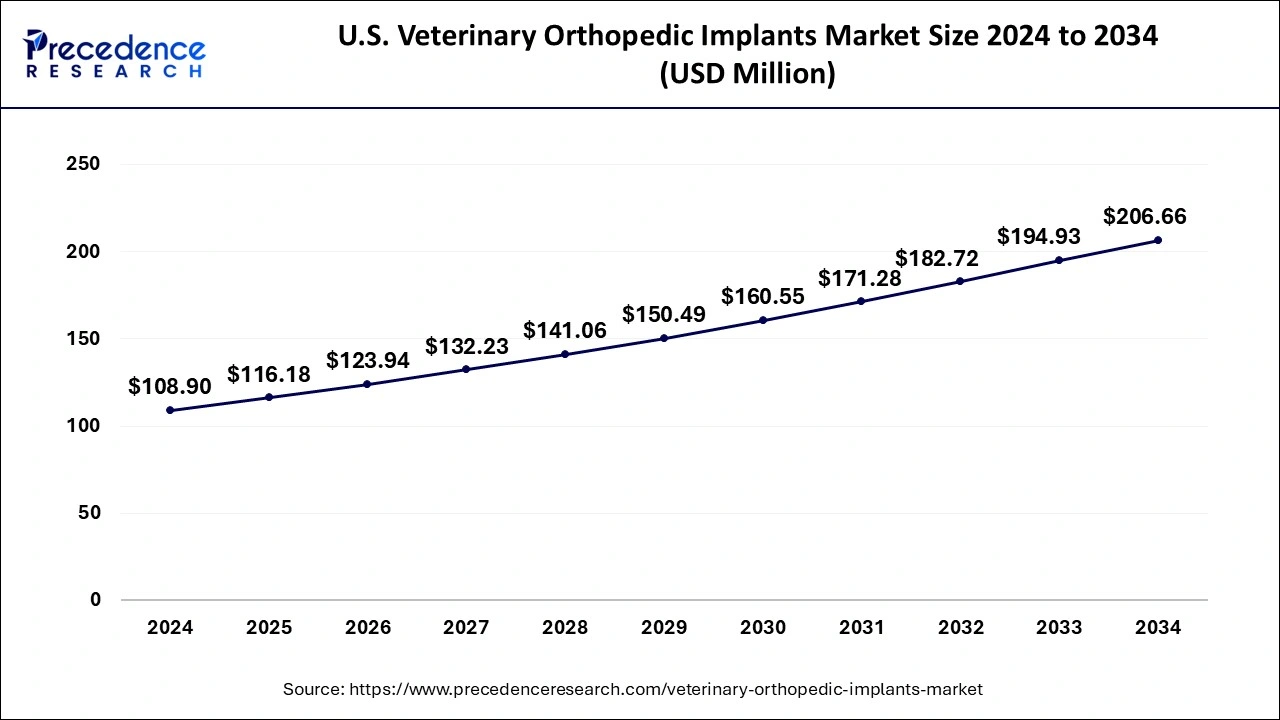

The U.S. veterinary orthopedic implants market size was estimated at USD 108.90 million in 2024 and is predicted to be worth around USD 206.66 million by 2034, at a CAGR of 6.62% from 2025 to 2034.

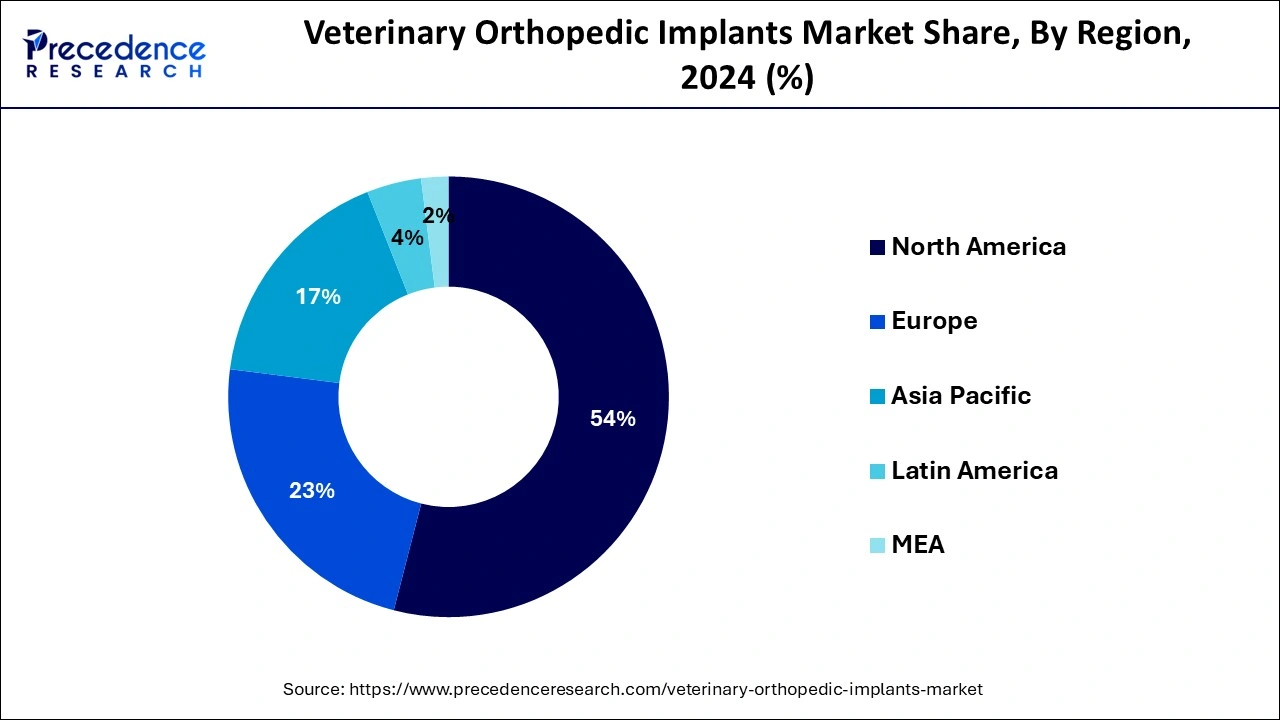

North America Is Projected To Lead the Veterinary Orthopedic Implants Market By Region

North America dominated the veterinary orthopedic implants market with revenue share of 54% in 2024. The rising adoption of companion animals and the increasing incidences of orthopedic disorders in animals drive the market. The rising disposable income and the increasing expenditure on pet health also contribute to market growth. The North American Veterinary Community (NAVC) increases awareness about veterinary care through veterinary publications, online continuing education, conferences, certifications, and webinars. The increasing number of veterinary clinics and hospitals also propels market growth in North America.

Europe accounted for the second-highest share of the veterinary orthopedic implants market in 2024. The rising pet ownership, increasing number of veterinary clinics, and the presence of trained professionals are the major growth factors driving the Europe market. The total number of enterprises in veterinary services in Europe is more than 70,000. While there are more than 214,000 people employed in veterinary services in Europe.

Asia-Pacific is projected to host the fastest-growing veterinary orthopedic implants market in the coming years. The increasing demand for pets and growing awareness of veterinary care boost the market. The increasing pet expenditure and rising middle-class population also augment market growth. The presence of key players and rising disposable income presents opportunities for market growth in Asia-Pacific. The growing research and development activities for expanding veterinary care also drive the market.

United States: Technological advancements and advanced healthcare infrastructure drive the market growth in the US. The US National Institute of Food and Agriculture announced an investment of $3.8 million for veterinary services. The US government also provides funding to provide education and extension activities for current and future veterinarians and veterinary students.

The use of implants in animals is increasing at a rapid pace. The use is even more prevalent in cats and dogs. These domesticated animals frequently get hurt from fractures owing to multiple factors such as old age, fights, accidents, vehicular trauma, and sport related injuries. Although animal injuries heal rapidly, orthopedic surgeries are needed for healing in the event of cracked bones. The veterinarians decide the type of treatment and implant to be used based on the type of fracture. Plates and screws are the most common types of orthopedic implants.

The orthopedic screws are used to tighten injured bones or reestablish stability in a weak part. Orthopedic plates are used to treat fractures and provide stability and reconstruction. Other implants such as joint replacement implants, knee replacement implants, and hip replacement implants are also widely used to treat animals with serious injuries. Organized animal sports have also developed as a business in many parts of the world. In all such sports, trained animals can be quite lucrative for the people who control, train, and supervise them. These sports lead to serious injuries which require surgeries and use of implants.

The demand for veterinary orthopedic implants is growing rapidly due to increasing trend of owing companion animals. People are keen to spend more on the well being of their pets which is consolidating the demand for veterinary healthcare products. Moreover, increasing approvals for veterinary orthopedic implants is expected to present attractive opportunities over the forecast period.

Future of Veterinary Orthopedic Implants

Implants have been used in both humans and animals since a long time to effectively treat a huge array orthopedic ailment. After years of research, the use of new type of implants is on the rise. These bioabsorbable implants can be used in multiple orthopedic procedures. Bioabsorbable polymer implants are expected to make significant inroads into various orthopedic applications. Physicians who have been familiar with the features and handling attributes of the metal implants, could find it beneficial to familiarize themselves with the exclusive characteristics and benefits of these latest types of biomaterials.

| Report Highlights | Details |

| Market Size in 2024 | USD 409.09 Million |

| Market Size in 2025 | USD 436.09 Million |

| Market Size by 2034 | USD 770.32 Million |

| Growth Rate from 2025 to 2034 | CAGR of 6.53% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Increasing Pet Ownership

The growing adoption of pets is driven by demographic changes, rising income levels, and the COVID-19 pandemic. It is estimated that more than half of the global population owns a pet. People in the regions like the US, Brazil, Europe, and China have the highest number of pets globally. The rising disposable income and healthcare expenditure drive the market. According to the American Pet Product Association, people spent $147 billion on their pets in 2024. The increasing pet ownership shows a positive influence on the veterinary orthopedic implants market growth. This results in more people becoming aware of pet health.

Risk of Infections and Lack of Trained Professionals

The major challenge of the veterinary orthopedic implants market is the risk of infection. Surgery for implanting veterinary orthopedic implants possess high risk of infection, causing implant failure and further health issues for the animal. This decreases the demand for orthopedic implants, restricting market growth.

Another major challenge is the lack of trained professionals. Several veterinary offices in the underdeveloped and developing countries do not have sufficient trained professionals to perform surgery, hindering market growth.

Emphasis over 3D Printing

3D printing or additive manufacturing is a technique of manufacturing a three-dimensional object from a digital file. 3D printing is an emerging technique used for designing and manufacturing veterinary orthopedic implants. It can manufacture customized implants for different animals, eliminating the need for bulk manufacturing. It minimizes waste to a huge level as only the materials required for the implants are used. It is also environmentally friendly due to its capability to generate less waste. Additionally, 3D printing significantly reduces the overall cost of the product and results in faster production. Hence, 3D printing presents numerous opportunities for the veterinary orthopedic implants market in the future owing to its superior benefits compared to conventional manufacturing techniques.

The Orthopedic Plates Accounted for Highest Market Stake in 2024

Plates recorded the major market stake in the worldwide veterinary orthopedic implants market in 2024. Ease of availability and new product launches are the major reason for high market share of NSAIDs. Other factors such as technological improvements and use of new materials will boost the demand for Orthopedic Implant Plates. Screw Implants are anticipated to advance at the maximum CAGR through the forecast period due to high demand in the treatment of companion animals as well as cattle.

Veterinary Hospitals Are Expected to Dominate the End User Segment of Veterinary Orthopedic Implants Market

Veterinary hospitals are equipped with all the latest equipment’s and skilled veterinarians which encourages the animal owners to visit these healthcare facilities for better and effective care of their pets. Moreover, the larger veterinary hospitals have sufficient funds to acquire latest technologies which can reduce the procedure duration and make the procedure pain free for small animals. These factors contribute to the high popularity of veterinary hospitals. Veterinary clinics are expected to advance at a high CAGR due to launch of new chains especially in developed regions.

By Product

By End User

By Geography

North America

Europe

Asia Pacific

Latin America

Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

November 2024

January 2025