December 2024

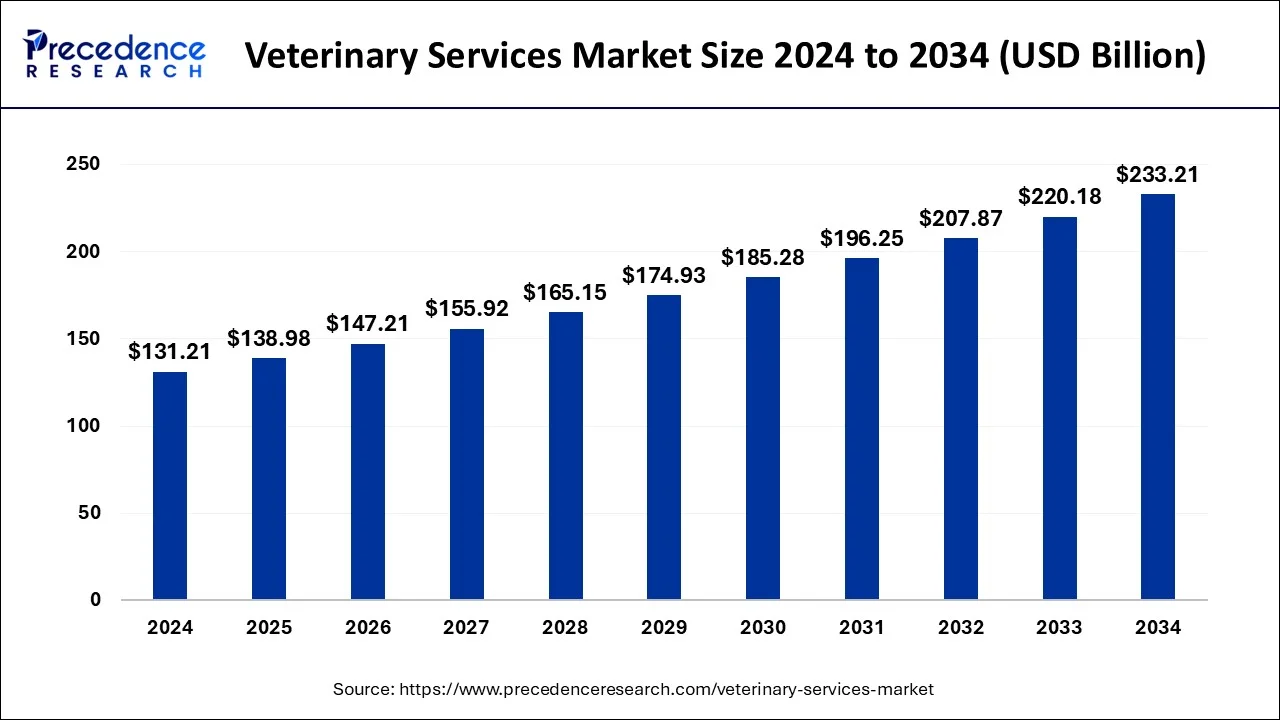

The global veterinary services market size accounted for USD 131.21 billion in 2024, grew to USD 138.98 billion in 2025 and is predicted to surpass around USD 233.21 billion by 2034, expanding at a CAGR of 5.92% between 2025 and 2034. The North America veterinary services market size accounted for USD 57.73 billion in 2024 and is anticipated to grow at a fastest CAGR of 6.04% during the forecast year.

The global veterinary services market size was estimated at USD 131.21 billion in 2024 and is anticipated to reach around USD 233.21 billion by 2034, expanding at a CAGR of 5.92% between 2025 and 2034. The market is expected to grow due to increased pet ownership globally, increased awareness of animal health and health-related issues, increasing amounts of research and development, increased uptake of pet insurance; increased expenditures on pet health care, and the emergence of innovative and advanced technologies like mobile veterinary units..

The future of veterinary services is taking new turns with the introduction of Artificial Intelligence (AI). It is improving diagnosis and treatment processes as well as improving general operational efficiency in the veterinary services market. AI makes the most intricate analysis of medical records, laboratory tests, and imaging studies and assists veterinarians in the highly accurate detection of diseases and conditions. This would create better treatment strategies and allow for more effective interventions while decreasing the guesswork. Also, it allows one to reach telemedicine and remote care. Today, it allows real-time monitoring and consultation through telemedicine and remote care. AI-driven chatbots mainly take care of appointment scheduling while fielding queries and optimizing inventories while automating billing. In such ways, AI is speeding up veterinary research. Collaborations between veterinary professionals, AI specialists, and tech developers are very important in making this full realization possible. The future of AI in veterinary services is currently very bright with lots of room for further development and innovations.

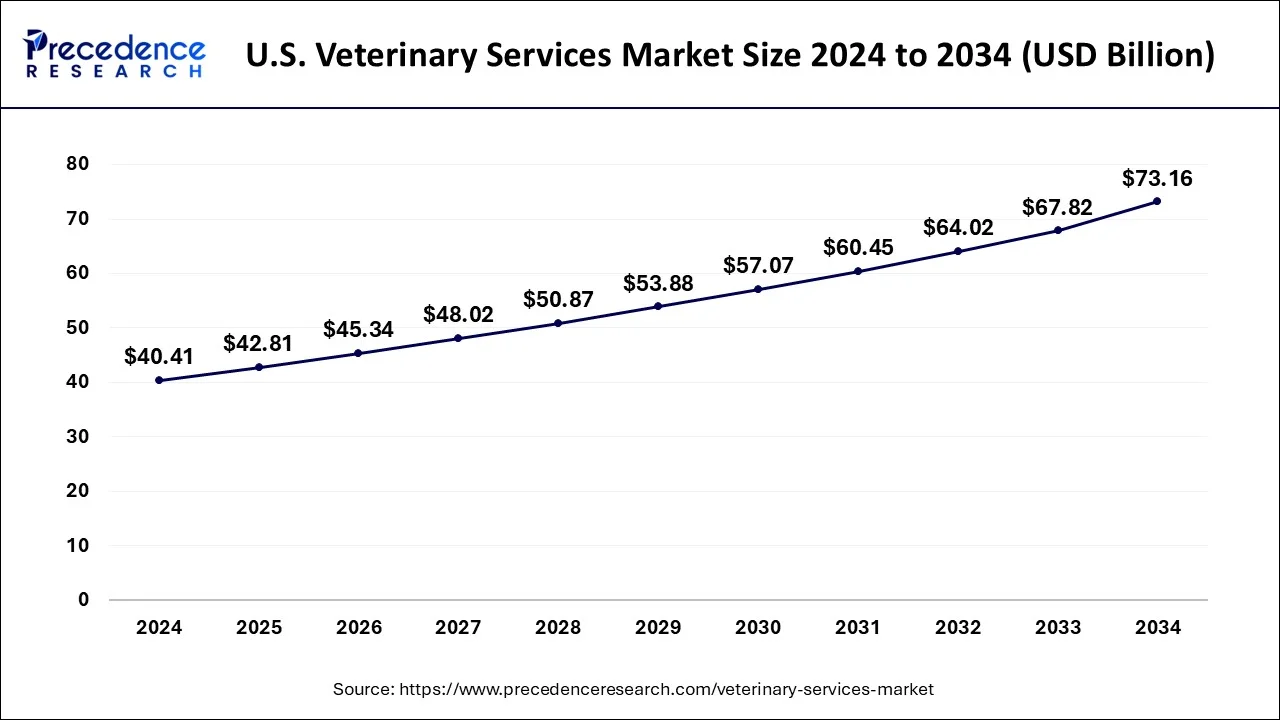

The U.S. veterinary services market size reached USD 40.41 billion in 2024 and is expected to be worth around USD 73.16 billion by 2034, poised to grow at a CAGR of 6.12% from 2025 to 2034.

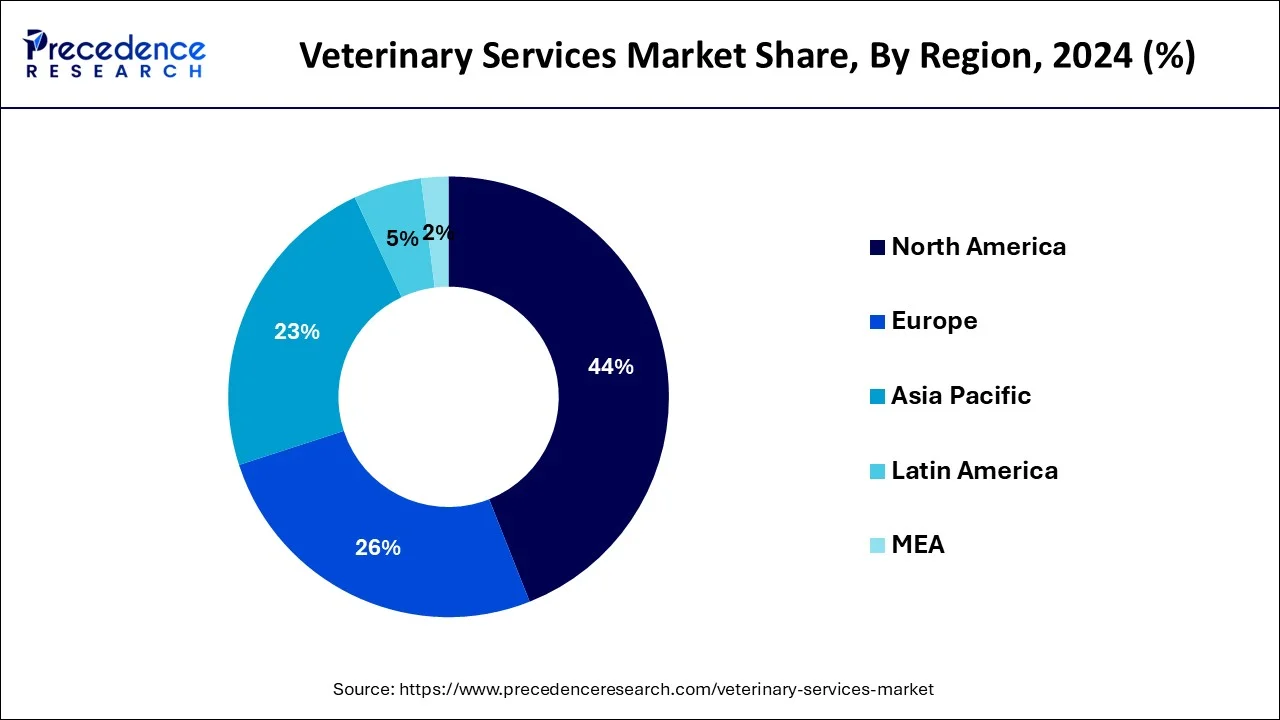

North America had the biggest revenue share of more than 43% in 2024. The main causes of this significant expansion are the determined actions conducted by various government animal welfare groups geared at the enhancement of veterinary services in the United States and Canada. It is projected that the proliferation of new animal education programs in the United States, including unconventional programs seeking accreditation, will increase access to these services and hence increase the potential for acceptance of veterinary services in the years to come.

On the other hand, during the anticipated years, Asia Pacific is expected to see the quickest rate of growth. The regions developed and developing economies' expanding pet and livestock populations are the cause of the exponential rise. Additionally, because they aid in the maintenance of the priceless livestock herd, veterinary services also serve to lower poverty, particularly among rural communities in developing nations. The number of veterinarians in Japan who treat pets and other small animals is rising, which might present a development opportunity for the industry. The increased demand for goods like meat and milk as a result of the expanding population, which leads to animal husbandry, is predicted to enhance the need for veterinarians and their services in India.

The huge global increase in zoonotic and food-borne illnesses is the primary factor driving the market. The protection of animal health and welfare as well as the upkeep of the hygienic safety of international trade are vital functions of veterinary services. Additionally, it helps protect the general public's health and guarantees food safety. The Organization for Animal Health (OIE) said in an article that there is a rising worldwide demand for foods derived from animals, including meat, which is anticipated to reach 445 million tons by 2050. Customers' preferences for shopping have changed from traditional brick-and-mortar stores to online marketplaces as a result of the COVID-19 pandemic, which has accelerated industry growth.

It is expected that a growing number of government measures to guarantee food security and biosecurity would hasten the adoption of veterinary services in cattle across the world. For instance, the OIE, which is concerned with preserving food safety, has continuously issued guidelines to remove possible biological dangers and risks connected with inspections on-farm, before slaughter, prior to processing, and during processing. Because more workers are working from home due to the pandemic, pet adoption has skyrocketed. Pets are a big part of many people's life. Many people view their pet as a member of the family. There are always cats and dogs around, and people are spending more money on them. In order to meet the growing demand, veterinary businesses produced new goods, diagnostic equipment, and services. This is a brand-new platform for diagnosing intestinal parasites in canines. Additionally, the following rise in pet ownership around the globe has aided in the market's quick expansion. In order to ensure animal welfare, veterinarians and veterinary service providers consistently make efforts, which motivates pet owners to employ these services.

| Report Coverage | Details |

| Market Size in 2024 | USD 131.21 Billion |

| Market Size by 2034 | USD 233.21 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.92% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Type, and By Animal Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The willingness of pet parents to spend more on pets

Rising costs of veterinary services may hamper the market growth

Increase in pet adoption

Government programs for animal care

The market for diagnostic tests and imaging services generated over USD 34 billion in revenue in 2024, and it is expected to continue to dominate over the forecast period with a sizable market growth rate. Pets who get infectious illnesses run the risk of dying, and farm animals are frequently less productive as a result. The potential of disease invasion is exacerbated by the globalization of the animal and allied product trade. The detection, control, and eradication of such illnesses depend on accurate and timely diagnostic procedures. As a result, veterinary services including diagnostic testing and imaging have increased. The development of equipment and auxiliary instruments for the quick and simple identification of animal diseases has been prompted by the requirement for imaging and diagnostic tests. The creation of prototype diagnostic tests for a variety of zoonotic illnesses is made possible by revolutionary technological technologies for personalized human medicine. A veterinary clinic also uses cutting-edge imaging technologies in its radiology and imaging rooms to identify and treat illnesses in animals. Therefore, as a result of the aforementioned factors, the market for veterinary services is anticipated to continue to grow over the projected period.

Over 60% of the market was predicted to be occupied by companion animals in 2024. The need for pet care services, including veterinary services among others, is significantly increased by the growing adoption rate of companion animals. For instance, The American Pet Products Association (APPA) estimates that in 2021, pet owners would spend USD 1,480 on average per year on the essential costs of a pet dog. Similar to this, there has been a marked rise in the prevalence of several illnesses in animals kept as pets. In 2018, it was projected that 2.5% of dogs in the UK have osteoarthritis, according to research that was published in the Nature Journal. Additionally, about 8% of cats and 10% of dogs received surgery, according to the APPA's 2017-2018 National Pet Owners Survey data. As a result, the market need for veterinary services will increase as more pets undergo surgical operations.

Segment Covered in the Report

By Service Type

By Animal Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

November 2024

January 2025