August 2024

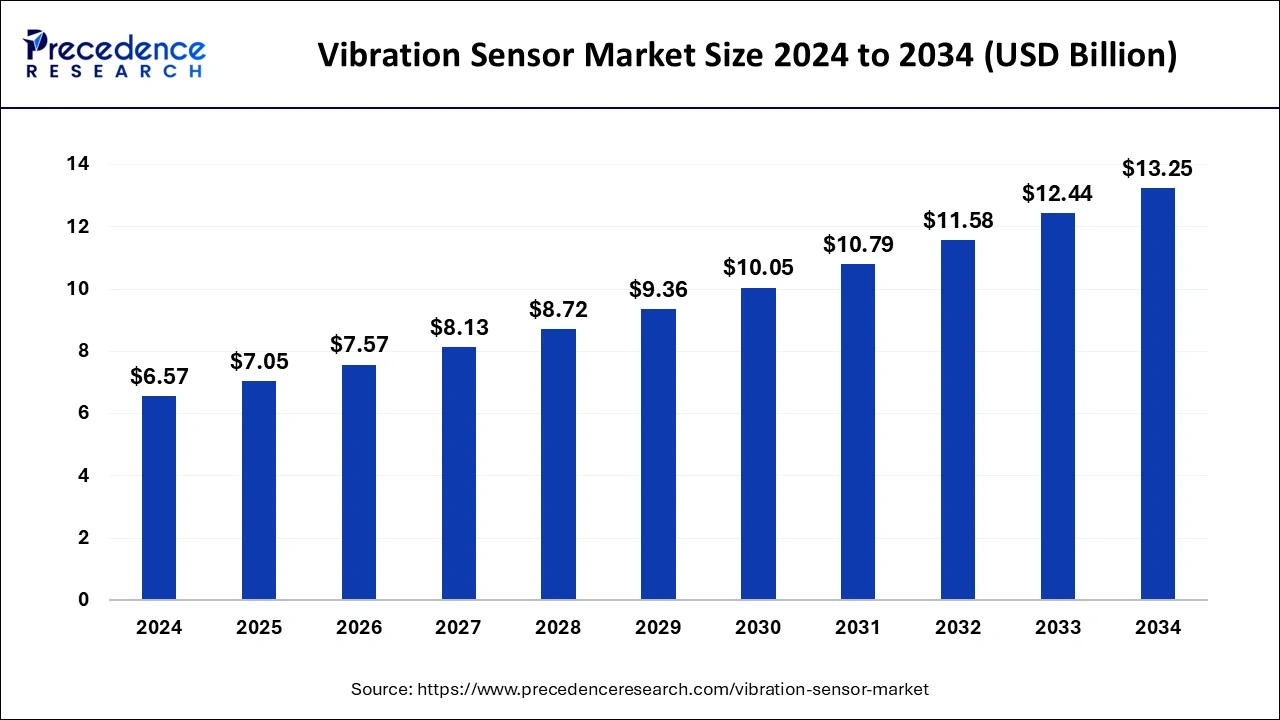

The global vibration sensor market size is accounted at USD 7.05 billion in 2025 and is forecasted to hit around USD 13.25 billion by 2034, representing a CAGR of 7.27% from 2025 to 2034. The North America market size was estimated at USD 2.50 billion in 2024 and is expanding at a CAGR of 7.28% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vibration sensor market size accounted for USD 6.57 billion in 2024 and is predicted to increase from USD 7.05 billion in 2025 to approximately USD 13.25 billion by 2034, expanding at a CAGR of 7.27% from 2025 to 2034. The surge in industrial automation and the imperative for predictive maintenance solutions are propelling the expansion of the vibration sensor market.

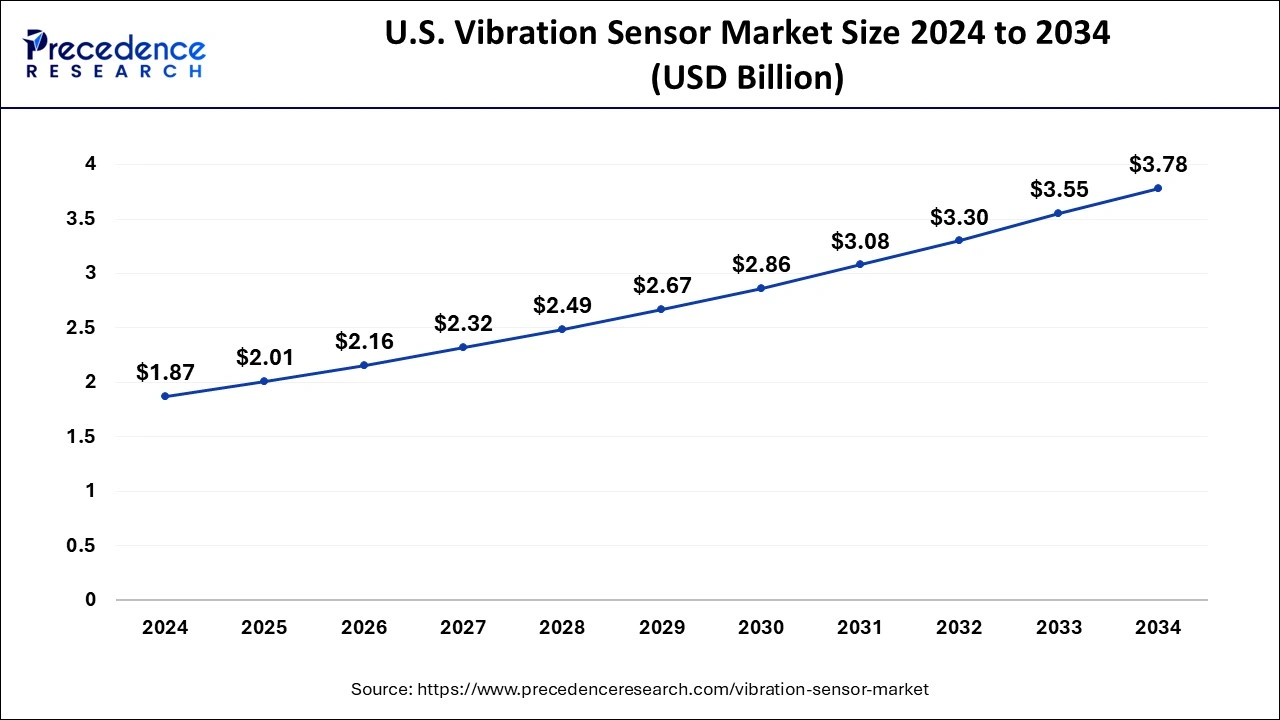

The U.S. vibration sensor market size was evaluated at USD 1.87 billion in 2024 and is projected to be worth around USD 3.78 billion by 2034, growing at a CAGR of 7.29% from 2025 to 2034.

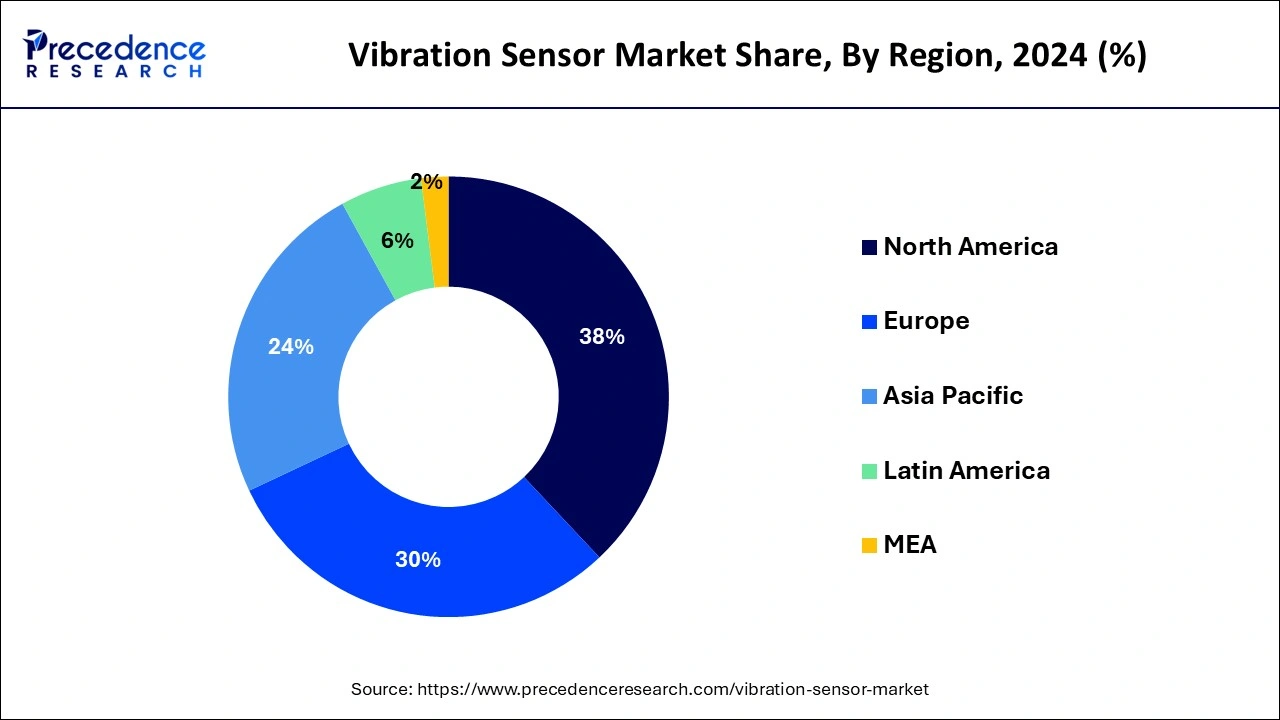

North America held the largest market share of 38% in 2024. This dominance is primarily driven by the widespread adoption of vibration sensors within the region's well-established automotive sector. Additionally, North America boasts some of the world's largest railway networks, including the Canadian National Railway and Norfolk Southern Railway, which further bolster demand for vibration sensors in rail asset management applications. The region also witnesses a surge in demand for vibration sensors in consumer electronics applications, supporting market growth.

The United States, with its extensive automotive and aerospace industries, represents a significant market for vibration sensors. Moreover, the presence of key players in the region, along with substantial investments in research and development, contributes to market growth. Canada also plays a vital role, with a growing emphasis on industrial automation and condition monitoring across various sectors.

Asia Pacific is poised to exhibit the fastest growth rate in the vibration sensor market. This growth is fueled by the increasing automation across various industries in the region, driving the demand for advanced vibration sensors. Moreover, the presence of low labor costs incentivizes global manufacturers to expand their production bases in countries like India, China, and South Korea, thereby boosting demand for vibration sensors in the regional manufacturing sector. Furthermore, China and Japan serve as prominent manufacturing and assembling hubs for leading consumer electronics companies such as Samsung and Sony Corporation, where vibration sensors find applications in orientation detection and free-fall sensing.

China, with its burgeoning manufacturing sector and increasing adoption of industrial automation, presents lucrative opportunities for market players. India, on the other hand, is experiencing significant growth in infrastructure development and automotive production, driving demand for vibration sensors in the construction and transportation sectors. Japan, with its advanced technology landscape, is a key contributor to market growth, particularly in high-precision manufacturing applications.

The vibration sensor market encompasses the industry involved in the production, distribution, and utilization of sensors designed to detect and measure vibrations in various applications. These sensors play a crucial role in predictive maintenance, structural health monitoring, automotive safety, and other sectors where monitoring vibrations is essential for performance optimization and risk mitigation.

The vibration sensor market is witnessing significant growth propelled by the escalating demand for predictive maintenance solutions across various industries. Vibration sensors are instrumental in detecting and monitoring mechanical vibrations, providing critical insights into the health and performance of machinery and infrastructure. With industries increasingly prioritizing efficiency and reliability, the adoption of vibration sensors has become indispensable for optimizing operational processes and minimizing downtime. Moreover, the growing emphasis on safety standards, particularly in sectors such as manufacturing, automotive, aerospace, and energy, further fuels the demand for vibration sensors.

The integration of cutting-edge technologies such as artificial intelligence (AI) and the Internet of Things (IoT) into the vibration sensor market is creating new avenues for expansion. Partnerships like the one between Reality Analytics Inc. and Fujitsu Component Ltd., aimed at incorporating AI-enabled features into vibration sensors, underscore this trend. Additionally, research initiatives, such as the development of opt mechanical accelerometers by organizations like the National Institute of Standards and Technology (NIST), promise further innovation and application diversification.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.27% |

| Market Size in 2025 | USD 7.05 Billion |

| Market Size by 2034 | USD 13.25 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, End-use, and Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for condition monitoring

One of the primary drivers propelling the growth of the vibration sensor market is the escalating demand for condition-monitoring solutions across a wide array of industries. This surge in demand is primarily attributed to the imperative need for businesses to ensure the reliability and optimal performance of their critical assets. With industries increasingly reliant on machinery and equipment to drive productivity and meet production targets, the ability to monitor the health of these assets in real time has become paramount.

Condition monitoring solutions, enabled by vibration sensors, offer a proactive approach to asset management by continuously assessing the health and performance of machinery. This proactive monitoring allows organizations to detect anomalies and potential issues early on, long before they escalate into costly failures. By implementing condition monitoring systems equipped with vibration sensors, businesses can transition from traditional reactive maintenance practices to more predictive and preventive maintenance strategies.

Technological advancements in sensor technology expand

The rapid pace of technological advancements in sensor technology is a pivotal driver shaping the growth trajectory of the vibration sensor market. Over the years, significant innovations and breakthroughs have transformed vibration sensors from simple mechanical devices to highly sophisticated and intelligent sensors capable of delivering accurate and actionable insights into machinery health.

One of the notable advancements in sensor technology is the miniaturization of vibration sensors facilitated by advancements in microelectromechanical systems (MEMS) technology. MEMS-based vibration sensors are characterized by their compact size, low power consumption, and high sensitivity, making them ideal for integration into a wide range of applications, including industrial machinery, automotive systems, consumer electronics, and IoT devices. The miniaturization of vibration sensors has enabled their deployment in space-constrained environments and portable devices, expanding their utility across diverse industries and applications.

High initial investment costs

The initial investment required for deploying vibration sensor systems, especially for large-scale industrial applications, can be substantial. This includes the costs associated with sensor procurement, installation, integration with existing infrastructure, and implementation of supporting software and analytics platforms. The high upfront costs may deter some organizations, particularly small and medium-sized enterprises (SMEs), from investing in vibration monitoring solutions, thereby limiting the growth of the vibration sensor market.

Limited awareness and education

Despite the growing recognition of the benefits of condition monitoring and predictive maintenance, there remains a lack of awareness and education among end-users regarding the capabilities and potential applications of vibration sensors. Many organizations, especially in traditional industries, may not fully understand the importance of monitoring vibration levels or the role of vibration sensors in preventing equipment failures and optimizing asset performance. The lack of awareness and education regarding vibration monitoring solutions may hinder market expansion, as potential customers may not perceive the value proposition or may prioritize other investment areas.

Integration with artificial intelligence and machine learning

Advancements in artificial intelligence (AI) and machine learning (ML) algorithms are enhancing the capabilities of vibration sensor systems for predictive maintenance and anomaly detection. By leveraging AI-driven analytics platforms, vibration sensor data can be processed, analyzed, and interpreted in real time to predict equipment failures, identify abnormal operating conditions, and recommend optimal maintenance actions.

The integration of AI and ML technologies with vibration sensors enables proactive maintenance strategies, improves equipment reliability, and reduces maintenance costs. Market players have the opportunity to develop AI-powered vibration monitoring solutions that offer advanced predictive capabilities and actionable insights to end-users across various industries.

Development of miniaturized and wireless sensors

The miniaturization and wireless connectivity of vibration sensors are enabling new use cases and applications in various industries. Miniaturized vibration sensors can be integrated into compact and space-constrained equipment, machinery, and wearable devices, expanding their deployment possibilities. Wireless vibration sensors eliminate the need for wired connections and enable remote monitoring of assets in inaccessible or hazardous environments.

Market players have the opportunity to develop compact, low-power, and wireless-enabled vibration sensors that offer flexibility, scalability, and ease of deployment across diverse applications, including industrial machinery, consumer electronics, and structural monitoring.

The accelerometers segment held the largest share of the market in 2024, for instance, they are widely utilized across industries due to their versatility and ability to detect various types of vibrations. This segment, driven by their applications in the automotive, consumer electronics, and manufacturing sectors is observed to expand at a notable rate in the upcoming years. Additionally, advancements in technology, such as the development of tri-axial accelerometers, further bolstered their growth.

The displacement sensors segment, on the other hand, is witnessing a surge in demand in the market. This is particularly observed in applications requiring precise measurements, like defect detection in PCBs and elevator synchronization systems.

The piezoresistive sensors segment dominated the market in 2023. Piezoresistive sensors are known for their fixed sensitivity and cost-effectiveness. These sensors find extensive use in automotive safety systems and medical devices due to their reliability and affordability.

However, the market is witnessing a rising demand for the tri-axial sensors segment, driven by their ability to provide accurate phase analysis and their increasing adoption in critical applications such as automotive gearboxes.

The automobile segment dominated the market share in 2024. Vibration sensors are crucial in vehicles for detecting mechanical vibrations and ensuring engine health. Stringent safety regulations in the automotive industry further propel the adoption of these sensors. Besides the automobile segment, the aerospace and defense segments are also experiencing rapid growth, fueled by the increasing use of vibration sensors in applications like inertial navigation and turbine engine monitoring.

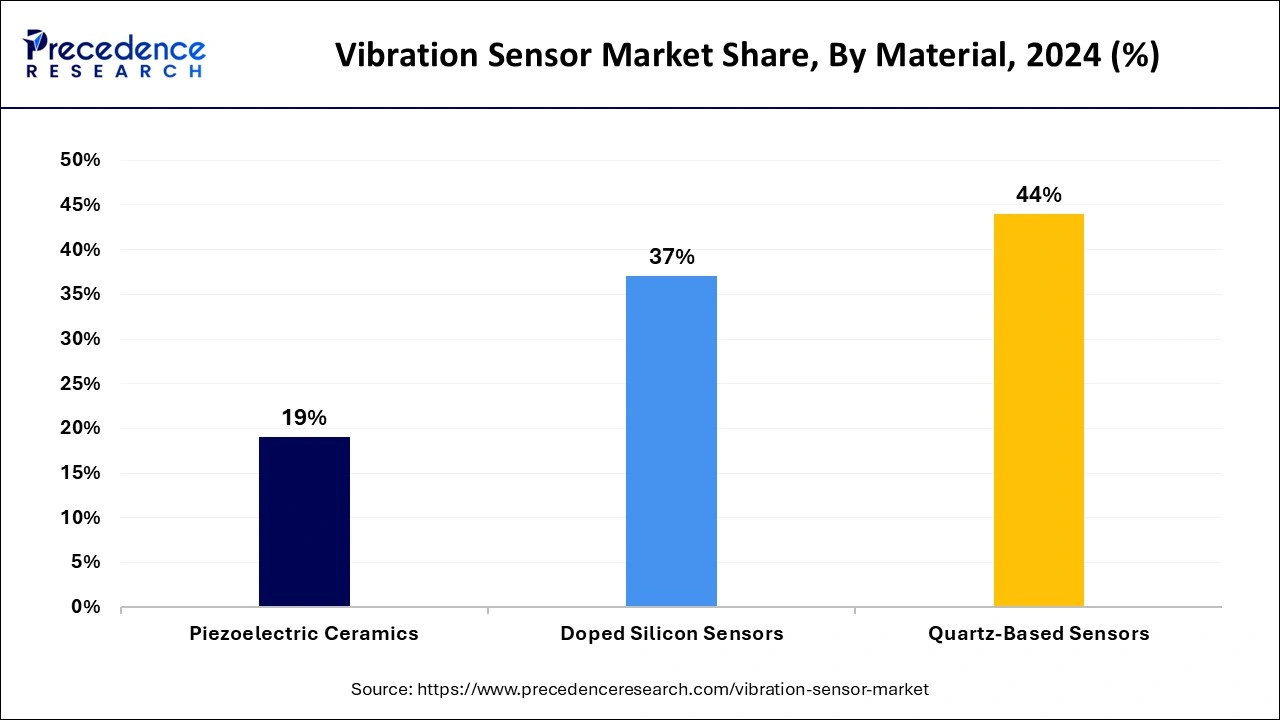

The quartz-based sensors segment held a dominant market share of 44% in 2024. However, doped silicon sensors are gaining traction due to their versatility and expanding applications across various industries, including electronics and semiconductors.

Additionally, piezoelectric ceramics are emerging as promising materials, particularly in automotive and energy harvesting applications, owing to their unique properties and lightweight nature.

By Type

By Technology

By End-use

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

November 2024

October 2024

January 2025