August 2024

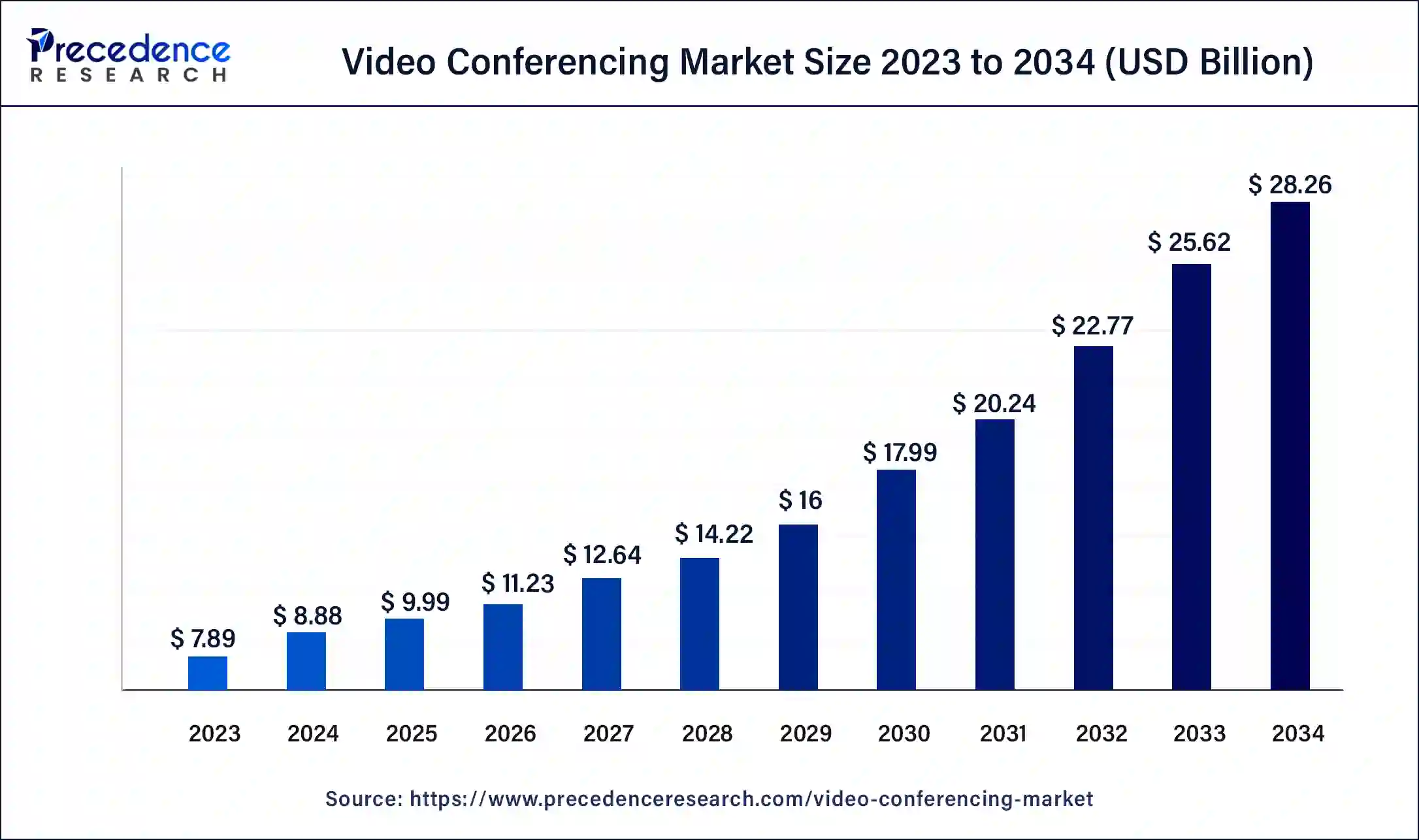

The global video conferencing market size was USD 7.89 billion in 2023, estimated at USD 8.88 billion in 2024 and is anticipated to reach around USD 28.26 billion by 2034, expanding at a CAGR of 12% from 2024 to 2034.

The global video conferencing market size accounted for USD 8.88 billion in 2024 and is predicted to reach around USD 28.26 billion by 2034, growing at a CAGR of 12% from 2024 to 2034.

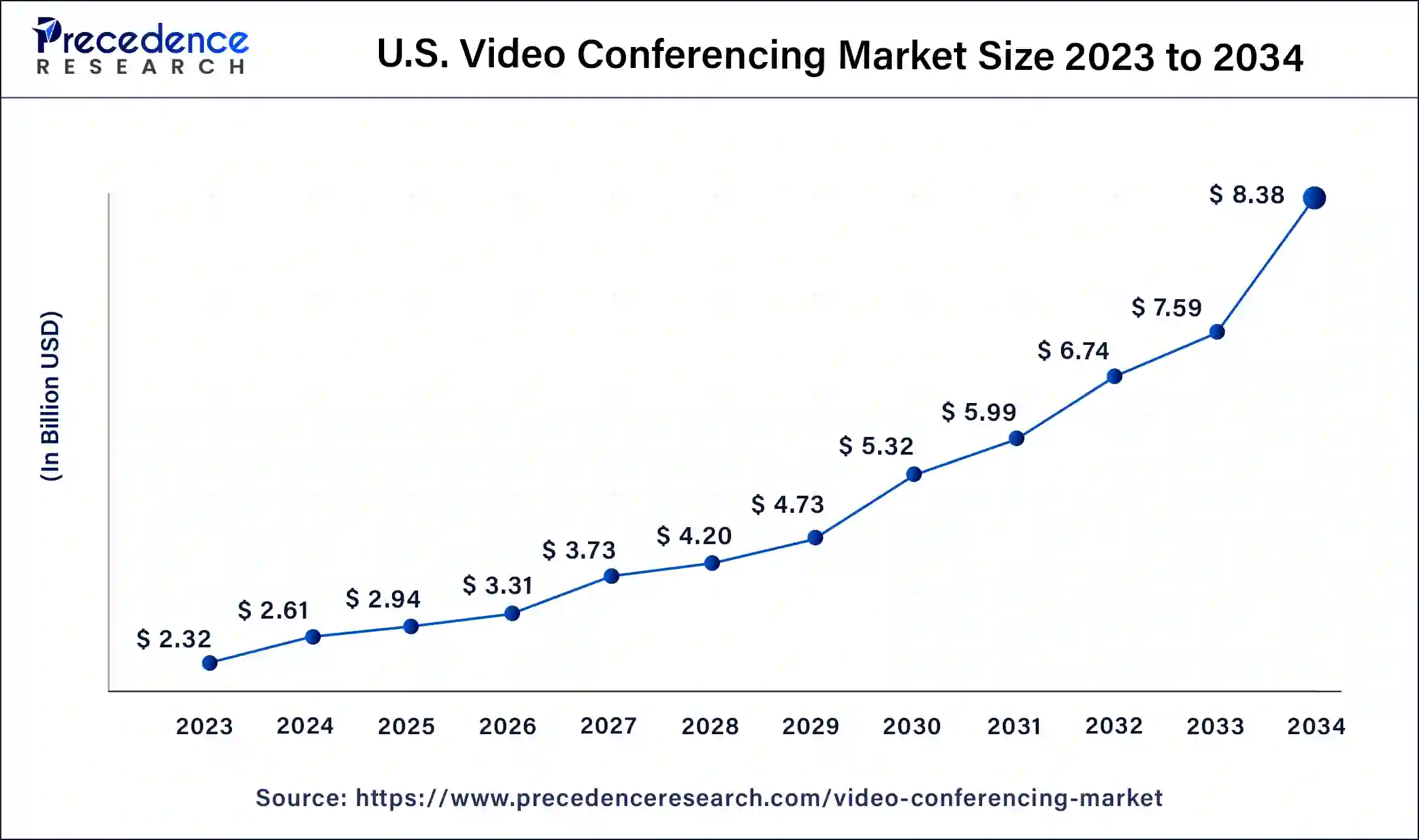

The U.S. video conferencing market size was valued at USD 2.32 billion in 2023 and is expected to be worth around USD 8.38 billion by 2034, at a CAGR of 12.35% from 2024 to 2034.

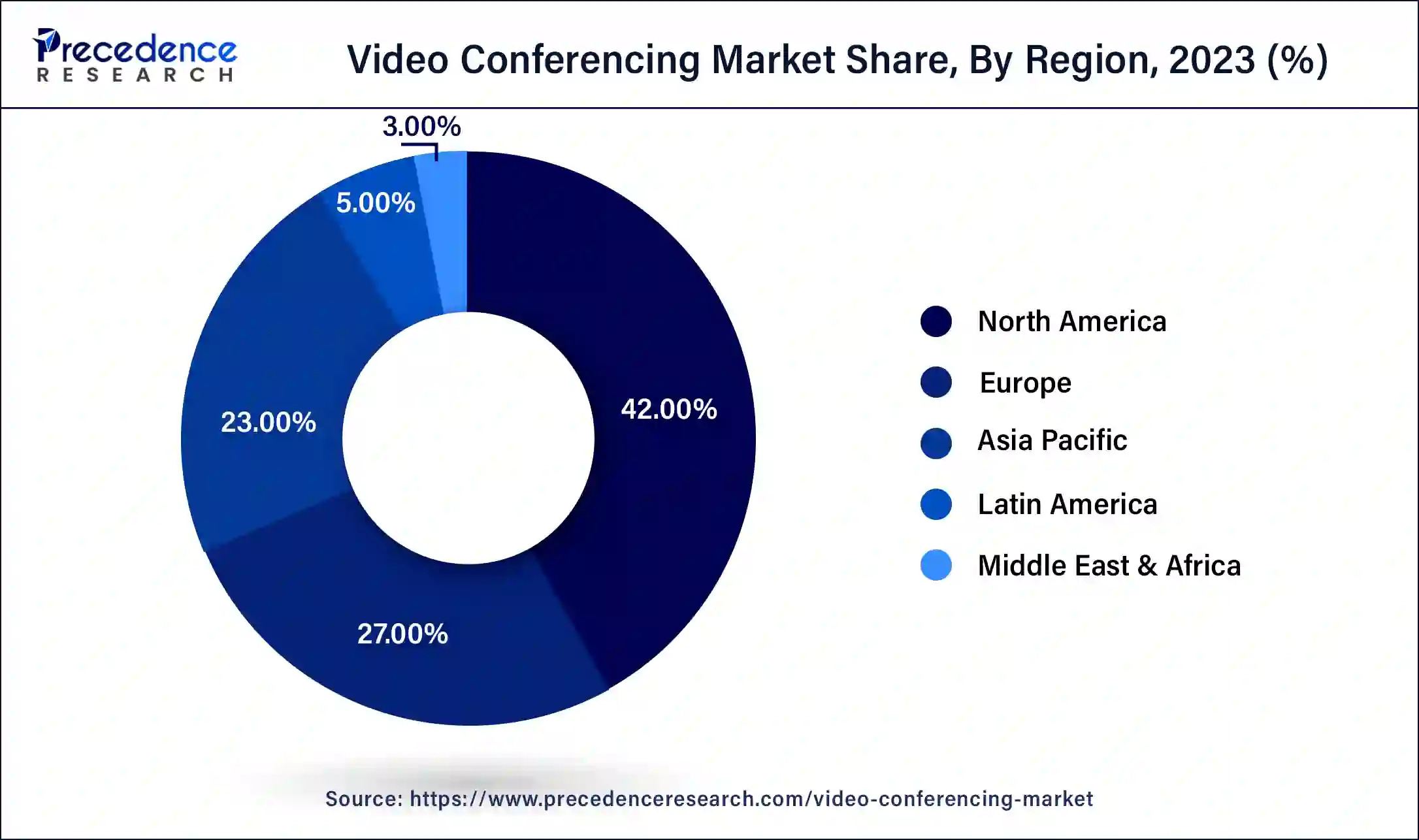

The North America region accounted revenue share of around 42% in 2023. The availability of big significant corporations such as Cisco Systems, Inc., Microsoft Corporation, Zoom Video Communications, Inc. and many more, and even the rapid adoption of technological solutions, are boosting market for these video conferencing solutions in the United States and Canada. The Asia Pacific region is expected to grow at a rapid pace. The increase is attributable to an increase in request for video infrastructure solutions for programmed operations in the academic and training sectors. The appearance of a substantial number of SMEs and a high number of locations of top global 1000 enterprises in the area suggests that the region has enormous market growth prospects.

The European market is projected to expand at a rapid rate of CAGR. The ease of use of a wide range of collaboration between stakeholder’s solutions and services has aided growth. Furthermore, rising corporate R&D investments are expected to improve Europe's share in the market in the coming years.

Real-time visual conferences among one or more users are referred to as video conferencing engagements. In the near future, market development is likely to be driven by the inclusion of established technology regarding internet of things (IoT), Artificial Intelligence (AI) and cloud technology. Also, the rising demand for video based communication, virtual administrative management and cloud technology based collaboration tools are important drivers influencing market expansion in positive manner. Companies and organisations are implementing video collaboration technologies in order to try and make quicker and more efficient decisions and avoid the large expenditures of travel.

Furthermore, rising demand for e-learning is expected to propel market expansion. For example, Cisco Systems, Inc. announced Webex Devices in December 2020, along with Webex’s hub camera to improve the distant work experience. Thus these objects promote the adoption of multifunctional workplaces as well.The rise in popularity of online and net banking between clients is expected to fuel the expansion of video conferencing industry trends. Customers that are using video banking alternatives could save time and money. Additionally, video banking allows end users to securely interact with distant clients and colleagues, enhancing productivity. As a result, officers, customer executive staff, financial counsellors, and others in the banking and finance business are increasingly utilizing visual communication solutions. Vendors are creating new solutions to address the increased competition for video products and services in the BASF.

Significant growth is being driven by increased urbanisation, which is crucial for the usage of video conferencing. The market economy is projected to be driven by consumers' high coverage of high-speed internet access. The bandwidth determines the type of connection that may be used for corporate video conferencing. Because of the cost reductions, the expanding startup environment is rapidly using cloud-based video conferencing systems. Many businesses are hesitant to spend in traditional workplace arrangements and infrastructures that is why video conferencing is becoming more popular with startups. A growing percentage of employees want to work remotely and conduct meetings via mobile devices. This practice has drastically cut corporate travel expenditures while increasing company levels of productivity.

Corporations in the video conferencing industry see significant economic opportunities in healthcare industry. This is clear since the income of the healthcare end-use industry is expected to expand rapidly throughout the projected timeframe. The obvious next step in the video conferencing business is clinics adopting video conferencing for post-discharge programmes. Conducting contractual enterprises in a worldwide setting is a significant aspect that is predicted to propel the global expansion of the video conferencing market. Due to increased globalization, corporations from many sectors aspire to run from several branches in different parts of the world in order to utilise the perks of local infrastructure, availability of knowledge, and cost savings in purchasing of materials.

| Report Coverage | Details |

| Market Size in 2023 | USD 7.89 Billion |

| Market Size in 2024 | USD 8.88 Billion |

| Market Size by 2034 | USD 25.61 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment, Application, Conference Type, and Enterprises Size |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The hardware industry has accounted for a sizable overall revenue of over 50% in 2023, owing to the increased usage of endpoints such as laptops, smartphones and desktops equipped with high-resolution cameras. Demand for enterprise-based hardware has decreased as more firms embrace the remote working paradigm in 2020.

Cameras and microphones/headphones are two subcategories of hardware segment. Between them, the microphones/headphones category had significant increase in 2023 as a result of rising sales volume during the pandemic, which was fueled by the widespread adoption of video conferencing technologies for team communication. Furthermore, continuous technical breakthroughs in the fields of augmented reality and the Internet of Things (IoT) also hastened the creation of sophisticated equipment, which is likely to boost category expansion even further.

In respect of deployment, the on-premise segment held the largest market in 2023, contributing for around 60% of total revenues. This is mostly due to the increased acceptance of this deployment approach throughout large enterprises in result of growing data security concerns. However, the increased preference for cloud technology is projected to impede segment development in the future years.

Over the projection timeframe, the cloud deployment sector is expected to increase at a considerable pace of roughly 14.5%. Cloud technology improves connectivity by providing simple access to video conferencing services via many platforms, such as mobile devices and laptop computers. Furthermore, the growing use of the Software as a Service (SaaS) platform, which has attracted a large number of small and medium-sized businesses, is driving category growth. As per Amazon Web Services, Inc., small and medium companies will boost their cloud operations in India in 2022.

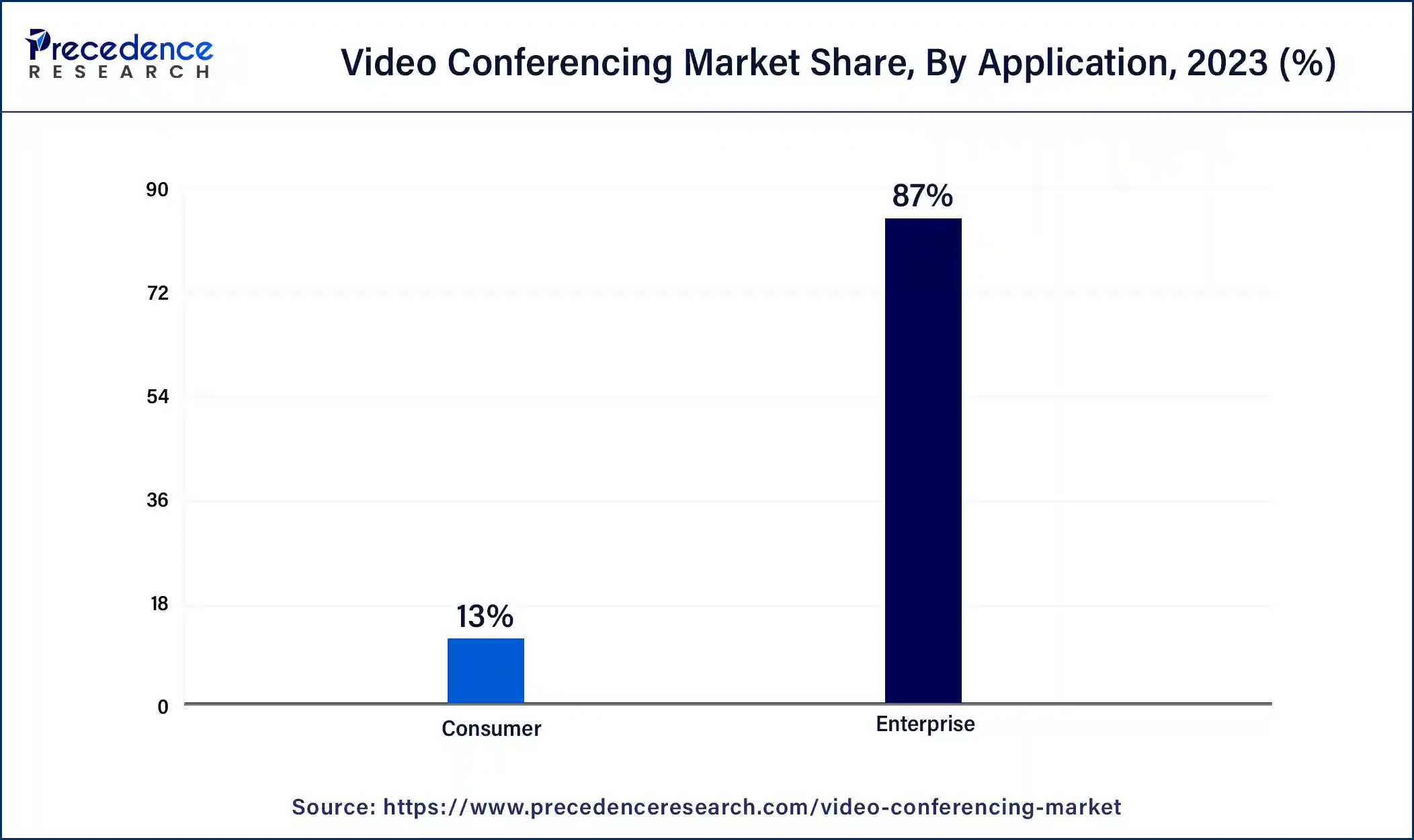

Due to competition for conference video endpoints, which are room-based equipment solutions deployed and installed in meeting spaces, the enterprise segment secured a sales portion of more than 87% in 2023. Given the rising product acceptance as a medium of communication and cooperation among employees, the development prospects for corporation video conferencing solutions were predicted to be stronger prior to the pandemic.

Nevertheless, the outbreak prompted an increase in the market for consumer solutions, prompting industry participants to add increased attributes to their goods and services in order to reach a bigger client base. For example, in September 2022, Logitech released its first pair of TWS earbuds, which were specifically tailored for the burgeoning work-from-home industry. The new TWS earbuds can connect to both PCs and cellphones at the same time.

Segments Covered in the Report

By Component

By Deployment

By Application

By Conference Type

By Enterprises Size

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

January 2025

November 2024