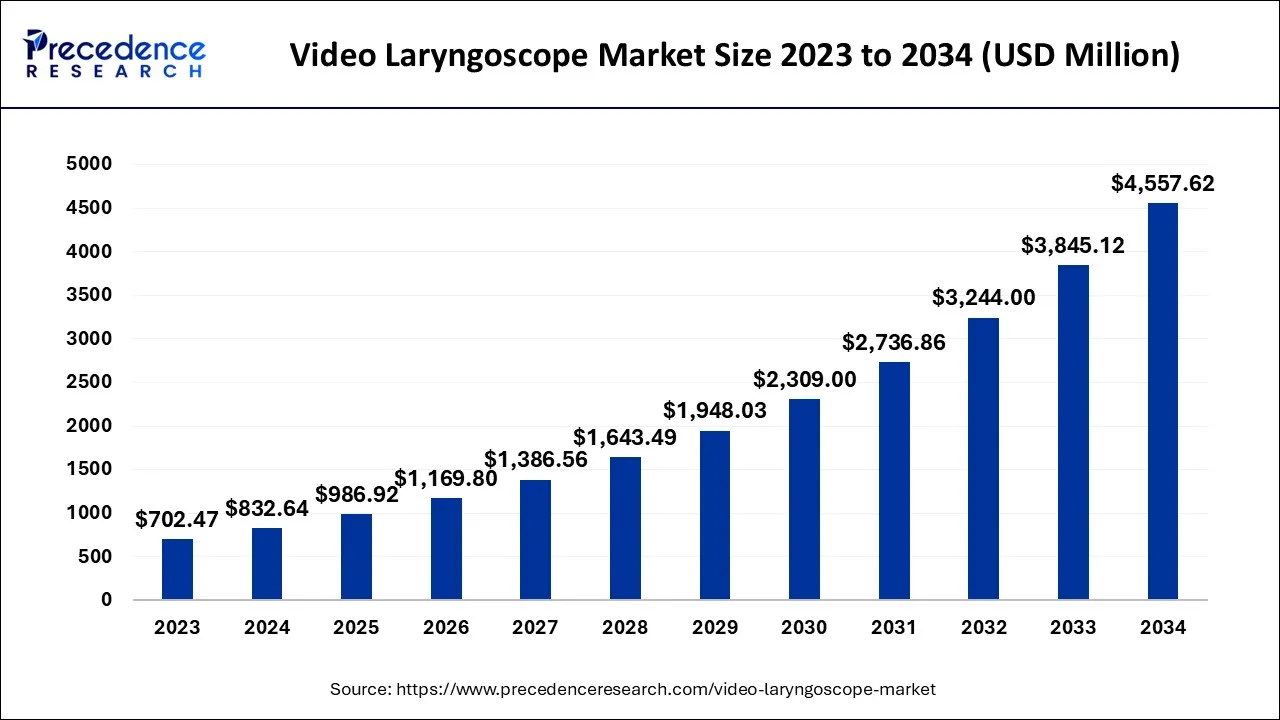

The global video laryngoscope market size accounted for USD 832.64 million in 2024, grew to USD 986.92 million in 2025, and is expected to be worth around USD 4,557.62 million by 2034, poised to grow at a CAGR of 18.53% between 2024 and 2034. The North America video laryngoscope market size is predicted to increase from USD 333.06 million in 2024 and is estimated to grow at the fastest CAGR of 18.68% during the forecast year.

The global video laryngoscope market size is expected to be valued at USD 832.64 million in 2024 and is anticipated to reach around USD 4,557.62 million by 2034, expanding at a CAGR of 18.53% over the forecast period from 2024 to 2034.

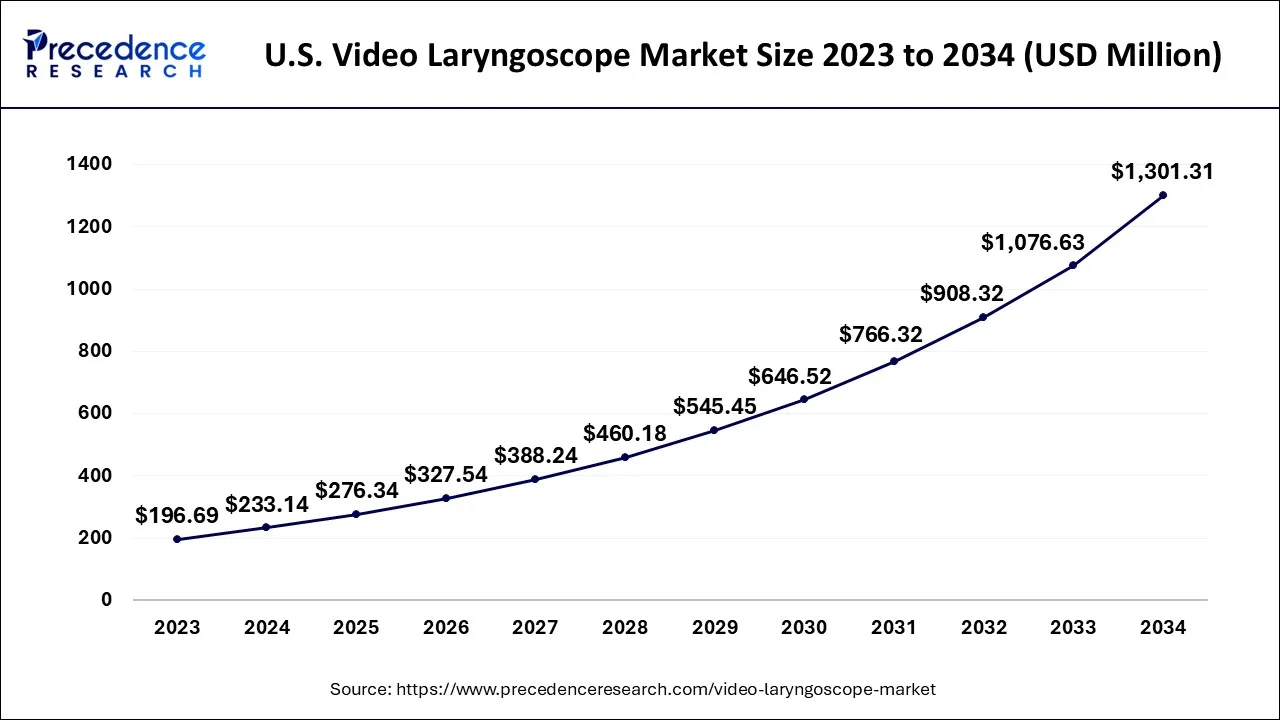

The U.S. video laryngoscope market size is exhibited at USD 233.14 million in 2024 and is projected to bevideo laryngoscope market worth around USD 1,301.31 million by 2034, growing at a CAGR of 18.76% from 2024 to 2034.

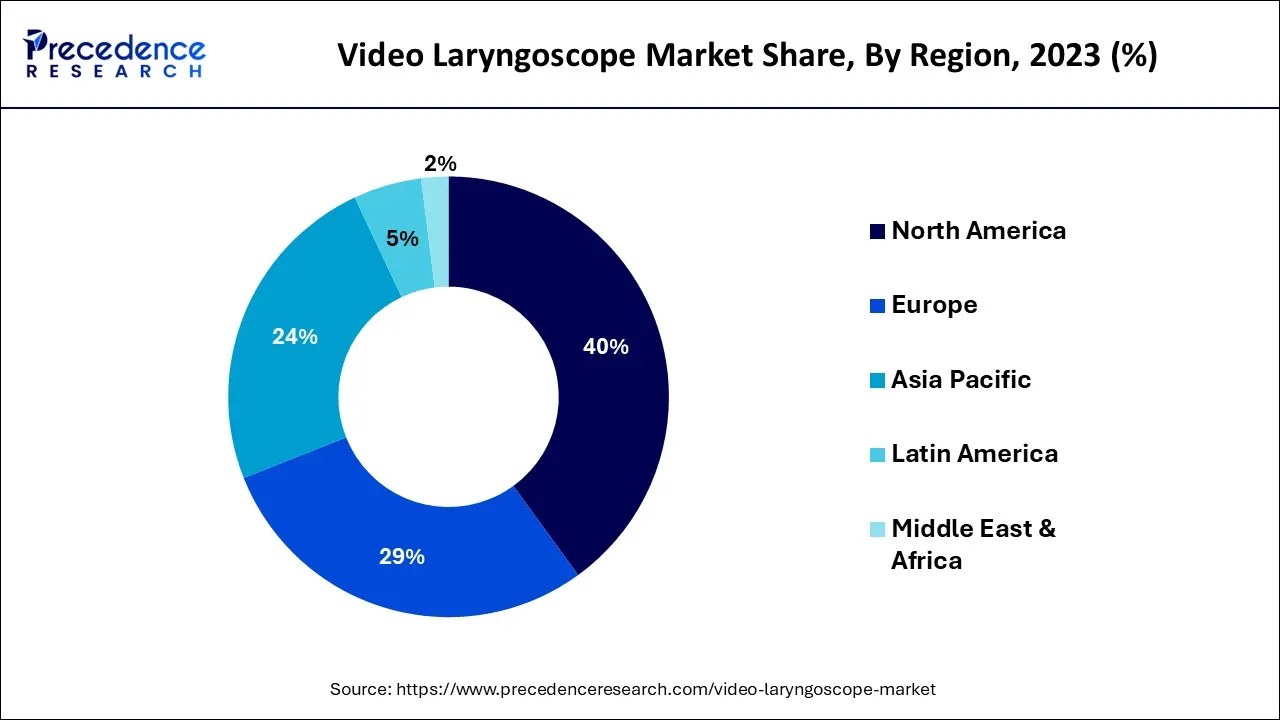

North America has held largest revenue share 40% in 2023. This is owing to the early adoption of technologies in the region even in the healthcare industry. The market for video laryngoscope in the United States is anticipated to grow significantly during the study period as a result of increased investments by large corporations and expansion strategies like mergers, acquisitions, and the introduction of novel products by market participants. Furthermore, the increasing occurrence of respiratory diseases is also likely to support the regional growth of the video laryngoscope market during the forecast period.

Additionally, the availability of guidelines for practicing by various healthcare organizations and American Society of Anesthesiologists (ASA) along with supportive government initiatives is also expected to contribute to the regional growth of the video laryngoscope market during the forecast period.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. The region is home to some of the world's largest and fastest-growing cities which is likely to increase the demand for video laryngoscopes, and this trend is expected to continue in the coming years. The rising government policies and incentives are likely to encourage the adoption of video laryngoscope which is driving market growth in the region. Further, the growing investment in the modernizing of the healthcare systems along with the growing need to reduce the healthcare costs is also likely to support the regional growth of the video laryngoscope market during the forecast period.

Video laryngoscopes consist of display monitor and an integrated camera to indirectly visualize the upper airway during the intubation procedures, helping to place the breathing tube in between the trachea and vocal cords. In addition to intubation, the recording and display features of video laryngoscopes are beneficial for teaching intubation techniques, chiefly in patients with difficult airways. These devices consist of four main components namely: interchangeable reusable or single-use blades, high-resolution small camera, integrated (attached) or stand-alone (cart-based) monitor and single or multiple internal power sources.

The growing awareness of the benefits of video laryngoscopes compared to the traditional laryngoscopes is a significant factor driving the growth of the market during the forecast period. These advantages include improved laryngeal visualization, reduction in applied force, reduced risk of cross contamination, visual confirmation of tube placement, and increased success rates for rescuing failed direct laryngoscopy, all of this is contributing to the increased demand of video laryngoscopes.

The rising occurrence of respiratory diseases is anticipated to augment the growth of the video laryngoscope market within the estimated timeframe. As robot-assisted intubation is gaining more popularity, the demand for video laryngoscopes is expected to increase further. With advancements in intubation, manufacturers have developed innovative solutions that provide medical professionals with more support and precision. By automating anesthetic treatment and improving all aspects of patient care, robot-assisted technologies reduce the burden on anesthesiologists. Various manufacturers and researchers are exploring the use of robotics in a range of laryngoscopy techniques.

Furthermore, as minimally invasive surgeries are preferred over open/invasive surgeries, the demand for minimally invasive laryngoscopic technologies is expected to increase in the years to come. Factors driving this trend include greater financial viability, higher patient satisfaction, shorter hospital stay, and fewer postoperative complications. Moreover, laryngoscopy is a relatively safe procedure, further boosting the growth of the video laryngoscope market by reducing surgical complications and the time required for recovery.

In addition, video laryngoscopes manufacturers across the globe are expanding their production units in emerging countries. The rise in demand and inadequate medical facilities in these economies are driving the market for video laryngoscopes. Nevertheless, the growth of the video laryngoscope industry is hindered by a shortage of qualified medical professionals and certified experts, especially in developing and underdeveloped countries.

| Report Coverage | Details |

| Market Size in 2024 | USD 832.64 Million |

| Market Size by 2034 | USD 4,557.62 Million |

| Growth Rate from 2024 to 2034 | CAGR of 18.53% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Usage Type, Device Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and, Middle East & Africa |

Increasing prevalence of respiratory diseases

The increasing prevalence of respiratory diseases is likely to contribute to the growth of the video laryngoscopes market during the forecast period. According to the World Health Organization, Chronic respiratory illnesses (CRIs) impact the lungs' airways and other skeletal and functional components. In 2019, chronic obstructive pulmonary disease (COPD) caused 3.23 million deaths worldwide, making it the third leading cause of death globally.

The majority of these deaths occur in low- and middle-income countries (LMIC), with nearly 90% of COPD deaths in those under the age of 70 being reported in LMIC. Furthermore, COPD is the seventh leading cause of poor health worldwide, as measured by disability-adjusted life years. Tobacco smoking is responsible for over 70% of COPD cases in high-income countries. However, in LMIC, household air pollution is a major risk factor, with tobacco smoking accounting for 30-40% of COPD cases.

As respiratory diseases become more common, the demand for video laryngoscopes is rising globally. This is because video laryngoscopes are an effective tool for the placement of breathing tubes between the vocal cords and into the trachea to maintain the airway. They provide indirect visualization of the upper airway, which is particularly useful in people with difficult airways. In addition, the record and display features of video laryngoscopes are helpful for teaching intubation techniques, thereby increasing their adoption.

When it comes to difficult airway cases, the video laryngoscope is considered a crucial tool. It can be used as the primary method for tracheal intubation or as a backup rescue technique. Given the constantly evolving and challenging nature of difficult airway cases, it is important for anesthesiologists to have access to video laryngoscopes to ensure safe tracheal intubation. Therefore, the video laryngoscope must be considered an essential resource for anesthesiologists in such scenarios. Consequently, the increasing prevalence of respiratory diseases is creating a greater need for video laryngoscopes, which is driving the growth of the market.

High costs of the device

When healthcare providers consider incorporating video laryngoscopy into their regular clinical practice, the cost of the equipment is often a primary concern. There are several factors that can impact the cost of video laryngoscopes, including the cost of the laryngoscope handle and blade. Video laryngoscope systems are generally classified as either cart-based or handheld, and these different types affect how the systems are used and the associated costs.

The cost of video laryngoscopes can range from $1,000 to $15,000, in contrast to a single-use, disposable laryngoscope which costs around $18 apiece. Bulk purchases may lower the total purchase cost, with the McGRATH MAC video laryngoscope costing less than $1,000 each when bought in bulk. The cost of the laryngoscope blade is also a factor, with reusable blades having a higher upfront cost and recurring cleaning costs after each intubation.

In comparison, disposable blades have only an upfront purchase cost, ranging from $6 to $18 per blade. This is expected to restrain the growth of the video laryngoscope market within the estimated timeframe.

Introduction of new technologies

Manufacturers of video laryngoscopes are addressing the unmet needs of healthcare professionals who perform difficult intubations. They focus on introducing advanced devices to improve performance and safety during intubations. In February 2018, Dilon Technologies Inc. launched CoPilot VL+, an advanced device designed to provide optimal view of the airway during placement of breathing tubes.

The market players are introducing fully disposable devices, such as Vivid Medical and Intersurgical Ltd., which are preferred by healthcare providers due to the reduced risk of cross-contamination compared to reusable direct laryngoscopes. Key players are also adopting inorganic growth strategies such as acquisitions to establish their foothold in the market and commercialize their products globally. These initiatives are expected to result in the introduction of advanced devices, which will boost the demand for video laryngoscopes during the forecast period.

On the basis of product, the rigid segment held largest revenue share in 2023. The growth of the segment is expected to be driven by increase in development of the product and investments by various market players. The segmental growth is also attributed to the decreasing use of traditional laryngoscopes. The rigid video laryngoscopes have advantages over direct laryngoscopy as they overcome line-of-sight limitations. Minimal head manipulation and positioning are required for rigid video laryngoscopes, compared to conventional direct laryngoscopy. Therefore, this trend is expected to boost the growth of the segment in the global video laryngoscope market during the forecast period.

On the basis of usage type, the reusable segment held the largest revenue share in 2023. Medical professionals and hospitals consider reusability as a significant factor when making purchasing decisions for video laryngoscopes. These devices are preferred because they are easy to use and offer greater functionality than traditional laryngoscopes. While reusable video laryngoscopes may have higher upfront costs, they do not need to be replaced as frequently, leading to increased adoption and a larger market share.

Based on the end-user, hospital segment held the largest market share in 2023. The increase in the number of airway management procedures that are performed in hospitals is making them the primary users of video laryngoscopes. The adoption of video laryngoscopes has increased due to their ability to provide improved visualization, leading to higher success rates in intubation procedures and improving safety for patients and healthcare practitioners compared to traditional direct laryngoscopy. In February 2021, Ambu expanded its presence in the endoscope market by extending contracts with two key Group Purchasing Organizations in the United States, which granted around 90% of US hospitals access to the company's range of single-use endoscopes such as rhino laryngoscopes and cystoscopes.

Segments Covered in the Report

By Product

By Usage Type

By Device Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client