August 2024

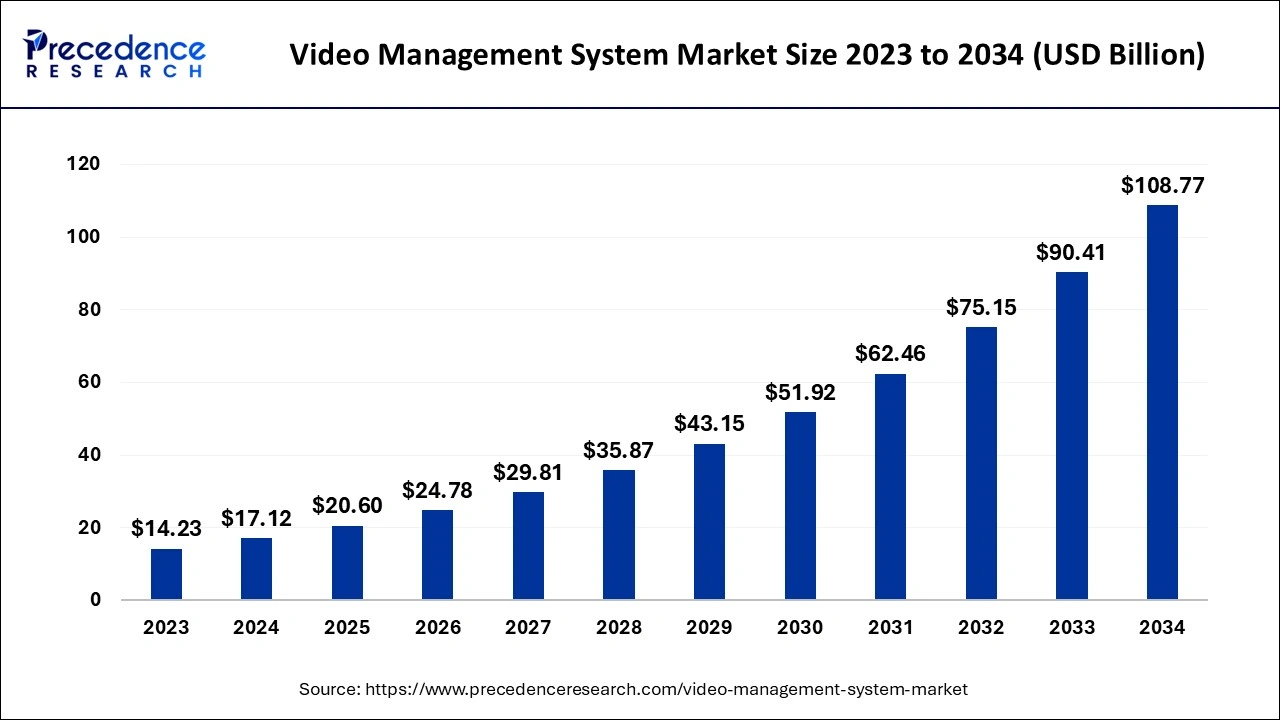

The global video management system market size is calculated at USD 17.12 billion in 2024, grew to USD 20.6 billion in 2025 and is projected to surpass around USD 108.77 billion by 2034. The market is representing a healthy CAGR of 20.31% between 2024 and 2034. The North America video management system market size is evaluated at USD 5.99 billion in 2024 and is estimated to grow at a fastest CAGR of 20.46% during the forecast period.

The global video management system market size is worth around USD 17.12 billion in 2024 and is predicted to reach around USD 108.77 billion by 2034, with a CAGR of 20.31% from 2024 to 2034.

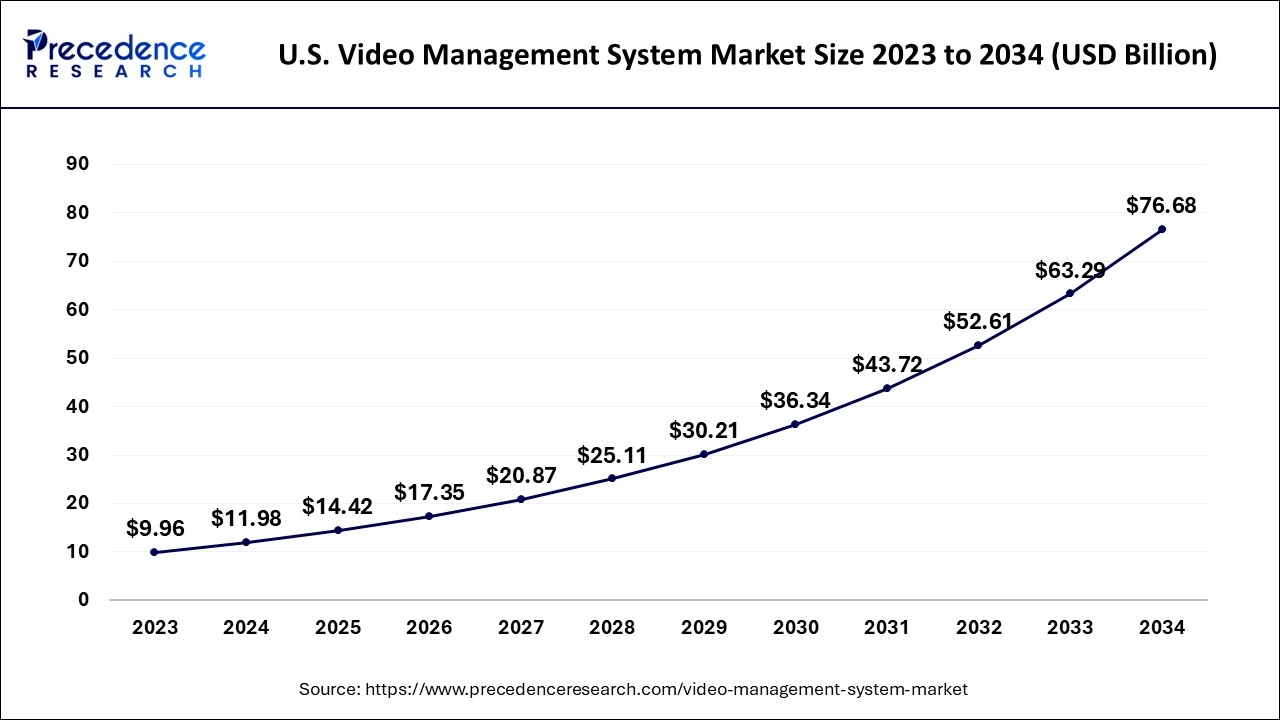

The U.S. video management system market size is exhibited at USD 11.98 billion in 2024 and is projected to be worth around USD 76.68 billion by 2034, expanding at a double-digit CAGR of 20.38% from 2024 to 2034.

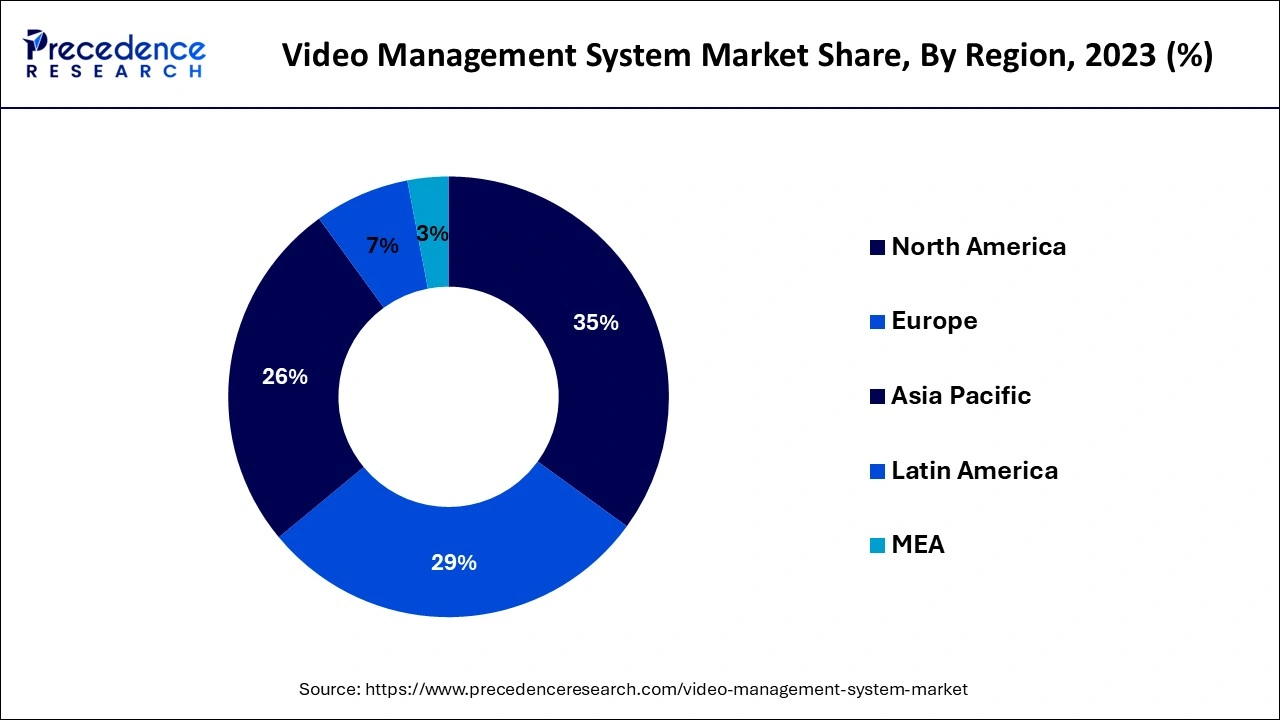

North America dominated the video management system market in 2023. The region's market is anticipated to expand continuously over the next decade, propelled by the presence of major VMS companies, rising deployment of VMS for traffic management and highway safety, and rising concern to safeguard critical infrastructure and national borders with the use of VMS. Additionally, the region’s rapid growth is driven by the increasing adoption of IP-based surveillance systems and monitoring systems facilitated by aging infrastructure. Furthermore, there is a significant rise in demand for affordable cloud-based video surveillance and VMS in a wide range of end-user industries.

Asia Pacific is anticipated to grow at a notable rate in the video management system market during the forecast period. Regional growth is attributed to the rise in small and medium-sized businesses and the increase in investments in smart cities and infrastructure development. China, India, and Japan are expected to be leading countries witnessing strong demand for video management systems (VMS) during the forecast period, owing to the rising usage of video surveillance networks for public safety purposes.

Rapid urbanization and industrialization in the region are driving the demand for VMS solutions, which is expected to boost the growth of the market in Asia Pacific. Furthermore, the government's supportive initiative is expected to witness positive infrastructural developments in the region. Asia Pacific is experiencing an exponential increase in population, particularly in countries like China and India, which is creating lucrative opportunities for the video management system market. VMS solutions assist in monitoring and managing populated areas to ensure public safety.

A video management system (VMS) is a software-based platform that manages and controls video surveillance cameras, recording devices, and various other security components. VMS systems can also allow for video recording from multiple cameras, and the recorded videos are stored on a server or network storage device. A video management system assists users in monitoring events through surveillance cameras and provides alerts for any potential risks, threats, events, or scheduled tasks.

VMS systems permit security personnel to view live video feeds from surveillance cameras in real-time, either remotely or on-site. It is interoperable with other systems, which is likely to enhance overall security. VMS are generally used by businesses, governments, individuals, and other organizations that require large-scale surveillance and prioritize security monitoring. This system provides the option to search and retrieve any recorded video.

| Report Coverage | Details |

| Market Size by 2034 | USD 108.77 Billion |

| Market Size in 2024 | USD 17.12 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.31% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Technology, Mode Of Deployment, End-User Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing concern for public security and safety

The rise in security surveillance is expected to boost the expansion of the video management system market in the coming years. The market has witnessed robust growth in security measures to ensure public safety. Video management system generally manages data streamed from several surveillance devices, including security cameras. It allows the user to access real-time videos and recorded videos and derive critical insights from the surveillance site. Several government entities are focusing on developing and deploying sophisticated surveillance cameras in densely populated areas.

Organizations or businesses with multiple locations are adopting video management system market services to integrate all areas and get centralized monitoring. It allows for real-time tracking. Additionally, the rising use of security cameras in public and private places such as roads, hospitals, airports, railways, banks, metro stations, small and medium-sized businesses, residential buildings, and others has been observed in recent years.

High implementation cost

The high implementation cost associated with VMS is anticipated to hamper the video management system market growth. High initial costs, including hardware, software, and integration costs, are required for the implementation of VMS. Due to budget constraints, small and medium-sized enterprises are often discouraged from adopting these technologies.

Rapid technological advancement in VMS

The technological advancement in VMS is projected to offer a lucrative opportunity for the growth of the video management system market during the forecast period. Several companies are engaged in introducing new and advanced technologies to sustain their position and gain a competitive edge in the market. Customers are increasingly being shifted from conventional video cameras to IP video camera (IP) systems. With rapid technological advancement and cloud-based technology, the VMS is gaining significant popularity in the market.

Video management systems offer various advanced functionalities such as video analytics, remote or on-site access, and real-time monitoring, which makes them crucial for modern surveillance systems. The integration of advanced technologies, including AI and the Internet of Things (IoT), enhances the capabilities of VMS, which enables safety features like automated potential threat detection.

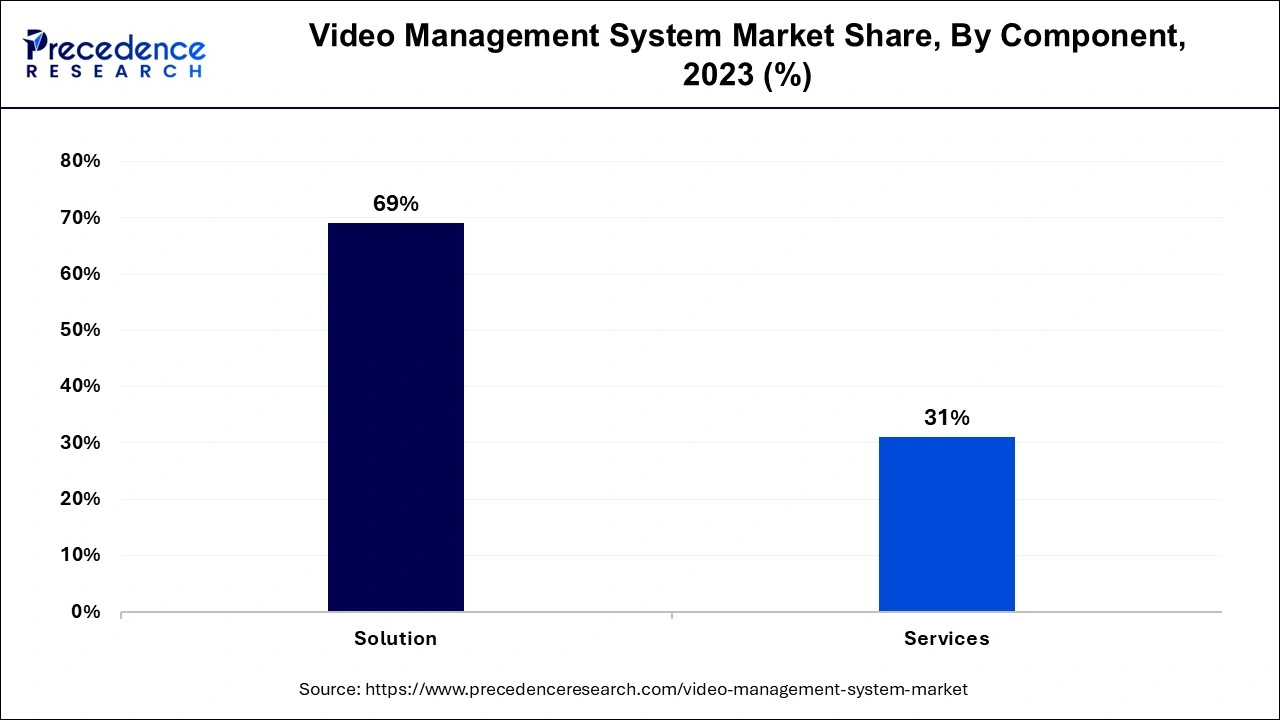

The solution segment accounted for the largest share of the video management system market in 2023. Organizations adopt video management solutions that offer interoperability with other systems to enhance overall security. Video management solutions play an integral role in several sectors, offering numerous applications. Moreover, large enterprises and academic institutions use VMS for many purposes, such as corporate training, live event streaming, executive communication, and others.

The services segment is expected to grow at a rapid CAGR in the video management system market over the forecast period. It encompasses a wide range of offerings, including education, certification, consulting, training, planning, implementation, and others. These services are considered important as several end-users often lack the technical expertise to store and handle video data effectively.

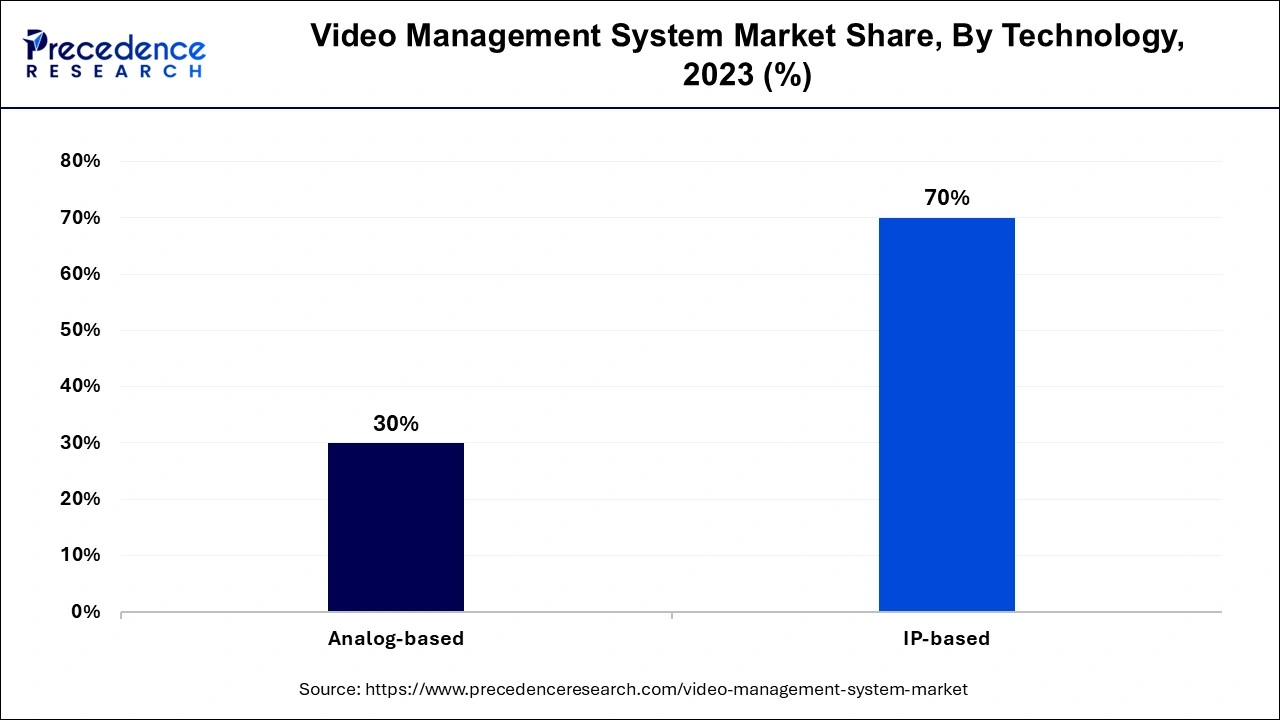

The IP-based segment accounted for the dominating share of the video management system market in 2023 and is projected to continue its dominance over the forecast period. In recent years, the market has witnessed the increasing use of IP cameras owing to the rising demand for high-resolution images and perimeter monitoring. IP-based cameras provide several advanced features that have been important in addressing various critical issues in several industries. Real-time communication capabilities increase the need for IP-based VMS. It facilitates smooth and instantaneous data transmission, enabling quick decision-making and response in a wide range of applications.

The analog-based segment will witness considerable growth in the video management system market over the forecast period. The analog-based VMS is capable of supporting several cameras, including the latest IP and older analog cameras. Analog-based VMS can generate a dynamic range of high-efficiency video coding (HEVC) content according to the needs of the users.

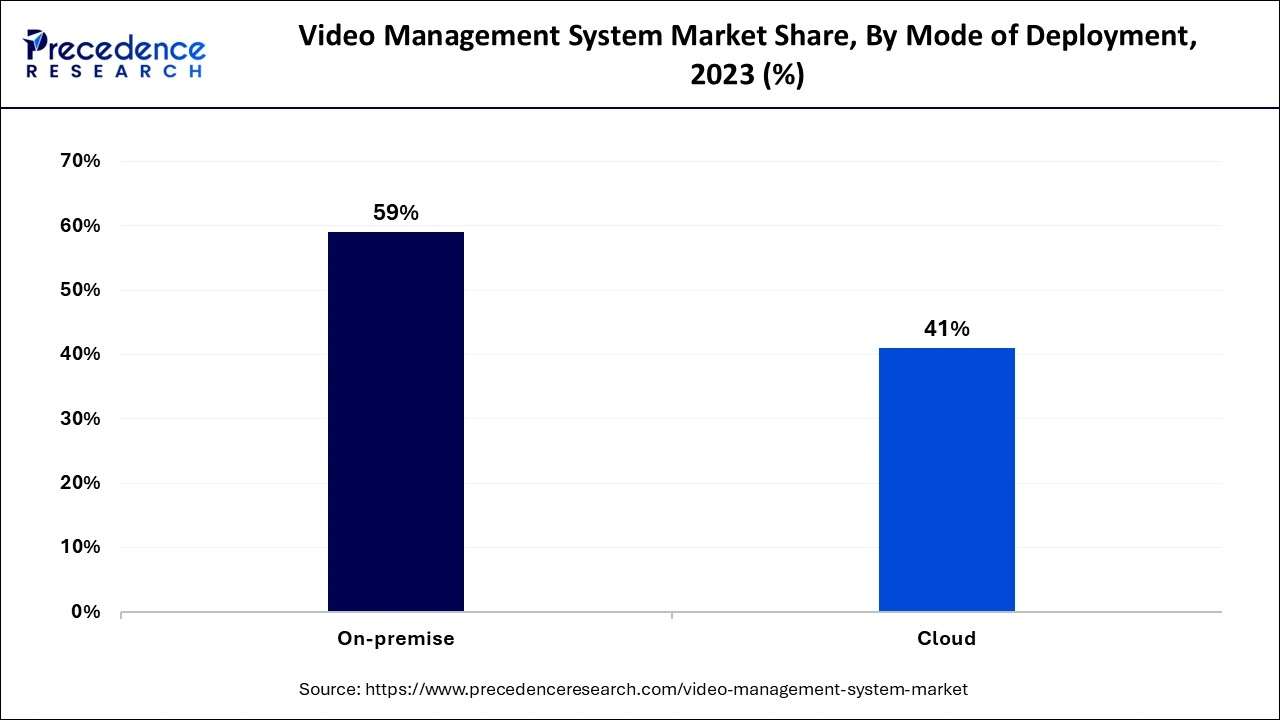

The on-premises segment held the dominating share of the video management system market in 2023. The segment’s growth is driven by the benefits offered by the VMS flexibility, cost-effectiveness, and scalability. On-premise solutions are increasingly becoming popular across various industry verticals, such as traffic management building and infrastructure management. Organizations or businesses are adopting VMS to improve their streaming experiences by using these systems within their internal IT infrastructure as well as leveraging real-time messaging protocol (RTMP) encoders.

The cloud segment is expected to grow at a notable rate in the video management system market during the studied years. In recent years, cloud-based video management systems have provided excellent and tailored experiences for organizations or businesses. Cloud-based technology delivers scalable and cost-effective solutions for encoding various video formats. These systems enable organizations to provide more personalized and responsive experiences to their users.

The retail segment held the largest share of the video management system market in 2023. The video management system market plays a crucial role in the retail industry. The retail vertical includes small retail stores, shopping malls, and others. Customers are mostly always present in shopping centers, which increases the risk of theft and scams. Video surveillance software provides a secure environment for both customers and employees. IP-based cameras are widely utilized in the retail sector. There are several reports of employees engaging in fraudulent financial transactions. The IP video surveillance system assists in addressing this issue by electronically connecting all transactions and video recordings of the events. This data gets stored in a centralized database, allowing retailers to view all the transactions and search on various parameters if required. Advanced digital IP-based video cameras and recorders are deployed in retail stores to prevent fraud, theft, and unsubstantiated claims. It also offers remote access, allowing executives to monitor the performance of their stores from their comfort places with access to the internet.

The transportation & logistics segment is expected to grow significantly in the video management system market during the forecast period. The video management system is crucial for effective traffic monitoring and management to ensure road safety. The rise in urbanization and population growth results in increasing traffic, which increases the demand for advanced video solutions for traffic safety. Rising investment in the logistics industry and transportation, including roadways, railways, airports, and seaports, are observed.

Segments Covered in the Report

By Component

By Technology

By Mode of Deployment

By End-user Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

January 2025

January 2025