March 2025

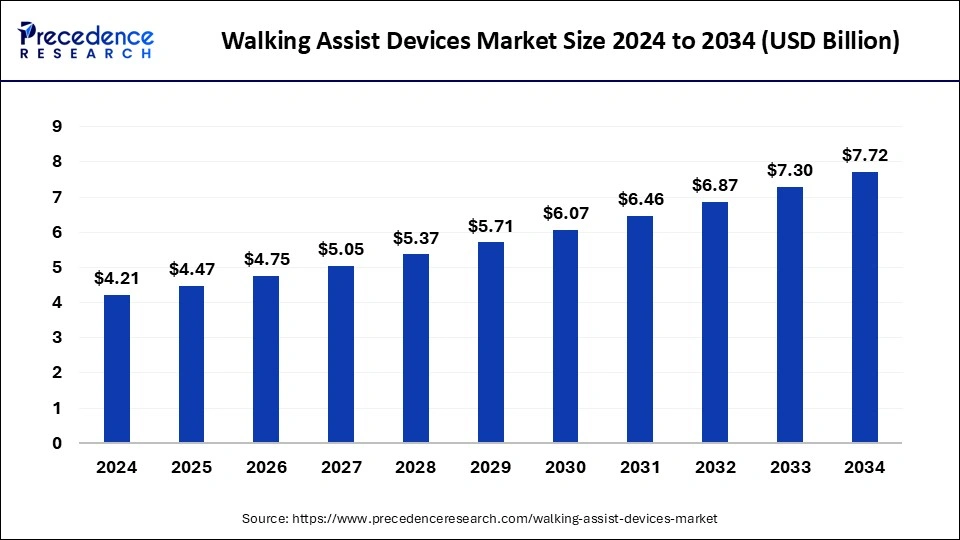

The global walking assist devices market size is accounted at USD 4.47 billion in 2025 and is forecasted to hit around USD 7.72 billion by 2034, representing a CAGR of 6.25% from 2025 to 2034. The North America market size was estimated at USD 1.52 billion in 2024 and is expanding at a CAGR of 6.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global walking assist devices market size was calculated at USD 4.21 billion in 2024 and is predicted to increase from USD 4.47 billion in 2025 to approximately USD 7.72 billion by 2034, expanding at a CAGR of 6.25% from 2025 to 2034. The rising demand for the mobility solutions for the physically disabled people or injured people with difficulties in walking independently is driving the growth of the walking assist devices market.

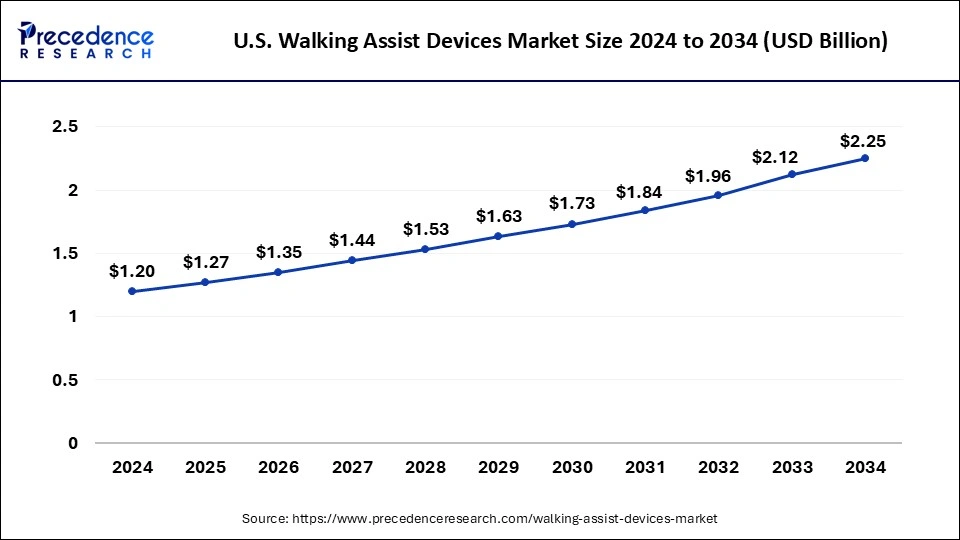

The U.S. walking assist devices market was exhibited at USD 1.20 billion in 2024 and is projected to be worth around USD 2.25 billion by 2034, growing at a CAGR of 6.49% from 2025 to 2034.

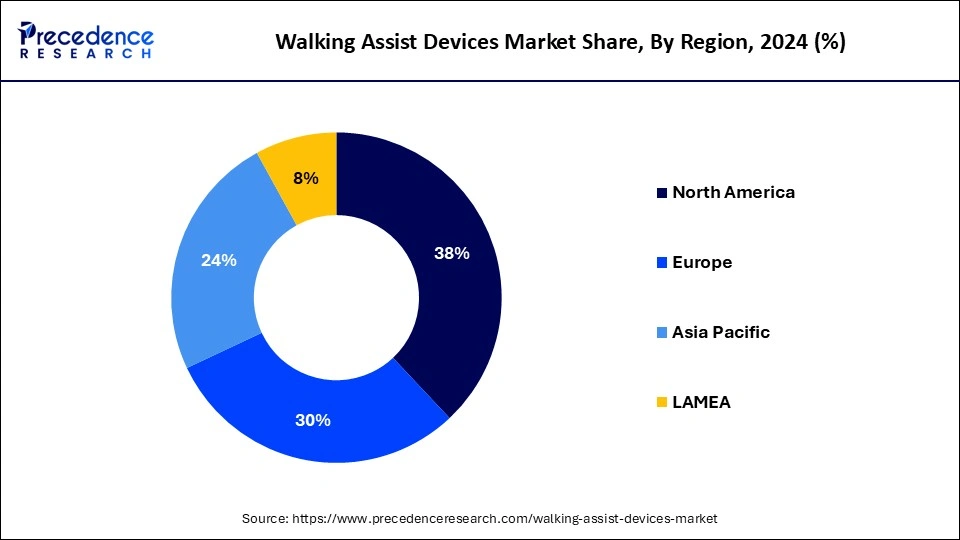

North America dominated the assist devices market in 2024. The growth of the walking assist devices market is attributed to the increasing availability of well-developed healthcare infrastructure and the availability of major market players that support the trend of assisted walking devices. The region has recorded significant growth in surgeries like knee and hip replacement, which is driving the demand for assisted walking devices by patients and hospitals.

The increasing demand for assisted walking devices by patients ' surgeries is due to difficulties due to surgical operations and extreme pain in walking. The assisted walking devices help patients with independent mobility. Additionally, the technological integration in healthcare devices and the ongoing investment in the further launch and innovations in new healthcare devices are contributing to the expansion of the walking assist devices market in the region.

Asia Pacific is expected to witness significant growth in the walking assist devices market during the forecast period. The growth of the market is attributed to the rising population and the rising number of geriatric population suffering from some kind of physical pain and challenges in walking due to the aging effect or some kind of disease that drives the demand for assisted walking devices. The rising number of road accidents and surgical treatment is further contributing to the demand for assisted walking devices. The growing disposable income in the population and the surging expenditure on healthcare are also boosting the growth of the market in the region.

Walking devices are also known as ambulatory-assisted devices that are used by patients suffering from walking issues post-surgery to help support patients in ambulating independently. The assisted walking devices aim to enhance the walking pattern and improve balance and safety while moving independently. There are several types of assisted walking devices, such as walkers, canes, wheelchairs, and communication aids. The increasing geriatric population and the rising incidents like accidental cases, post-surgical operations, and falls are some of the causes that lead to the challenge in mobility and drive the demand for the walking assist devices market.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.72 Billion |

| Market Size in 2025 | USD 4.47 Billion |

| Market Size in 2024 | USD 4.21 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, Age Group, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing geriatric population

The rising global population and the rising aging population are mostly affected by some types of physical diseases, such as arthritis and other orthopedic conditions, due to the aging effects that lead to the difficulties in walking that drive the demand for assisted walking devices. Additionally, the increasing number of surgical operations in the targeted diseases drives the demand for assisted walking devices. The rise in traumatic injuries, such as the risk of falls, road accidents, spinal cord injuries, and brain injuries that may cause physical disabilities in patients, also boosts the growth of the walking assist devices market.

High cost

The higher cost associated with assisted walking devices limits the growth of the market. The increased cost of devices is not afforded by the fixed and limited-income seniors or geriatric population with low monthly incomes. Thus, the higher cost of the devices is restraining the growth of the walking assist devices market.

Integration of advanced technologies

The integration of smart technologies such as artificial intelligence and robotics into assisted walking devices is used as the mobility solution for patients with some kind of challenges in walking independently. The expansion of artificial intelligence and robotics are driving the opportunities in the advancements in assisted walking devices. AI helps in enhancing assisting technologies and helps people make their lives easier. Many of the major players in the walking assist devices market are researching the advancements in assisted walking devices like wheelchairs.

The walker's segment held the largest walking assist devices market share in 2024. The growth of the segment is attributed to the rising adaptation of the walkers by the patients with the post-surgical operations that are driving the demand for the walkers. The higher adoption of walkers is due to their advanced safety, which is used to stabilize patients with poor balance. The walker provides more balance and a base of support than other walking devices like walking sticks. It comes with three sides and a side closet. Walker has several benefits, such as promoting independent mobility, increasing metabolic and musculoskeletal demands, optimizing activity levels, and reducing the risk of falls. There are various types of walkers available on the market, depending on the user or patient's requirements. Rollators, knee walkers, and walker cane hybrids. The Rollators are one of the common types of walkers that come with handlebars, four-wheels, and comforting space for seating; they are also equipped with handbrakes for safety concerns.

The geriatric population segment dominated the walking assist devices market in 2023. The rising geriatric population around the world, which comes under the age group of 60 and above, is more likely to get affected by incidents like the risk of falls and misbalance, weakness in muscles, and pain in joints that may lead to difficulty in mobility independently that may drive the demand for the walking assist devices market. Additionally, the increasing prevalence of chronic diseases in the geriatric population, such as Parkinson’s disease and arthritis, is one of the major reasons for the rising demand for assisted walking devices by the geriatric population.

The homecare segment led the global walking assist devices market in 2023. The increasing demand for home healthcare facilities due to the higher comfort and home healthcare reduces the extra time for traveling. The rising adoption of advanced technologies in healthcare, such as the rise of telehealth, is driving the growth of the home healthcare segment in the healthcare industry. The increasing demand for assisted walking devices is due to the geriatric population's preference for home treatment for comfort, which is also driving the growth of the walking assist devices market.

By Products

By Age Group

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

April 2025

January 2025

January 2025