September 2024

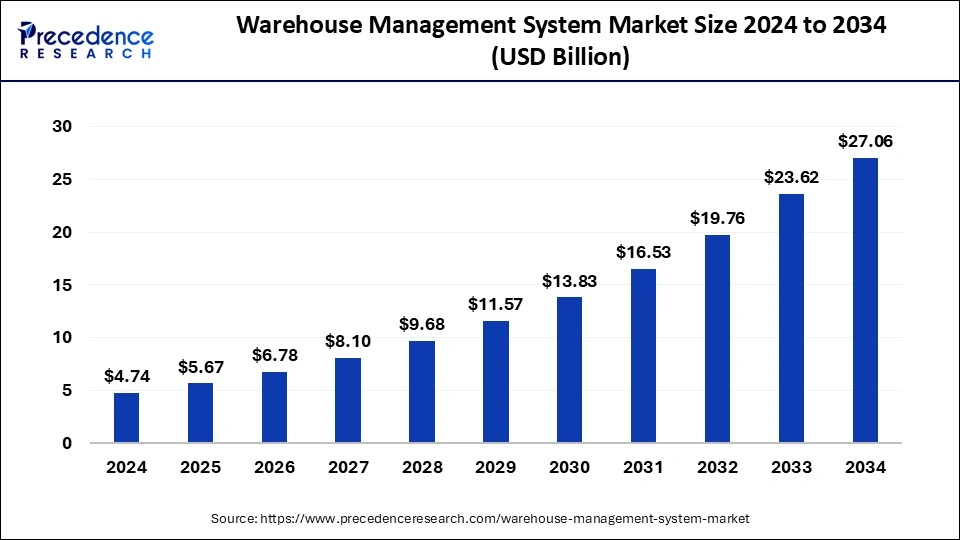

The global warehouse management system market size is calculated at USD 5.67 billion in 2025 and is forecasted to reach around USD 27.06 billion by 2034, accelerating at a CAGR of 19.03% from 2025 to 2034. The Europe warehouse management system market size surpassed USD 1.87 billion in 2025 and is expanding at a CAGR of 19.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global warehouse management system market size was estimated at USD 4.74 billion in 2024 and is predicted to increase from USD 5.67 billion in 2025 to approximately USD 27.06 billion by 2034, expanding at a CAGR of 19.03% from 2025 to 2034. Growing economies across the globe have propelled various sectors, such as healthcare and manufacturing, which are the key drivers of the warehouse management system market.

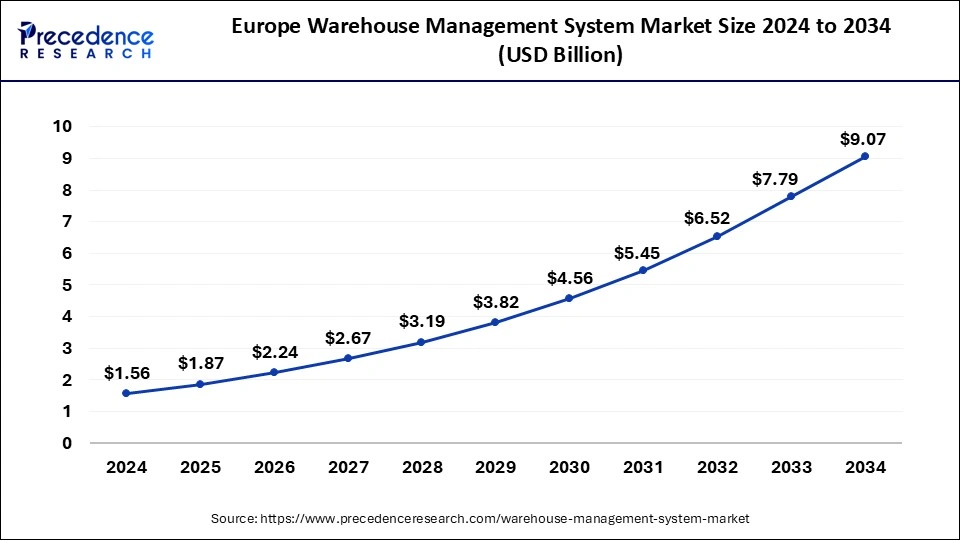

The Europe warehouse management system market size was valued at USD 1.56 billion in 2024 and is expected to be worth around USD 9.07 billion by 2034 with a CAGR of 19.25% from 2025 to 2034.

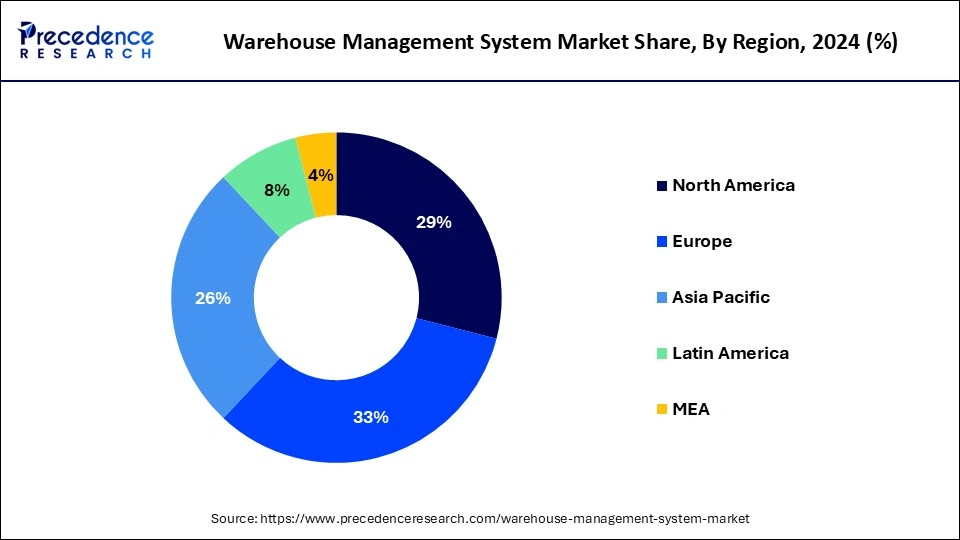

Europe dominated the warehouse management system market in 2024. The current expansion of the warehouse management system market in Europe is driven by the innovation in warehouse management systems and the increasing adoption of cloud-based solutions. The market is further fueled by the presence of extensive networks of third-party logistics (3PL) providers and large corporations providing global distribution and storage services alongside continued growth in the e-commerce industry.

Asia Pacific is expected to host the fastest-growing warehouse management system market during the period studied. Various technological advancements, such as the utilization of connected devices and sensors to manage product quantities efficiently, have facilitated the adoption of WMS. As a result, the WMS market is projected to experience steady growth in the region throughout the forecast period.

In the Asia Pacific warehouse management system market, China is expected to dominate with a significant revenue share. Increased demand from manufacturers for software that assists in order tracking, labeling, and quality control management is anticipated to be a crucial factor for market growth.

A warehouse management system (WMS) is a software application designed to oversee and manage warehouse operations. It provides comprehensive visibility into a company’s entire inventory and handles supply chain fulfillment processes from the distribution center to the retail shelf. Functions of these systems include inventory control, workforce management, yard management, and dock management.

Implementing a WMS can minimize errors and accidents during product distribution. It enhances a company's ability to fulfill orders promptly and efficiently while tracking products within the warehouse. Additional benefits of an integrated warehouse management system are reduced fulfillment time, improved customer service, better space utilization, and lower labor costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.06 Billion |

| Market Size in 2025 | USD 5.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 19.03% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing automation in distribution channels

In today's landscape, automation is a vital component across all industries. Distribution businesses globally are increasingly focusing on enhancing automation to reduce costs, improve throughput and efficiency within existing distribution routes, and address labor issues and other challenges. Automation is significantly transforming distribution channels and altering the sales process. With automation, tasks such as accessing data insights, managing inventory and sales processes, and understanding competitors have become more streamlined.

The high implementation cost of on-premises WMS

The high implementation cost of on-premises warehouse management systems is a significant factor hindering market growth. The expense of setting up on-premises WMS is substantially higher compared to other enterprise software—additionally, the salaries of IT personnel and the infrastructure costs associated with on-premises WMS present major challenges. In developing economies, the lack of reliable, high-quality Internet makes cloud-based WMS unreliable. These factors can impede the growth of the warehouse management system market.

E-commerce growth and supply chain management

The rise of e-commerce has increased the demand for the warehouse management system market as businesses strive to handle the surge in online sales. To keep pace with the need for rapid and precise order fulfillment, companies must manage their warehouses more efficiently. E-commerce has fundamentally transformed warehouse operations, emphasizing the necessity for swift and accurate order processing. Hence, there is a growing requirement for automation and optimization in warehouse activities. WMS solutions address this need by streamlining warehouse operations, automating inventory control, and improving order processing efficiency. This ultimately leads to quicker and more accurate order fulfillment.

The services segment dominated the warehouse management system market in 2024 and is expected to grow at the fastest rate during the forecast period. The services segment encompasses consulting, system integration, and maintenance services. Third-party vendors can provide warehouse management as an outsourced service, which is offered by WMS providers. Vendors market their products either by providing them as a service, which allows clients to concentrate on their core business activities, or by selling the software directly to clients without additional services.

The software segment is expected to show rapid growth in the warehouse management system market during the forecast period. The expansion is mainly driven by the increasing adoption of WMS software by small and mid-sized enterprises (SMEs) globally. The software is hosted on a cloud-based system. Additionally, factors such as rising consumer disposable income and growing demand in the manufacturing and retail sectors are expected to propel the segment's growth.

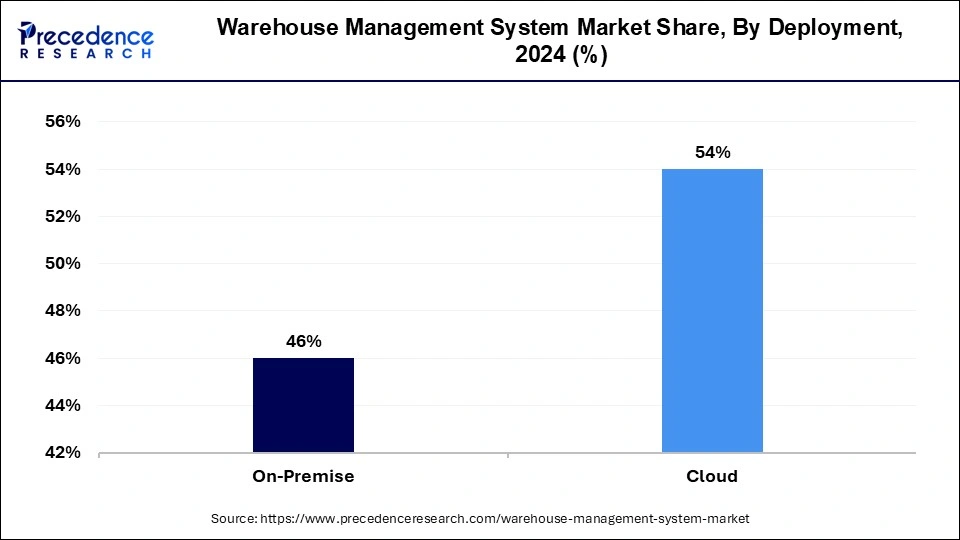

The cloud segment held the dominant share of the warehouse management system market in 2024 and is expected to grow at the fastest rate during the forecast period. Cloud-based technologies have fundamentally changed how organizations operate. Hosting WMS on the cloud offers companies savings on initial costs and greatly enhances warehouse efficiency. Moreover, warehousing allows firms to save on upfront expenditures and fuel productivity further.

The on-premises segment is experiencing significant growth in the warehouse management system market. On-premise solutions are characterized by large servers and high maintenance costs, which significantly increase a company's expenses. The initial and ongoing costs of maintaining an on-premise server are much higher compared to cloud-based technology. Also, implementing an on-premise WMS takes considerably longer than deploying a cloud-based solution.

The systems integration & maintenance segment dominated the warehouse management system market in 2024. WMS handles tasks such as receiving and storing goods, optimizing order picking and shipping, and suggesting inventory replenishment. One of its key features is automating the paper-based order-picking process. Factors like order type, warehouse layout, client requirements, and product movement can influence picking and material handling.

The analytics & optimization segment is expected to grow at the fastest rate in the warehouse management system market during the studies period. This is attributed to the rapid technological advancements and the growing demand for efficient storage solutions that have made warehouse operations more complex. Moreover, modern warehouse management requires increased transparency and information access throughout all processes. This enables the effective use of data to reduce costs, maximize revenue, and optimize workflows.

The manufacturing segment dominated the warehouse management system market in 2024. Manufacturing companies initially integrated ERP and WMS systems. To achieve full control over their supply chains, they are now also integrating logistics and transport management systems. Cloud-based technology is further improving the efficiency and performance of supply chain management in the manufacturing sector.

The transportation & logistics segment is anticipated to grow at the fastest rate in the warehouse management system market over the projected period. The growth is driven by the rising use of e-commerce platforms, along with increasing consumer disposable incomes, particularly in emerging markets like India and China. Logistics and supply chain firms are swiftly embracing WMS to enhance their operations and boost warehouse efficiency and productivity.

By Component

By Deployment

By Function

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

August 2024

April 2025