February 2025

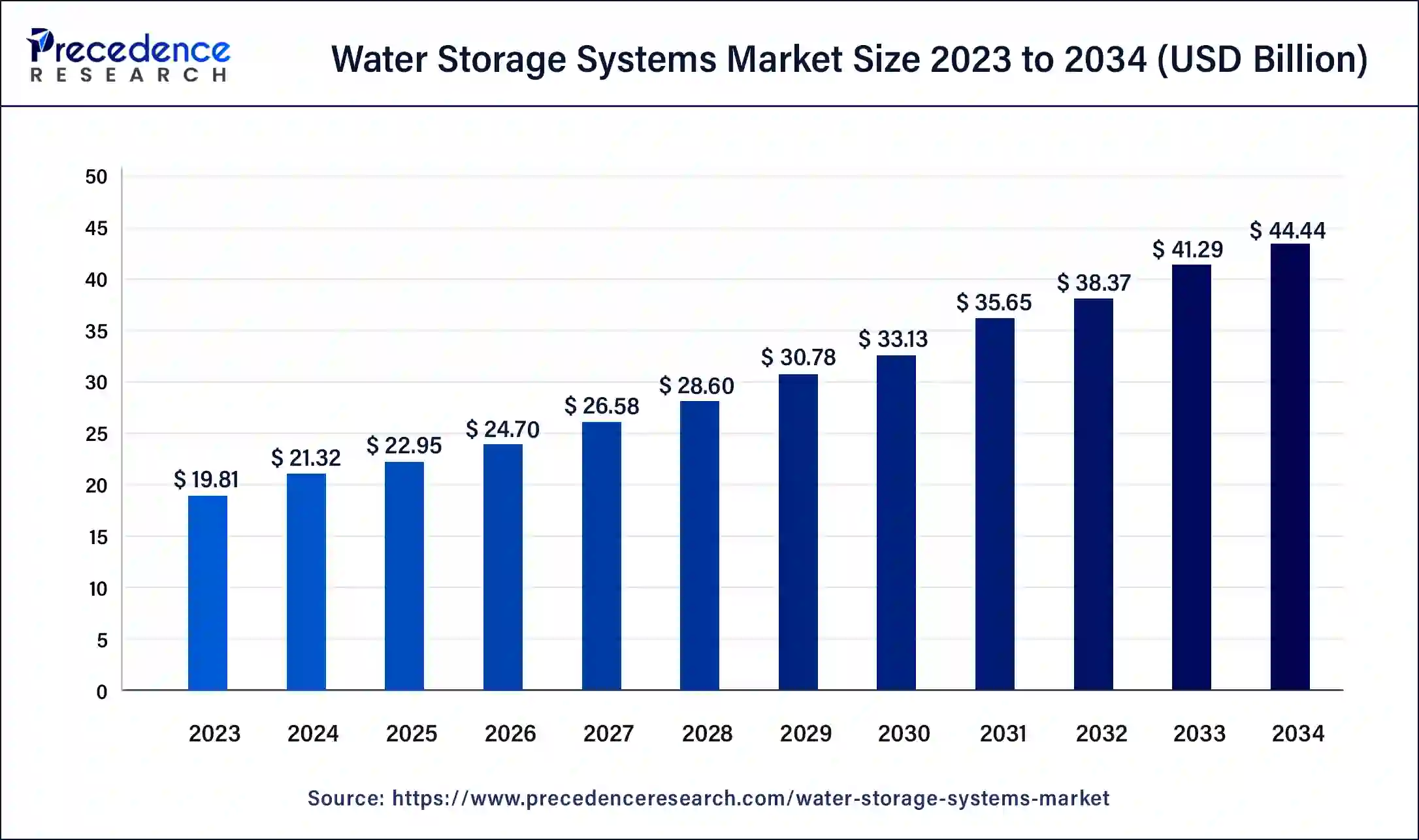

The global water storage systems market size surpassed USD 19.81 billion in 2023 and is estimated to increase from USD 21.32 billion in 2024 to approximately USD 44.44 billion by 2034. It is projected to grow at a CAGR of 7.62% from 2024 to 2034.

The global water storage systems market size is worth around USD 21.32 billion in 2024 and is anticipated to reach around USD 19.81 billion by 2034, growing at a CAGR of 7.62% over the forecast period 2024 to 2034. The increasingly growing concerns regarding water shortages are the key factor driving the growth of the water storage systems market.

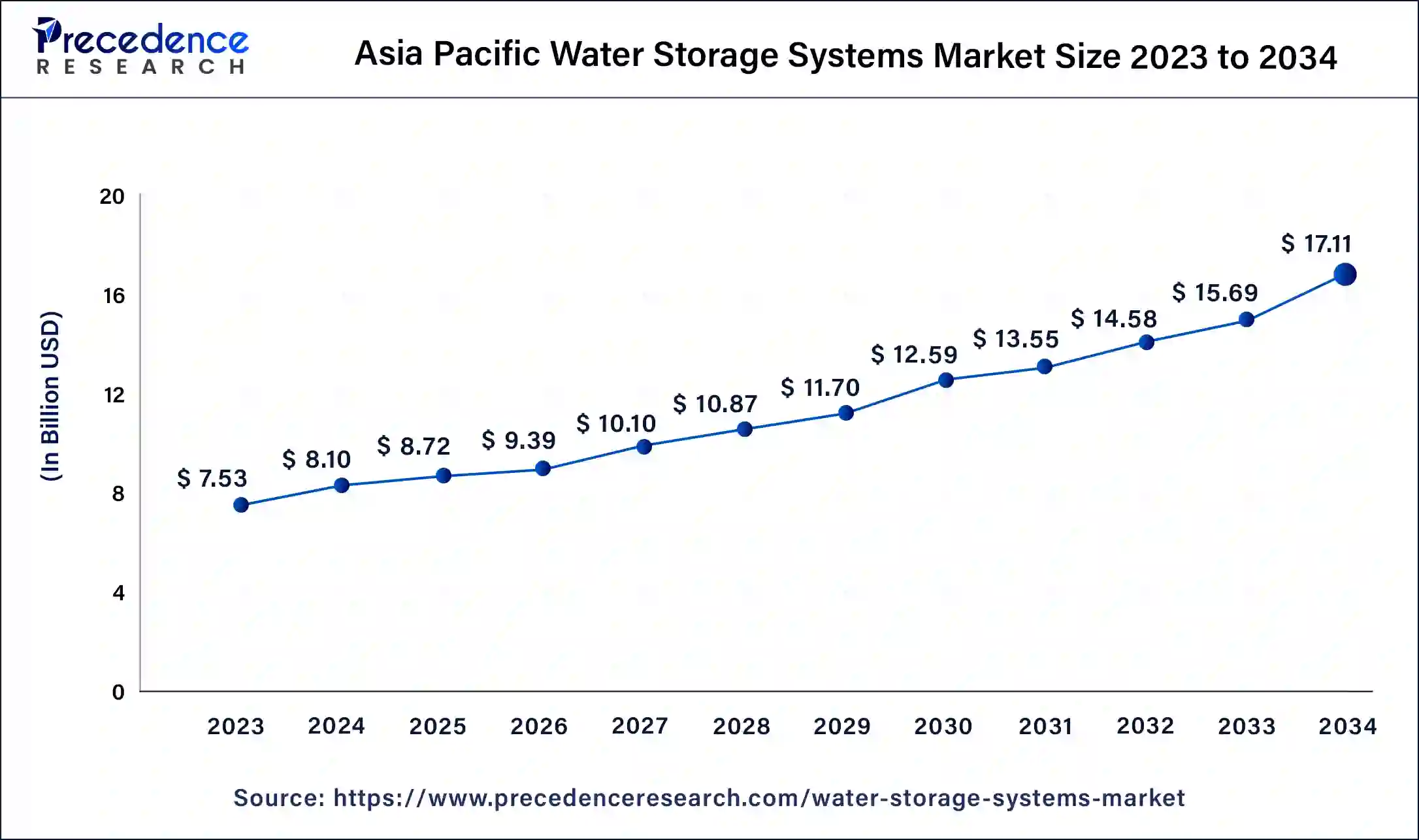

The Asia Pacific water storage systems market size was exhibited at USD 7.53 billion in 2023 and is projected to cross around USD 17.11 billion by 2034, poised to grow at a CAGR of 7.74% from 2024 to 2034.

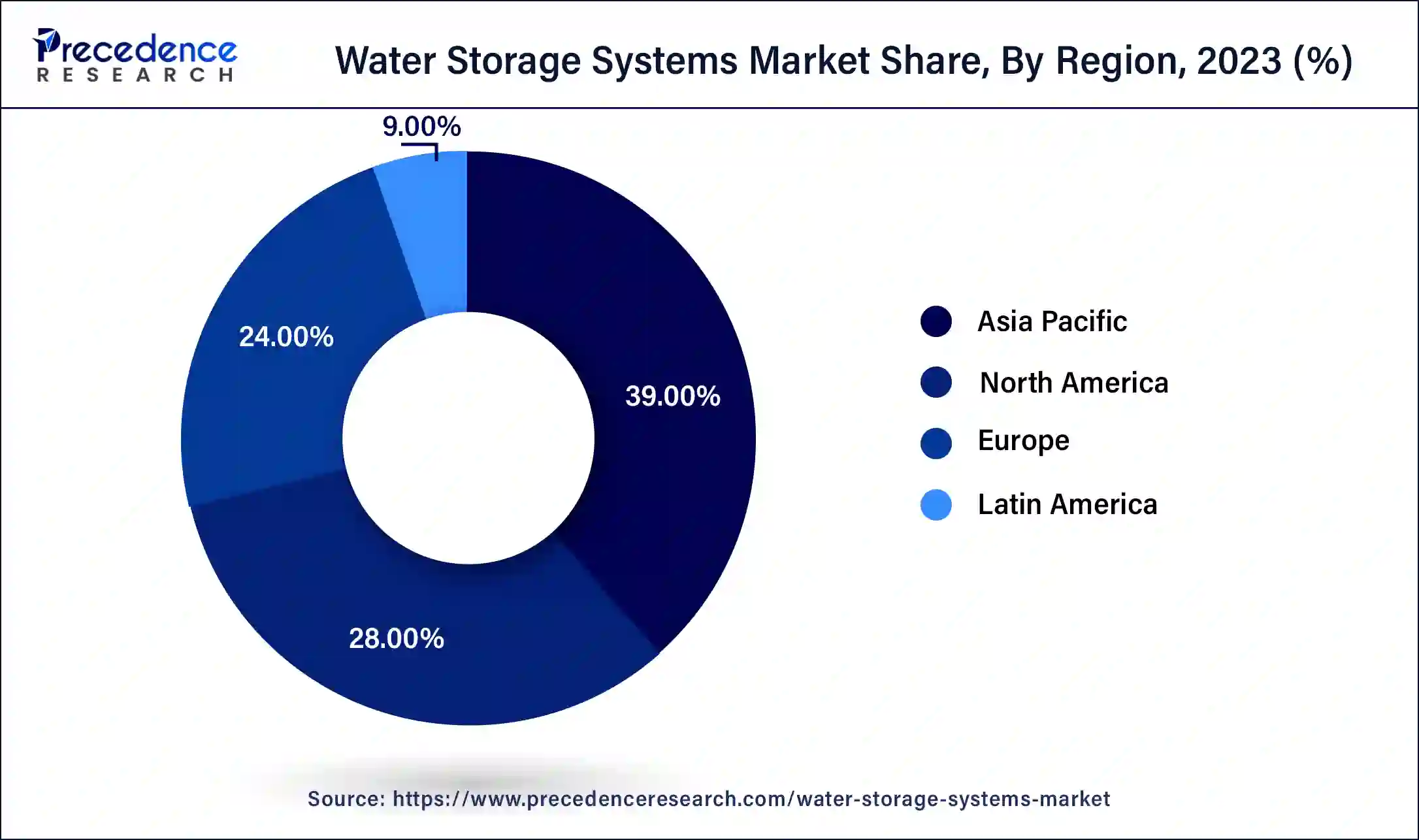

Asia Pacific dominated the water storage systems market in 2023. This is because the region has witnessed tremendous economic growth, good water management, and rapid social development. Moreover, the region faces growing needs for sophisticated water management and the cultivation of human capital. As urbanization increases with the rising population, the pressure on existing water resources increases, necessitating advanced solutions for water storage and distribution.

North America is expected to witness significant growth in the water storage systems market over the forecast period. The region's growth can be attributed to the increasing utilization of water in nations like the U.S. and Canada for industrial, commercial, and residential applications. Coupled with the presence of major gas reserves in the U.S. Furthermore, the increasing oil and gas activities and surge in the thermoelectric power generation field utilize water on a larger scale.

Water storage systems are a key element of water management infrastructure that stores. Maintains and distributes water for various applications, including industrial, agricultural, home, and environmental needs. These systems include an extensive range of buildings and technology created to fulfill needs geographic locations, and environmental conditions. The water storage systems market plays a crucial role in regulating a vast range of water management issues, such as conservation, distribution, and access to clean water. Urban clusters and megacities need large-scale reservoir facilities to maintain a constant water supply in the face of climatic change.

Water consumption by country 2020

| Country | Total water withdraw (m3 per capita) 2020 |

| Turkmenistan | 4351.49 |

| Guyana | 1836.75 |

| Uzbekistan | 1759.83 |

| Chile | 1693.33 |

| Iraq | 1407.67 |

| United States | 1342.26 |

| Kazakhstan | 1308.22 |

Role of AI in the water storage systems market

In the water storage systems market, AI can help detect and prevent leaks in water distribution systems by processing data from meters and sensors. AI algorithms can detect hurdles in water pressure and flow by indicating possible leaks. This approach can save a substantial amount of water and reduce the expenses associated with repairing leaks. Furthermore, AI algorithms can offer key insights on when and what amount of water should be used for irrigation, cutting water waste, and stimulating sustainable agriculture practices.

| Report Coverage | Details |

| Market Size by 2034 | USD 44.44 Billion |

| Market Size in 2024 | USD 21.32 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising concerns over climate change and water scarcity

Climate change causes droughts, unpredictable rainfall patterns, and extreme weather events. Promoting global water scarcity concerns. As climatic unpredictability rises, regions related to dependable water sources face uncertainty, exacerbating stakeholders' need to invest in new adaptation measures of the water storage systems market. Additionally, Water storage can play the role of buffer against climate-created changes in water supply, enabling water to be captured, stored, and distributed during the period of abundance for later use.

Infrastructure aging and deterioration

Many storage facilities, such as tanks, reservoirs, and pipelines, were constructed years ago and are now nearing the end of their operational life. This aging infrastructure is at risk of developing leaks, cracks, and structural failures, which could lead to water contamination, loss, and service disruptions. Furthermore, the water storage systems market infrastructure is aging and diverse, which may result in long-term damage.

The emergence of smart cities and green buildings

Governments of various nations have implemented diverse initiatives to develop smart cities. ‘Green building’ refers to activities primarily focused on reducing environmental impact through efficient design, construction, and maintenance. These innovations aim to minimize waste and environmental degradation. An excellent example of this is the rainwater harvesting systems market. Both private and public organizations endorse the concept of green building.

The concrete segment dominated the water storage systems market in 2023. The dominance of the segment can be attributed to the cost-effectiveness of material-based water tanks coupled with lower maintenance costs. Additionally, concrete-based water storage systems are more durable, easily available in developed and developing countries, and have easy-to-maintain hygiene, which can fuel their adoption across the globe shortly.

The fiberglass segment is expected to witness the fastest growth in the water storage systems market over the forecast period. The growth of the segment can be credited to the superior qualities of fiberglass-based structures over other materials, including extra mechanical strength and resistance to degradation, which is propelling its usage in a variety of storage systems and water tanks. Moreover, rising awareness regarding the food-grade coating makes fiberglass highly preferable for a longer duration of time.

The hydraulic fracture storage & collection segment led the global water storage systems market in 2023. This is due to increasing usage of treated and fresh water in the gas& oil refineries and rising concerns related to water conservation because of water scarcity in numerous regions, which are among the key concerns boosting the segment growth. Also, the demand for water storage systems is get impacted by the extent of hydraulic fracturing, regulatory oversight, and water resource accessibility.

The onsite water & wastewater collection segment is expected to grow at a significant rate in the water storage systems market during the projected period. The growth of the segment is driven by a rapid increase in the incidence of a variety of water-borne diseases and raised regulations on the safe and appropriate use of onsite water treatment systems globally. Furthermore, the upsurge in clean water supply in developing nations across the globe has added to the demand for advanced water storage systems.

The municipal segment accounted for the largest share of the water storage systems market. The key factor that lets the municipal segment dominate the market is the global water crisis. However, the segment’s growth is anticipated to be promoted by growing urbanization and an increased population over the studied period. Moreover, municipal organizations utilize water storage systems to provide a consistent water supply for their municipalities and towns. These systems also help to store and regulate water for a variety of goals like firefighting, irrigation, and other municipal needs.

The residential segment will show remarkable growth in the water storage systems market over the projected period. The growth of the segment can be linked to the growing awareness about the depletion of groundwater levels with the extensively rising g scarcity of freshwater resources in the entire world, which has led to the increased adoption of smooth water-saving techniques in various households.

Segments Covered in the Report

By Material

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

October 2024

September 2024