March 2025

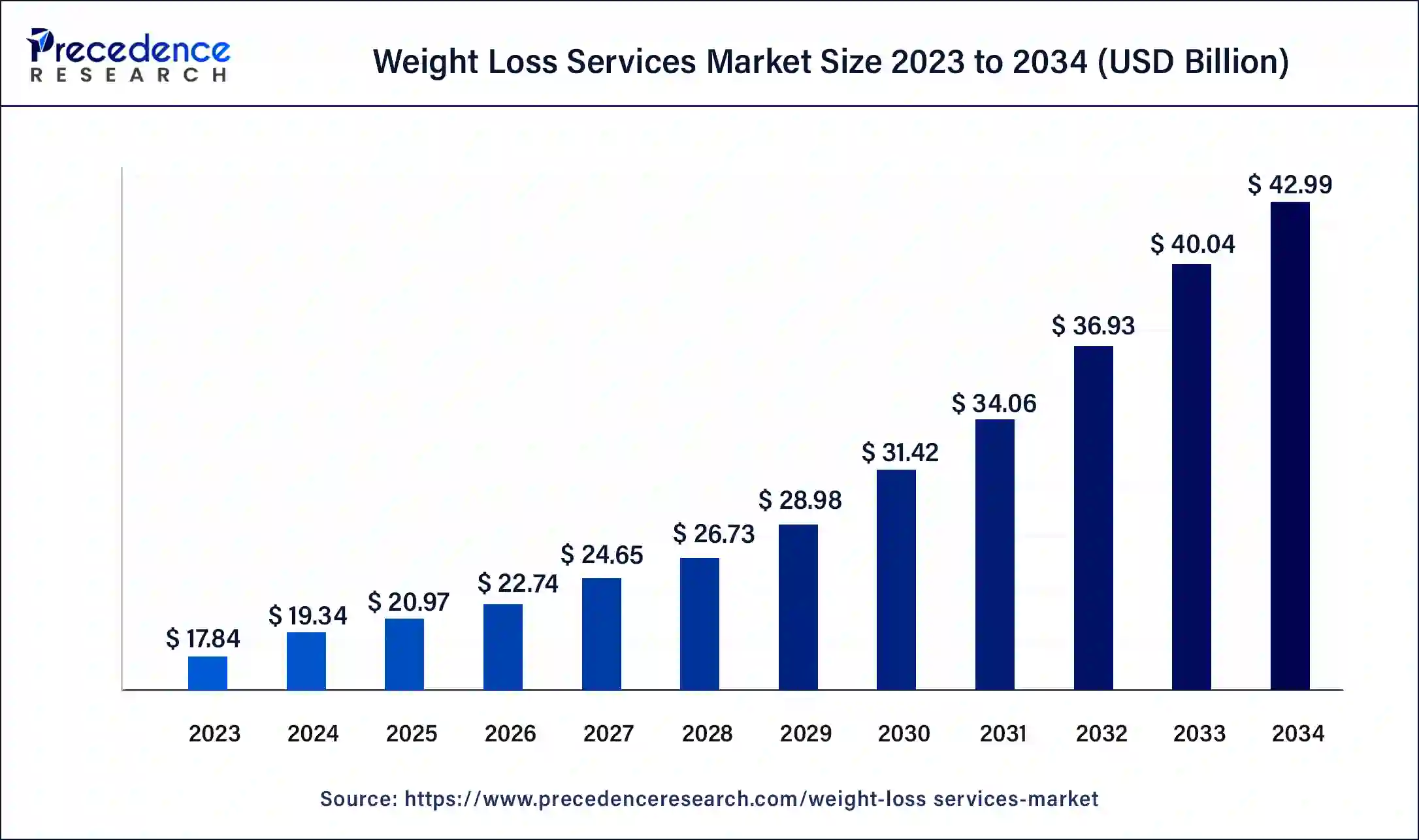

The global weight loss services market size was USD 17.84 billion in 2023, estimated at USD 19.34 billion in 2024 and is anticipated to reach around USD 42.99 billion by 2034, expanding at a CAGR of 8.32% from 2024 to 2034.

The global weight loss services market size accounted for USD 19.34 billion in 2023 and is predicted to reach around USD 40.05 billion by 2034, growing at a CAGR of 8.32% from 2024 to 2034. The increasing awareness for the nutritional based diet, exercises, and maintaining body shape and weight that boosting the growth of the market.

The weight loss services market is the industry that offers services and solutions to help in the management and reduction of weight in people who are overweight or obese. It helps reduce the overall body weight and manage it in the ideal state. Weight loss services help to decrease weight through various processes like changing the consumer’s diet plan, increasing physical activities, medication, surgeries, and others. The overall aim of weight loss services is to manage overweight and obesity and reduce the risk of chronic diseases.

The rising number of obese people globally, those more likely to be prone to chronic illnesses like diabetes, high blood pressure, and cardiovascular disorders, are driving the demand for weight loss services for maintaining their weight. The rising awareness of the body and health is also boosting the growth of the market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.32% |

| Market Size in 2023 | USD 17.84 Billion |

| Market Size in 2024 | USD 19.34 Billion |

| Market Size by 2034 | USD 42.99 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Payments, Equipment, Services, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing cases of obesity

The rising obesity cases in the world are due to changes in lifestyle, and increasing consumption of junk food, alcohol, and smoking is causing an increased number of obese patients. Obese people are more likely to be prone to severe chronic diseases such as cardiovascular diseases, diabetes, high blood pressure, and others. They need to go through various treatment procedures, which also drive awareness regarding obesity and overweight problems in people and impact the growth of weight loss services.

The weight loss services help the consumers with the proper and maintained diet plans, exercises, and physical activities that help maintain the consumer's health and reduce obesity or overweight problems. Weight loss services are minimally invasive procedures or plans that the patient does not need to go through painful surgical procedures. Thus, the rising incidence of obesity worldwide is driving the growth of the weight loss services market.

Expensive diet plans

The high-cost diet given by nutritionists for maintaining weight and reducing obesity. Low-calorie foods are more expensive than normal food, and the high cost of services or the subscription of services is unaffordable for a large segment of people in society, which limits the expansion of the weight loss services market. Such high-cost services are prone to create a limitation in adoption for underdeveloped areas.

Integration of technologies in weight management

The integration of technologies in healthcare and weight management is revolutionizing the wellness industry. Combining technologies such as AI-powered coaching and intervention designs can provide personalized nutritional plans and recommendations to people who are suffering from overweight or obesity problems. Artificial intelligence and machine learning tools help in assessing, recommending, and intervening in design that enhances the usability and value of the product. There are various nutritional and health assessment programs that use AI and ML for hyper-personalization.

The private insurance segment will dominate the weight loss services market during the forecast period. The increasing number of obesity cases globally and the rising acceptance of invasive surgical processes for fat reduction drive the growth of the private insurance segment. Private insurance may cover fat reduction surgeries like gastric sleeves, gastric bypass, and lap band surgeries. Private insurance is allowed to cover the treatment of obesity.

The fitness equipment segment dominated the market in 2023. The segment's growth is attributed to the rising awareness regarding physical health, which boosts demand for it. Technological developments in weight loss equipment and wearable technologies further contribute to the segment's expansion. Fitness equipment includes strength training equipment, cardiovascular equipment, infrared light therapy, and others.

The surgical equipment segment is expected to grow significantly during the forecast period. The surgical equipment is further divided into bariatric surgical equipment and non-invasive surgical equipment, which the non-invasive surgical equipment is gaining significant popularity in the market. The growth of the non-invasive surgical process due to the instant recovery after the surgery and fewer side effects are driving the segment's expansion. The advances in the production process and technologies added to the non-invasive surgical procedure are further propelling the segment's growth.

The consulting segment is expected to have the fastest growth rate in the market during the predicted period. The increasing awareness about obesity and health and the cost-effective services offered with the different packages are driving the growth of fitness centers and consulting services in weight loss management. Major market players are interventions that are accelerating the growth of consulting services. The increasing competition in health consulting services is driving the opportunities for low-cost and budget-friendly consulting services that also boost the adoption of the consulting services segment.

North America led the weight loss services with the largest market size in 2023. The growth of the market in the region is increasing due to the rising number of obese people due to the shifting lifestyle habits, rising consumption of fast foods, and lesser physical activities that cause overweight problems in the people. The rising awareness regarding health and growing obesity in the population drives the demand for weight loss services.

The rising integration of technologies in nutritional services is also boosting the adoption of the market. Additionally, the rising market competition in the wellness industry is accelerating the growth of the weight loss services market in the region. In North America, the U.S. is majorly responsible for the market’s growth due to the large number of obese people, awareness about the risks associated with obesity, government support, and technological advancements.

Asia Pacific is expected to witness the fastest growth in the market during the forecast period. The growth of the region is due to the rising change in lifestyle due to the rising per capita income in the people and rising adoption of junk food, alcohol, smoking, etc., which impact the health of humans and the higher cause of obesity in people that are also contributing in creating a big marketplace for the weight loss services in the region.

The surging expenditure on healthcare and body maintenance by the population is also driving the growth of the weight loss services market in the region. India is among the top country that is dealing with obesity issues in the Asia Pacific region. It is essential for the Indian government to take steps to reduce the obesity rates. Various key players are also launching their products in the Indian market, which can boost the growth of the market in the Asia Pacific region.

Segments Covered in the Report

By Payments

By Equipment

By Services

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

January 2025

January 2025