March 2025

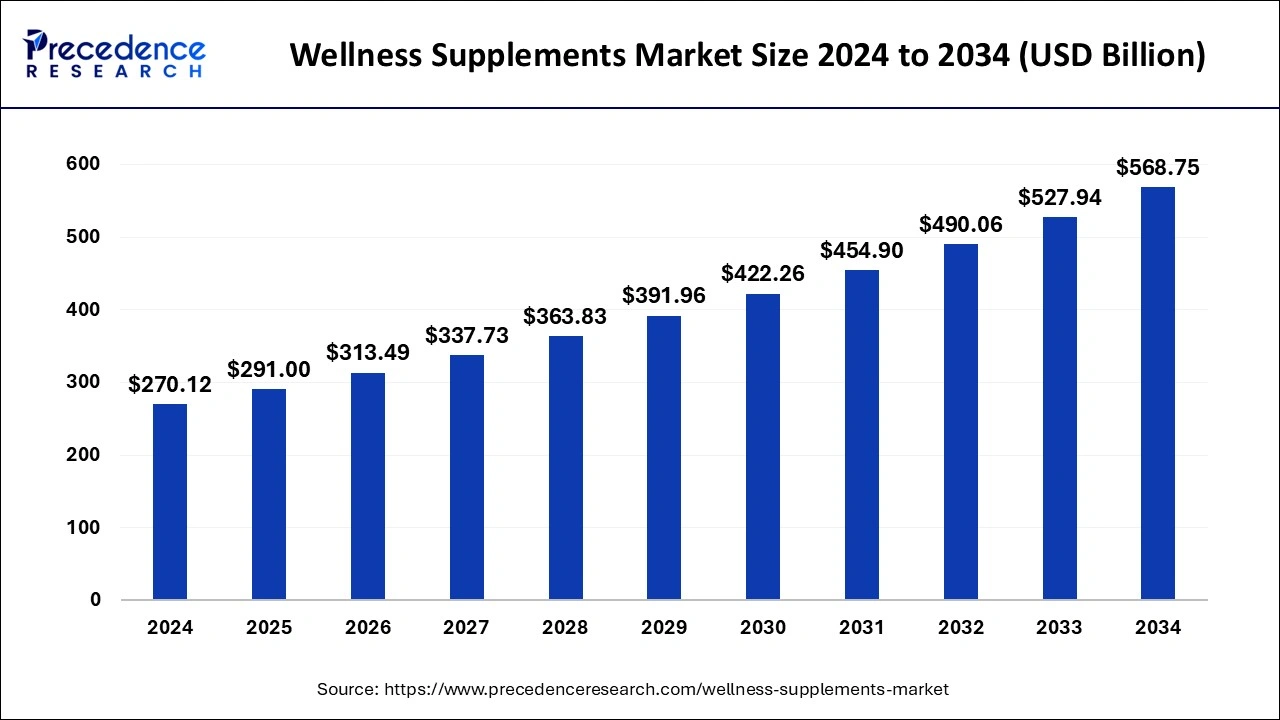

The global wellness supplements market size is accounted at USD 291 billion in 2025 and is forecasted to hit around USD 568.75 billion by 2034, representing a CAGR of 7.73% from 2025 to 2034. The North America wellness supplements market size was estimated at USD 121.55 billion in 2024 and is expanding at a CAGR of 7.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wellness supplements market size was estimated at USD 270.12 billion in 2024 and is anticipated to reach around USD 568.75 billion by 2034, expanding at a CAGR of 7.73% from 2025 to 2034. Consumer lifestyle changes and growing demand for vitamin and mineral deficiencies among populations in emerging economies is leading to expansion of the wellness supplements market.

Artificial intelligence (AI) tools will improve supply chain management, ensuring timely procurement of raw materials, improving inventory levels, and predicting demand more accurately. AI helps to boost nutrition, well-being, and health. It also helps to stay consistent and accountable, preventive healthcare with AI, manage chronic conditions, optimize your sleep, support mental health, custom workout routines, and personalized nutrition which help the growth of the wellness supplements market.

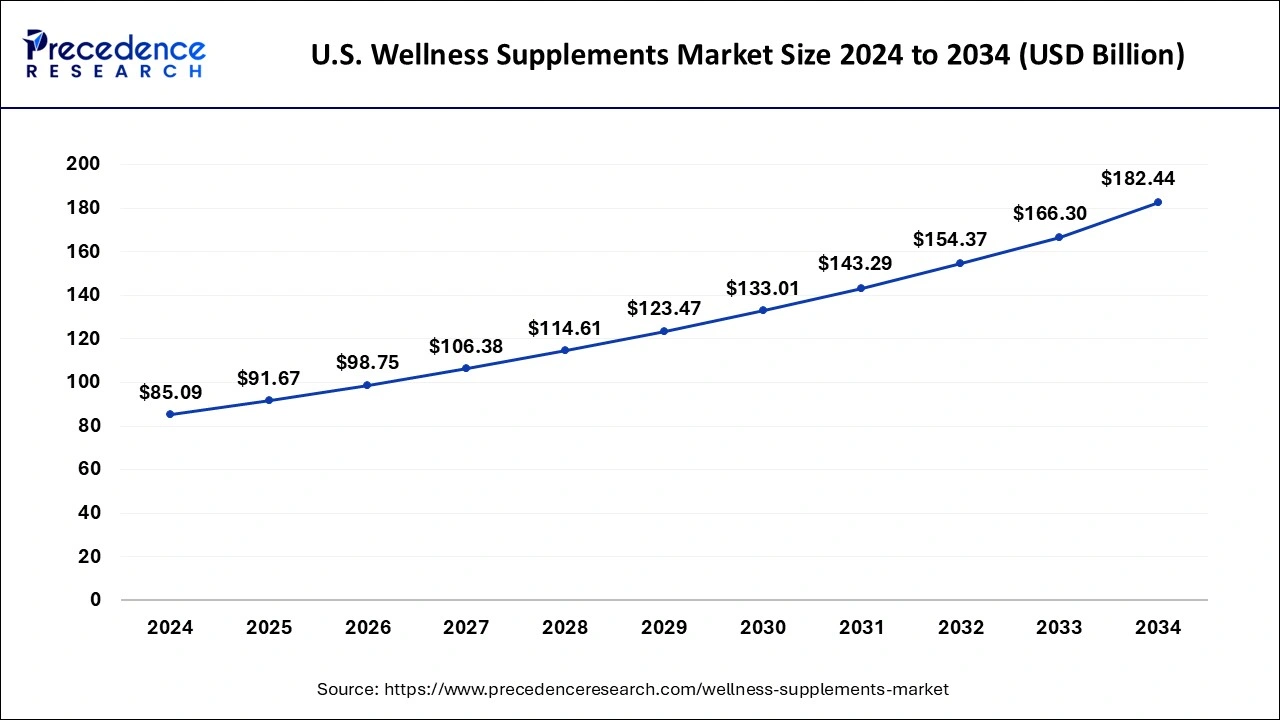

The U.S. wellness supplements market size was evaluated at USD 85.09 billion in 2024 and is predicted to be worth around USD 182.78 billion by 2034, rising at a CAGR of 7.93% from 2025 to 2034.

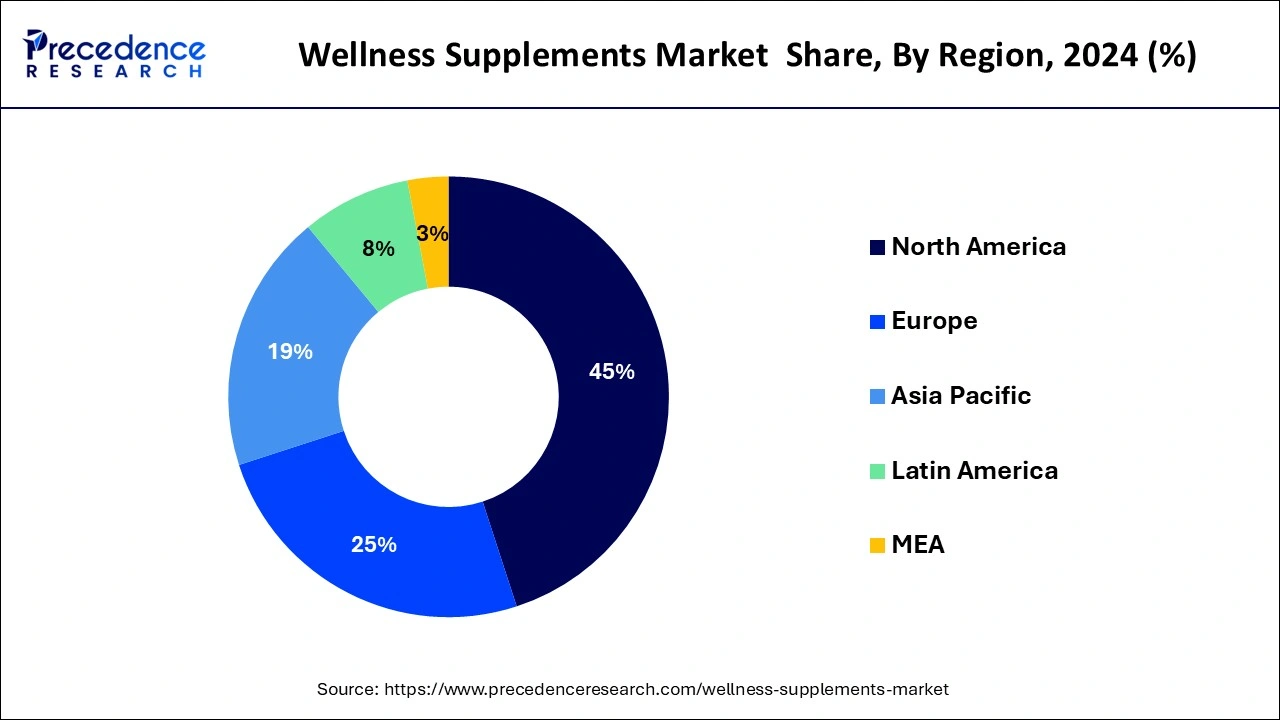

North America dominates the wellness supplements market due to the rise in the aging population. In addition, the rising health consciousness and awareness among consumers is likely to further propel the wellness supplements market growth in the region during the forecast period. Also, Asia-Pacific is likely to have significant growth rate in the market of wellness supplements owing to the dynamic attention of the customers towards healthier and fit lifestyles. Furthermore, the growing awareness regarding wellness products and rise in the purchasing power is further anticipated to boost the wellness supplements market growth in the region.

On the other hand Asia Pacific is expected to register a healthy pace of growth during the forecast period. The growth of the region is largely complemented by the shifting focus of the consumer towards healthier lifestyles along with the rising awareness and acceptance regarding wellness products. The rising consumer disposable income is further propelling the uptake of wellness supplements in the region

| Report Coverage | Details |

| Market Size in 2025 | USD 291 Billion |

| Market Size by 2034 | USD 568.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.73% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Dietary Supplements, Functional Food & Beverages, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The surge in participation of number of athletes in sports at national and international levels is likely to boost the market demand for functional beverages. Furthermore, higher costs on the health related products, growing urbanized population and chronic, growing cardiovascular, and diseased linked with obesity are majorly boosting the growth of the wellness supplements market. Wellness supplements are rich omega fatty acid sources, which aids to control blood circulation and maintain the weight in the human body which is therefore propelling the market growth. In addition, the primary reason driving the wellness supplements is the growing health consciousness among individuals. Consumers from all over the world are increasingly choosing the advantages of preventative health over treatments, which is resulting in a trend of living healthier lives. Furthermore, the industry is further fueled by rising availability and accessibility of the wellness supplements. The market benefits from the rising elder population, as older generation have a weaker immune system which is fuelling the demand for wellness supplements highly among the oldest segment.

The occurrence of the coronavirus disease pandemic caused by the severe acute respiratory syndrome starting in November 2019 led to rise in sales of dietary supplements in early of 2020. In the mid of a global pandemic, consumers wanted additional protections from viral disease and infections based on the awareness regarding the supplement that it offer numerous health benefits and has immune-boosting effects if consumed. In addition, in the U.S. prior to the pandemic, the sales of wellness supplement sales increased by 5% in 2019 compared to the 2018. However, there was a 44% rise in sales in first quarter of the first wave of the pandemic, relative to the same period in 2019. Therefore, Covid19 pandemic has brought multifold growth towards the wellness supplements market.

Vitamin wellness supplements segment has generated a revenue share of more than 30% and dominated the global wellness supplements market in 2022. The rapid growth in the adoption of supplements has offered a huge growth opportunity to the wellness supplements brands that has fostered the growth of the vitamin segment.

The protein segment is expected to be the fastest-growing segment during the forecast period. With growth in number of elderly population, the demand for supplements like additional wellness nutritional is rising, as the consumers are looking for enhanced sources in order to enable the body to obtain complete nourishment. In addition, rise in spending over these products especially among baby boomers predominantly drives the market growth of the proteins wellness supplements.

Sports drink is the dominating market segment. In addition, sports drinks that contain protein helps maintain lean muscles in athletes, and promote building of new muscles in bodybuilders and while products containing electrolytes, minerals, carbohydrates, and other types of nutrients help provide, hydration, energy, and nutrition to the body.

Infant formula is the fastest growing segment, change in lifestyle, rise in middle class population, growth in disposable income in emerging economies such as Indonesia, India, China, and increase in awareness about high nutritional content in the infant formula turns it to be the fastest growing segment of the market.

By Dietary Supplements

By Functional Food & Beverages

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

December 2024

March 2025