March 2025

Wind Energy Market (By Location: Onshore and Offshore; By Application: Utility and Non-utility; By Component: Turbine, Support Structure, Electrical Infrastructure, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024 – 2034

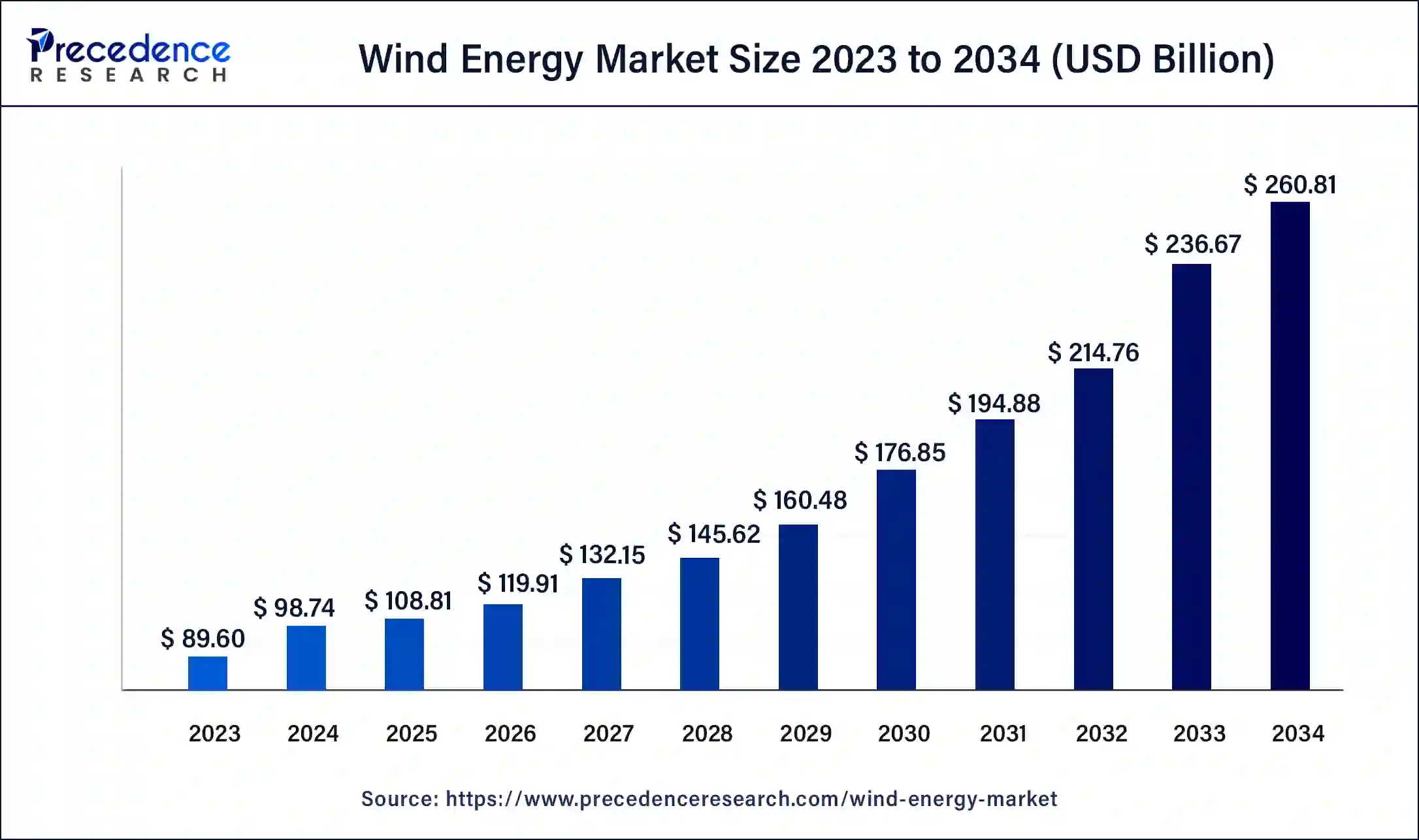

The global wind energy market size was USD 89.60 billion in 2023, accounted for USD 98.74 billion in 2024, and is expected to reach around USD 260.81 billion by 2034, expanding at a CAGR of 10.2% from 2024 to 2034.

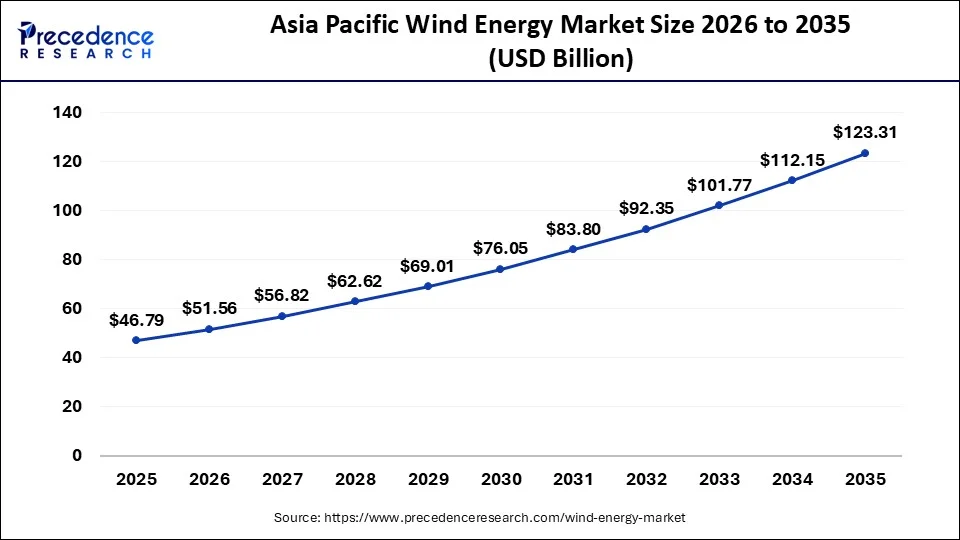

The Asia Pacific wind energy market size was estimated at USD 38.53 billion in 2023 and is predicted to be worth around USD 112.15 billion by 2034, at a CAGR of 10.4% from 2024 to 2034.

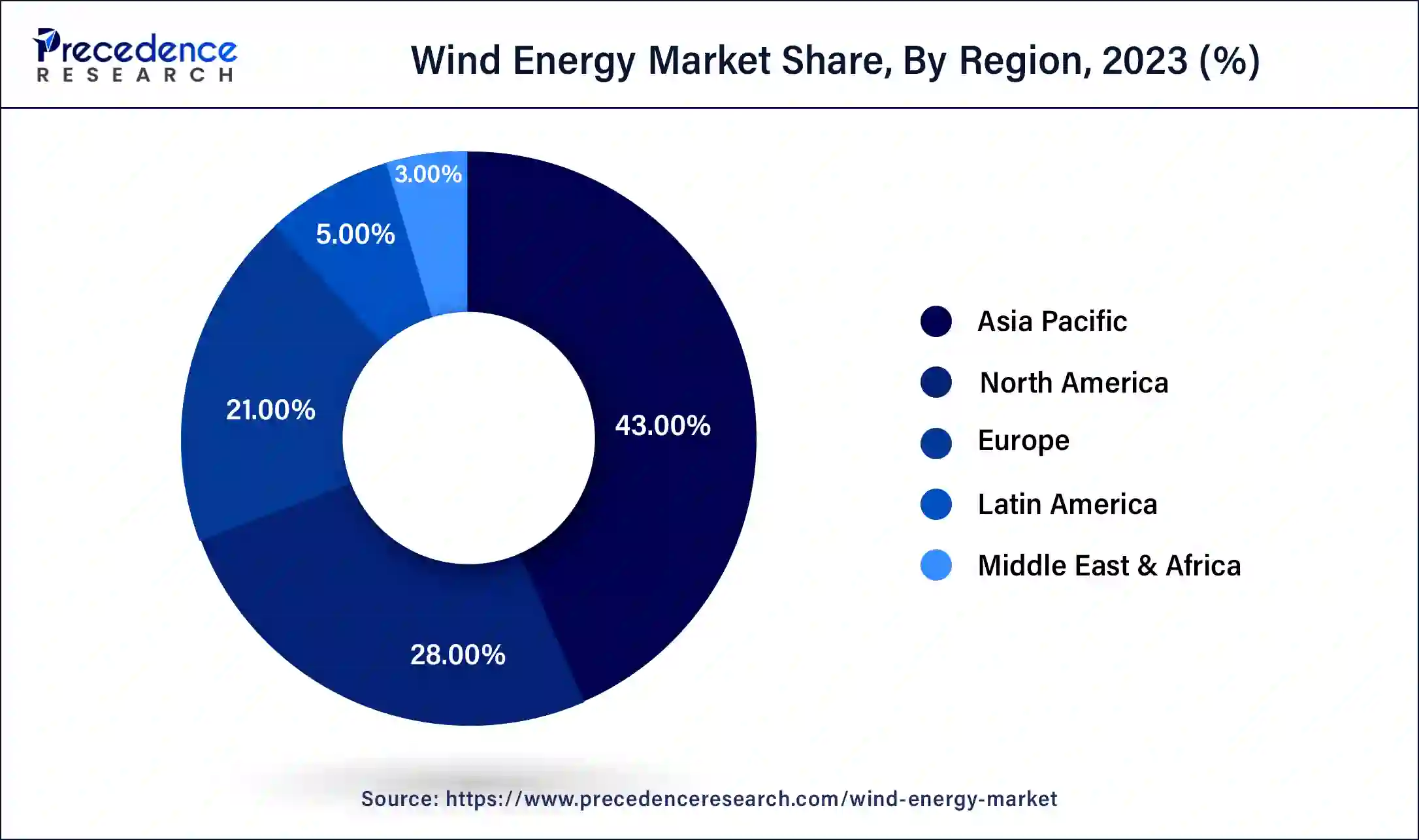

The Asia-Pacific region has accounted largest revenue share in 2023. Asia-Pacific’s wind energy market is expected to grow gradually in the coming years, as governments are constantly taking action and initiatives to promote infrastructural development in the energy sector. This is likely to influence the advancement of wind energy projects in the country, which would drive the growth of the wind energy market in the Asia-Pacific region during the forecast period.

Based on the region, the North America region is estimated to be the most opportunistic segment during the forecast period. The emerging markets in the U.S., provide a lucrative opportunity for the wind energy market, owing to increased demand for electricity. Furthermore, the immense wind power potential, along with a decrease in the cost of advanced technologies, is projected to present the industry with widespread commercial opportunities during the forecast period.

Wind energy is a kind of renewable energy. The method of using wind to generate electricity is known as wind energy. Wind turbines are used to transform the wind’s kinetic energy into mechanical energy. The mechanical power can also be used for specific purposes such as water pumping.

The offshore and onshore wind turbines can be used to generate electricity. Onshore wind energy is related with land-based turbines, whereas offshore wind energy is associated with turbines that are positioned in the sea or ocean. Offshore wind turbines, on the other hand, are more efficient and effective in producing electricity as compared to onshore wind turbines.

Due to the implementation of rigorous environmental rules, the market will continue to move away from traditional energy sources and towards renewable energy technology. The product penetration will be influenced by increasing offshore prospects along with the development of a strong industrial and commercial sector infrastructure.

The global wind energy market is predicted to rise due to a significant increase in demand for renewable energy sources. Governments all around the world are encouraging sustainable energy sources, which, unlike traditional power sources, may cut carbon emissions. In addition, offshore wind energy turbines eliminate the constraint of sea depth, making it easier to choose the ideal location for electricity generation.

Government regulatory authorities and agencies in developed and developing regions are concentrating on reducing reliance on traditional energy sources in order to reduce carbon emissions, which encourages the generation of electricity using renewable energy sources such as solar and wind. The increased need for energy in a variety of industries such as healthcare, food and beverage, and residential, has boosted the growth of the wind energy market during the forecast period.

Offshore wind farms are also becoming more popular as a source of energy among wind energy market players. Offshore wind power projects are expected to open up growth opportunities for deepwater projects, where the high speed produces a much more advantageous operating environment, driving the demand for offshore locations. Renewable energy sources have been widely supported by governments all around the globe.

Countries all over the world are concentrating their efforts on growing investment in offshore wind energy projects in order to collect energy from the environment’s natural wind resources, ultimately boosting the growth of the global wind energy market. Offshore wind power installation is a difficult undertaking since it necessitates the transportation of large and heavy equipment to the project site, raising the overall cost of the wind energy projects. However, due to technological advancements for offshore installation of wind turbines, the overall cost has decreased, making offshore wind a viable renewable energy choice.

| Report Coverage | Details |

| Market Size in 2023 | USD 89.60 Billion |

| Market Size in 2024 | USD 98.74 Billion |

| Market Size by 2034 | USD 260.81 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.2% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Location, Application, and Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the location, the offshore segment dominated the global wind energy market in 2023 due to the availability of modern technology and comprehensive solutions given by various service providers, the segment is expected to develop as demand for offshore wind installation rises.

On the other hand, the onshore segment is estimated to be the most opportunistic segment during the forecast period. Due to its lower cost than offshore wind power, onshore wind power has become one of the most popular renewable energy sources across the globe. Additional elements supporting category expansion are an easy installation method and a reduction in greenhouse gas emissions.

Based on the application, the utility segment dominated the global wind energy market in 2023, in terms of revenue. The utility-scale wind turbines are that are connected to the country’s transmission infrastructure. Large-scale utility-scale wind generating projects necessitate a variety of building, land, and other permissions, as well as the careful management of relationships with many market players.

On the other hand, the non-utility segment is estimated to be the most opportunistic segment during the forecast period. Both commercial and residential wind energy projects are included in the non-utility sector. Due to the infeasibility of installing a wind turbine due to land constraints, non-utility applications had a smaller market share than utility applications.

Companies Market Share Insights

To minimize the overall cost of wind energy projects, the key market players are working together and acquiring raw materials and component manufacturers. Furthermore, the key market players are spending on research and development to improve the efficiency of their technologies in order to obtain a competitive advantage over their competitors and gain a larger market share over the projection period. Continuum Wind Energy Ltd, backed by Singapore-based Clean Energy Investing Ltd., an indirect wholly-owned subsidiary of Morgan Stanley fund New Haven Infrastructure Partners, announced plans to issue its first green bond in February 2021.

Segments Covered in the Report

By Location

By Application

By Component

By Rating

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

August 2024

June 2025

December 2024