August 2024

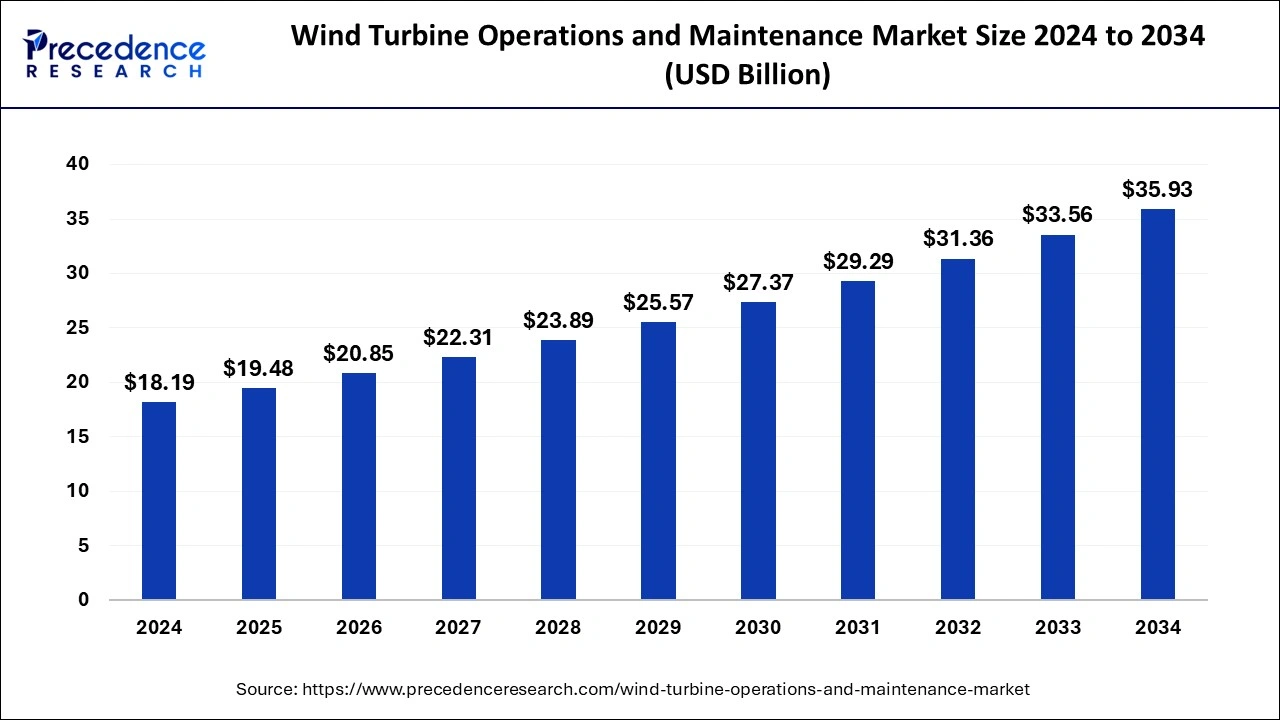

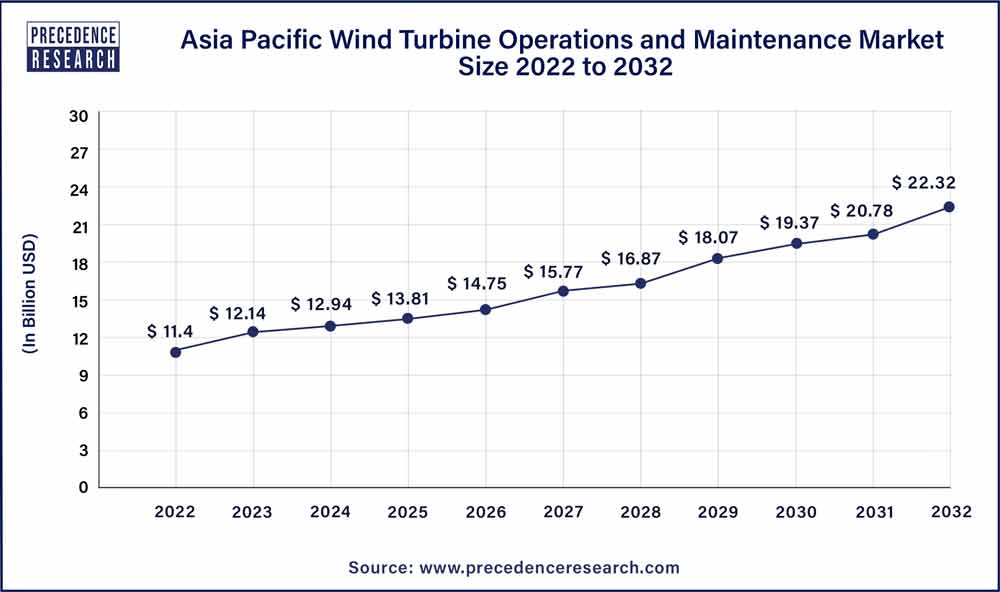

The global wind turbine operations and maintenance market size is calculated at USD 19.48 billion in 2025 and is forecasted to reach around USD 35.93 billion by 2034, accelerating at a CAGR of 7.04% from 2025 to 2034. The Asia Pacific wind turbine operations and maintenance market size surpassed USD 7.82 billion in 2024 and is expanding at a CAGR of 7.17% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wind turbine operations and maintenance market size was estimated at USD 18.19 billion in 2024 and is anticipated to reach around USD 35.93 billion by 2034, expanding at a CAGR of 7.04% from 2025 to 2034. The wind turbine operations and maintenance market are driven by the increasing installation of aging wind turbines.

AI offers detailed data analytics to wind farm operators that enable them to make well-informed decisions. Operators use machine learning algorithms to understand historical and current data to find trends, enhance operating tactics, and create data-driven choices to improve the wind farm’s overall productivity and profitability. The latest technology, including artificial intelligence, offers many ways to save money. With AI, wind farm assets may be remotely tailored and controlled. It is no longer necessary for operators to be physically present on-site since they may access real-time data and control systems from centralized locations.

The Asia Pacific wind turbine operations and maintenance market size was exhibited at USD 7.82 billion in 2024 and is projected to be worth around USD 15.63 billion by 2034, growing at a CAGR of 7.17% from 2025 to 2034.

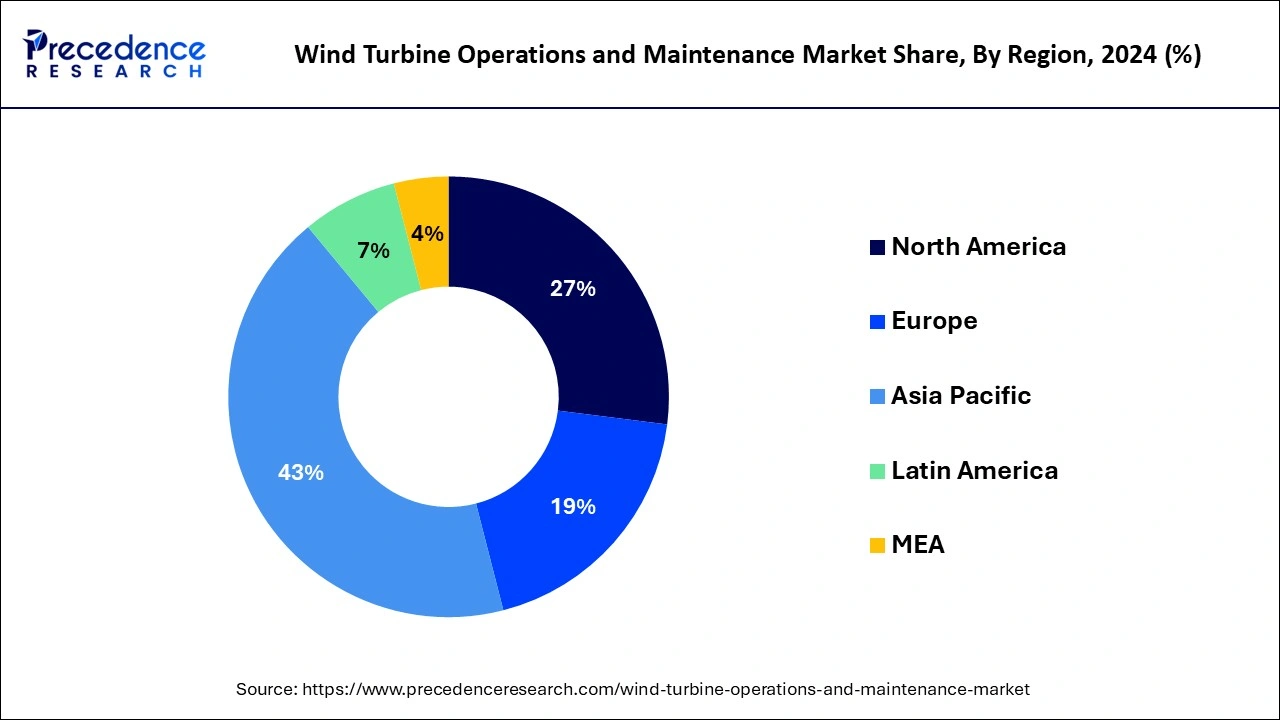

Region wise, the North America segment dominated the global wind turbine operations and maintenance market in 2022, in terms of revenue and is estimated to sustain its dominance during the forecast period. The wind turbine operations and maintenance market in region is growing due to increasing renewable energy policies.

The Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. The wind turbine operations and maintenance market in Asia-Pacific region is being driven by a rapid growth in wind turbine installations and favorable regulatory frameworks.

Wind is a type of solar energy that results from the uneven heating of the atmosphere and irregularities on the earth’s surface. Due to the long-term impact, wind farm owners must conduct operations and maintenance on their turbines. Self-perform tactics are frequently pursued by larger owners in order to gain complete control over their assets, advance original equipment manufacturer (OEM) practices, and reduce expenses.

A wind turbine is a machine that turns the kinetic energy of the wind into electricity. The number of big turbines in wind farms now generates over 650 gigawatts of electricity, with 60 gigawatts installed every year. The leading market players in the global wind turbine operations and maintenance market must invest a significant amount of money to generate both electricity and income over the projected period. Wind turbine manufacturers, in-house operations and maintenance, and independent service provider teams have emerged in the industry as options for operations and maintenance.

Scheduled maintenance is the key to remaining at the top of the global wind turbine operations and maintenance market, as it avoids time-consuming and costly procedures. As a result, large players in the global wind turbine operations and maintenance market are concentrating on regular oiling and greasing of wind turbine components.

| Report Coverage | Details |

| Market Size in 2025 | USD 19.48 Billion |

| Market Size by 2034 | USD 35.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.04% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing adoption of wind energy

As wind energy installations become more widespread, there is an increasing focus on maximizing the lifespan of these turbines. Effective O&M strategies, which include preventive and corrective maintenance, are important for prolonging the operational life of turbines and ensuring optimal performance.

High maintenance costs

Wind turbines generally need regular maintenance to ensure optimal performance. For example, periodic inspections, lubrication, and cleaning can be costly, and parts such as blades or gearboxes can require more frequent repairs due to wear and tear.

Development of predictive maintenance technologies

Predictive maintenance technologies offer valuable insights through data analytics that allow operators to make more informed decisions about resource allocation, maintenance schedules, and operational strategies.

On the basis of type, the scheduled segment dominated the global wind turbine operations and maintenance market in 2022, in terms of revenue and is estimated to sustain its dominance during the forecast period. These services are performed at regular intervals to keep the wind turbines running smoothly.

On the other hand, the unscheduled segment is estimated to be the most opportunistic segment during the forecast period. This is owing to the high frequency of the services, as scheduled maintenance is often performed only in the event of an emergency such as a failure of equipment of a turbine fire.

Based on the application, the onshore segment dominated the global wind turbine operations and maintenance market in 2022. The onshore wind’s advantages over offshore wind including as lower initial investment costs, faster installation, and shorter cables are attracting the attention of industry participants.

However, the offshore segment is estimated to be the most beneficial segment during the forecast period. Offshore turbines are more efficient than onshore turbines, but they come with installation costs and as a result of higher operational costs.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

August 2024

December 2024