March 2025

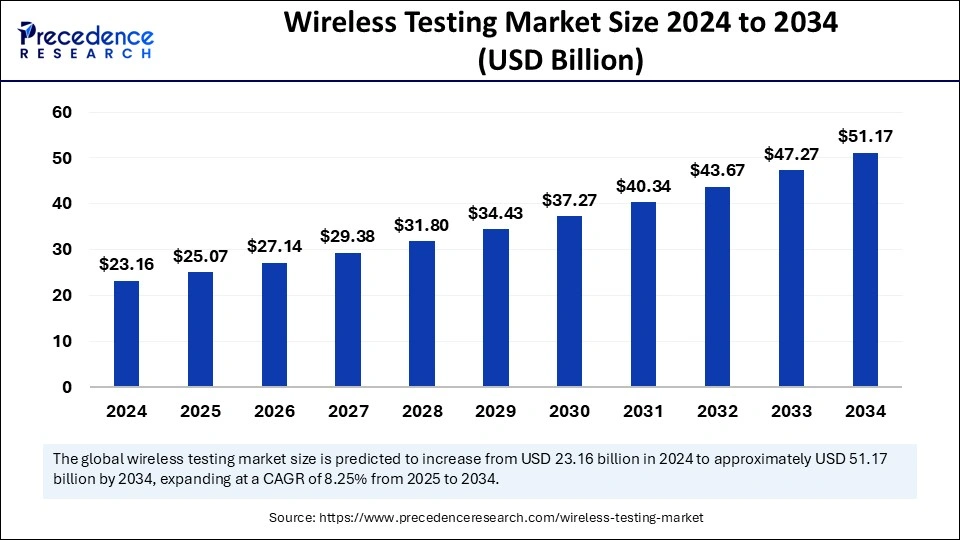

The global wireless testing market size is calculated at USD 25.07 billion in 2025 and is forecasted to reach around USD 51.17 billion by 2034, accelerating at a CAGR of 8.25% from 2025 to 2034. The North America market size surpassed USD 9.50 billion in 2024 and is expanding at a CAGR of 8.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wireless testing market size was estimated at USD 23.16 billion in 2024 and is predicted to increase from USD 25.07 billion in 2025 to approximately USD 51.17 billion by 2034, expanding at a CAGR of 8.25% from 2025 to 2034. The growth of the wireless testing market is driven by continued advancements in wireless communication services.

Artificial Intelligence can automate several tasks, making the testing process faster. AI-driven testing becomes instrumental in ensuring seamless communication with devices. The integration of ML and AI algorithms in testing equipment automates and optimizes testing processes by identifying anomalies. AI automation simplifies the entire testing process, from test case generation to execution and result analysis. AI also helps in identifying errors that may missed by manual testing.

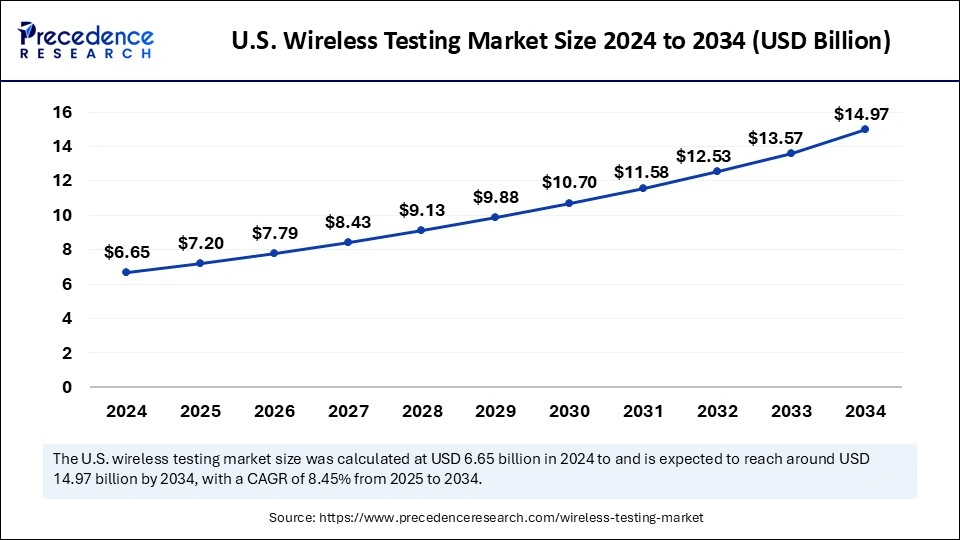

The U.S. wireless testing market size was evaluated at USD 6.65 billion in 2024 and is projected to be worth around USD 14.97 billion by 2034, growing at a CAGR of 8.45% from 2025 to 2034.

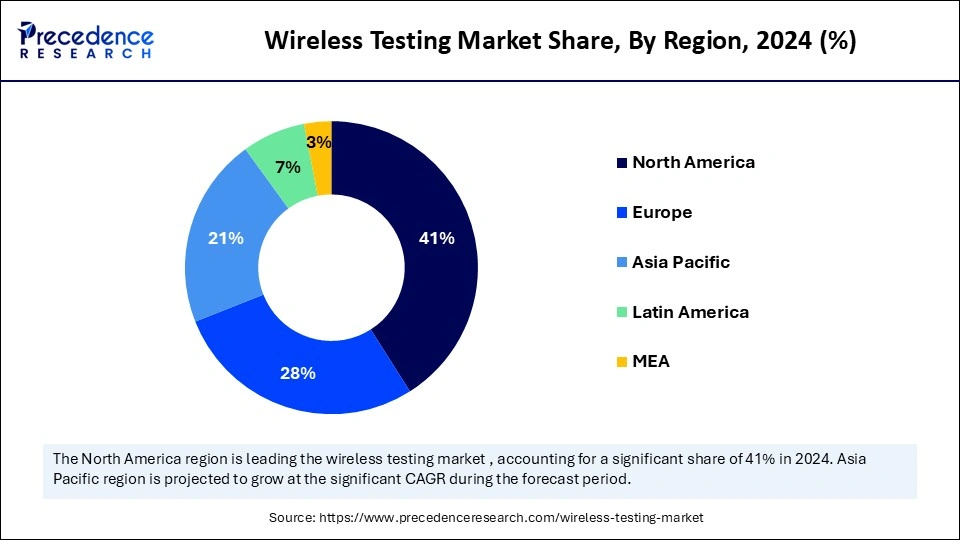

North America dominated the wireless testing market by capturing the largest share in 2024. This is mainly due to its well-established IT and telecommunication infrastructure, in which wireless testing plays a crucial role. There is a high adoption of 5G technologies. The region is home to major telecom operators such as AT&T Inc, T-Mobile U.S. Inc, Charter Communications, Deutsche Telekom, and Verizon, boosting the demand for wireless connectivity. The increasing investments in research and development (R&D) of next-generation wireless technologies further maintain the region’s long-term dominance in the market.

The U.S. is a major contributor to the North American wireless testing market. The increasing government initiatives to promote the use of modern technology drive the growth of the market. For instance, leading agencies in the U.S., such as the Federal Communications Commission (FCC), are making efforts to make additional spectrums available for 5G services. The FCC has made auctioning high-band spectrum a priority. Moreover, the rising adoption of wireless devices and the expansion of IT infrastructure in various industries are expected to drive market growth.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The regional market growth is attributed to the rising adoption of the Industrial Internet of Things (IoT) devices, which rely on connected technologies. The proliferation of 5G networks further supports market growth in the region. China is one of the world’s largest producers and exporters of electronic devices, boosting the demand for testing equipment to ensure optimal performance of wireless devices. Moreover, rapid digital transformation in India and the expansion of the IT & telecommunication sector contribute to market growth. Governments around the region are also making efforts to support digital transformation, which further boosts market growth.

Europe is observed to grow at a significant rate in the coming years. The European wireless testing market growth can be attributed to the increasing initiatives to enhance the digital connectedness of enterprises, citizens, and government institutions. This, in turn, boosts the demand of wireless testing solution. Innovations in satellite and NTN communications drive market growth. In addition, the rising adoption of wireless technologies and the rollout of 5G networks contribute to regional market growth.

The wireless testing market is growing rapidly due to the growing adoption of wireless technologies in various industries. Wireless testing is a reliable way to ensure that devices perform well. In the evolving landscape of digital connectivity, wireless testing has become instrumental. The increasing adoption of wireless technologies across various industries and the rising dependence on seamless communication highlight the critical role of comprehensive testing strategies. With the rising reliance on wireless solutions, the need for robust testing strategies has become more important than ever. Continuous advancements in wireless technologies and the transition from 4G to 5G further support market growth. Wireless testing is vital to validate interoperability, compatibility, and performance through a diverse array of protocols, networks, and devices.

| Report Coverage | Details |

| Market Size by 2034 | USD 51.17 Billion |

| Market Size by 2025 | USD 25.07 Billion |

| Market Size by 2024 | USD 23.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.25% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in Digital Inclusion

The growing digitalization is a key factor driving the growth of the wireless testing market. With the growing digitization, there is a high adoption of wireless devices and sensors in a range of industries, boosting the demand for wireless testing solutions. As governments and private stakeholders invest in reasonable internet infrastructure, digital literacy programs, and digital platforms, the demand for wireless devices and connectivity solutions is surging. This further boosts the demand for testing solutions to ensure the interoperability, security, and performance of wireless technologies across various environments and use cases. By enabling safe and reliable access to the digital economy, digital inclusion efforts are significantly boosting the need for standardized wireless testing across emerging markets and low connectivity areas.

Testing Complexity

As wireless technologies become more advanced and complex, testing becomes more challenging, limiting the growth of the market. Testing of interoperability between various technologies and devices, such as 4G, 5G, Wi-Fi, and Bluetooth, adds complexity to the process. Optimizing performance of these networks and devices require sophisticated testing methods. In addition, high costs associated with wireless testing restrain the growth of the market.

Adoption of Wireless Testing for Medical and Consumer Devices

The rising integration of wireless technology in a wide range of products, from everyday consumer electronics such as laptops and electric toothbrushes to advanced medical and industrial devices, creates a significant growth opportunity for the wireless testing market. As global regulatory bodies enforce varying compliance standards for wireless security, functionality, and health-related performance, manufacturers must navigate a complex web of jurisdiction-specific requirements. This regulatory diversity is particularly critical in the medical sector, where the performance of wireless medical devices is subject to stringent testing. As a result, the demand for comprehensive, tailored wireless testing solutions is expected to increase.

The equipment segment dominated the wireless testing market with the largest share in 2024. This is mainly due to the increased adoption of wireless devices in various industries. As the adoption of wireless devices increases, so does the demand for testing equipment. Wireless test equipment enables companies to lower maintenance and debugging time while enhancing test performance. Wireless test equipment replaces all of the wires with copper traces that are used on a multi-layer printed circuit board (PCB) for more direct and accurate results. This equipment has many advantages like cleaner signals and faster test rates.

The services segment is expected to grow at a significant rate during the forecast period. Wireless testing is a significant solution that ensures the security, functionality, and performance of wireless communication devices and systems. Since procuring testing equipment is costly, companies often choose to outsource testing services from service providers. The growing reliance on wireless technologies further boosts the demand for efficient testing services.

The 4G/LTE segment dominated the market in 2024. The growth of the segment is driven by the widespread adoption of 4G/LTE networks. 4G has transformed wireless technology in the last few years, providing better reliability, faster speeds, and a seamless consumer experience. 4G/LTE remains a versatile and powerful technology, which is able to meet the requirements of mobile users and create the way for future developments in wireless communication.

The 5G segment is anticipated to expand at a significant CAGR in the upcoming period. The segment growth can be attributed to the rising proliferation of 5G technology worldwide. 5G networks offer high bandwidth and lower latency, making them ideal in the digital landscape. With the increasing desire for high-speed connectivity, the demand for 5G technology is rising. This, in turn, boosts the demand for efficient testing equipment.

The consumer electronics segment led the wireless testing market in 2024. This is mainly due to the increased production and adoption of wireless consumer devices. Wireless testing is a reliable way to confirm that these devices perform better. Wireless testing enables seamless connectivity between networks and electronic devices and ensures that they perform tasks smoothly without interruption or delay. The rise in the proliferation of smart devices further bolstered the segmental growth.

The IT & telecommunication segment is projected to grow at a rapid pace during the projection period. The growth of the segment can be attributed to the rapid expansion of the IT infrastructure. Wireless testing is essential to meet regulatory requirements, enhance performance, and lower complexities in IT and telecommunication networks. Wireless testing supports the identification of potential anomalies and performance bottlenecks in wireless networks. The rising adoption of high-speed networks in IT & telecommunication sector further supports the growth of the segment.

By Offering

By Technology

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

October 2024

February 2025