September 2024

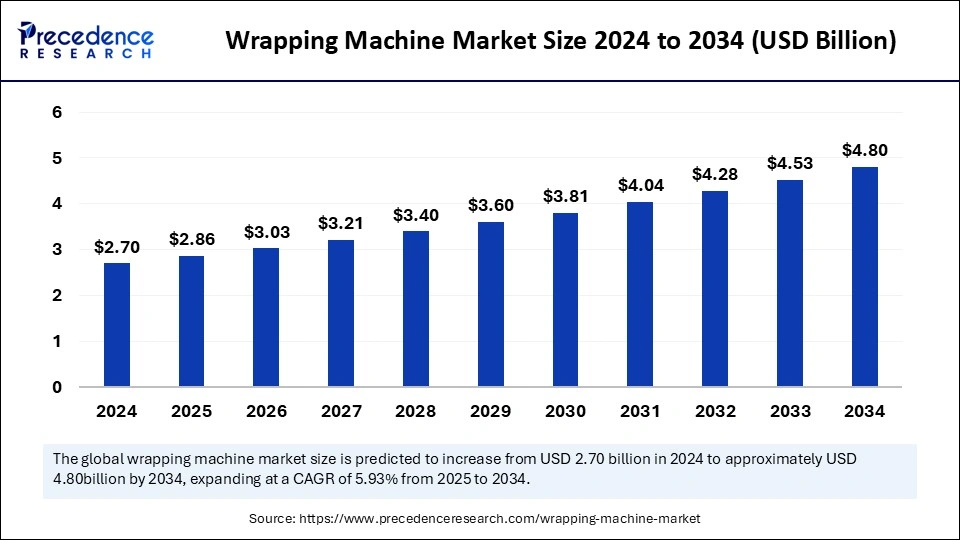

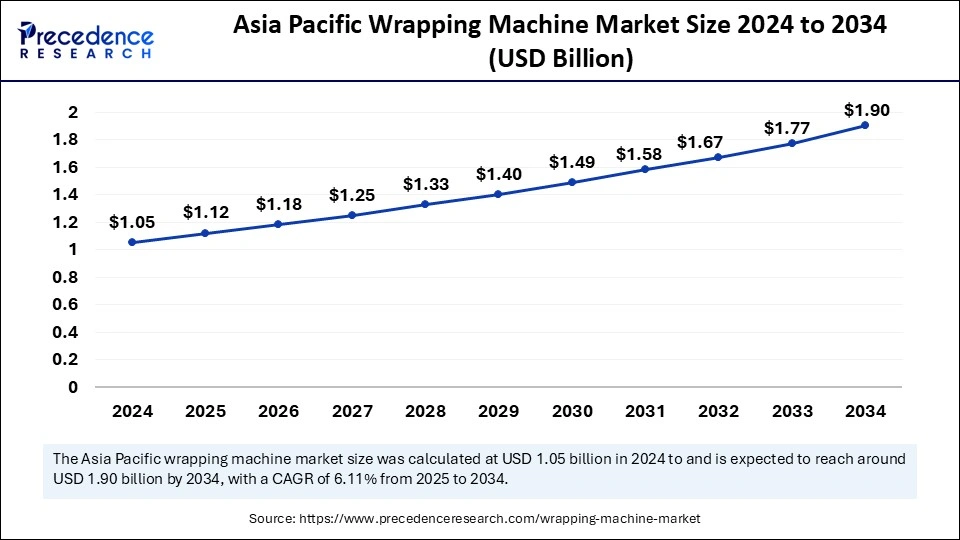

The global wrapping machine market size is calculated at USD 2.86 billion in 2025 and is forecasted to reach around USD 4.80 billion by 2034, accelerating at a CAGR of 5.93% from 2025 to 2034. The Asia Pacific market size surpassed USD 1.05 billion in 2024 and is expanding at a CAGR of 6.11% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wrapping machine market size was calculated at USD 2.70 billion in 2024 and is predicted to increase from USD 2.86 billion in 2025 to approximately USD 4.80 billion by 2034, expanding at a CAGR of 5.93% from 2025 to 2034.Rising investments in the food and beverage sector are the key factor driving market growth. Also, increasing industrialization coupled with technological advancements in wrapping machines can drive market growth further.

Artificial intelligence provides the capability to assess and diagnose issues in packaging to make quick adjustments to prevent loss. AI in the wrapping machine market makes it convenient to track products from start to end of the process. Furthermore, AI-driven predictive maintenance can monitor wear and tear in real-time and make changes in the system accordingly. It also ensures that all packaging lines are running smoothly and optimized in a proper manner.

The Asia Pacific wrapping machine market size was exhibited at USD 1.05 billion in 2024 and is projected to be worth around USD 1.90 billion by 2034, growing at a CAGR of 6.11% from 2025 to 2034.

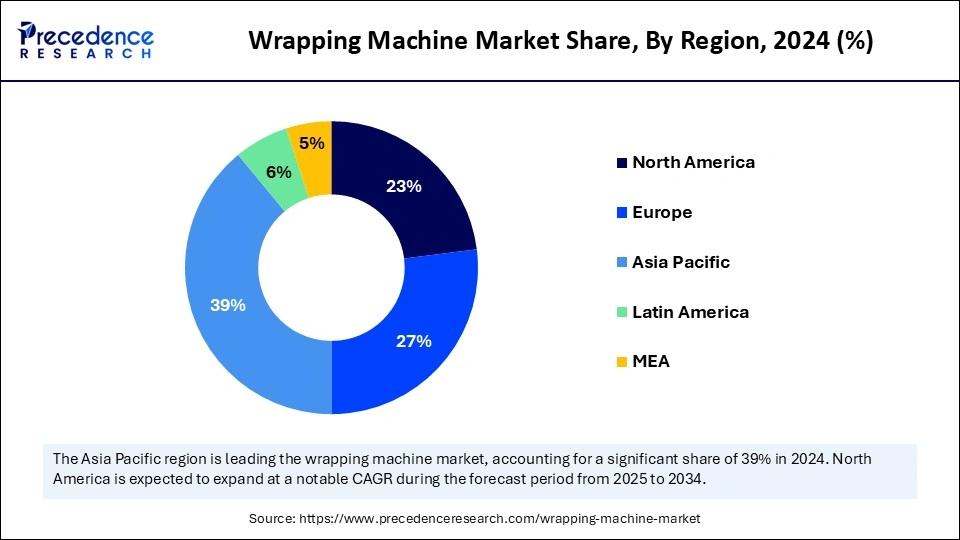

Asia Pacific dominated the wrapping machine market in 2024. The dominance of the segment can be attributed to the growth in the food and beverage industry coupled with the ongoing industrialization and urbanization in the region. These machines are in high demand in many sectors, such as food manufacturing, pharmaceutical products, and consumer electronics and products. In Asia Pacific, China led the market, owing to the government strategies supporting industrial automation and advancements.

Latin America is expected to grow at the fastest rate over the projected period. The growth of the region can be credited to the market players' increasing shift towards automation in packaging processes, which improves efficiency and decreases labor costs. However, countries like Brazil are leading the market in the region due to ongoing industrial development and the growing demand for innovative wrapping machines.

Wrapping machines are utilized in the manufacturing and packaging industry to pack items in stretch film to maintain product quality and achieve high manufacturing rates. Wrappers are available in various sizes and shapes, such as stationary, ring, vertical, and orbital wrappers. The major requirement for the wrapping machine market was recently noticed in huge manufacturing economies like Germany, Italy, the UK, and the U.S. Wrapping machines utilize a series of sealing and folding operations to encapsulate a material completely.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.80 Billion |

| Market Size in 2025 | USD 2.86 Billion |

| Market Size in 2024 | USD 2.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Latin America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Mode Of Operation, Machine Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase demand for safe transport and packaged goods

An automated wrapping machine can wrap the whole pallet without using any lifting machines. Hence, the wrapping machine market is anticipated to grow smoothly in the upcoming years because of the surging demand for safe transportation of commodities and packaged goods. In addition, the packaging market is witnessing substantial growth in product wrapping, which further fuels the demand for wrapping machines. These machines are mostly preferred by organizations that specialize in one product.

Higher cost

The high cost associated with innovative wrapping machines is challenging for small organizations to afford, which is the major factor hampering the wrapping machine market. The rising market competition also strengthens a hard business environment, which can reduce the overall profit rate of the company. However, this high cost of wrapping machines can also impact other areas in the market, such as the packaging of goods and storage.

Increasing use of pneumatic technology

The wrapping machine market extensively uses pneumatic technology to boost motion and actuate the machine series, hence enhancing the safe operating performance of the equipment. This technology is compact, reliable, and lightweight, offering cost-effective actuation and control. Furthermore, pneumatic technology is primarily used for the impactful performance of point-to-point and high-speed movements like indexing and sorting.

The stretch machine segment dominated the wrapping machine market in 2024. The dominance of the segment can be attributed to the rising need for efficient packaging options across many industries, especially in pharmaceuticals and food and beverage. Additionally, innovations in technology like smart features and automation improve the reliability and function of stretch machines, which makes them more appealing to market players.

The shrink machine segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing demand for secure packaging that holds products tightly. This kind of wrapping is especially favored for its capability to safeguard items from damage and dust while keeping a visually appealing presentation. Also, advancements in shrink film technology are enhancing efficiency and sustainability.

The food application segment led the wrapping machine market in 2024. The dominance of the segment can be linked to the growing utilization of wrapping machines in the food industry as they used to pack many food items like confectioneries, cookies, chocolates, fruits, and bakery products. Moreover, destroyable food products with fewer lives, including dairy, bakery, and allied items, are prone to contamination, waste, and climatic changes. Which in turn results in further segment expansion.

The pharmaceutical application segment is estimated to grow at the fastest rate during the projected period. The growth of the segment can be driven by increasing demand for compliant and secure packaging solutions for healthcare and medicines products. The pharmaceutical industry necessitates high grades of safety and hygiene, which can be offered by wrapping machines through innovative technology.

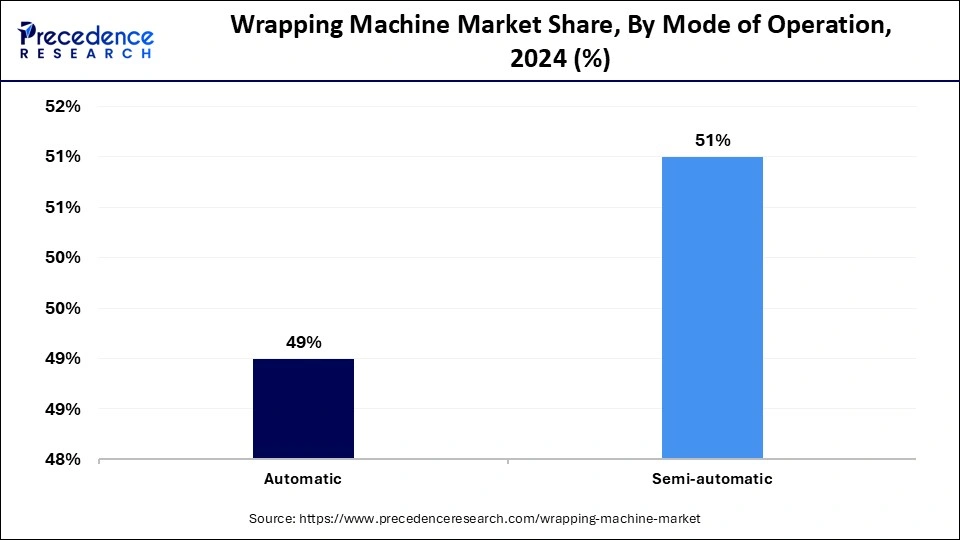

In 2024, the semi-automatic mode of operation segment dominated the wrapping machine market by holding the largest market share. The dominance of the segment is due to the lower initial investment costs required than the automatic systems. Semi-automatic mode offers flexibility in overall packaging processes, which makes it convenient for organizations with changing production volumes. Furthermore, the adaptable nature of these machines improves their appeal in many industries.

The automatic mode of operation segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is because of the growing market demand for automation among a range of industries. Automated wrapping machines have several advantages, such as quicker packing, less human interference, and efficient wrapping of many items, enhancing efficiency.

By Machine Type

By Mode of Operation

By Application

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

October 2024

December 2024