January 2025

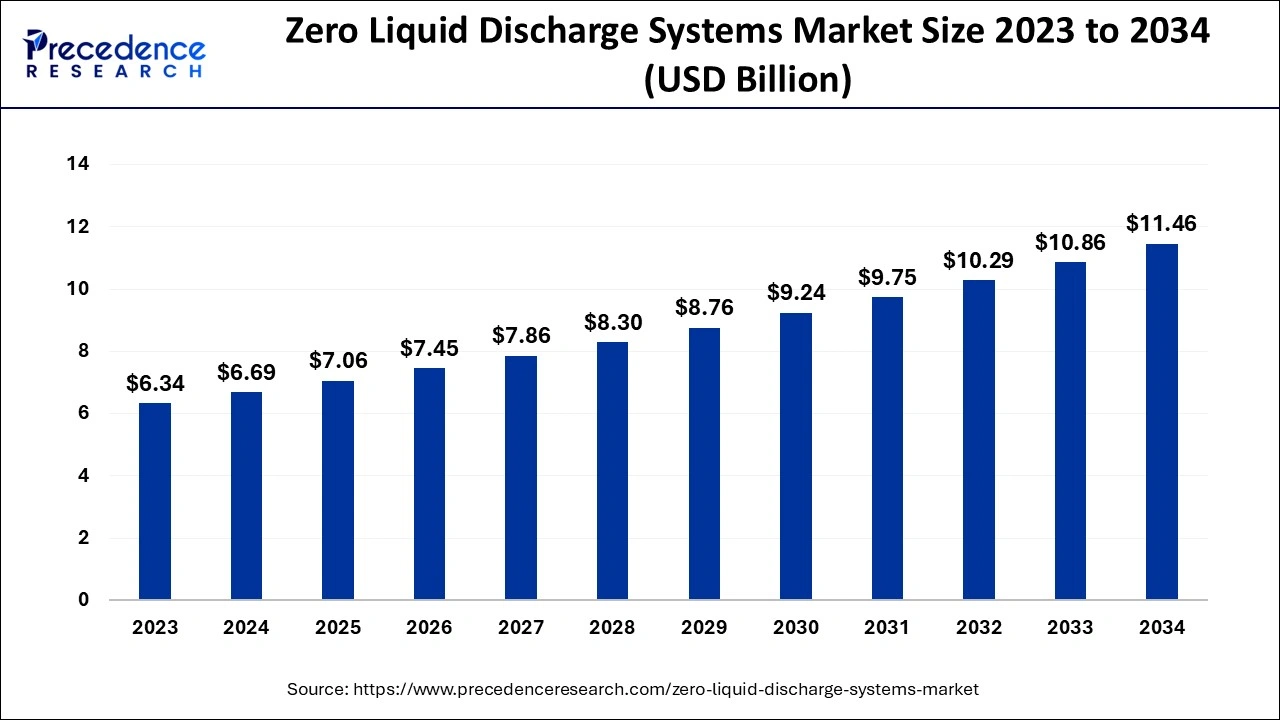

The global zero liquid discharge systems market size accounted for USD 6.69 billion in 2024, grew to USD 7.06 billion in 2025 and is estimated to hit around USD 11.46 billion by 2034, representing a CAGR of 5.53% between 2024 and 2034.

The global zero liquid discharge systems market size is calculated at 6.69 billion in 2024 and is anticipated to reach around USD 11.46 billion by 2034, growing at a CAGR of 5.53% from 2024 to 2034. The rising demand for wastewater management in industries is driving the growth of the zero liquid discharge systems market.

The integration of artificial intelligence into the zero liquid discharge systems market improves the operations and predicts the demand for time-to-time maintenance. AI provides the real-time parameters in waste water treatment. AI helps in increasing efficiency and reduces the downtime. Predictive analytics helps in preventing failure of equipment and minimize the cost effectiveness and enhance the reliability.

Zero liquid discharge systems are engineering technologies and systems for water treatment. They help recover contaminated wastewater. The increasing demand for the zero liquid discharge systems market from different end-use industries for efficient and cost-effective wastewater management.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.46 Billion |

| Market Size in 2024 | USD 6.69 Billion |

| Market Size in 2025 | USD 7.06 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | System Type, Technology, Process, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of the zero liquid discharge system owing to its benefits

The increasing demand for the zero liquid discharge systems market by different industries due to its several benefits, such as reduced water consumption, enhanced water recovery, water conservation, cost-effectiveness, compliance with regulations, reduced waste, flexibility for multiple water resources, compliance with the stringent environmental pollution, energy recovery, and others.

High cost

The increased cost of the operations and installation process of the zero liquid discharge systems in the different industries is restraining the growth of the zero liquid discharge systems market.

Technological advancements in zero liquid discharge systems

Technological advancements in the zero-liquid discharge system, such as evaporators and reverse osmosis, significantly minimize the required energy for the treatment of wastewater in the zero liquid discharge systems market. Technological advancements have increased energy efficiency in industries.

The conventional segment led the global zero liquid discharge systems market in 2023. The rising industrial development in economically developing countries is driving the demand for zero-discharge systems. The technology is deployed by several industries for the management of end-of-pipe treatment. The conventional zero liquid discharge system is effective and cost-efficient, which drives the adaptation of technology or systems by the different end-use industries.

The smart segment is expected to witness the fastest growth in the zero liquid discharge systems market during the forecast period. The rising advancement in the industries and the adaptation of smart technologies into the industries and other applications are driving the growth of the market. Smart technologies help in enhancing wastewater management in industries. The smart zero liquid discharge system is implemented by different end-use industries such as the electronics industry, chemical industry, pharmaceutical industry, and others.

The thermal based segment dominated the zero liquid discharge systems market in 2023. The increasing adoption of thermal-based technology in zero liquid discharge industries is due to its association with several advantages, such as a reliable and strong working system. The thermal system is compatible with working in tough conditions, though it is widely adopted by various end-use industries. Thermal-based technology helps reduce industry waste and supports economic goals and environmental policies.

The membrane based segment will witness the fastest growth in the zero liquid discharge systems market during the predicted period. The increasing demand for the cost-effective and efficient solution of industrial wastewater is driving the demand for membrane-based technology. There are two types of membranes used in wastewater management: organic membranes and inorganic membranes.

The evaporation/crystallization segment held a notable share in the zero liquid discharge systems market in 2023. The evaporation and crystallization process is majorly adopted by a number of industries due to its separation and management capabilities of the wastewater. The evaporation and crystallization efficiently manage the different types of wastewater, such as high-content salt water and water with different contaminants. In the crystallization process, the soluble liquid solution is converted into a solid state using both the purification and separation models. In the evaporation state, any type of liquid or compound turns into a gas state.

The energy & power segment dominated the zero liquid discharge systems market in 2023. The rising global population and the demand for the energy and power industries for efficient working management of the residential, commercial, and industrial sectors are driving the growth of the market in the energy and power industries. The rising environmental concern, the demand for reducing the carbon footprint, and the demand for water consumption from the energy and power industries are driving the growth of the market in the energy and power industries.

The oil & gas segment is anticipated to show the fastest growth in the zero liquid discharge systems market during the anticipated period. Industries like oil and gas are driving the demand for efficient technologies to reduce the wastage of water and provide environmental benefits, which are driving the growth of the market. The zero-liquid discharge systems reduce liquid waste and increase water usage efficiency.

Asia Pacific dominated the zero liquid discharge systems market in 2023. The growth of the market is attributed to the rising population across countries like China, India, and other regional countries, as well as the economic development of the countries that are driving industrialization, which drives the growth of the zero liquid discharge systems. The rising concern over environmental pollution due to industrial waste and excess use of fluid is driving the demand for technology that copes with the pollution level by the industries.

North America will witness significant growth in the zero liquid discharge systems market during the forecast period. The growth of the market is attributed to the increased presence of different industries, such as automotive, pharmaceutical, oil and gas, energy and power, and chemical industries, which require an increased number of fluid substances or water in the manufacturing of the product drives the demand for the zero liquid discharge system for reducing fluid wastage and eliminating the excessive water wastage from the industries. The integration of the technological advance system in the different end-use industries and the government intervention in the development of industries.

By System Type

By Technology

By Process

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

April 2022