February 2025

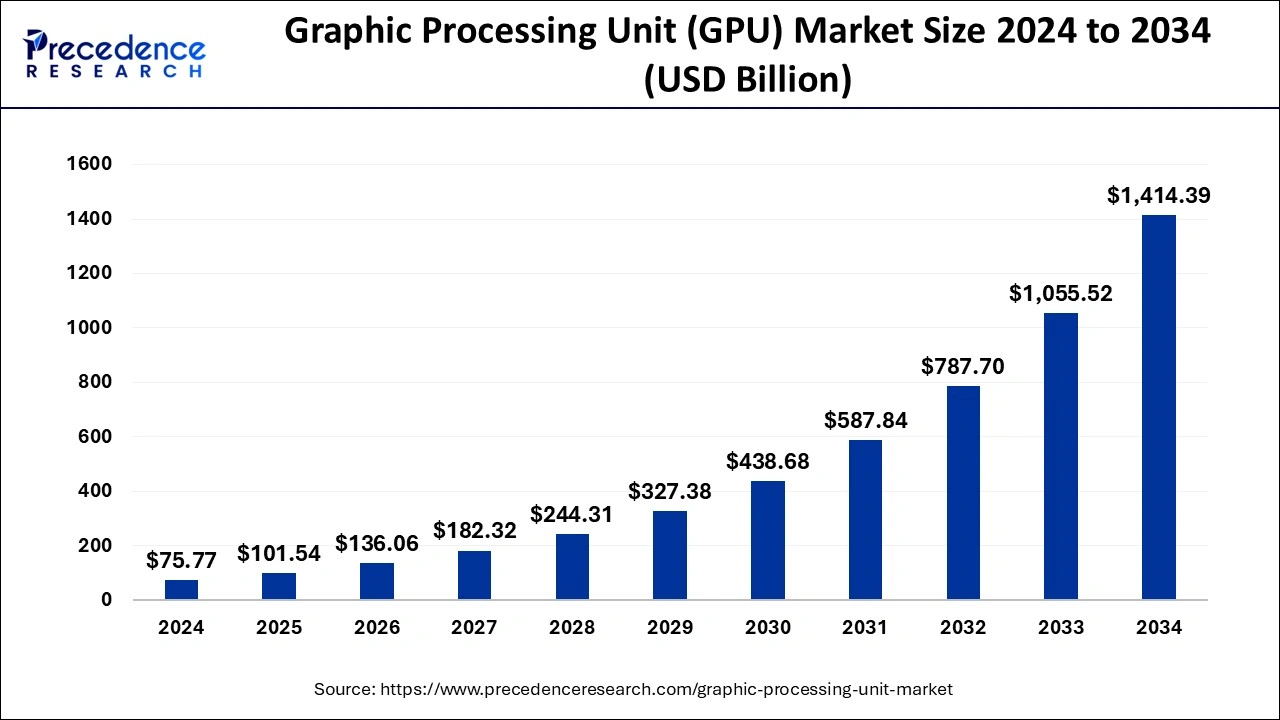

The global graphic processing unit (GPU) market size is calculated at USD 101.54 billion in 2025 and is forecasted to reach around USD 1,414.39 billion by 2034, accelerating at a CAGR of 13.8% from 2025 to 2034. The Asia Pacific graphic processing unit (GPU) market size surpassed USD 32.49 billion in 2025 and is expanding at a CAGR of 14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global graphic processing unit (GPU) market size was estimated at USD 75.77 billion in 2024 and is anticipated to reach around USD 1,414.39 billion by 2034, expanding at a CAGR of 13.8% from 2025 to 2034. The demand for graphic processing unit (GPU) market is expected to rise during the forecast period with growing sales of portable electronics, popularity of Internet of Things (IoT) and wearables.

GPU’s have proven itself to be suitable option for integration of AI technology. It is more versatile for researchers as well as developers that require experimentation with AI technology through different approaches. AI models are trained regularly utilizing GPU to complete complex mathematical operations that are needed to adjust model’s parameters. This training process need to be fed large amounts of data, GPU can help to accelerate the process because it can perform different calculations at the same time. GPUs have a crucial role to play in the inference phase of running AI models. Their capability of quickly being able to execute tough calculations help enable AI powered applications to respond to user requests efficiently and fast. With rising implementation of AI technology, the demand for graphic processing unit (GPU) market will soar.

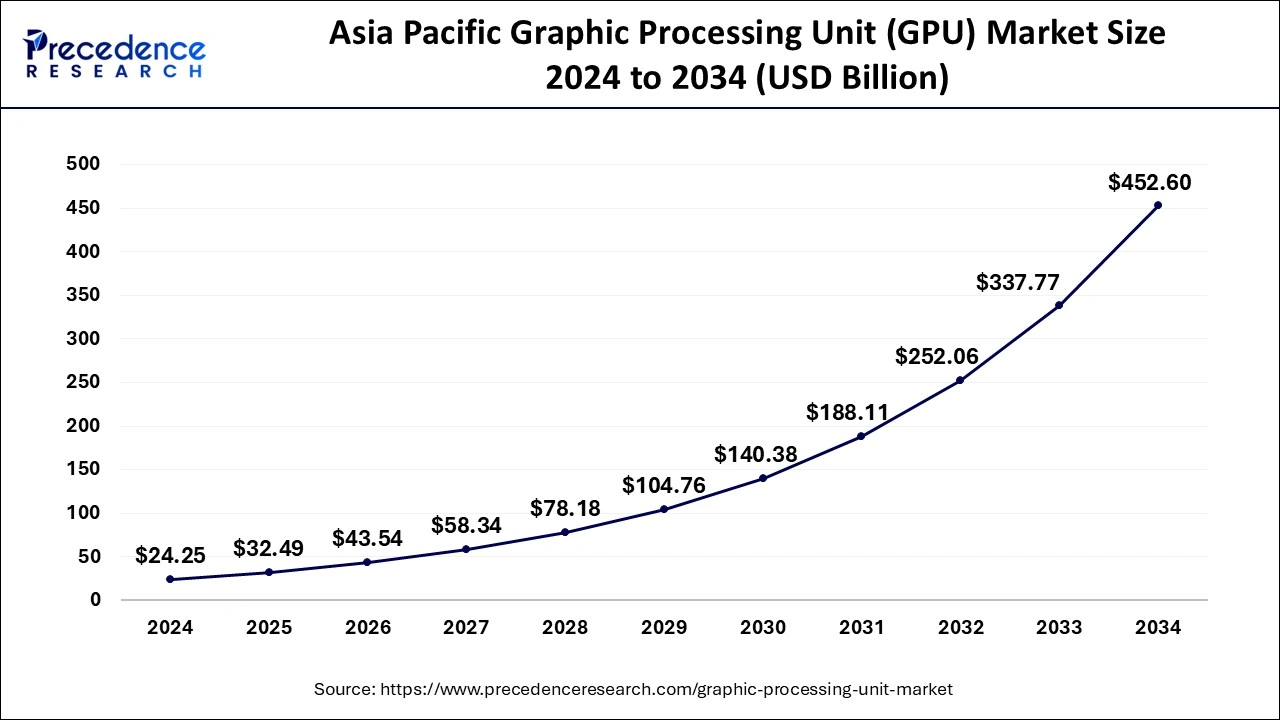

The Asia Pacific graphic processing unit (GPU) market size was estimated at USD 24.25 billion in 2024 and is predicted to be worth around USD 452.60 billion by 2034, at a CAGR of 14% from 2025 to 2034.

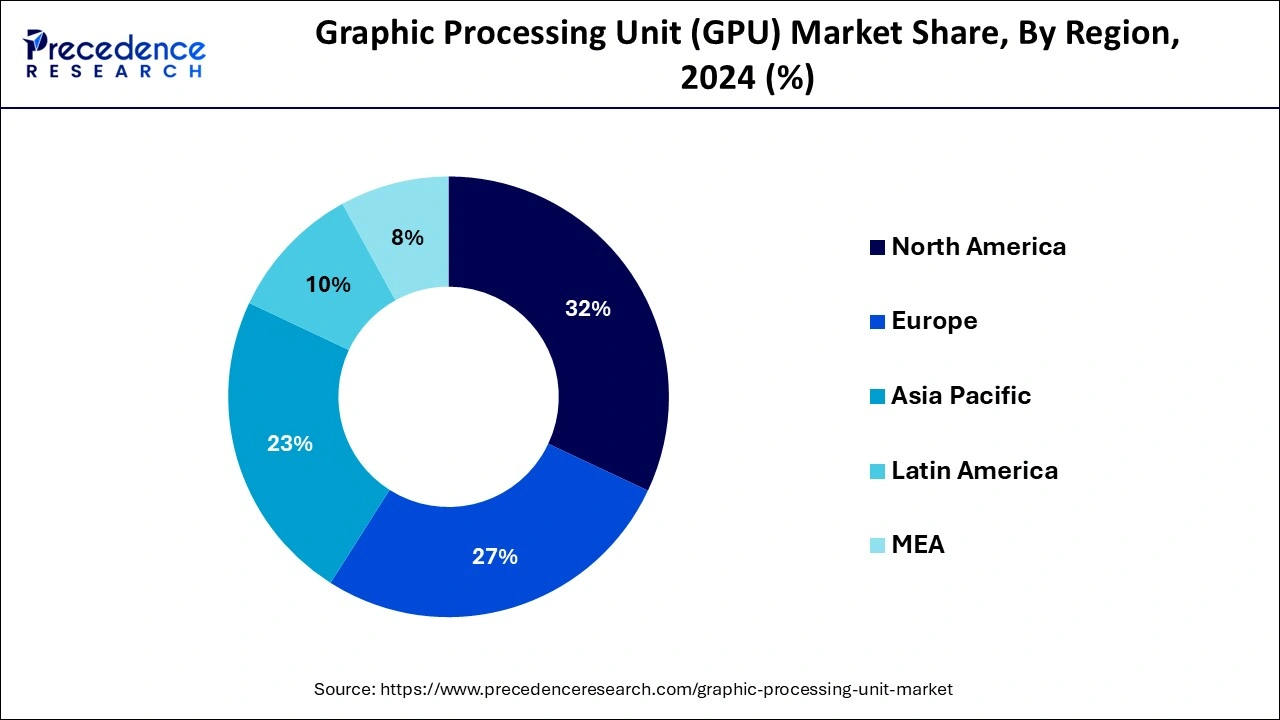

The Asia-Pacific dominated the global graphics processing unit market in the year 2024 and is projected to retain its dominant position during the forecast period. The growth of the region is attributed to the significant investment from the government to generate high graphic computing systems used for defense & intelligence coupled with the rising incorporation of IoT systems that demand efficient graphic computing systems. Furthermore, rising penetration of the internet and smartphones in the region accounted as the other most important factors escalating the demand for graphic processing units over the forecast timeframe.

In Asia Pacific, China has a major role in the growth of graphic processing unit (GPU) market. China is a main producer as well as consumers of semiconductors and other related products. The initiatives by the government support the rise of digital technologies in the country. It promotes integration of technological advancements like Artificial intelligence (AI), Internet of Things (IoT), automation etc. China is rapidly adopting digital technologies in their public sector for efficient public services. Such factors will continue aiding the growth of this market in the country during the forecast period.

Rest of the world anticipated to witnesses the highest growth rate in the upcoming years because of various factors that include rise in disposable income, increasing purchasing capability of consumers, and rise in demand for smartwatches and smart TV in the region drives the growth of the market. Furthermore, Latin America and Middle East & Africa offer lucrative opportunities for establishing new network communication that triggers the investment in the internet and smartphone market in the region.

Factors such as continuous advancements in graphic-based games, trending Artificial Intelligence (AI), traction in Augmented Reality (AR) & Virtual Reality (VR), and increasing adoption of gaming laptops together with computers are expected to propel the graphics processing unit market growth. In addition, thriving wearable and portable electronics market along with the rising popularity of the Internet of Things (IoT) predicted to accelerate the growth of the graphics processing unit market during the upcoming years.

Achieving augmented reality along with producing a convincing user experience is now feasible due to significant improvements in the graphics technology coupled with related technology developments in consumer electronics and smart phones. Numerous GPU manufacturing companies are engaged in the development of VR solutions that expected to basically redefine the computing experience. Furthermore, companies are prominently developing advanced GPU systems for VR and AR, thereby attracting the computer and film industries, consumers, and developers. Increasing integration of VR and AR in different applications projected to propel the adoption of graphic processing units.

On the other side, inability of integrated GPU to assist intensive graphic designing software projected to restrict the growth of the graphics processing unit market during forecast period.

| Report Highlights | Details |

| Market Size in 2024 | USD 75.77 Billion |

| Market Size by 2034 | USD 1,414.39 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.8% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device, Type, Industry Vertical, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The smartphone devices emerged as the dominating segment in the global GPU market for the year 2024 and expected to maintain the same trend over the forecast period. The growth of the segment is attributed to the significant demand of durable as well as less power consuming GPU that foster the growth of integrated GPUs in the smartphone segment. In addition, smartphone manufacturers develop products that support AR and VR that projected to offer significant opportunity for the smartphone GPU market. Moreover, increasing adoption of smartphones for gaming purpose has surged the demand for high-end computing systems that can serve graphics-intensive gaming applications.

On the other hand, the other segment anticipated to witness the highest growth rate during upcoming years because of rising demand for small sized and efficient GPUs in other devices for example medical equipment that can potentially spur the graphic computing quality and speed.

The integrated segment led the GPU market by type with a prominent value share in 2024 and expected to retain its position during the forthcoming years because integrated GPUs find wide application in portable electronic devices that include tablets, smartphones, laptops, wearable’s, and many others. In addition, the market witness significant research activities dedicated towards the development of integrated GPUs that are capable enough to aid high graphic processing in supercomputers, AI platforms, and VR systems.

Besides this, hybrid GPUs predicted to register the highest growth over the analysis period as hybrid processors have capabilities of both dedicated and integrated GPU that makes them a preferred choice for the software developers to improve the efficiency of graphics-intensive applications.

By Device

By Type

By Industry Vertical

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

August 2024