July 2025

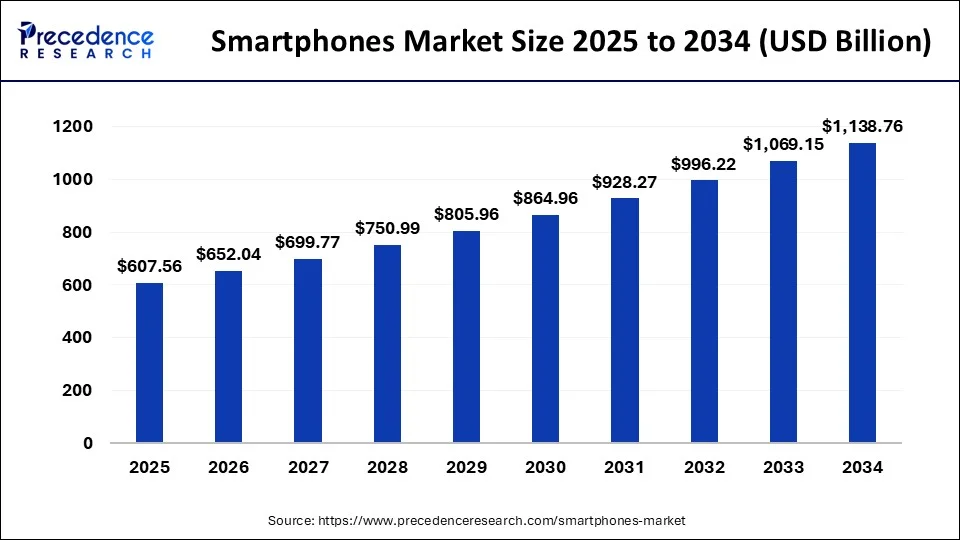

The global smartphones market size accounted at USD 566.12 billion in 2024 and is predicted to reach around USD 1138.76 billion by 2034, growing at a CAGR of 8% from 2025 to 2034. Several technological advancements, including the integration of augmented reality and virtual reality, are observed to drive the growth of the smartphones market.

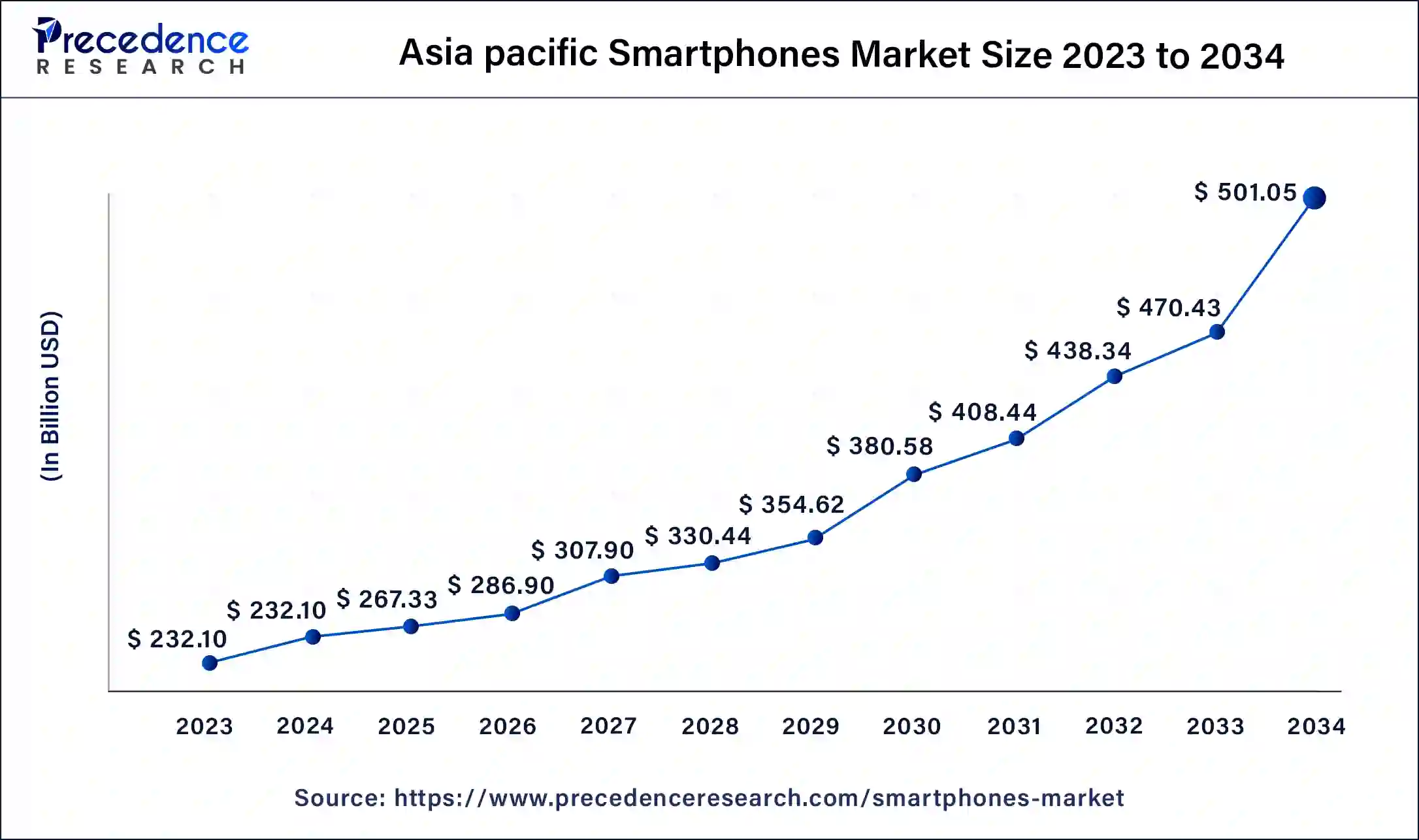

The Asia Pacific smartphones market size was estimated at USD 232.10 billion in 2024 and is predicted to be worth around USD 501.05 billion by 2034 at a CAGR of 8.10% from 2025 to 2034.

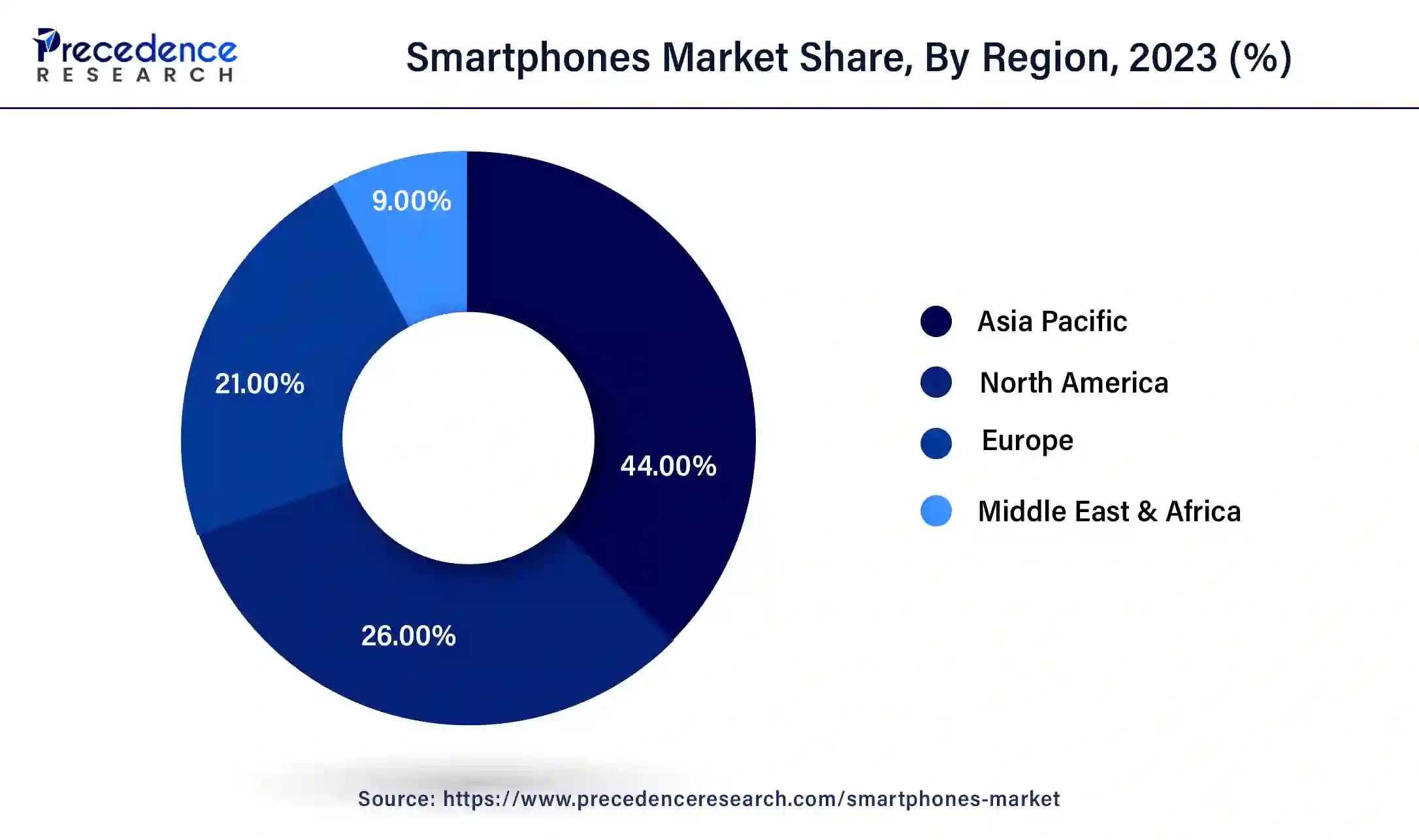

Asia Pacific dominated the Smartphones market in 2024. Due to a number of factors, including a sizable and increasingly affluent consumer base, robust manufacturing capabilities, and the presence of major Smartphones companies such as Samsung, Huawei, Xiaomi, and Oppo, which offer cutting-edge products at a range of price points and cater to diverse market segments, the region leads the global market. The demand for smartphoness for business, leisure, and communication has also increased due to the region's quick urbanization and digitization.

Currently, Asia Pacific is dominating the smartphone market. Within the region, China holds the largest market share. This region is the innovative and advanced center of various smartphone brands, expanding globally, and is reshaping and developing in the technological sector. The popular brands Samsung and Xiaomi of Asia Pacific have ruled the smartphone industry for years.

North America is expected to grow at the fastest rate in the Smartphones market during the forecast period. Due to factors like the growing adoption of 5G and other advanced technologies, growing demand for smartphoness with more features and capabilities, ongoing innovation in smartphones design and functionality, and the growth of digital services and applications that encourage smartphones usage, North America is expected to have a larger share of the market.

The smartphones market in the United States is one of the world’s largest, with over 310 million smartphones users as of 2023. In line with the overall growth of the market worldwide, the smartphones penetration rate in the United States has continuously risen over the past several years, reaching around 92 percent in 2023.

The smartphones market refers to a portable device that integrates phone and computer features. Typically, they provide portable devices with functions like email, applications, cameras, and other internet connections, among others. The iPhone from Apple, the Galaxy series from Samsung, the Pixel phones from Google, and many more are well-known brands.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8% |

| Market Size in 2024 | USD 566.12 Billion |

| Market Size in 2025 | USD 607.56 Billion |

| Market Size by 2034 | USD 1138.76 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Operating System, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of smartphoness in the younger generation

The rising adoption of smartphoness by the younger generation can grow thesmartphones market. The younger generation is usually the first to adopt new technologies and settings trends, affecting the older group and their friends. People have become more dependent on smartphoness as they use them for work, entertainment, and communication, which has expanded the market for smartphoness. Younger consumers also tend to be more interested in the newest features and updates, which encourage constant innovation and competitiveness in the market.

Environmental impact of smartphones production

The environmental impact of Smartphones production slows down the smartphones market. The growing environmental limits may result in increased cost of production of the market and decreased profit margins for procedures or higher pricing for consumers of the market.

Rising production of 5G connectivity smartphoness

The rising production of 5G connectivity smartphoness can be an opportunity to grow the smartphones market. There are numerous strategies to grow the market with the growing supply of devices with 5G connection. First of all, it satisfies consumers’ need for smooth streaming, gaming, and browsing experiences by meeting the rising need for faster and more dependable mobile internet access. Second, it encourages customers to replace their outdated gadgets with ones that can connect to 5G networks, boosting income and sales in the market.

Technological advancements in the smartphone market feature foldable displays, 5G connectivity, generative AI, and AR/VR integration. The foldable display is a device that presents the combination of expansive screen real estate with compact design, supporting applications such as gaming. The 5G connectivity in smartphones is a first preference of customers. The connection offers faster data speed, which enhances customer experience. The generative AI technology is a development and advantage for new brands to adopt this technology briefly, to compete and survive in the long-term market race. The AR/VR integration technology offers a thrilling and virtual experience mainly in entertainment and gaming. Furthermore, the smartphone market is prone to new technology and advancement. The fastest adaptive market seeks innovation and expansion.

The iOS segment dominated the smartphones market in 2023. Due to a number of factors, including its reputation for security, the ecosystem's interaction with other Apple goods, regular software upgrades across devices, and a strong focus on user experience and design, iOS manages to hold a sizable portion of the market. Furthermore, Apple's marketing approaches and brand loyalty help it maintain its supremacy in particular markets and demographics.

The number of Apple iPhone unit sales dramatically increased between 2007 and 2022. Indeed, when the iPhone was first introduced in 2007, Apple shipped around 1.4 million smartphoness. By 2022, this number reached over 232 million units.

The android segment is expected to grow at a significant CAGR in the smartphones market during the forecast period. Android is more accessible to a wider spectrum of customers due to its abundance of devices in different price ranges. Furthermore, customers who value customization choices will find Android more enticing than iOS since it offers greater customization and flexibility. Moreover, the fact that Android is available on devices made by several manufacturers encourages innovation and competition, which advances both software and hardware features. Lastly, the adaptability of Android and its substantial presence in emerging markets.

The e-commerce segment dominated the smartphones market in 2024. The ease that e-commerce provides is a major factor in its domination in the smartphones industry. The users can explore, compare, and buy things from anywhere at any time with only a few clicks on their phones. Furthermore, mobile-friendly user experiences are a common feature of e-commerce platforms, which makes it easy for customers to buy on their Smartphoness. Because of its usability and accessibility, e-commerce has expanded rapidly in the market.

The retailer segment is expected to grow at a rapid pace in the smartphones market during the forecast period. In the smartphones industry, the retailer segment is anticipated to expand because of a number of causes. First off, merchants are investing in developing smooth mobile purchasing experiences for their customers as they become more aware of the significance of mobile commerce, or m-commerce. This includes creating mobile applications, making websites mobile-friendly, and putting in place mobile-friendly payment methods. Second, merchants now have a larger pool of prospective customers because of the widespread use of cell phones.

Etailers may interact with customers who choose to purchase on their mobile devices and reach a wider audience as more individuals have access to Smartphoness globally. Furthermore, by enabling shoppers to view things before making a purchase, technological innovations like augmented reality (AR) and virtual reality (VR) are improving the mobile shopping experience. As more shops incorporate these technologies into their mobile platforms, it is anticipated that the retailer section of the market will rise as a result of this immersive shopping experience.

Almost three-quarters (74%) of retailers said mobile technology has made them more accessible to customers, while 66% said it has led to higher customer satisfaction. Other benefits of mobile technology include greater efficiency (cited by 62% of retailers) and lower customer service costs (33%). Only 18% of retailers said mobile technology makes it hard to service customers.

By Operating System

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2025

September 2025