August 2024

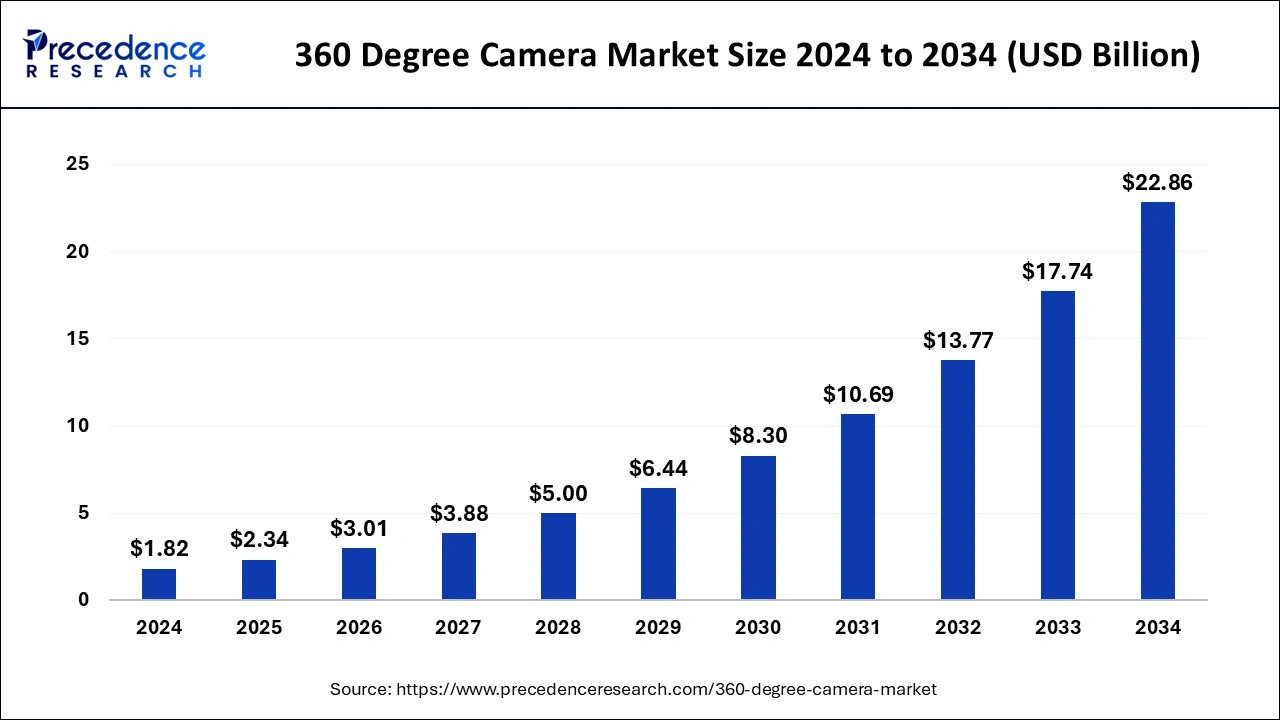

The global 360 degree camera market size is accounted at USD 2.34 billion in 2025 and is forecasted to hit around USD 22.86 billion by 2034, representing a CAGR of 28.82% from 2025 to 2034. The North America market size was estimated at USD 670 million in 2024 and is expanding at a CAGR of 29.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 360 degree camera market size was calculated at USD 1.82 billion in 2024 and is predicted to reach around USD 22.86 billion by 2034, expanding at a CAGR of 28.82% from 2025 to 2034. The rising demand for 360-degree cameras across diverse fields like entertainment and media, travel and tourism, real estate, and security surveillance boosts the growth of the market.

Artificial intelligence plays a crucial role in 360-degree camera mapping by analyzing a large dataset collected by these cameras in a short period of time. Such analysis is important in urgent scenarios. 360-degree cameras capture panoramic visuals with a full view of the environment. However, AI algorithms help to transcribe detailed panoramic images. It also helps in enhancing images and videos captured by these cameras. With the help of AI, these cameras can scan objects in real time.

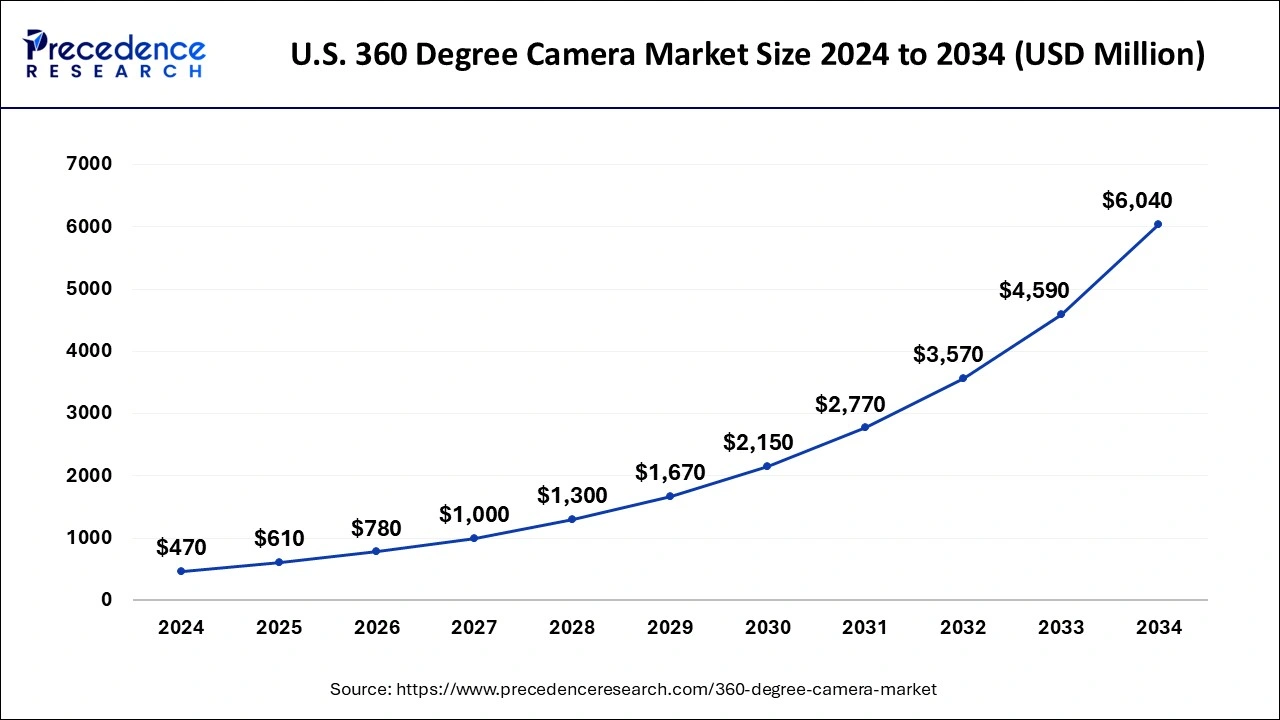

The U.S. 360 degree camera market size was exhibited at USD 470 million in 2024 and is projected to be worth around USD 6,040 million by 2034, growing at a CAGR of 29.09% from 2025 to 2034.

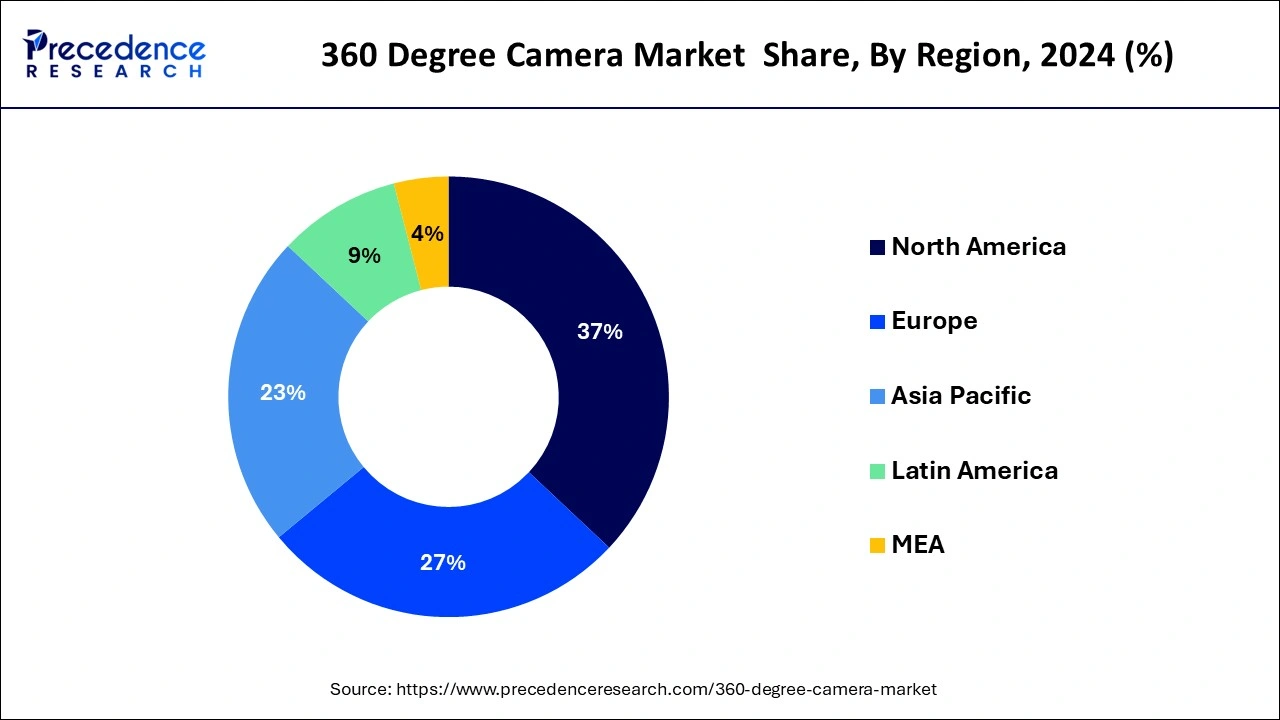

Based on the region, the North America dominated the market with highest market share in 2022. The tendency of customers to adopt technologically advanced products, as well as the presence of large number of market players producing solo cameras and setups, are driving the market growth in North America.

On the other hand, the Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. The growing demand for 360 degree cameras in virtual reality games will fuel the growth of the 360 degree camera market in Asia-Pacific region.

A 360 degree camera has a field of vision that encompasses almost the entire sphere or at least a full circle in the horizontal plane. In applications where vast visual field coverage is required, such as panoramic photography and robotics, 360-degree cameras are commonly employed in robotics for visual simultaneous localization and mapping and visual odometry challenges. Better results for optical flow and feature selection matching can be achieved due to its capacity to record a 360-degree image.

There are several 360 degree camera implementations available, including cameras with more than 30 lenses and two opposing fisheye lens combinations. There are a variety of 360-degree cameras available in the market, including Z-CAM, MadV, Red Digital Cinema, Ricoh, FXG, Panono, Trisio, Vuze, Insta360, Gear360, GoPro, and Kandao.

The 360-degree cameras are also available as standalone and single cameras with many lenses that assist in recording and automatically merging the content captured by the device. The greatest thing about utilizing 360-degree cameras is that they are simple to use compared to other cameras and are inexpensive.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.34 Billion |

| Market Size in 2034 | USD 22.86 Billion |

| Growth Rate | CAGR of 28.82% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Connectivity Type, Resolution, Vertical, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Platforms such as Facebook, Instagram, and YouTube have fully embraced 360-degree content, creating an engaging environment where users are encouraged to capture and share immersive experiences. These platforms are transforming the landscape of digital interaction by allowing users to experience content in a more interactive and lifelike manner. To facilitate this shift, 360-degree cameras have become essential tools for producing high-quality immersive content, particularly in the realms of virtual reality (VR) and augmented reality (AR), thereby boosting market growth. The increasing popularity of virtual and augmented reality content and the increasing usage of virtual reality headsets are propelling the global 360 degree camera market growth.

Despite the growing interest in 360-degree cameras, several factors limit their widespread adoption. One of the major challenges the market faces is the high costs associated with 360-degree cameras, restricting their accessibility to a broader consumer base. This financial limitation can deter potential buyers and content creators from investing in them. Additionally, technical challenges associated with seamlessly stitching together images from multiple cameras can be a significant concern. Achieving a cohesive and distortion-free 360-degree image requires advanced skills and software, and failures in this process can result in visual artifacts that detract from the immersive experience.

There are promising advancements on the horizon that could revolutionize the 360 degree camera market. Rapid developments in sensor technology and image processing algorithms enable the creation of high-resolution images and more realistic content. These developments make these cameras more appealing to consumers and creators alike. Furthermore, integrating artificial intelligence into 360-degree cameras unlocks a range of advanced features, including object recognition. These capabilities can simplify content creation and improve user experience.

Based on the connectivity type, the wired segment dominated the global 360 degree camera market in 2024, in terms of revenue. Wired cameras are connected to a power source and the internet connection by cable. This type of cameras is widely used in photo studios.

On the other hand, the wireless segment is estimated to be the most opportunistic segment during the forecast period. The wireless 360 degree cameras are widely used for commercial and residential purposes. This type of cameras is also used for the home security.

Based on the resolution, the high definition (HD) segment dominated the market in 2024. Due to high definition (HD) 360 degree camera’s increased clarity, the image on screen can be less blurry. Other advantages of high definition (HD) include better motion and brighter and more natural colors.

On the other hand, the ultra-high definition (UHD) is estimated to be the most opportunistic segment during the forecast period. The ultra-high definition (UHD) 360 degree camera are little expensive than high definition (HD) 360 degree cameras. The photos and videos taken by this camera is of high quality.

Based on the vertical, the consumer segment accounted largest revenue share in 2024. The use of 360 degree cameras is growing in a variety of applications including sports, photography, events, and festivals, indicating that the 360 degree camera market has capacity to grow.

On the other hand, the media and entertainment segment is estimated to be the most opportunistic segment during the forecast period. The multiple cameras are used in the 360 degree camera setups, resulting in exceptional 360 degree images. These setups are simple to use and incredibly durable, making them ideal for a variety of shooting scenarios.

By Connectivity Type

By Resolution

By Camera Type

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

January 2025

January 2025