What is Autonomous Vehicle Market Size?

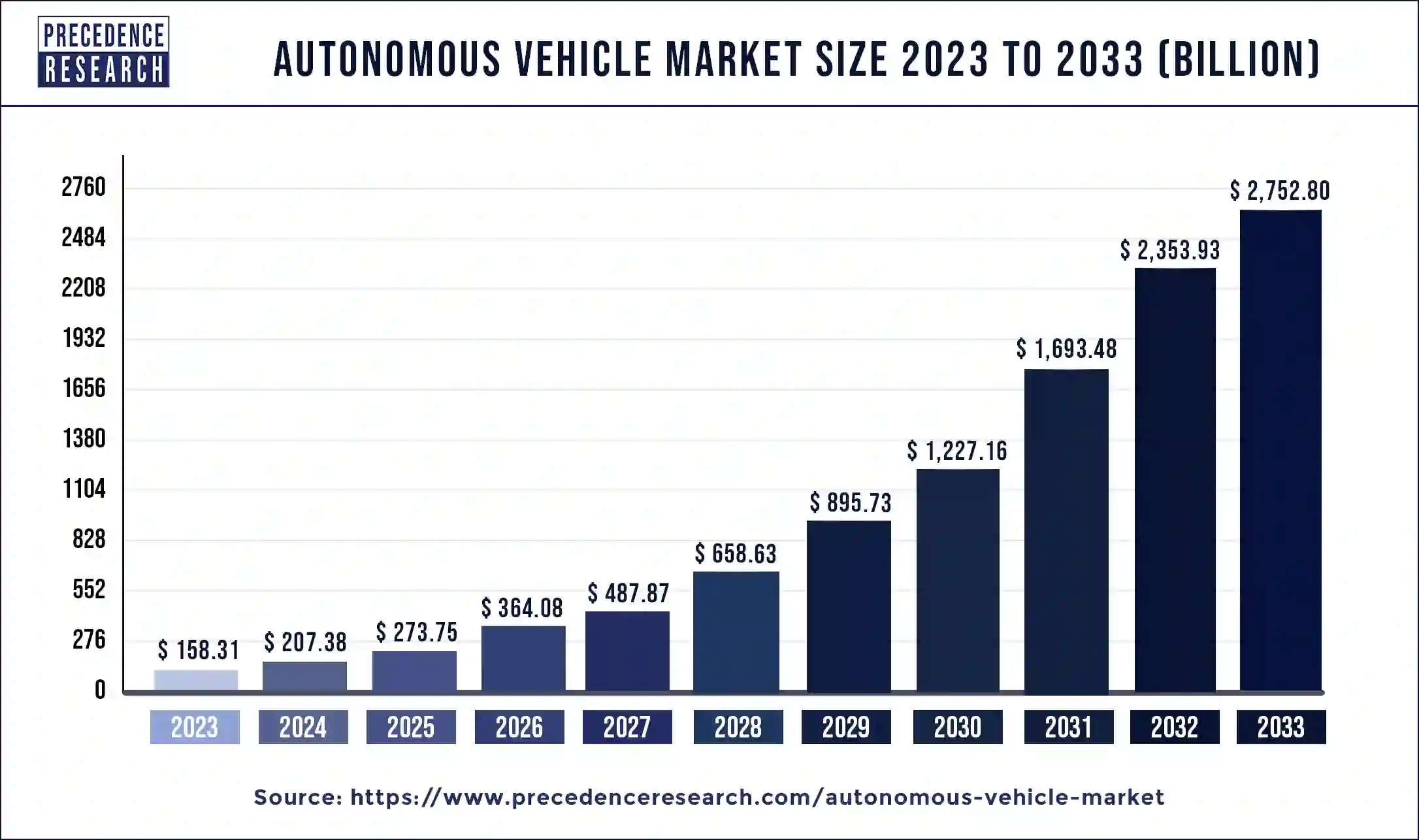

The global autonomous vehicle market size is estimated at USD 273.75 billion in 2025 and is predicted to increase from USD 364.08 billion in 2026 to approximately USD 5,439.46 billion by 2035, expanding at a CAGR of 34.84% from 2026 to 2035.

Market Highlights

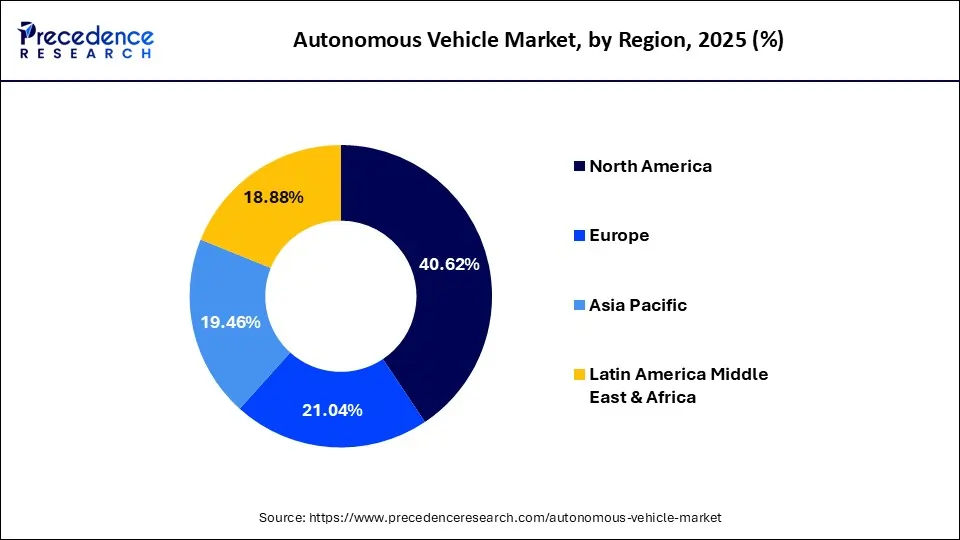

- North America dominated the global market with the largest market share of 40.46% in 2025.

- Asia-Pacific region is expected to hit a CAGR of 36.9% from 2026 to 2035.

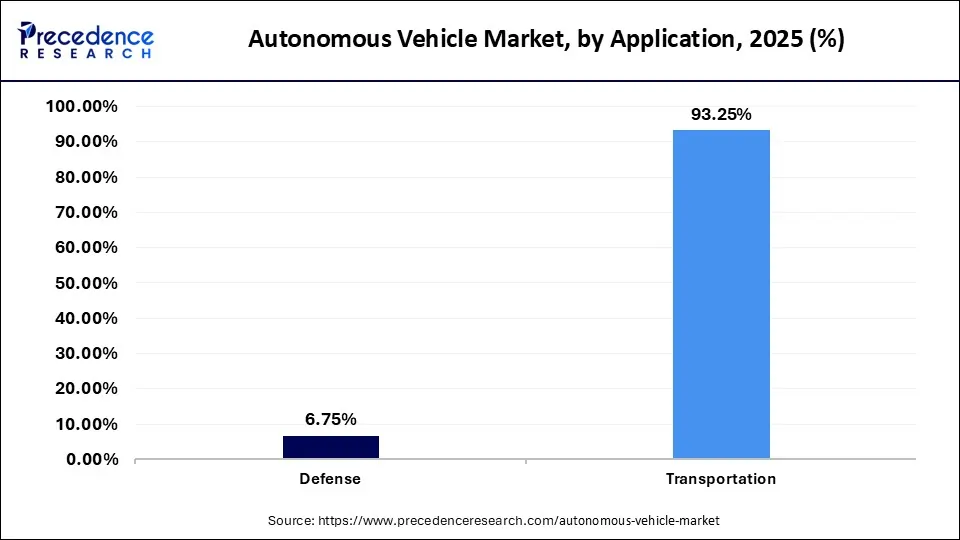

- By application, the transportation segment accounted largest market share of 93.41% in 2025.

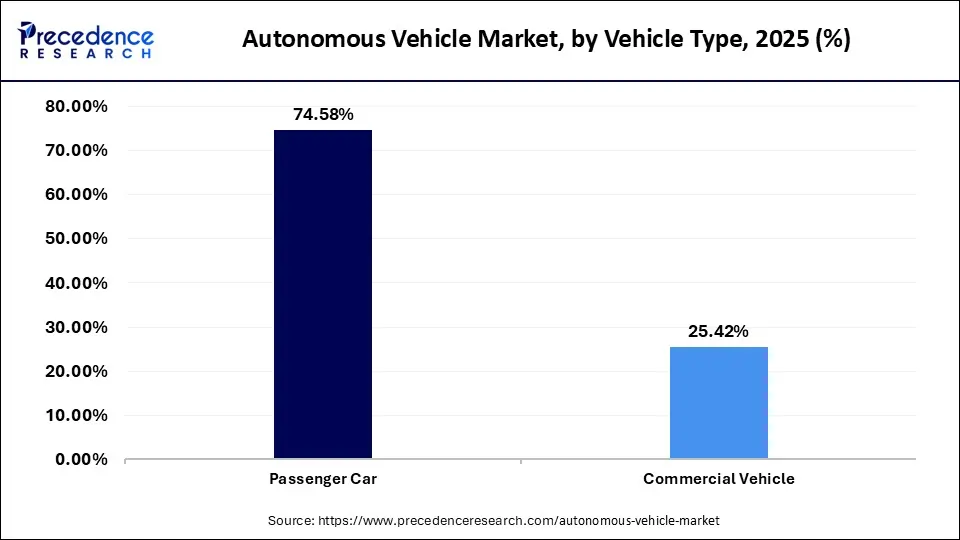

- By vehicle type, the passenger segment contributed the highest market share of 74.44% in 2025.

- By propulsion type, the semi-autonomous vehicle segment captured the biggest market share of 95.19% in 2025.

- By transportation, the commercial transportation segment generated a major market share of 85.17% in 2025.

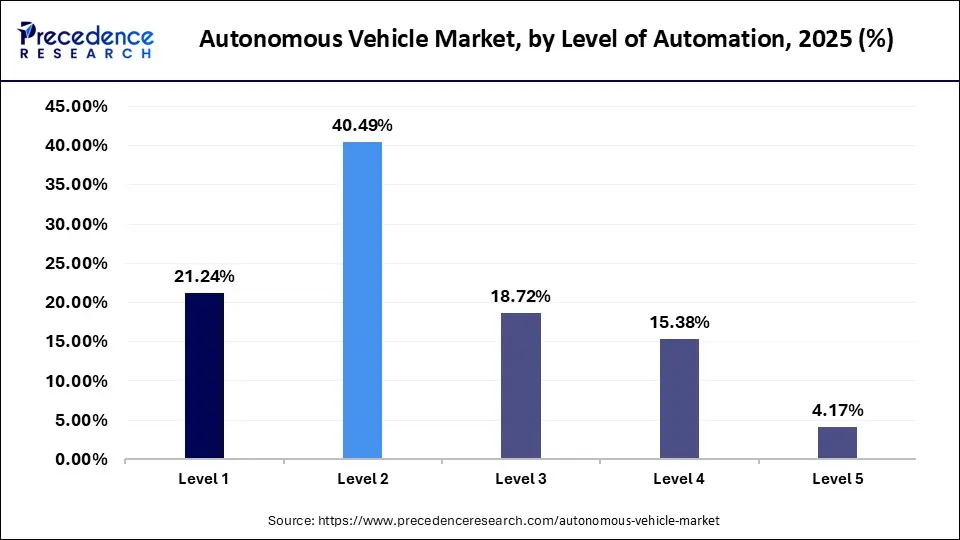

- By Level of Automation, the Level 2 segment has held the largest market share of 40.39% in 2025.

Market Overview

The autonomous vehicle market is rapidly changing with developments in artificial intelligence, sensor technologies and the rollout and acceptance of 5G. The demand for safer and more efficient means of travelling from point A to Point B is leading self-driving vehicles closer to reality every day. Companies like Tesla, Waymo and Nvidia are investing millions of dollars into research and developments and these expenditures provide the inertia to further spur innovation of AV technology.

Applications are being developed for every form of transportation, whether that be for personal vehicles or for numerous commercial fleet applications, shared robo-taxis and logistics applications, among other examples. As consumer demand for self-driving cars increases, so does the demand for safety features such as adaptive cruise control and automated parking. Although there are challenges to address in this market (including regulatory frameworks, big cybersecurity challenges and others) and challenges of moving public trust in and acceptance of self-driving technology, it seems that the market will continue to grow in the coming years as the technology becomes more accepted and as infrastructure continues to adapt.

In 2024, autonomous-ready vehicle production reached approximately 7.61 million units globally, marking a 39% increase from about 5.42 million vehicles in 2023. This sharp year-over-year growth highlights how rapidly advanced driver-assistance and autonomous technologies are moving from premium segments into mainstream manufacturing. The surge reflects stronger integration of AI processors, sensor fusion systems, and software-defined vehicle platforms directly at the factory level. Rather than niche innovation, autonomy is becoming embedded in large-scale automotive production. The significant rise in output also signals improved supply chain stability, falling component costs, and growing regulatory confidence, positioning autonomous-ready vehicles as a central pillar of next-generation automotive manufacturing.

AI in the Autonomous Vehicle Market

Depending on the artificial intelligence, the collision feature is the basis of autonomous vehicle technology, the safest, most intelligent, and efficient way of transportation. AI brings in safety by eliminating human error through advanced driver-assistance features and real-time hazard detection. Traffic-related issues are handled through route optimisation and congestion control, keeping energy responsibilities in check. In fact, AI-based predictive maintenance detects faults at an early stage so as to minimise downtime and operating cost. For passengers, AI improves accessibility by providing travel solutions for those who cannot drive and enhances productive opportunities through hands-free working. It further creates a personalised in-car experience via AI-enabled infotainment and voice assistant. Having these AI integrated into the autonomous vehicle industry makes the industry more sustainable, more convenient, safer, and economically feasible.

What are Major Technological Advancements in Autonomous Vehicle Market

- The autonomous vehicle market is at the forefront of innovation, with advanced technologies enhancing its journey to full autonomy. With the rise of technologies such as LiDAR, radar , AI-enabled perception systems, and real-time data processing, AVs are rethinking how they can understand and respond to their environments.

- AVs, if equipped with a means of communication, can use machine-learning algorithms to reliably make predictive choices using vehicle-to-everything (V2X) or other forms of communication to improve safety and coordination with other vehicles while maintaining reduced societal friction.

- When paired with connected 5G networks, AVs will utilize ultra-low latency to share data in real-time with each other, the transportation infrastructure and other elements of the urban ecosystem, with technologies such as V2X and other communication including road side infrastructure providing synergistic connections to each.

- All of this integrates with vehicle applications like advanced driver-assistance systems (ADAS), HD mapping, and over-the-air (OTA) software updates that are built and driven by automotive manufacturers and technology companies.

- Progress in edge computing and on-board sensor fusion is leading to greater levels of autonomous navigation reliability, ease and contextual awareness in formerly unpredictable environments.

Autonomous Vehicle Market Growth Factors

- Funding from governments and far-reaching digital infrastructure refills the developmental pockets for autonomous vehicle integration.

- Autonomous vehicles for folks with limited or no ability to drive stand as potentially transformative opportunities for the enhancement of inclusiveness and independence.

- Demand increases with improved comfort and flexibility for passengers, as autonomous vehicles provide a medium for working, resting, or leisure activities during travel.

- Technological innovations in the automobile industry have greatly expedited the coming of autonomous vehicles, representing a breakthrough after electric and hybrid motor cars.

- With the growing grounds of safety on roads and human error, the push for autonomy is being intensified, as the technology offers the prospect of fewer accidents and more reliable transportation.

Autonomous Vehicle Market Outlook

- Industry Growth Overview: The market is experiencing rapid growth, driven by tech advancements (AI, LiDAR), urban mobility needs, government support, and demand for safety/convenience.

- Major Investors:Major investors in the market include tech giants (Alphabet/Waymo, NVIDIA, Intel), venture capitalists (Sequoia, IDG Capital, Plug and Play), established automakers (GM, Ford, Toyota, VW, Mercedes-Benz), and even government agencies (EU), all investing in AV tech, software , and startups. However, recent trends indicate a shift, with some large investments facing challenges.

- Global Expansion:The market is growing worldwide due to advancements in AI, sensor technologies, and connectivity, enabling safer and more efficient transportation. Additionally, increasing government support, rising urbanization, and demand for reduced traffic congestion and lower emissions are driving global adoption.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 273.75 Billion |

| Market Size in 2026 | USD 364.08 Billion |

| Market Size by 2035 | USD 5,439.46 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 34.84% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Level of Automation, Propulsion, Transportation, Vehicle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising Need for Road Safety

The number of road accidents are increasing day by day. According to the Association for Safe International Road Travel (ASIRT), more than one million people die in road accidents each year. The primary cause of accidents is human error that occurs in an uncertainty of events, for instance, head-on collisions due to misinterpretation of the driver. Accidents may also occur due to machine or parts failure, such as the failure of brakes or breakage of axles. The governments of many nations are strengthening the regulations that can resolve road safety concerns.

Autonomous vehicles are safer than traditional vehicles as they are technologically advanced vehicles with various driving assisting systems, such as navigation systems, lane management systems, anti-collision systems, among others, and are connected to a central processing and decision-making system.

According to Automotive World Ltd., a leader in automotive industry information, there would be more than 2 billion cars across the globe in 2050. Thus, with a large number of cars, there would be a high concern for traffic congestion. Autonomous vehicles could assist in resolving traffic congestion issues. Autonomous cars can communicate with other cars and thus avoid traffic congestions. Also, with rising sharing economy self-driving cars can provide the travelers with an easy and convenient point to point travel with optimal efficiency and minimum traffic congestion.

Growing R&D Spending in Autonomous Vehicle Development

An autonomous vehicle is a combination of various sensors and networking system that assist the computer in driving the vehicle. In 2018, BMW Group is expected to spend the largest share of its revenue in research and development operations. The usual amount spent by the company is in the range of 5 to 5.5% of the sales, but in the recent annual report, the company has stated that it would spend 6.5 to 7% of its sales toward the development of technology. It is mainly focusing on the development of autonomous and electric vehicles. For better and rapid development of autonomous technology in vehicles, several companies such as Audi and Tesla Motors collaborate with technology developers. For instance, collaboration companies such as Nvidia will assist automobile manufacturers in developing object recognition.

Also, auto manufacturers such as Waymo have partnered with Intel Corporation to enhance automobile infotainment systems. In addition, several other competitors conduct in-house research for developing cutting edge technologies for autonomous vehicles. In the luxury car segment, Tesla and Mercedes are investing more than 60% in internal research. Many OEMs in Japan, such as Toyota, have also initiated in- house research that enhances the technological capabilities of the companies.

Environmental Impact Due to Traditional Vehicles

The rising environmental impact of the pollution caused by traditional vehicles has increased the global temperature as well as health hazards to humans. According to Environmental Protection Agency (EPA), in the U.S. more than 75% of the carbon monoxide is emitted by motor vehicles. It causes various respiratory and cardiovascular diseases such as asthma. Thus, with the rise of autonomous vehicles, the percentage of pollution caused by cars and trucks is expected to reduce owing to optimum usage of fuel by vehicles and the growing implementation of ecofriendly automotive solutions such as electric cars .

Furthermore, the growth of the sharing economy would act as a catalyst in the rise of autonomous vehicles. As the cars would be self-driven, they could be shared, thus decreasing the impact on the environment. For instance, Uber, a company that provides ride sharing and food delivery, has initiated the development and testing of autonomous vehicles in Arizona, U.S. Moreover, other ride sharing companies such as Lyft and Gett have started collaborating with OEMs that develop autonomous vehicles.

Increased Energy Savings by Autonomous Vehicles

The rising development of autonomous cars that are integrated with artificial intelligence would increase the efficiency of the car as compared to human drivers. Autonomous vehicles can increase the efficiency of the vehicle as they would have real-time traffic updates, enhanced telematics and connected cars, the self-driving vehicle would change the routes accordingly. Thus, the vehicles would be more efficient as they would not result in the wastage of fuel at traffic jams.

Autonomous vehicles have enhanced fuel efficiency since they use proper acceleration and gear shifts as compared to human drivers who tend to accelerate or deaccelerate the vehicle aggressively and ending up wasting more fuel. Platooning of vehicles is possible with autonomous vehicles. This would also assist in increasing the efficiency of the vehicle, owing to reduced aerodynamic drag caused by the platooning. The rise of hybrid technologies used in traditional cars and trucks currently, along with the use of pure electric and hybrid electric technologies in future autonomous cars and trucks, would together assist in saving energy and increasing the efficiency of the drive. The sharing economy would also increase energy savings with the use of autonomous cars and trucks.

Opportunities

Government Initiatives taken in the Autonomous Vehicle Market

Government programs are critical in accelerating development in the autonomous vehicle (AV) market. Through funding for R&D, implementing regulatory frameworks, and building smart infrastructure, the public sector is facilitating innovation and readiness to deploy AVs. Countries such as the U.S., China, Germany, and Japan are heavily investing in smart cities, 5G connectivity, and V2X infrastructure, and subsequently, facilitating the ability to allow AVs to be tested and their utilization networked and adopted more quickly.

Regulators around the world are adapting existing transportation regulations to create provisions for Level 4 and Level 5 autonomy thereby increasing the availability of AVs on the road. These authorities are offering testing permits, pilot zones, and incentives for sharing data. Countries are also creating incentives to support electric autonomous vehicles because of the environmental goals in reducing greenhouse gases through tax credits or green mobility grants.

Safety is still paramount, and governments are establishing cybersecurity protocols and standardization guidelines. Through purpose-built, supportive regulations, this creates better public comfort levels as well as the ability for countries to rise to the challenge of traveling unexperimented ecological, social, and technological paths in the autonomous mobility race for world first attractiveness towards AV.

Restraint

Vehicle Safety and Cybersecurity Concerns

Autonomous vehicles are a cyber-physical system as they have elements of both physical and virtual worlds. The physical system comprises the car and all the mechanical components, while the virtual system comprises the AI-based driving assisting systems, such as car-to-car communication, navigation, and cloud connectivity. Thus, Connectivity also poses a threat to the security of the autonomous car. Autonomous vehicles can be hacked by traditional hackers for personal data, such as behavior patterns. Moreover, autonomous vehicles can be infected by ransomware that can cause accidents while also increasing the chances of vehicle theft. In 2015, Jeep Cherokee was hacked by researchers from IOActive, Inc., a company that provides cybersecurity solutions. The car was hacked using the entertainment system that was connected to the cloud through the internet. Thus, the hackers were successful in taking control of the car.

The LiDAR and image recognition system can also be tricked by portraying false images and road signs. Also, Lidar is unable to sense glass while radar can mainly sense metal objects only. Thus, it poses a threat to the passengers travelling in autonomous cars. The malfunctioning of autonomous cars can be fatal, which emerges as the biggest social perception inhibiting their espousal. Extensive and scrupulous testing is indispensable, as is redundancy in autonomous systems. In case something miscarries, there are alternatives or back-ups in place, which permit the continued safe operation of these cars. However, this would further increase the cost of autonomous cars. Moreover, people are highly concerned about the cars' performance in different driving conditions as regards weather and traffic. Functional safety is another key concern that hampers the adoption of autonomous cars. It is referred to as the absence of unreasonable risks that occur due to hazards caused by the malfunctioning of electronic systems. Moreover, random failures are unpredictable.

Non-Availability of Infrastructure in Developing Countries

The main pillars of autonomous vehicles are policies and regulations, technological innovation, infrastructure, and adoption by customers. The self-driving vehicle is dependent on factors such as continuously maintained road infrastructure, road signs, and updated maps or navigation systems. In many developing countries such as India, Mexico, and Brazil, the road infrastructure is not as developed as compared to developed countries such as the U.S., Singapore, and Sweden. Thus, it would cause a hindrance in the development of autonomous vehicles.

The networking and development of roads also plays an important role in enhancing the adoption of self-diving vehicles. For instance, in 2017, according to the World Economic Forum, Brazil was ranked 107th out of 144 countries in infrastructure development. Thus, such issues in developing nations would act as a restraint in the development of autonomous vehicles. The investments in developing the infrastructure would play a vital role in the adoption and growth of autonomous vehicles. Also, upgrading the existing infrastructures and building new ones would act as a restraint in the development of autonomous vehicles in the growing economies.

Autonomous Vehicle Market Challenge

System Reliability and Uncertainty in User Acceptance

The surging technological advancements aiming at offering enhanced features while reducing the social perception pertaining to the adoption of driverless cars is a key concern. Moreover, people would prefer to spend a little more on their current cars and equip them with features such as crash avoidance and lane keeping systems, which form the basis of autonomous cars. Furthermore, several social equity concerns associated with driverless cars may hinder their adoption as these cars may have unfair impacts.

In addition, autonomous cars would affect business activity as well. There would be a decline in the demand for car repairs owing to reduced crash rates, thereby impacting the maintenance & repair department revenue. Moreover, if the frequency of accidents drops then a complete “crash economy” of insurance firms, chiropractors, automotive body-shops, and others will be disrupted. The adoption of autonomous cars is emphasized due to the increased safety that it offers in driving as compared to humans. A computers faulty reading from a sensor or miscalculation may trigger a car to perform unsuitable tasks, which could catch the driver off-guard. This may possibly result in uncommon and highly complex types of accidents that are difficult to predict.

Segment Insights

Application Insights

The global autonomous vehicles market is bifurcated into defense and transportation segments. Among them transportation segment cover nearly 93.25% of the market value share in 2025 and anticipated to witness a proliferating growth over the analysis period. The transportation segment is further categorized into commercial and industrial applications. Rising adoption of electric and hybrid vehicles with various level of automation has significantly triggered the demand for autonomous vehicles in transportation application. Furthermore, public awareness and government support for shared mobility in commercial sector has prominently boosted the trend of autonomous vehicles in the segment. For instance, in December 2019, a manufacturer and supplier of Internet-related services and products, Baidu, announced to secure 40 licenses that help company to test its driverless cars. Other than commercial application, industrial segment also projected to expand at a rapid rate owing to surge in logistics and e-commerce platform that require heavy vehicles for goods transportation.

Due to increasing adoption of autonomous vehicles in transportation, the transportation segment is expected to grow significantly in the coming years. This is also due to technological advancements and a growing acceptance of autonomous vehicles by governments around the world.

However, defense sector experience flourishing growth in the demand for autonomous vehicles and expected to emerge as one of the most prominent application during the forecast period owing to various initiatives across different regions such as North America. For instance, in April 2019, the U.S. military announced to deploy autonomous combat trucks to assist soldiers while driving to avoid accidents especially in rough terrain.

Global Autonomous Vehicle Market Revenue, By Application, 2023-2025 (USD Billion)

| Application | 2023 | 2024 | 2025 |

| Defense | 13.22 | 17.53 | 23.43 |

| Transportation | 145.09 | 189.85 | 250.32 |

Vehicle Type Insights

The passenger vehicle segment held the largest share in the autonomous vehicle market. In terms of consumer acceptance, passenger cars make up the majority of the AV market. Autonomous vehicles that are tailored to the needs of specific customers and provide safety, convenience, and maybe lower ownership and transportation expenses are being developed by companies. Passenger cars that are driven autonomously could drastically lower the number of traffic incidents brought on by human error. In addition, they can lessen traffic and improve flow, which makes better use of the road infrastructure possible. With the advancement of technology and rising public acceptability, the market for autonomous passenger cars is predicted to expand. Beyond personal use, this expansion includes fleet operations, ridesharing services, and urban mobility solutions.

The commercial vehicle segment is expected to be the fastest growing market. Because autonomous technology increases productivity, lowers costs, and improves safety, it has the potential to completely transform logistics and freight transportation. For instance, self-driving trucks might be able to work constantly, cutting down on downtime and improving delivery timetables. In cities, autonomous shuttles and buses can offer more dependable and adaptable public transportation choices, which could ease traffic and increase accessibility. By reducing accidents brought on by human mistake, autonomous vehicles (AVs) seek to improve safety in commercial aviation. Additionally, autonomous systems can reduce costs by optimizing routes, fuel economy, and vehicle maintenance. Although the advantages appear prospective, technological developments and legal obstacles must be overcome for autonomous commercial cars to operate safely and dependably.

Global Autonomous Vehicle Market Revenue, By Vehicle Type, 2022-2024 (USD Billion)

| Vehicle Type | 2023 | 2024 | 2025 |

| Passenger Car | 117.61 | 154.37 | 204.17 |

| Commercial Vehicle | 40.70 | 53.02 | 69.58 |

Level of Automation Insights

The level 1 segment holds the largest sharethe autonomousmous vehicle market. Cars with driver assistance systems that offer fundamental automation, including adaptive cruise control and lane-keeping aid, are referred to as "Level 1" vehicles. Although these devices are meant to help the driver, human supervision and involvement are still necessary. Compared to higher levels like Level 4 or Level 5, Level 1 automation is regarded as a lesser level since it does not feature totally autonomous functioning. Since Level 1 automation is the first step toward more sophisticated autonomous driving technology, its significance in the AV market cannot be overstated. It's a transitional stage where producers and customers get used to automated features and start to trust that some tasks can be partially automated.

The level 4 & 5 segment is expected to be the fastest growing market. At level four levels, autonomous cars can improve mobility for the elderly and disabled, who might find it difficult to use other forms of transportation. Under some circumstances and environments, cars are able to operate in all driving capacities without the need for human assistance. But they only function in some regions or under certain circumstances (such the type of road or the weather) when they are completely capable of operating autonomously. Although Level 4 vehicles are capable of handling the majority of driving scenarios on their own, in certain extreme cases, they may still need human assistance. Level 5 automation suggests that all driving functions can be carried out by the car without the need for human supervision or involvement. These vehicles are built to function securely in every situation that might be handled by a conventional human-driven vehicle.

Global Autonomous Vehicle Market Revenue, By Level of Automation, 2023-2025 (USD Billion)

| Level of Automation | 2023 | 2024 | 2025 |

| Level 1 | 29.23 | 38.41 | 50.85 |

| Level 2 | 64.35 | 84.48 | 111.77 |

| Level 3 | 26.32 | 34.60 | 45.83 |

| Level 4 | 23.34 | 30.82 | 41.00 |

| Level 5 | 15.08 | 19.08 | 24.30 |

Regional Insights

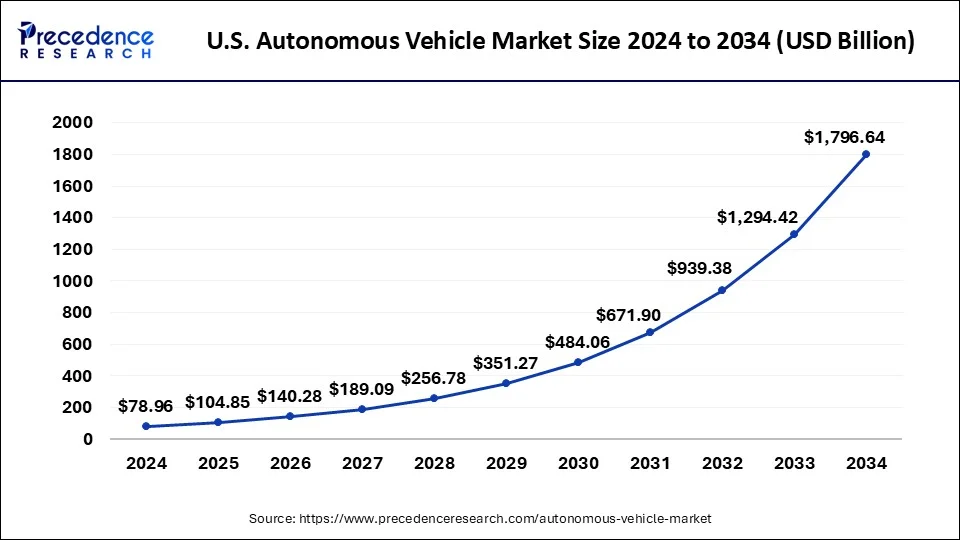

What is the U.S. Autonomous Vehicle Market Size?

The U.S. autonomous vehicle market size is valued at USD 104.85 billion in 2025 and is predicted to be worth around USD 2,200.74 billion by 2035, expanding at a CAGR of 35.58% from 2026 to 2035

What Made North America the Leading Region in the Autonomous Vehicle Market?

North America continues to lead the autonomous vehicle market, driven by strong technology infrastructure, supportive regulations, and a robust of innovators. The United States - with major companies such as Tesla, Waymo, Apple, and Cruise, spearheading development in autonomous driving systems, AI, and sensor integration - dominates the region. With state-level efforts like California's AV testing permits and Arizona's open-road trials, and a strong taste for electric vehicles (EVs) (most AV prototypes are EV-based in design) landscape has focused on providing a positive testing / development environment for companies and researchers to commence testing and development.

Rising investments in smart infrastructure, V2X communication networks, and mobility-as-a-service (MaaS) platforms also correlate with a more mature marketplace. Consumer interest in AV autonomous applications is expected to continue increasing - and demand for commercial applications like autonomous delivery and robo-taxis will continue to expand - all contributing to North America maintaining its leading position through 2030 and beyond.

The U.S. is a major contributor to the North American autonomous vehicle market. This leadership is driven by the strong presence of technology companies and automakers such as Waymo, Tesla, GM Cruise, and NVIDIA, along with extensive R&D investments. Favorable regulatory frameworks in several states, large-scale pilot programs, and advanced digital infrastructure further support testing and commercialization. Additionally, high consumer adoption of advanced driver-assistance systems (ADAS) accelerates the country's dominance in the market.

What Drives the Autonomous Vehicle Market in Asia Pacific?

Asia-Pacific is rapidly developing as one of the major regions in the highly competitive autonomous vehicle space due to urbanization, extensive government policies around Smart Cities , and populations that embrace technology. China is a leader in this regard. With companies like Baidu, Pony.ai, and AutoX leading the charge, investment in AV R&D and pilot deployment is significant.

The Chinese government is launching smart transportation policies, subsidies for AV ecosystems, and major infrastructure projects, such as the Autonomous Driving Zone in Beijing, to catalyze adoption of Level 4 autonomy. While Japan and South Korea see cooperation between OEMs and a wealth of AI startups as an opportunity to catch up. Japan is aiming to deploy autonomous public transport ahead of global events like Expo 2025. South Korean is designing autonomous freight corridors. With a focus on 5G connectivity, electric mobility, and optimization in urban traffic, it is an exciting time for Asia-Pacific as an agent of innovation and AV deployment at scale.

What Influences the Market in Europe?

Europe is well-established and heading in a consistent, positive direction in the autonomous driving realm supported by safety regulations, sustainability measures, and the proper policies surrounding vehicle automation standards. Some notable countries, particularly Germany, United Kingdom, and France have made substantial investments in cross-border AV testing corridors, which results in seamless multi-nation testing.

Germany is home to several automotive manufacturer's heads of major international automotive brands, including: BMW, Mercedes-Benz, and Volkswagen. As such, Germany is taking the lead with their further development of the ADAS technologies and semi-autonomous functions in new vehicles. The European trajectory looks promising, as the union relies on Green Deal policies and policies encouraging electric and autonomous transport while they continue to explore the development of zero-emission AVs.

Similarly, the UK government is committing funding streams toward the establishment of connected and autonomous vehicle (CAV) testbeds for public-private partnerships to further enable innovation, development, etc. Europe is focusing on autonomous shuttles and last-mile delivery choices, in addition to self-driving taxis and these countries have strong public transit systems. Therefore, Europe is an important structure in the global AV further growth.

What Opportunities Exist in Latin America?

Latin America presents opportunities for the market through growing investments in smart transportation infrastructure and connected vehicle technologies. Countries like Brazil and Mexico are exploring pilot projects for self-driving shuttles, logistics, and public transport, creating avenues for technology deployment. Additionally, increasing urbanization and demand for safer, more efficient mobility solutions are encouraging partnerships between governments and private companies to accelerate autonomous vehicle adoption.

Brazil is considered a major player in the market within Latin America because of its large automotive industry, strong presence of global automakers, and increasing investments in smart mobility and connected vehicle technologies. Additionally, government initiatives supporting innovation, pilot testing of autonomous and semi-autonomous vehicles, and improving digital and transport infrastructure position Brazil as the regional leader in autonomous vehicle adoption.

What Potentiates the Market within the Middle East & Africa (MEA)?

The autonomous vehicle market in the Middle East & Africa (MEA) is potentiated by strong government initiatives supporting smart cities, smart transport, and sustainable mobility solutions. Wealthy Gulf countries are investing heavily in autonomous mobility pilot projects, test tracks, and infrastructure development to showcase advanced technologies. Additionally, growing interest from logistics, public transport, and ride-hailing companies in the region is driving adoption and creating a favorable environment for market growth.

The UAE is a major contributor to the Middle East & Africa autonomous vehicle market. This leadership is driven by strong government support, smart city initiatives such as Dubai's Autonomous Transportation Strategy, and significant investments in AI and advanced mobility technologies. Additionally, favorable regulations, pilot projects, and partnerships with global autonomous vehicle developers have accelerated adoption across the region.

Value Cain Analysis

- Raw Material Sourcing: Procurement of raw materials like steel , plastics , and electronics, which are increasingly specialized for use in the one-of-a-kind sensors and computing systems of autonomous vehicles.

Key Players: Nvidia, Intel (Mobileye), Qualcomm, and NXP - Component Manufacturing: The production of hardware and software components in the greatest degree of specialization by AI systems, LiDAR, radar, cameras, and other sensors necessary for autonomous driving.

Key Players: Intel, Nvidia, and Bosch - Vehicle Assembly and Integration: The assembly of all vehicle parts and the seamless integration of advanced hardware and software into the vehicle system toward autonomous driving.

Key Players: Ford, GM/Cruise, Mercedes-Benz, and Honda - Testing and Quality Control: The rigorous validation and verification of the autonomous functions in terms of standard and performance through advanced simulation, hardware-in-the-loop, and real-world trials.

Key Players: Waymo and TÜV SÜD - Retail Sales and Financing: Sale of autonomous vehicles to end-consumers and fleets and potentially involving alternative business models, such as subscription and shared mobility services, rather than traditional ownership.

Key Players: Tesla, General Motors, and Ford

Key Companies & Market Share Insights

The global autonomous vehicle market is highly competitive and dominated by the presence of major automotive giants. Leading market players are significantly focused towards inorganic growth strategies such as collaboration, partnership, merger & acquisition, and regional expansion. In August 2017, Intel Corporation, BMW AG, Fiat Chrysler Automobiles (FCA), and Mobileye, affiliated business of Intel Corporation contracted a memo of understanding for Fiat Chrysler Automobiles to link companies for the development of autonomous vehicle driving platform. The memorandum aimed at collaborating capabilities, resources, and strengths of all the companies to reduce the product launch time, in addition, also enhances the development efficiency and platform technology.

Moreover, industry participants also invest significantly for the product development as autonomous vehicles require high-end electronic devices for advanced automotive features. Rapidly changing consumer preference and increasing awareness among the people for environment-friendly vehicles motivate the market players to incorporate such features in their vehicles. These market players tie up with the electronic hardware manufacturing companies to meet the consumer demand.

Leading Companies in the Autonomous Vehicle Market

TESLA

Tesla Inc. is a well-known and leading electric vehicle company that provides highly advanced energy storage solutions, innovative electric vehicles, and solar products with clean energy applications. Tesla offers an advanced driver assistance feature, which is developed by full self-driving software along with autonomous vehicles. These vehicles offer various capabilities that can be controlled automatically, like lane changes, street navigation, recognizing obstacles, avoiding them, and others. Tesla is continuously updating its driving software and comes with innovative solutions to achieve fully self-driving capabilities.

Mercedes-Benz Group

The Mercedes-Benz group is another renowned automobile company popularly known for its independently developed first gasoline-based vehicle. Over the decades, the company has offered innovative solutions and built a strong foundation for future automobile companies. The company is continuously growing due to its ongoing expansion into new markets and continents, allowing it to tap into unexplored areas, which increases its consumer base and drives sales across the world. Moreover, the company offers a diverse range of SUVs, EVs, and commercial vehicles to reach maximum consumers around the globe. The company has invested in adopting eco-friendly technologies along with production methods to promote safer automobile production and lower carbon emissions.

Autonomous Vehicle Market Companies

- BMW AG

- Audi AG

- Ford Motor Company

- Daimler AG

- Google LLC

- General Motors Company

- Nissan Motor Company

- Honda Motor Co., Ltd.

- Toyota Motor Corporation

- Tesla

- Volvo Car Corporation

- Uber Technologies, Inc.

- Volkswagen AG

Recent Developments

- On June 17, 2025, Pony.ai unveiled its Gen?7 Robotaxi at the Hong Kong Auto Expo, featuring 34 sensors and a 70% reduction in ADK hardware costs, designed for large-scale Level 4 deployment.(Source- Autonomous Vehicle International )

- On June 22, 2025 – Tesla launched its first robotaxi pilot in Austin, Texas, deploying 10–20 Model Y vehicles equipped with Full Self-Driving (FSD) software for flat-rate rides within a geofenced zone.(Source- https://www.fortuneindia.com )

- On July 17 2025, Uber announced a \$300 million investment in Lucid and a partnership with Nuro to launch 20,000 Gravity SUV-based robotaxis, with deployment scheduled to begin in late 2026. (Source- https://www.reuters.com )

- In January 2025, a leading company in the world, named Sony and Honda, collaborated and planned to launch an electric vehicle with the name Afeela EV in the U.S. and Japan by the end of 2026. This automobile will be equipped with various AI technologies to support self-driving capabilities. (Source: https://auto.hindustantimes.com/ )

Segments Covered in the Report

By Application

- Defense

- Transportation

- Commercial transportation

- Industrial transportation

By Level of Automation

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Propulsion Type

- Semi-autonomous

- Fully Autonomous

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting