February 2025

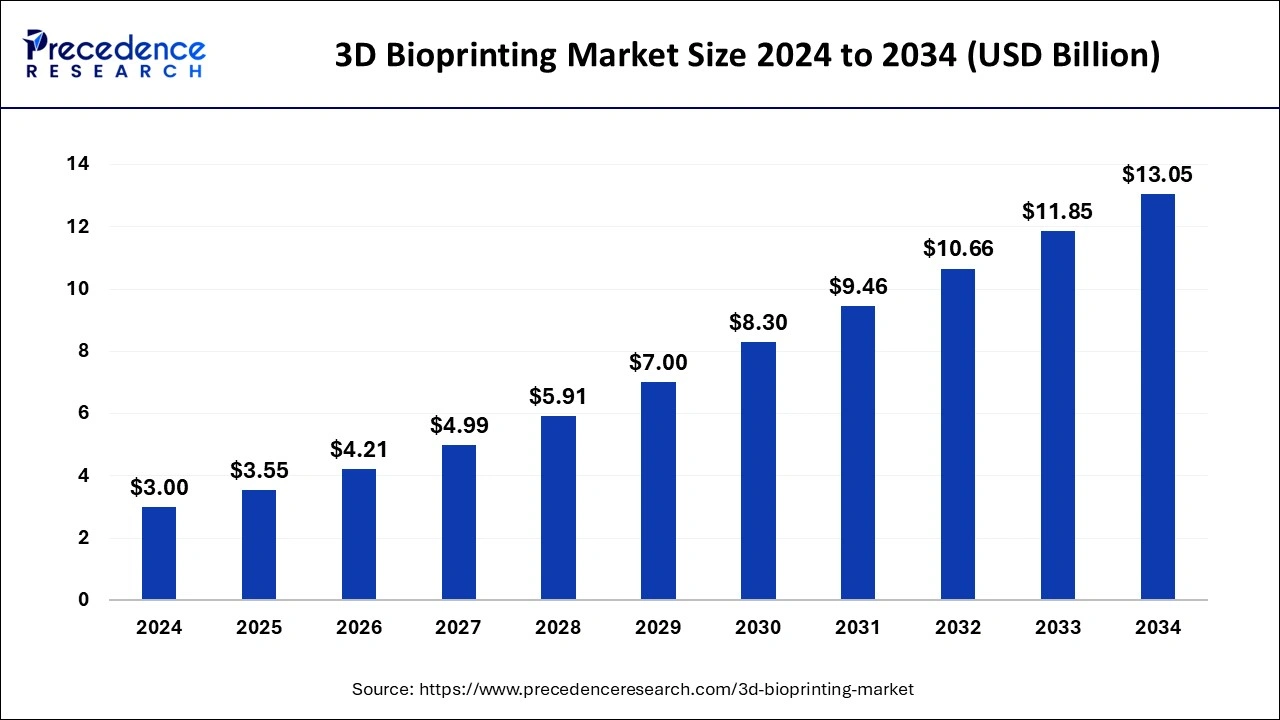

The global 3D bioprinting market size is calculated at USD 3.55 billion in 2025 and is forecasted to reach around USD 13.05 billion by 2034, accelerating at a CAGR of 15.84% from 2025 to 2034. The North America 3D bioprinting market size surpassed USD 0.99 billion in 2024 and is expanding at a CAGR of 16.01% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 3D bioprinting market size was estimated at USD 3 billion in 2024 and is anticipated to reach around USD 13.05 billion by 2034, expanding at a CAGR of 15.84% from 2025 to 2034.

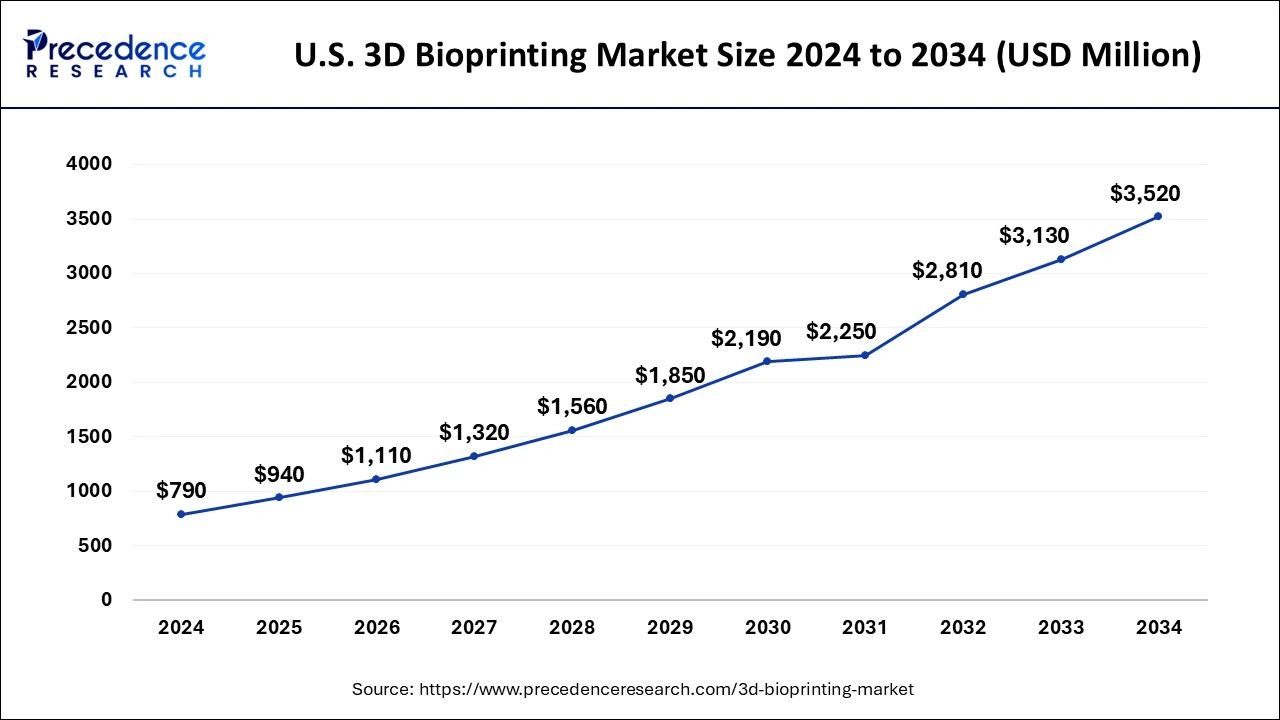

The U.S. 3D bioprinting market size was evaluated at USD 790 million in 2024 and is predicted to be worth around USD 3520 million by 2034, rising at a CAGR of 16.12% from 2025 to 2034.

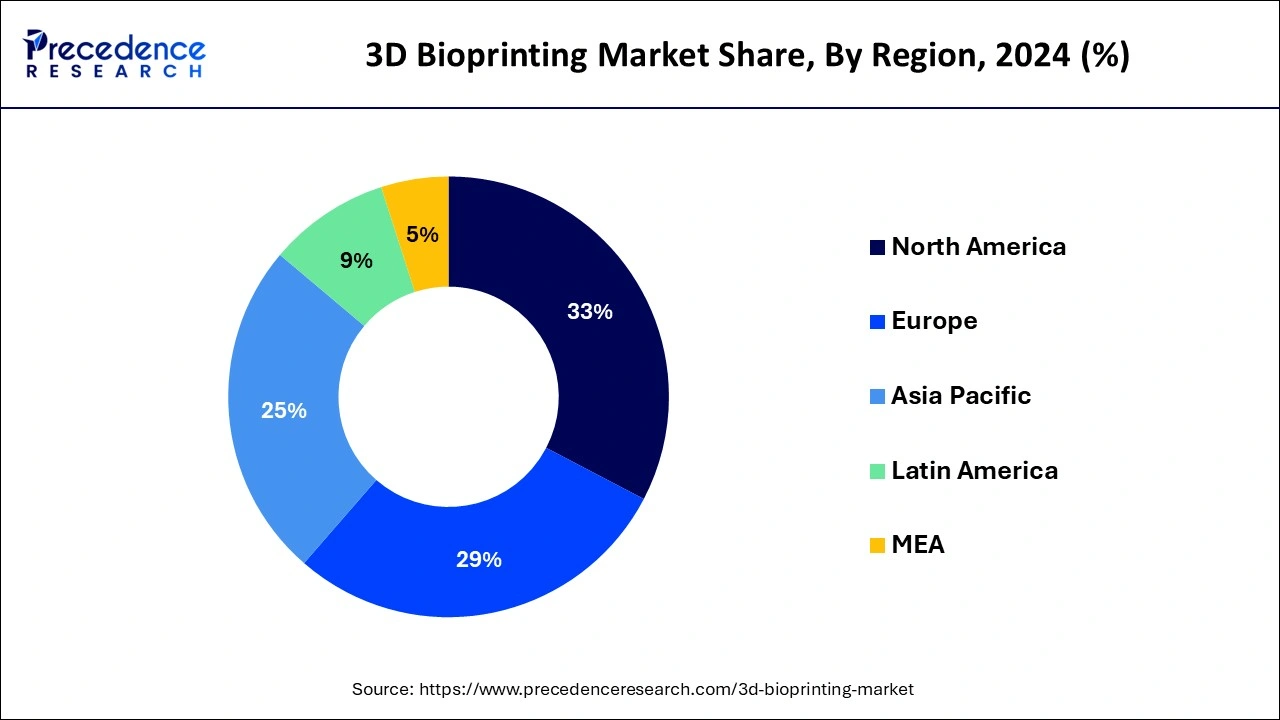

With an overall revenue of 25% in the 3d printing technology market in Asia-Pacific in 2024. Due to the expanding number of COVID-19 instances and increased government R&D spending, China and Japan contributed to the greatest overall revenue in the area.

North American dominated the global market with the largest market share of 33% in 2024 and it is anticipated that it will continue to dominate for the entire projected timeframe. Throughout the projection period, it is anticipated that the market would rise due to the growing adoption of technology in the health industry. Around 23,369,732 active COVID-19 cases were registered in the United States alone up until January 13th, 2021, according to the Worldometer Survey 2021. About 50 vaccine candidates are now being tested. To produce a vaccination for this illness, the government is investing more in study and development. Because this technique has already been recognized for use in drug screening and organ donation, there is a growing market for 3D bioprinting. In 2021, North America had the biggest market share worldwide. North America holds a sizable portion of the industry thanks to significant public and private investments in the development of cutting-edge 3D bioprinting technology.

A 3D bioprinting business used other biomaterials technology and its laser printer, the U-FAB, to construct a pulmonary epithelial model. The majority of the respiratory system is lined with a kind of tissue called the respiratory epithelial. This epithelial serves as a defense against diseases and other objects. However, with the aid of the mucociliary elevators, it also guards against infections and tissue damage. Consequently, it is expected that the industry for bioprinting would expand as a result of rising instances of desire for these respiratory epithelial models.

The market is anticipated to have greater growth throughout the forecast period as a result of such advancements. To speed up COVID-19 research, many biotherapeutic businesses are utilizing bioprinting technology. For instance, Viscient Biosciences created lung tissue using 3d printing technology to enhance viral pathogenicity studies and aid in the hunt for a viable treatment for SARS-CoV-2, the new coronavirus that causes COVID-19. A fully thermoformed nasopharyngeal swab has been developed by the Harvard University Central Institute in conjunction with medical professionals, business associates, as well as other research organizations. With the COVID-19 infection's rapid expansion, 3D bioprinting is experiencing high demand. As a result, a lot of biopharmaceutical and pharmaceutical companies are stepping up to support medical professionals, doctors, and researchers in whatever manner they can.

Due to the rising use of 3D bioprinting within the pharmaceutical, healthcare, and biotech markets, the world market for 3d printing is anticipated to experience considerable expansion over the projected timeframe. Throughout the course of the forecast period, it is also projected that the increasing use of 3d printers in beauty treatments and advancements in 3D bioprinting. The expansion of private and public financing for bioprinting research initiatives also has fueled the market's expansion.

The major technological developments in the 3d printing technology field, including liver modeling, cancer treatments, bones & tissue production, and epidermal layer growth, have been made for a variety of medical uses, including the advancement of body tissue. There are some current 3D bioprinting themes. The use of 3D bioprinters for clinical studies & drug screening is predicted to significantly minimize the requirement for animal testing. The American Foods and Medication Government's regulatory authority has begun to take 3D bioprinting into account as a potential alternative for combining pharmaceutical safety and effectiveness testing. Additionally, in April 2019, dealing with such issues researchers from the University of Minnesota constructed a brand-new, dynamic 3D Bioprinted tumor prototype in a lab to test antitumor medications and analyze their impact on the prevalence of cancer and the initial tumor stage.

Additionally, elements like the favorable regulatory climate in developing nations like India, the existence of numerous cell therapy project flow, and the use of tissue regeneration to treat a variety of diseases are anticipated to provide favorable growth potential for the 3d printing technology industry throughout the forecast timeframe. Furthermore, the market for 3D bioprinting is being constrained by problems like a lack of skilled workers and significant production and development expenses. Additionally, continuous process control is necessary for the efficient use of bioprinting technologies, so this procedure differs between systems is a system to uncontrollable process factors and material variations. Consequently, this issue is also anticipated to limit market expansion.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.55 Billion |

| Market Size by 2034 | USD 13.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.84% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Application, End User, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The Healthcare Additive manufacturing market

Growing need for customized medical products, such as implants, coupled with the introduction of advanced technologies, to produce simple as well as complex designs is driving the market. Additive Manufacturing (AM) allows conversion of complex designs that are too difficult or expensive to produce using traditional machining, milling, molding, and dyeing. It also excels at rapid prototyping and offers a more dynamic and design-driven process. AM is ideal for quickly making prototypes, using 3D CAD, and simplifying extensive process and reducing the high cost associated with it.

In addition, the U.S. FDA reviewed more than 100 devices manufactured using 3D printers, which are available in the market. This comprises customized devices that fit a patient’s anatomy, including cranial implants and knee replacements. The U.S. FDA has been actively involved in understanding the technology to provide a broader regulatory pathway that is at pace with technological advancements and aids access to safe and effective innovations enabled by AM.

3D Cell Culture Market Insights

Emergence of scaffold-free technology as a promising platform for development of translational pathways for tissues is anticipated to impel adoption of cellular, 3D culture techniques. Moreover, advent of 3D bioprinting, which facilitates fabrication of scaffold-free tissue units through fusion of tissue spheroids, enables development of functional tissue-engineered constructs with distinct 3D structures. Such developments are anticipated to drive market growth.

Dental 3D Printing Market

Rising global geriatric population and growing incidence of dental conditions are anticipated to drive the market. Apart from this, surging demand for customized dental 3D printers is likely to aid market growth over the forecast period.

Moreover, increase in R&D expenses by key players, growing consumer awareness, and rapid technological advancements are estimated to boost the sales of dental 3D printers over the forecast period. Increasing incidence of edentulousness is also expected to augment market growth.

3D bioprinting is being used more and more in the cosmetics and pharmaceutical industries

Process management and knowledge of 3D printers

The need for organ transplants is growing

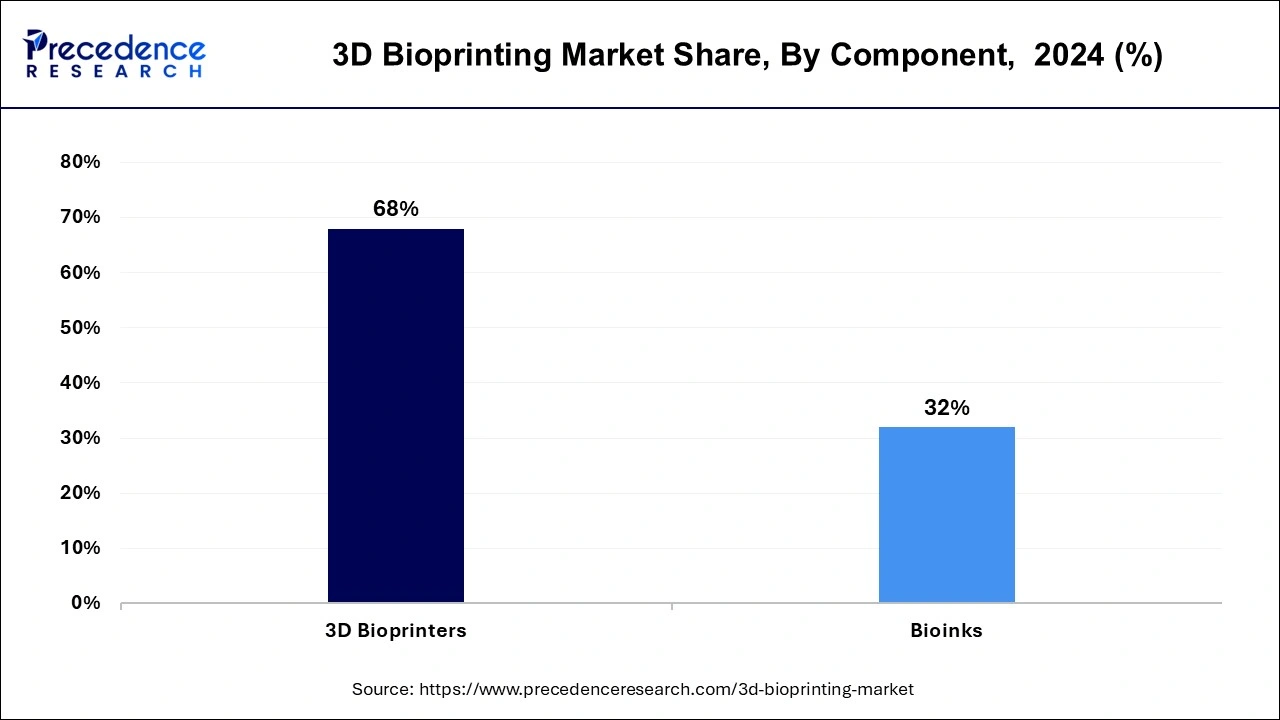

The 3D bioprinters segment contributed the highest market share of 68% in 2024. The industry for 3D bioprinting is expanding due to the widespread use of pharmaceutical pills to treat a variety of chronic conditions. The segment is also being driven by the expanding demand for pharmaceuticals and the efficient use of bio-drugs in this technology. The demand for pharmaceutical products is rising along with the number of players in the sector. Worldwide, millions of individuals regularly use pills and capsules for medical purposes. As a result, this market segment is anticipated to grow profitably throughout the forecast period.

During the anticipated timeframe, the industry's quickest CAGR achieved in the sub-segment of organ and tissue production. The most common application of 3D bioprinting in healthcare is to regenerate tissues and organs appropriate for transplant. The desire for organ and tissue production is increasing as COVID-19 disease cases rise. The organ and tissue production segment is predicted to experience explosive expansion throughout the projected period as a result. The main market participants anticipate that the rising number of COVID-19 cases in the world will open up new growth opportunities. New methods are being developed by several 3D bioprinting market participants to circumvent this epidemic impact and create a COVID-19 vaccine.

The Inkjet-based segment captured the biggest market share of 37% in 2024. allowed for the production of intricate biological tissues or organs upon the cultured substrate. The widespread use of inkjet printing in the healthcare industry is a factor in the expansion of this market. In particular, the subjects of biochemical regeneration and drug transport costs, and inkjet printing as a bio-applicable technique are covered in this study. Because of its greater durability and increasing demands, this market sector is expected to experience substantial expansion during the projected timeframe.

During the projected timeframe, the magnetically levitated market is anticipated to grow at the quickest CAGR . The technology's cost-effectiveness is responsible for the lucrative expansion. With its sophisticated features, increased speed, and increased accuracy, the magnetically levitated technique is anticipated to eliminate more than 80.0percent of the mistakes in 3D bioprinting. Additionally, toxicity testing, the printing of vascular muscles, and actual tissue repair all use these bioprinters. For instance, using electromagnetic levitation-based technologies, BioAssay has created a structure that resembles tissue. Due to the quick uptake of newer technologies, electromagnetic levitation-based gadgets are also most likely to have slower growth during the projected timeframe.

By Component

By Technology

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025