February 2025

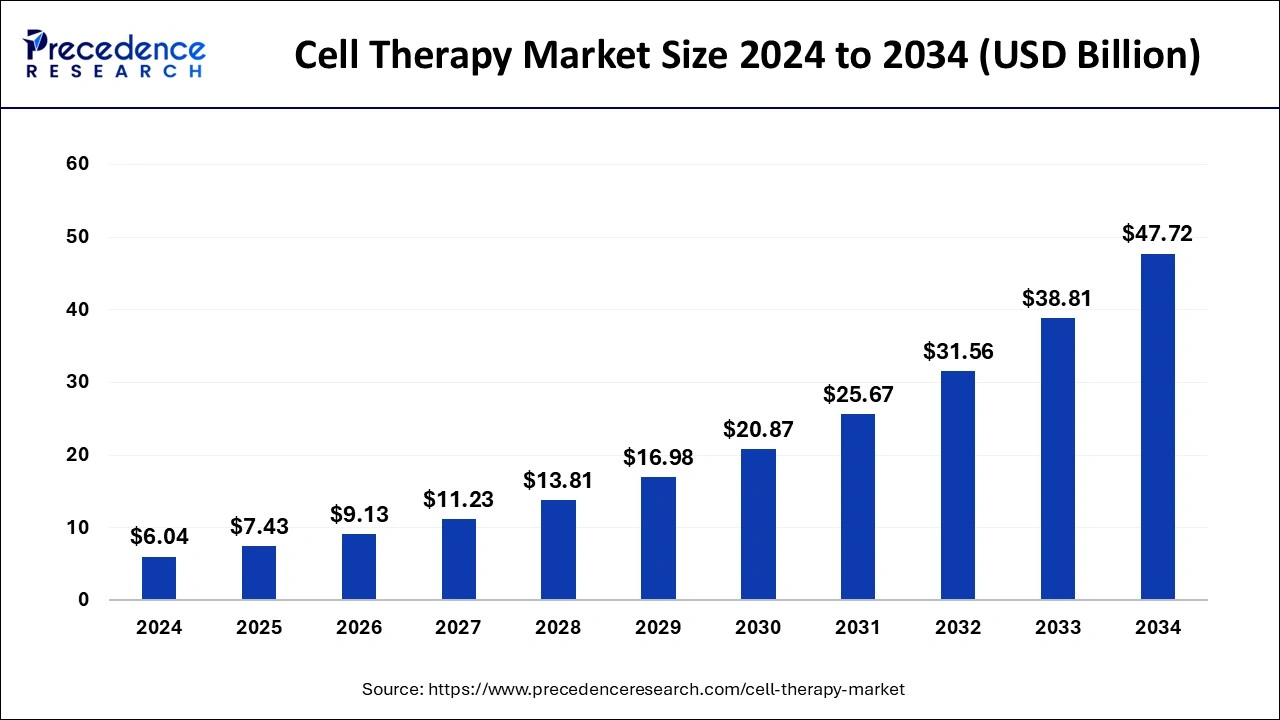

The global cell therapy market size is calculated at USD 7.43 billion in 2025 and is forecasted to reach around USD 47.72 billion by 2034, accelerating at a CAGR of 22.96% from 2025 to 2034. The North America cell therapy market size surpassed USD 3.56 billion in 2024 and is expanding at a CAGR of 23.07% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell therapy market size was accounted for USD 6.04 billion in 2024 and is anticipated to reach around USD 47.72 billion by 2034, growing at a CAGR of 22.96% from 2025 to 2034.

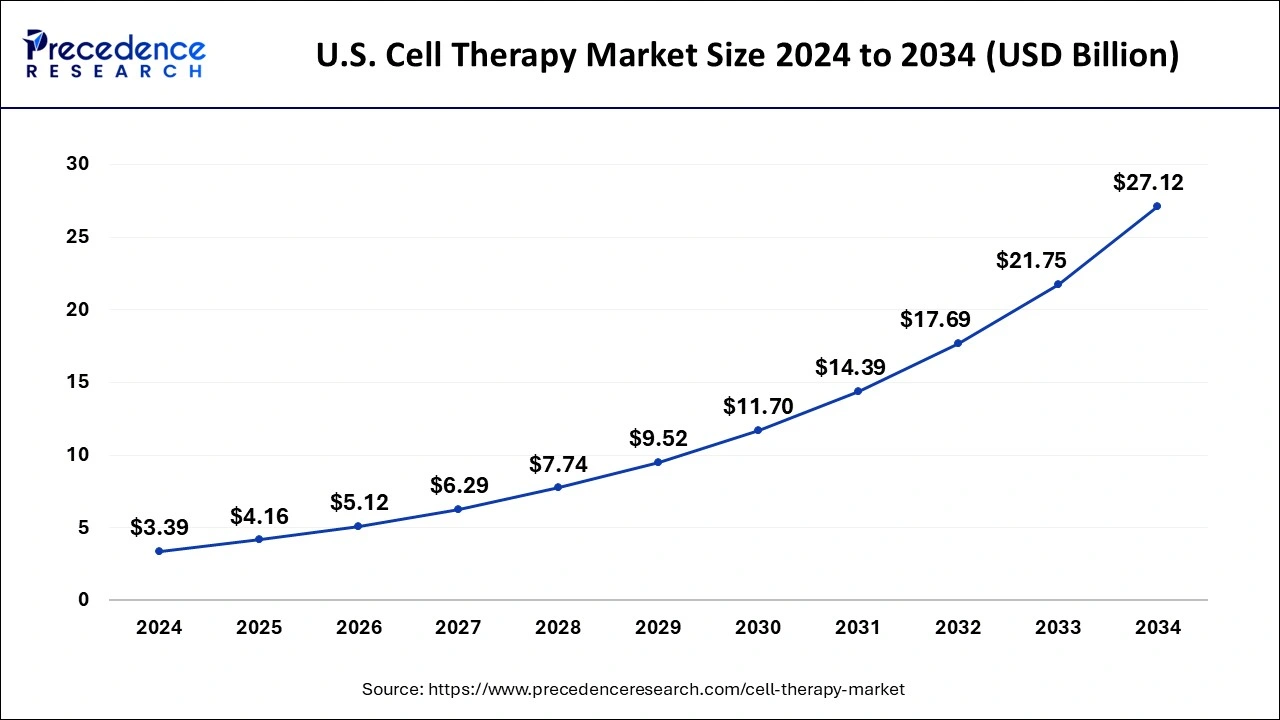

The U.S. cell therapy market size was evaluated at USD 3.39 billion in 2024 and is predicted to be worth around USD 27.12 billion by 2034, rising at a CAGR of 23.11% from 2025 to 2034.

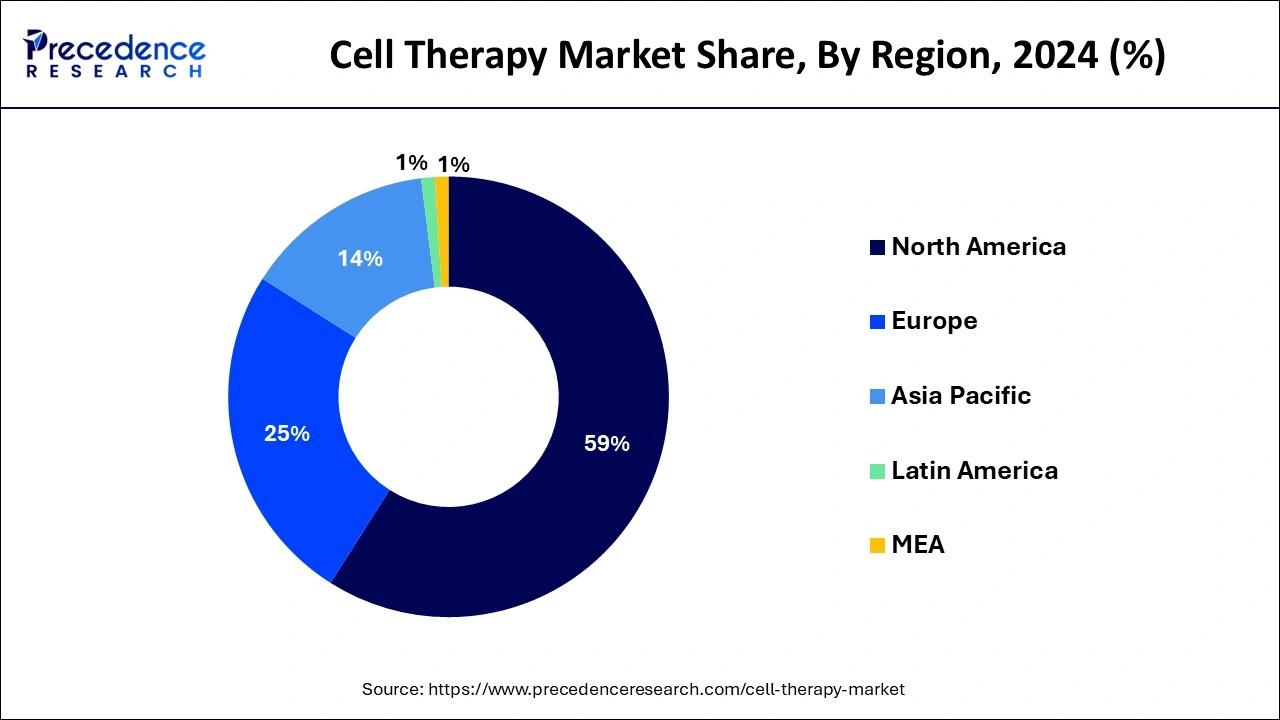

North America dominated the global cell therapy market with the largest market share of 59% in 2024. Factors such as rising incidents of chronic disorders and growing investments for the development of cell therapy market in the U.S. Cellino Biotech, an autonomous cell treatment manufacturing firm obtained a first investment round of $80 million in January 2022. Cellino wants to make stem cell-based medicines more accessible with the goal of building the first self-contained human cell foundry by 2025. In addition, the cell therapy market in North America region is also being driven by growing applications of stem cell technologies for the treatment of various diseases. Moreover, the growing research and development activities are boosting the growth of North America cell therapy market.

Asia-Pacific is expected to develop at the fastest growth rate 16% during the forecast period. China dominates the cell therapy market in Asia-Pacific region. The favorable government regulations are contributing towards the growth of cell therapy market in this region. Asia-Pacific has a great potential for market expansion, as it accounted for roughly 4.6 billion of the world human population in 2019, which might act as a prospective patient base. Furthermore, emerging nations such as China and India are predicted to grow as a result of improved healthcare facilities, low cost, and increased knowledge of cell therapy.

The growth of global cell therapy market is attributed to the rising incidents of chronic disorders and infections. In addition, the growing cases of diabetes are also boosting the market growth. As per the International Diabetes Federation Diabetes Altas, almost 573 million persons globally had diabetes in 2022, with the number anticipated to grow by 643 million by 2033 and 783 million by 2045. Moreover, the growing number of research studies and clinical trials are also boosting the growth of global cell therapy market.

One of the key factors propelling the expansion of global cell therapy market is adoption of innovative and latest technologies. Furthermore, after the impact of COVID-19 pandemic, the market for cell therapy is growing at a rapid pace. With over 900 companies working on advanced therapeutics around the world and around 1,000 cell or gene therapy clinical studies now conducted, the cell therapy market might see a surge in number of approvals. According to industry experts, up to 60 new cell therapies could be developed in the next few years, curing around 350,000 patients in the U.S. alone.

The impact of the COVID-19 pandemic on the growth of global cell therapy market is positive in nature. Due to pandemic, the cell therapies got momentum in the market. For example, Calidi Biotherapeutics Inc. announced in April 2020 that the FDA had approved the Investigational New Drug application approved by its partner, Personalized Stem Cells Inc. for the diagnosis and treatment of COVID-19 patients using stem cell therapy. Thus, this had positive outlook on the cell therapy market growth.

The global cell therapy market is also expanding due to stringent government regulations and guidelines. In addition, the growing investments for expansion of cell therapy market are paving way for the development of global cell therapy market. In July 2019, Bayer invested $215 million in Century Therapeutics, a biotechnology business established in the U.S. that aims to develop medicines for solid tumors and blood cancer. A $35 million donation from Versant Ventures and Fujifilm Cellular Dynamics boosted funding to $250 billion which is expected to help the sector to develop even more.

The government all around the world is constantly investing for the development of biopharmaceutical industry. This is directly impacting the growth of global cell therapy market. The key market players are collaborating with government agencies for the introduction of new cell therapies in the global market. In addition, market players are targeting developed and developing regions for the growth and development of global cell therapy market.

On the other hand, the high cost of cell therapies is a major challenge for the expansion of global cell therapy market. Moreover, lack of skilled professionals also acts as restraint for the cell therapy market growth. However, the growth of global cell therapy market is expected in near future due to wide applications of cell therapy.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 22.96% |

| Market Size in 2025 | USD 7.43 Billion |

| Market Size by 2034 | USD 47.72 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Use Type, By Therapy Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The research use segment led the global market in 2024. Cell therapy is widely used for research purposes. The growing research and development initiatives are driving the growth of the segment. In addition, key market players are highly investing in research projects. Not only market players are investing in research projects but also government agencies are collaborating for cell-based research projects. All of these factors are driving the growth of the segment.

The clinical use segment is expected to grow at a notable CAGR during the forecast period. Cell therapy is largely used for the treatment and diagnostics in some therapeutic areas such as malignancies, musculoskeletal therapies, autoimmune disorders, and dermatology. Thus, the growing number of clinical trials is boosting the segment’s growth.

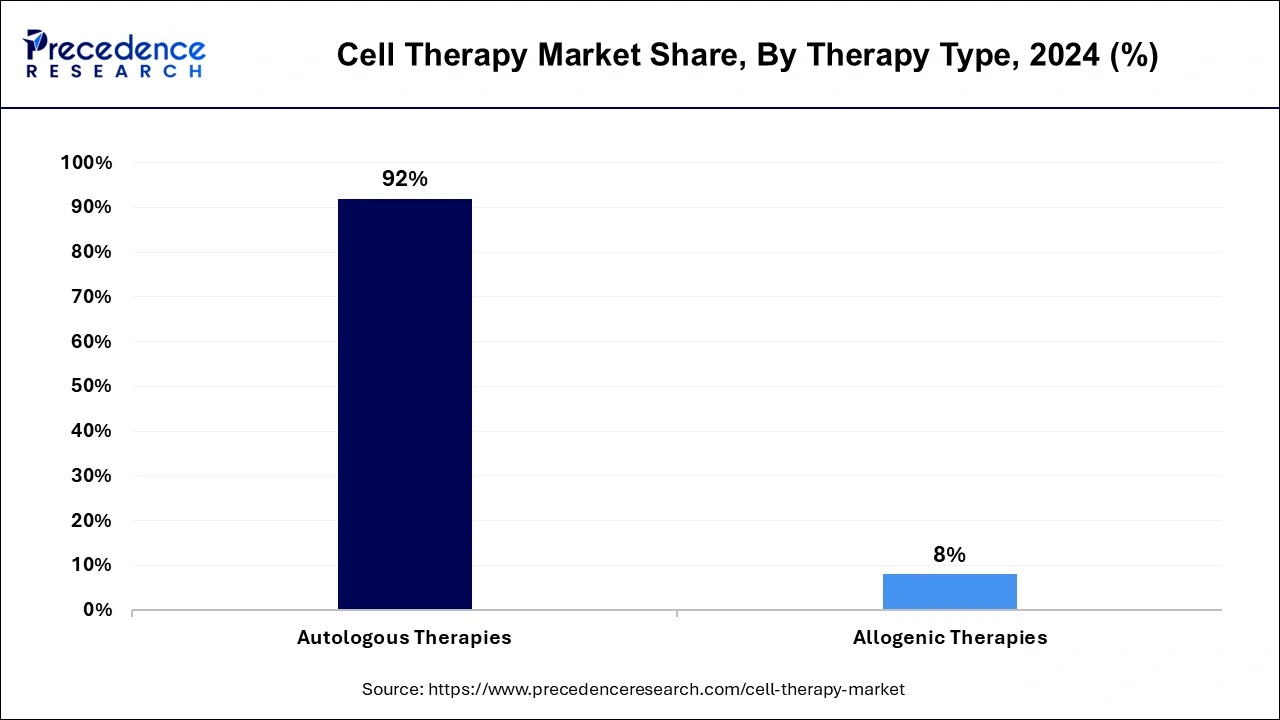

The autologous therapies segment contributed the highest market share of 92% in 2024. The segment growth is attributed to the growing adoption of autologous therapies on a large scale. Moreover, the autologous therapies are quite cost effective as compared to allogenic therapies. Thus, this factor is driving the growth of the segment.

The allogenic therapies segment is projected to grow at a solid CAGR during the forecast period. The segment is growing due to increasing research and development activities. Moreover, market players are adopting unique strategies for segment growth. For example, SpringWorks and Allogene Therapeutics Inc. signed a clinical trial partnership agreement in January 2020 for the investigation of ALLO-715 in patients with multiple myeloma who are also taking Nirogacestat.

By Use Type

By Therapy Type

By End User

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025