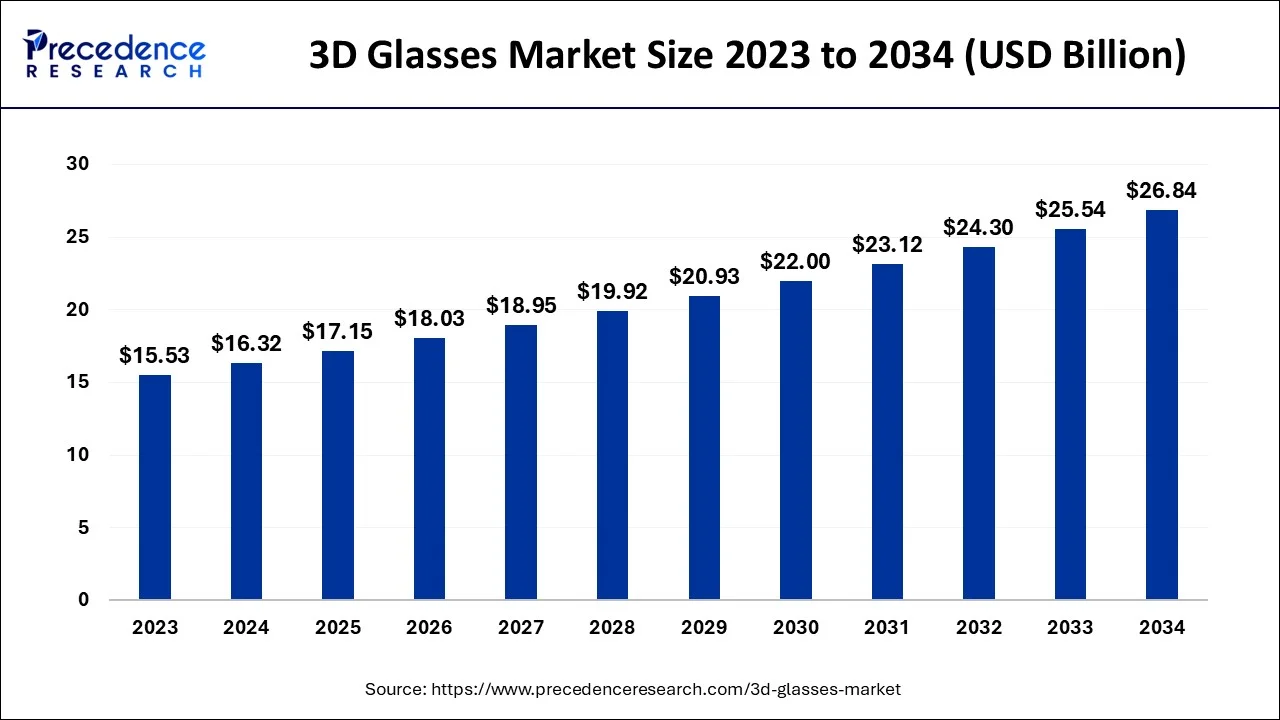

The global 3D glasses market size accounted for USD 16.32 billion in 2024, grew to USD 17.15 billion in 2025 and is predicted to surpass around USD 26.84 billion by 2034, representing a healthy CAGR of 5.10% between 2024 and 2034.

The global 3D glasses market size is estimated at USD 16.32 billion in 2024 and is anticipated to reach around USD 26.84 billion by 2034, expanding at a CAGR of 5.10% from 2024 to 2034.

By limiting the amount of light that enters each eye, 3D glasses use polarization to give the appearance of three-dimensional pictures. Two pictures are placed onto the same screen or device using different polarizing filters to present stereoscopic visuals and films. An important driver fueling the market's expansion is the rapid adoption of 3D cover glass technology in smartphones, together with a rise in the number of people using them globally.

At the moment, 3D glasses are widely used in video games, movies, and other forms of entertainment. As a result, the 3D glasses market is currently healthy and expanding. The use of 3D glasses is anticipated to increase in popularity over the coming years as technology advances and becomes more readily accessible. Additionally, 3D glasses are continually finding new uses in fields like surgery and medical imaging. As a result, the industry for 3D glasses has a very bright and exciting future.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.32 Billion |

| Market Size by 2034 | USD 26.84 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

On the basis of type, the active shutter 3D glasses segment is expected to have the largest market share in the coming years period. An active shutter 3D system is used to display stereoscopic 3D images in this way. It works by simply displaying the left-eye image while blocking the right eye's vision, then fast switching back and forth between the two images so that the interruptions do not affect the perception of the two images combined into a single 3D image.

On the basis of application, the smartphone segment is projected to have the highest market share in the coming years period. An increase in the manufacture of 3D smartphones with 3D display applications by various manufacturing companies across the world is fueling the growth of the 3D glass market. As an illustration, several of the leading smartphone producers, such as Samsung, Vivo, Huawei, Xiaomi, and Coolpad, have started developing 3D smartphones and releasing high-end smartphones with 3D cover glass. The growing number of 3D movies being produced and the widespread use of 3D glasses in theatres and home theatres are both contributing to the market's growth.

On the basis of geography, the Asia-Pacific region accounted for the majority of revenue share in 2023. The economies of South Korea, China, Japan, India, and other countries play a significant role in the market's expansion. The expansion is linked to customers' expanding use of cell phones in the area. The market is expanding as a result of rising import and export activities, as well as expanding research and development into 3D glass technology by various manufacturers. Over 196 nations have received 3D glasses that were exported from India. The statistics highlight Indian exporters' potential in the international trading sector. The top five trading partners of India include Singapore with US$ 62.33 million, the USA with US$ 57.52 million, the UAE with US$ 21.7 million, Germany with US$ 17.19 million, and Brazil with US$ 16.41 million. Together, these nations account for around 48% of India's total exports of 3D glasses.

Nearly half of the world's demand for 3D glasses comes from the US, which is also their biggest market. Numerous factors contribute to this high level of concentration, including the size of the US economy and the fact that many of the top 3D glasses manufacturers are based there. The US also has a strong culture of innovation and early acceptance of new technology, which has contributed to the country's high demand for 3D glasses. Going forward, the US is anticipated to remain a significant contributor to the market for 3D glasses on a global scale. This is partly a result of the economy and population continuing to expand, as well as the 3D glasses market continuing to innovate.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client